(9 am. – promoted by ek hornbeck)

The mal-distribution of wealth in the United States is at all time highs. A 2005 study conducted before the largest financial theft in history showed that (1) Americans overwhelmingly prefer a fairer distribution of wealth, and (2) they don’t know how badly wealth is currently distributed. Here’s the pdf.

The study’s 5,522 participants were randomly selected from a panel of one million people, and were representative of adult Americans in terms of sex ratio, incomes, political leanings (Bush vs. Kerry voters), and geography. Each participant was given the same definition of wealth:

“Wealth, also known as net worth, is defined as the total value of everything someone owns minus any debt that he or she owes. A person’s net worth includes his or her bank account savings plus the value of other things such as property, stocks, bonds, art, collections, etc., minus the value of things like loans and mortgages.”

Participants were then given a preference test using unlabeled pie charts showing different distributions of wealth across five quintiles.

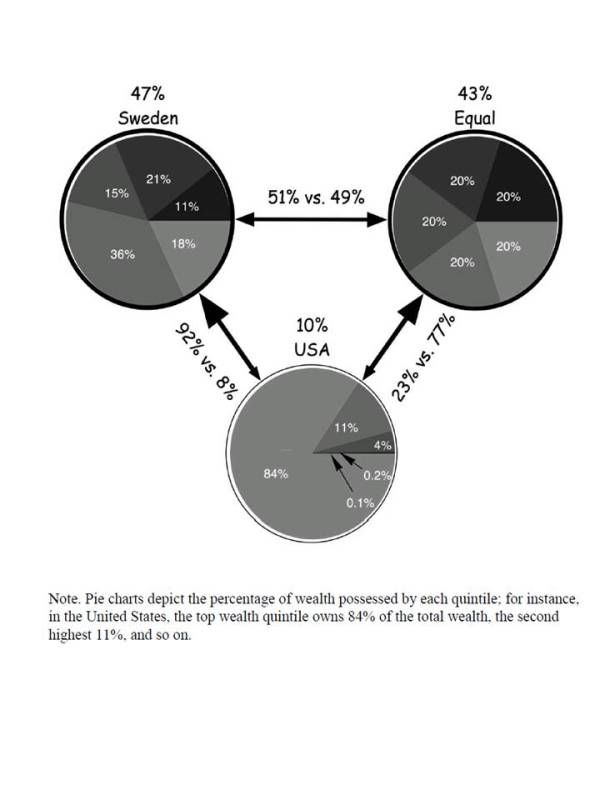

Americans Prefer Sweden For the first task, we created three unlabeled pie charts of wealth distributions, one of which depicted a perfectly equal distribution of wealth. Unbeknownst to respondents, a second distribution reflected the wealth distribution in the United States; in order to create a distribution with a level of inequality that clearly fell in between these two charts, we constructed a third pie chart from the income distribution of Sweden (Figure 1).2 We presented respondents with the three pair-wise combinations of these pie charts (in random order) and asked them to choose which nation they would rather join given a “Rawls constraint” for determining a just society (Rawls, 1971):

“In considering this question, imagine that if you joined this nation, you would be randomly assigned to a place in the distribution, so you could end up anywhere in this distribution, from the very richest to the very poorest.”

Here are the results of the pair-wise preference tests (with labels now added to the graphs):

Given a choice between distributions of wealth in the USA and Sweden, Americans overwhelmingly chose to live in Sweden. That is, when Americans are “blind” to what actual country they are selecting and they don’t know to which economic quintile they’ll be assigned (Rawls’s “veil of ignorance”), they overwhelmingly choose a fairer distribution of wealth.

Interestingly, they do not choose the most equal distribution as robustly, which may be attributable to a different sense fairness with respect to reward and merit. (There were slight differences in the ideal distributions of wealth (slightly more unfair) among the richer, Bush-leaning voters, but these were not huge).

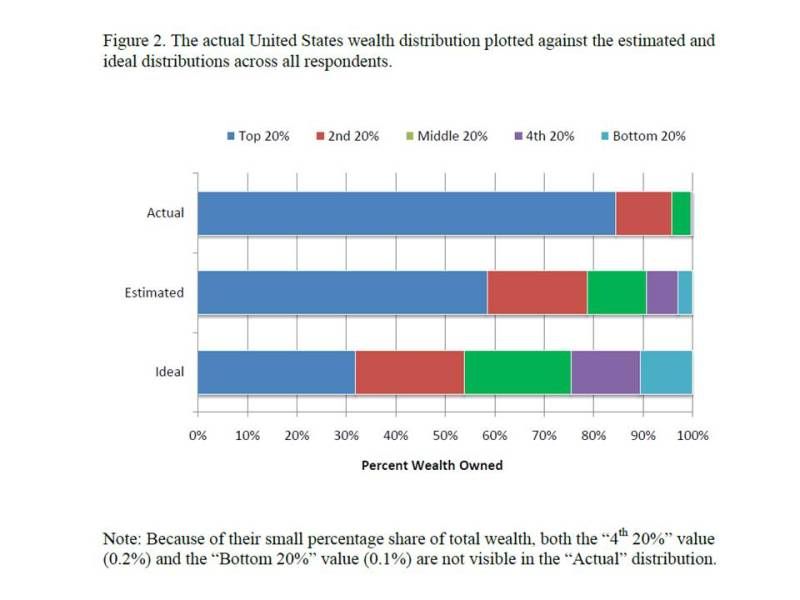

In a second task, participants were asked to estimate what they thought the actual distribution of wealth was in the United States. Here are the results showing the actual distribution of wealth across quintiles (top bar; note that the top quintile owns 84% of all wealth, whereas the bottom two quintiles don’t even show up on the freaking graph); the estimated distribution of wealth (middle bar); and the ideal distribution of wealth (bottom bar).

First, the actual distribution of wealth is much worse than Americans think. Second, what they consider an ideal distribution is far different than either what they erroneously estimate the distribution to be, and far, far different than what it actually is.

And this was true before the largest theft in the history of the world. For which no major figure has yet been indicted.

This chasm between what America is and what Americans want holds true for men, women, red states, blue states, and across income groups. Check out the pdf to see the breakdown, and you will see a lot more agreement than disagreement.

This survey tells me that very, very few people not only control the vast majority of the wealth, they control the dialogue, and to a large extent your erroneous thinking, as well.

Don’t let anyone tell you that you’re not getting hosed.

2 comments

Author