(4 pm. – promoted by ek hornbeck)

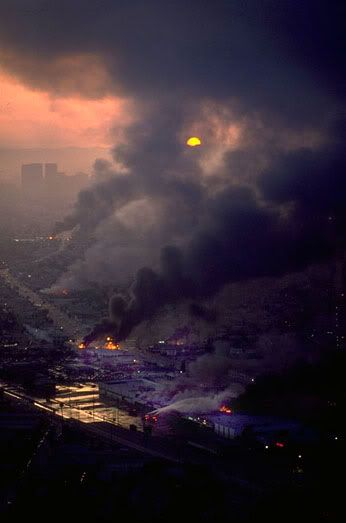

It’s been a rather tough week for capitalists. With people waking up from the illusion of money and riots erupting in otherwise reserved England, I almost feel a little sorry for the advocates of Milton Friedman. Almost.

It’s been a rather tough week for capitalists. With people waking up from the illusion of money and riots erupting in otherwise reserved England, I almost feel a little sorry for the advocates of Milton Friedman. Almost.

As you scrape together your last dollars to exchange for gold and throw another bucket of water on your burning London flat, have you considered abandoning this system? There is a choice, you know. We choose to have this system and all the pain that comes with it. Not offering opposition to a bad system is making a choice to continue with the dysfunction.

What’s that? You didn’t know you had choices? No one has explained to you the alternatives? Well, if you don’t feel obligated to ride this sinking ship to the bottom of the ocean, come along with us as we start talking solutions.

In Part I of this three part series, we discussed the history of a little known cooperative venture called Mondragon. This company went from a twelve-man paraffin stove manufacturing plant to a conglomerate that holds Wal-mart at bay in miniscule country of Basque, and employs 130,000 people. The cooperative has a remarkable 80% success rate in business ventures, far outstripping the typical success rate of 20% (less in this market). It has consistently helped the Basque people strengthen their communities with education, health care, housing and a robust social safety net. It creates jobs where none existed before, stabilizing their economy while nearby Spain and Portugal flounder.

How could this one company achieve such miraculous results? Well, it may actually be a divine intervention–through a Jesuit priest named Don Jose. In this segment, I delve deeper into Don Jose’s unique genius in devising the Mondragon system.

Mondragon Organization

“If these ideas are true, what kind of organization does it suggest?”–Don Jose

Don Jose understood you could not have a viable community under the economic tyranny of a capitalist corporation. He worked to create a system that could survive inside the fascist, capitalism of the Franco regime, but would actually work to preserve and boost the Basque community.

He created a cooperative that gave ownership to all its members. Workers must “buy in” to the Mondragon cooperative system. At present, the cost is $11,000 (10% of the capital cost to create a job). This can be deducted from the worker’s first several years of wages. However, if the venture goes bankrupt, the worker is still responsible for the amount pledged, committing every worker to the success of the venture from day one. Of course, this also grants the business a no-collateral loan at a fixed low interest rate. This win/win situation is typical of Don Jose.

The buy-in garners the worker/owner one vote in all elections, 6% interest on the money held by the bank, access to all records in Mondragon, a lifetime job with a share of annual profit distributions, health care, pension, and a garden plot.

Workers make competitive wages. Additionally, an annual share of profits is deposited into the company credit union, Caja Laboral Popular, under the worker’s name. There, it earns 6% interest plus adjustments for inflation. The worker cannot withdraw from this account. The money is only available upon leaving the coop or retirement. Mondragon self-capitalizes its business ventures with these funds.

On retirement, the worker receives 75% of the accumulated funds in the account. The other 25% is kept for the collective reserve that made the job possible in the first place. In the end, workers contribute 32% of their earnings but receive 60% of their final salary, full health care and a vegetable plot upon retirement.

On retirement, the worker receives 75% of the accumulated funds in the account. The other 25% is kept for the collective reserve that made the job possible in the first place. In the end, workers contribute 32% of their earnings but receive 60% of their final salary, full health care and a vegetable plot upon retirement.

Unlike American corporations, one worker gets one vote (democracy) instead of investors getting more voting power for more financial investment (plutocracy). Voting rights can only be sold en mass by a 2/3 vote of the General Assembly of Mondragon. They can never be sold by individuals, preventing hostile takeover of the company by economic means.

