In the first part, I talked about the false comparison of Orwell to Huxley and how features of the writing made it easy to mistake each author’s purpose and scope. However, there is something else. Neil Postman was not alone in thinking, in 1984, that we dodged a bullet and instead took a pill. I understand the feeling and shared it. It seemed like, as Lord Boyd Orr had said in 1966, “Give the people a choice between freedom and sandwiches, and they’ll take the sandwiches,” but we had already been shot but did not know the blood stain.

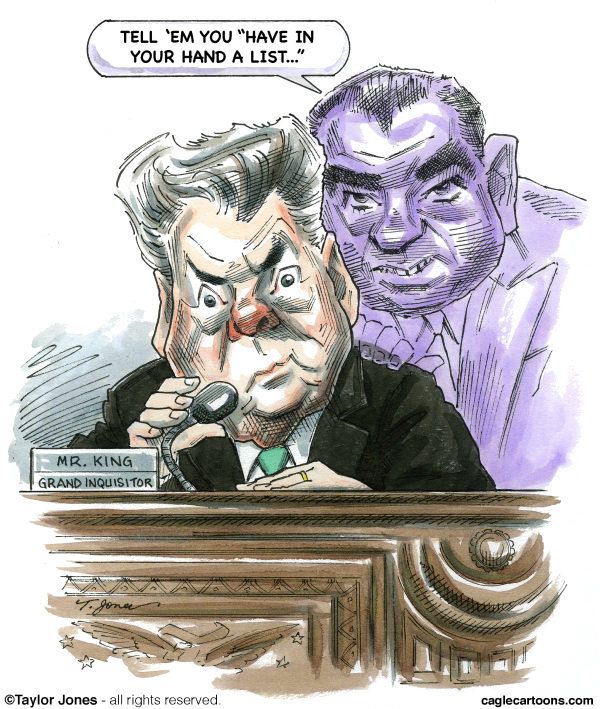

We were aware, then, that the public of democratic nations was placidly accepting outrages that would lead to atrocities, but I would propose that it took 2003 and George W. Bush to demonstrate to us how well television and the fragmented Internet have made every year 1984. Indeed, the television, which Postman saw as an abstracted medium that forbade long-form discourse and non-pictorial conceptualizing, would eventually resemble the view screen of 1984 as much as the Soma of Brave New World, especially cable news, where anything not at full volume and alarm was mere caesura for a day of emotional extremes and informational abbreviation. The Memory Hole was far easier to achieve by accident than plan.

I criticized Postman for a misplaced emphasis on the fiction of 1984 whereby he missed the systemic critique of the novel. The novel’s appearance in the midst of a nation enacting a policy called Austerity, where everyone was to “pitch in” to get “England” back on its feet after the war, is conspicuous and screams out for a comparison. Specifically, within the fiction and outside of it, a System of power is above the people, and the people are the enemy of power itself. Big Brother is an image or visage for a system, but the true power is no person or party — just the continuing flow of resources and labor from the people to an indifferent end. This is what is frightening. The group in charge was never fascists or Stalinists or Churchill or anyone else: it was capital.

Austerity today (the “new Austerity” in Europe and deficit mania in the U.S.) is different in cause, but the same in effect. Both ask nations to turn their GDP over to repayment of debt rather than intervention in markets to stimulate employment. The language used in both instances is similar, too: “Get back on our feet” and “recovery.” However, nation states and capital have had quite a bit of time and learned a few lessons.

We can see, in the gap of attitudes and responses of the public, the effect of social and cultural mutation. If we can see a greater or lesser increase in the effects of social control, then we can understand, I believe, just how thoroughgoing Orwell’s book was a description of an ongoing project that has now succeeded.