Cross posted from The Stars Hollow Gazette

New York Times economics columnist, Prof. Paul Krugman posted a graph from Center on Budget and Policy Priorities in a post to his blog indicating the deficit problem has mostly been solved:

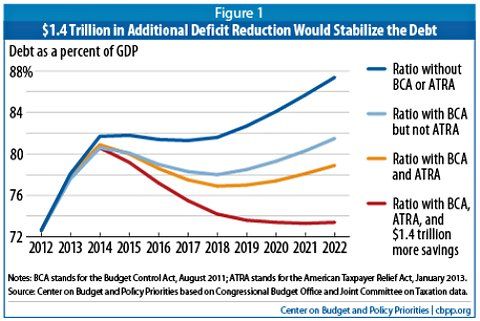

The Center on Budget and Policy Priorities has a graph:

Click on image to enlargeThe vertical axis measures the projected ratio of federal debt to GDP. The blue line at the top represents the projected path of that ratio as of early 2011 – that is, before recent agreements on spending cuts and tax increases. This projection showed a rising path for debt as far as the eye could see.

And just about all budget discussion in Washington and the news media is laid out as if that were still the case. But a lot has happened since then. The orange line shows the effects of those spending cuts and tax hikes: As long as the economy recovers, which is an assumption built into all these projections, the debt ratio will more or less stabilize soon.

Prof. Krugman noted that the CBPP advocates for another $1.4 trillion in revenue or spending cuts over the next decade. While there are still problems the debt/deficit is not as bad as is being presented by politicians and the traditional media. So while we everyone was loosing sleep about falling off cliffs, the cliff was a bad dream. Now the government and the media need to wake up and start talking about jobs.