Mondragon breaks with traditional coops in an important way. Workers do not vote directly for those with the greatest impact over their working lives-managers. All coops have a General Assembly, comprised of all worker/owners. This is the highest authority in the coop. They elect a Board of Directors and a President of the Board to four-year terms.

The Board of Directors appoints or hires managers. Managers are also worker/owners and serve for four-year terms. Once a manager is appointed, the board cannot direct managers within their own unit. The Board can only appoint or demote. This prevents micromanaging by uninvolved senior executives. It encourages the Board to hire skilled, rather than merely compliant, managers and then forces the Board out of the way, so managers can innovate. Brilliant.

When one coop conducted a job satisfaction survey and discovered significant dissatisfaction with two specific assembly lines, managers formed a committee of workers to suggest changes. And then management did something revolutionary-they actually listened to the workers’ advice.

They abandoned the conveyor belt, in favor of worktables. Workers sat around the table and set their own rhythm. Workers faced each other and exchanged information and ideas. They rotated tasks; when one worker was slow, or some one was absent, other workers picked up the slack. The workers began to manage their own labor, requiring less of the managers, and freeing management to look for ways to expand the business.

Mondragon shirked the traditional anarchist model for a worker owned cooperative as well: Not all people in the cooperative have the same status, pay or work. Instead, Mondragon coops have a layer of management not directly under worker control. However, management can only make six times what the lowest paid worker makes. If management wants more money, everyone has to benefit. Again, brilliant.

Mondragon wages are determined by a formula, taking into account the difficulty of the job, personal performance, experience level, and interpersonal skills. Work experience and intrapersonal skills are prized over simple efficiency.

A Social Council represents every worker division of 20-50 workers. This Council deals with any worker concerns about labor practices. It represents them as workers, like a labor union. The Social Council has direct access to any manager or employee all the way up to the Board and the CEO. At the same time, the Board tasks this Council with job descriptions, pay scales, fringe benefits, safety, etc.

An elected Governing Council watches over the Board of Directors and provides a worker voice at meetings. It represents the owner aspect of the members.

At the highest levels, a President and the General Council comprised of nine Vice Presidents-one for each division-run the conglomerate. The General Council is accountable to the Cooperative Congress, made up of representatives of each cooperative. The Congress exists as the highest authority in the Mondragon Conglomerate. The Standing Committee-elected from the previously elected leadership of the various groups and divisions-appoints the President and approves his choices for General Council. However, each coop is autonomous. They may leave Mondragon at any time by a vote of their own General Assembly.

“People in Birmingham blame the police for protecting big business in the center of town while leaving the small businesses on the periphery and in ethnic communities unprotected.”–News Hour on the BBC

“How can we do this in a way which works fully for those in the enterprise and those in the community rather than for one more than the other?”–Don Jose

Mondragon borrows its venture capital from the workers to self-capitalize their company. At the end of the year, the profits are divided with 45% going to the company reserves for investment and purchases in the common good (research , development, job creation, etc.), 45% distributed to the worker/owner’s capital accounts in proportion to their wages (retirement), and 10% going to social services run by Mondragon (education, housing, health care). By comparison, the average US corporation donates less than 2% to charity.

The bank funds programs necessary for worker well-being: A housing authority, healthcare until Spain had universal healthcare, education, pensions. It also loans money to workers for their personal needs. In this way, every act of business serves both the worker and the community. This simple association heals the for-profit and not-for-profit rift. Mind-blowingly brilliant. If only our nation had followed the teachings of Don Jose, instead of Milton Freidman, we would not be struggling with inadequate health care and bankrupting social security. In fact, there would never have been a housing bubble in the first place.

The bank, Caja Laboral Popular, has two divisions. The first, provided the usual services of a credit union. The Empresarial Division aids in creating new cooperatives and thus new jobs. Creating new jobs, in turn, increases the amount of profits and the amount of money in every worker’s capital fund as well as money to social services. Beginning to see the pattern? This branch contains a research division, library and documentation center, Ag/Food division, Industrial Products, Industrial Promotion and Intervention, Export, Marketing, Productions, Personnel, Admin-Financial, Legal, Auditing, Information and Control, Urban Planning, Industrial Building, and Housing. Even today, everything in Mondragon links back to the bank.

