Cross posted from The Stars Hollow Gazette

Last week Sen Elizabeth Warren (D-MA), along with Senators John McCain (R-Ariz.), Sens. Maria Cantwell (D-Wash.) and Angus King (I-Maine), introduced legislation that rein in the excesses of the Too Big Too Fail banks. The bill would require banks that accept federally insured deposits to focus on traditional lending and would bar them from engaging in risky securities trading. It would also bar banks that accept insured deposits from dealing swaps or operating hedge funds and private equity enterprises.

The legislation introduced today would separate traditional banks that have savings and checking accounts and are insured by the Federal Deposit Insurance Corporation from riskier financial institutions that offer services such as investment banking, insurance, swaps dealing, and hedge fund and private equity activities. This bill would clarify regulatory interpretations of banking law provisions that undermined the protections under the original Glass-Steagall and would make “Too Big to Fail” institutions smaller and safer, minimizing the likelihood of a government bailout.

“Since core provisions of the Glass-Steagall Act were repealed in 1999, shattering the wall dividing commercial banks and investment banks, a culture of dangerous greed and excessive risk-taking has taken root in the banking world,” said Senator John McCain. “Big Wall Street institutions should be free to engage in transactions with significant risk, but not with federally insured deposits. If enacted, the 21st Century Glass-Steagall Act would not end Too-Big-to-Fail. But, it would rebuild the wall between commercial and investment banking that was in place for over 60 years, restore confidence in the system, and reduce risk for the American taxpayer.”

“Despite the progress we’ve made since 2008, the biggest banks continue to threaten the economy,” said Senator Elizabeth Warren. “The four biggest banks are now 30% larger than they were just five years ago, and they have continued to engage in dangerous, high-risk practices that could once again put our economy at risk. The 21st Century Glass-Steagall Act will reestablish a wall between commercial and investment banking, make our financial system more stable and secure, and protect American families.”

Five Facts About the New Glass-Steagall

by Simon Johnson, Bloomberg The Ticker

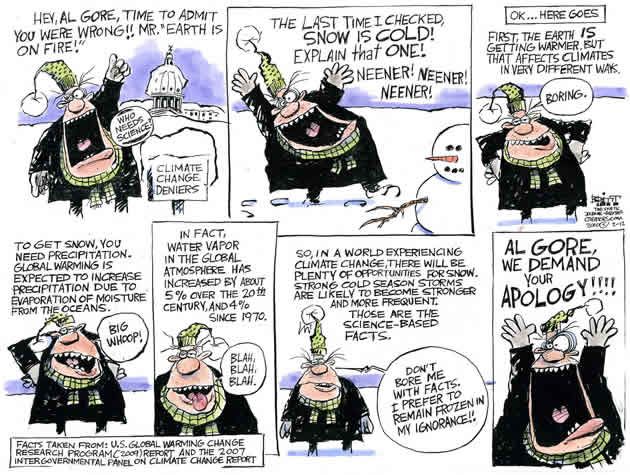

Naturally, Wall Street will respond with a huge disinformation campaign, saying that the bill would cause the sky to fall. As the debate intensifies, keep in mind the following five points.

1) The bill would actually help small banks, because it would force the taxpayer-subsidized megabanks and related financial companies to break up. [..]

2) The simplifying intent of the 21st century Glass-Steagall Act is complementary to other serious reform efforts underway, including plans for the “resolution,” or managed liquidation, of any financial firm that fails. [..]

3) Proponents of big banks will claim that the breakdown of the original Glass-Steagall Act (which separated commercial and investment banking) did not contribute to the crisis of 2007-08. [..]

4) As the preamble to the 21st century Glass-Steagall Act points out, it represents a convergence with European reform thinking, as seen in the Vickers Report (for the U.K.) and the Liikanen Report (for Europe more broadly). [..]

5) The Treasury Department is not going to welcome the legislation — in fact, it may assist in mobilizing opposition. At this stage, this is an advantage, not a problem. Treasury has a severe case of reform fatigue. It’s time for someone else to carry the ball.

Remember Citigroup

by Simon Johnson, Huffington Post

The strangest argument against the Act is that it would not have prevented the financial crisis of 2007-08. This completely ignores the central role played by Citigroup.

It is always a mistake to suggest there is any panacea that would prevent crises — either in the past or in the future. And none of the senators — Maria Cantwell of Washington, Angus King of Maine, John McCain of Arizona, and Elizabeth Warren of Massachusetts — proposing the legislation have made such an argument. But banking crises can be more or less severe, depending on the nature of the firms that become most troubled, including their size relative to the financial system and relative to the economy, the extent to which they provide critical functions, and how far the damage would spread around the world if they were to fall.

Executives at the helm of Citigroup argued long and hard, over decades, for the ability to expand the scope of their business — breaking down the barriers between conventional commercial banking and all of forms of financial transactions, including the most risky. In effect, the decline of the restrictions established by the original Glass-Steagall — at first gradual but ultimately dramatic — allowed Citigroup to increase the scale and complexity of gambles that it could take backed by deposits and ultimately backed by the government.

What are the chances of this bill getting passed? Probably not all that good considering the Wall St. cronies like Sen. Chuck Schumer (D-NY) who most certainly oppose it. Even if it makes it through the Senate relatively intact in intent, the wild children in the House will most certainly kill it. We need more Liz Warrens in both houses of congress.