(9 am. – promoted by ek hornbeck)

Warren Buffet gave a prophetic pronouncement back in 2003 about the Derivatives market, seeing the exponential dangers of this “paper-thin” type of investment.

Buffet did not mince words. He called them “financial weapons of mass destruction“:

Buffett warns on investment ‘time bomb’

BBC – 4 March, 2003

The derivatives market has exploded in recent years, with investment banks selling billions of dollars worth of these investments to clients as a way to off-load or manage market risk.

But Mr Buffett argues that such highly complex financial instruments are time bombs and “financial weapons of mass destruction” that could harm not only their buyers and sellers, but the whole economic system.

[…]Some derivatives contracts, Mr Buffett says, appear to have been devised by “madmen”. […]

http://news.bbc.co.uk/2/hi/bus…

Warren Buffet, the billionaire, renown for common-sense Investing, continues with his dire warnings on Derivatives …

Contracts devised by ‘madmen’

Derivatives are financial instruments that allow investors to speculate on the future price of, for example, commodities or shares – without buying the underlying investment.

[…]

Some derivatives contracts, Mr Buffett says, appear to have been devised by “madmen”.He warns that derivatives can push companies onto a “spiral that can lead to a corporate meltdown“,

[…]

Derivatives also pose a dangerous incentive for false accounting, Mr Buffett says.The profits and losses from derivatives deals are booked straight away, even though no actual money changes hand. In many cases the real costs hit companies only many years later.

http://news.bbc.co.uk/2/hi/bus…

SO why are these Derivative Bets, SO Dangerous?

What’s so wrong with a little “back-room trading” of “Profit and Loss Bookkeeping Risk” among Friends Thieves?

Derivatives: Buffet calls them financial Weapons of Mass Destruction

By John Riley, Chief Strategist — 01/18/08

What are Derivatives?

Derivatives are private contracts (bets) between financial institutions. They can be on the direction of commodities, the stock markets or currencies, but the banks’ favorites are interest rates. (You can go to the Comptroller of the Currency website to get their quarterly reports and see for yourself what Wall Street hopes you never see.)

[…]

The scariest part of derivatives is their leverage. Like exchange traded options, derivative contracts can control assets for only a fraction of the contract value. The banks take the leverage to an extreme and have very little in assets backing up their derivative portfolios. According to the Comptroller, the top 25 banks have assets that only amount to about 6% of the Notional Value of their derivatives.

[…]

Derivatives have barely any regulation on them. For years, Congress tried and Greenspan stood in the way. Banks barely mention them in the annual reports except for a footnote.Thanks to the lack of regulation, derivatives have grown dramatically. There has been a 473% increase in the Notional Value of derivatives at the top 25 banks since 1999.

http://www.rapidtrends.com/der…

Amazing, as of the beginning of 2008, the Top 25 banks ONLY HAD 6% Collateral to back up all their over-leveraged Derivative BETS! That includes all those notorious Credit Default Swaps too, tucked in among those Credit Derivatives. The Bankers put only 6% Down, to back up their betting!

In the old days, before Deregulation, trading betting “on margin”, required minimum levels of capital assets (20-30%) on hand to back up, Margin Trading (ie “leveraging shares” you don’t Pay for). But with Deregulation, and the convenience of Derivative Paper contracts, those quaint “Captial Asset” requirements went out the window.

Say, you got $1000 Dollars, BUT you want to bet $40,000 — No Problem! How about $50,000? How about $100,000? Step right up, as long as you have the prestige of an Investment Bank, or a Billion Dollar Hedge Fund, to back you up … “take a seat at the Table” — ante up with your 1K Chip — We’ll “spot you” the rest!

NOooo Problem!

The sheer speculative arrogance of the Top Wall Street Bankers is truly astronomical when you chart it out. The Comptroller of the Currency (pdf), of US Dept of Treasury, has been busy collecting the data, if anyone cares to take the time to chart it out, like I have. (By the way a Trillion, is an awful big number — It’s a Million, Millions!)

Their lack of Caution about the extreme Risks they were taking, should cause any Regulator, to sound an Alarm … [or cause any Congress-person to want to pass Strong Financial Reform …]

The Top 5 Banks — March 2008

The 6th-10th Over-leveraged Banks — March 2008

The 11th-15th sort-of-leveraged Banks — March 2008

The Top 5 Banks vs ALL the Rest of the Banks — March 2008

The Top 5 Banks cornering 96.9% of the Derivatives — March 2008

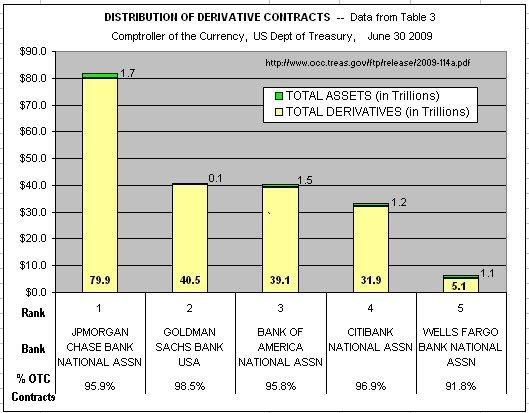

The NEW Top 5 Banks — June 2009

Data source: Comptroller of the Currency (pdf), of US Dept of Treasury, has issued an updated report as of June 2009.

Too bad, most of the Wall Street Regulators, of the LAST Decade, were happy let the Casino continue … they let it all ride.

They bet on the House.

And when the House didn’t have the funds to pay out on all those “Markers” … when the Market Risk finally turned against them?

OOOP’s !!!

Say America, could you “spot us” a few TRILLION Dollars, pretty please ???

Trust us … We’re Good for it!

Really … just let us get back in “the Game” …

Those Derivatives Bets will go our way, this Next time, you’ll see.

We know HOW to Manage Risk! … you simply Trade it away, to someone else!

Problem solved!

Risks-be-gone, has come through again. … There’s NOTHING left to worry about, SEE. On Paper — Everything’s hunky dory …

Warren, really ought to get a clue!

5 comments

Skip to comment form

Author

was a “Show about Nothing” —

BUT in the case of Derivative Investments,

those “Investments about Nothing”,

are NOT so funny!

There is no device I can buy which allows me to make a personal archive copy of the Blueray disc my kid may use as a frisbee.

My wife is “free” to not work at a company which forbids her to use the court system of the country she was born in.

I am bound by a non-disclosure agreement to not disclose the shit I know about my former employment at “Globo-corp”.

A minority population of 300 million consumes 25% of the world resources which does screw up the future profit potentials of the CEOs of globo-corps everywhere so what are you complaining about.

How can we critique something like derivatives? They are outlandish aren’t they? Yet, I honestly believe that they reflect the values of the average American. Derivatives and the casino economy and the rise and total domination of the financial oligarchy happened in plain (and plane) sight.

I believe, in my heart of hearts, that most Americans know that this is all a shell game from start to finish–but they like it that way as long as they get their dose of dope–to be precise, the entertainment media and it’s 10,000 ring circus. There some little amusement that rings your bell whether you are a pedophile or a fan of mediocre performers on American Idol.

This financial crises seems to me to be just the next jump into the emergent neo-feudal order. Did you see how the IMF said we would have to tighten our belts? Hmmm, I wonder what they mean by that?