Caja provides a new coop 75% of the required start-up capital in a loan at below market rate, repayable over 10 years. Another 12.5% comes from the state and 12.5% is provided by the original worker/owners. If the coop has problems making payments, the bank halves the interest rate. If they still have trouble, the interest rate goes to 0% and the Bank donates capital to the business. In other words, the riskier the loan the lower the interest rate! Ventures wobble but they don’t fall down.

Caja provides a new coop 75% of the required start-up capital in a loan at below market rate, repayable over 10 years. Another 12.5% comes from the state and 12.5% is provided by the original worker/owners. If the coop has problems making payments, the bank halves the interest rate. If they still have trouble, the interest rate goes to 0% and the Bank donates capital to the business. In other words, the riskier the loan the lower the interest rate! Ventures wobble but they don’t fall down.

Most new cooperatives find ways out of their financial difficulties, even if they have to make a major change to their business plan or management. Most loans are repaid, eventually. The Bank knows a successful coop contributes to the Bank’s capital, and its ability to create more coops and more jobs, leading to Mondragon’s phenomenal success. They are willing to make a small sacrifice to eventually achieve long term success. Again, a much better model than the current Western system, in which each round of bank foreclosures makes the whole economy circle the drain with ever increasing speed.

In All Fairness…The Downside:

Mondragon, for all its delightful features, is not a perfect organization. Being honest about the downside, allows us so see the potential pitfalls and avoid them for ourselves.

Mondragon joined conventional firms in foreign countries for some of its ventures. Many of these countries have laws prohibiting cooperative organization. This left future membership status of foreign workers unresolved, diluting the labor pool with workers who have no voice in the company. Mondragon has actually considered the sale of non-voting securities on the public stock exchange through an intermediary institution. This would further dilute worker ownership with capital investor ownership.

Also, 10-12% of the workers are “temporary” workers and 12-15% are salaried employees. MCC allows up to 30% of their workforce to be nonmembers, but temporary employees (mostly female) are not counted in this number. Mondragon is using woman as a reserve cheap labor army and disposable work force. True, women do better in Mondragon than traditional companies, and have a higher presence in management. However, things are not quite equitable for them. Remember, the majority of members fired during the Ulgor strike were women.

The Ulgor strike points out one other problem plaguing Mondragon. Ulgor’s large size at the time, made the coop bureaucratic. The worker’s concerns were ignored by upper management. Since the strike, coops have tried to limit themselves to 400 members. Large coops are divided to maintain their size.

However, Mondragon, itself, is huge. Global competition forced the overarching structure of Mondragon to become centralized and bureaucratic over the years, making them less responsive to workers. Power is being centrally concentrated and control of the managers is moving away from the workers and toward senior executives. The Social Councils’ power is severely curtailed and accountability is slipping away. Senior executives appear to make decisions on a profit-maximizing ideology instead of the people-oriented ideals originally laid out by Don Jose.

Due to the rapid increase in corporate management salaries elsewhere, Mondragon has had to increase their solidarity ratio (the ratio of the highest paid workers over the lowest) from 4.5:1 to 6:1 or as much as 15:1 in some cases. Salaries are even higher for competitive fields.

Critics of Mondragon argue the work pace for labor has become grinding and the Social Councils have no real power to protect workers. Mondragon bans worker unions, forcing workers to use Social Councils. Labor complains that Social Councils “rubber stamp” the Boards ideas because they do not take the time to understand the complexities of modern business. General Assemblies have even less time to comprehend these intricacies. Fatigued and apathetic workers are unlikely to question the Board’s decisions.

Profit efficiency over human well-being has contaminated bank thinking as well. The bank created a system in which the greater a coop’s success and profit, the smaller the percentage going to the individual capital accounts (individual pension fund). Increased profits are deposited in the collective reserve, instead. Yet, if a coop suffers a loss, up to 30% of the loss comes from the individual capital accounts and not the collective reserve.

This resulted in huge reserves for the bank, at the expense of individual capital accounts. These reserves are held in common and belong to no one. If the business fails, the reserve is donated to charity. The banker’s preoccupation with safeguarding reserves forced them to lose sight of their primary mission to serve the worker/owners. It calls into question whether bankers should be allotted so much control. A different organization may be necessary for the bank.

Next time, I talk more in depth about the lessons revealed by the Mondragon story and how it might influence our lives today.