( – promoted by buhdydharma )

Aug. 14 (Bloomberg) — Instead of a so-called New Normal of subdued growth, the U.S. may be heading for a robust recovery.

[snip]

Chairman Ben S. Bernanke and his Federal Open Market Committee colleagues two days ago said the economy is “leveling out.” The central bank has pumped about $1 trillion into the banking system in a campaign to end the crisis, triggered by mortgage defaults, that has caused more than $1.6 trillion in losses and writedowns among financial firms worldwide.

President Barack Obama last week said: “We are pointed in the right direction,” in remarks at the White House. “We’ve rescued our economy from catastrophe.” The administration anticipates a gathering impact from its $787 billion fiscal stimulus into next year.

Recovery for who?

Newly released figures of the Department of Labor show that productivity has sharply increased in the second quarter of 2009 but employers’ labor costs have plummeted. To analyze these numbers, The Real News spoke to Richard D. Wolff, economist at the New School in New York City, who speaks on whether these numbers are good for workers.

WOLFF: The recently announced productivity numbers say something very profound about what is going on here in the United States. Basically, the job of the productivity numbers is to measure the total amount of goods and services that result from an average worker’s hour of his or her labor. Now, obviously, when a worker produces more goods and services per hour of his or her work, that means there are more goods and services available for that worker’s employer to sell, and that employer then enjoys higher revenue.

So then the question becomes: clearly the employer is better off; is the worker better off? If the worker were paid 6.2 percent more in wages at the same time that the employer has 6.2 percent more of output, then the gain to the employer would be matched by the gain to the worker, allowing the worker to share in the fruits of his improved productivity.

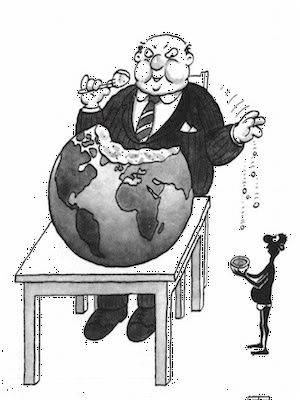

But over the last period, what was striking about the statistics is that workers’ wages went up by about one half of 1 percent, whereas what they produced for their employer went up by over 6 percent. That is a stunning difference. It means that the overwhelming bulk of the increased productivity of the workers in America went to their employers, and only a tiny proportion went to them.

Here we are in the depths of the worst economic downturn since the Great Depression of the 1930s, and the way in which this economy is coping is to widen the gap between the employers and employees.

The long period of time, roughly 30 years, during which the gap was already growing, not only is that not being reversed in this crash, but it is actually being made worse. Employers are economizing on workers, laying them off, making the workers who remain work that much harder, because they have to do the work that used to be done by the other employees that were fired.

The best guess of the economics profession as to why productivity rose so much is precisely that, that massive layoffs meant that employers had terrified workers, who would, in order to hold on to their jobs, work longer, work harder, work faster, and thereby produce so impressive a rise in productivity.

Real News Network – August 14, 2009

Recovery for who?

Worker productivity figures shoot up, with no gains in employment or wages to show for it

15 comments

Skip to comment form

Author

I can hardly stand it.

Don Monkerud wrote “Wealth Inequality Destroys US Ideals” in Consortium News in July. It was recently reprinted in Global Research.

Ah yes, it’s really hard to withstand this crash course of so much robustedness.

Author

in orange.

on Record.” (emphasis mine)

Apparently, the “top 10 percent of earners in America…” are the “Robust” ones–the other 90 percent having involuntarily contributed–by their lost jobs, or cutback hours/salaries, decreased or discontinued health care, eliminated government “safety net” programs, etc–to the top 10’ers new found wealth. Of course, the media talking heads are in that “top 10 percent” themselves, so don’t expect any objective reporting on the truth of the Mugging of the Middle Class by the Top 10 Percent.