( – promoted by undercovercalico)

Make no mistake. One of the central issues in this election is reforming a healthcare system that is designed to generate large profits for the insurance and pharmaceutical companies. Blue Cross just provided more ammunition for why the parasitic insurance industry must be dismantled and destroyed, not given a seat at the table.

Blue Cross of California is asking physicians to violate confidentiality and report pre-existing conditions that new members may have omitted so their insurance coverage can be cancelled.

LOS ANGELES (AP) – Citing an effort to hold down costs, health insurance giant Blue Cross wants doctors in California to report conditions it could use to cancel new patients’ medical coverage, it was reported Tuesday.

The state’s largest for-profit health insurer is sending physicians copies of health insurance applications filled out by new patients, along with a letter advising them that the company has a right to drop members who fail to disclose “material medical history,” the Los Angeles Times reported on its Web site.

– Source

Blue Cross claims that they are entitled to know all pre-existing conditions so they can “cherry pick” and “lemon drop.”

WellPoint Inc., the Indianapolis-based company that operates Blue Cross of California, said it was sending out the letters in an effort to keep costs at a minimum.

“Enrolling an applicant who did not disclose their true condition (and the condition is chronic or acute), will quickly drive increased utilization of services, which drives up costs for all members,” WellPoint spokeswoman Shannon Troughton said in an e-mail to the newspaper.

Companies like WellPoint exist to maximize profit of their corporation, not the health of its “members” (the people who pay large premiums so they can be assured of access to medical care).

Physicians understand that providing optimal medical care requires patients being willing to disclose their medical history and current concerns to their medical providers. Now the doctor-patient relationship has a third member, the health insurance provider, who would rather see the patient die than pay out large sums to treat life-threatening illnesses.

Doctors were unhappy about the letter, warning that some patients might hide any medical history that could affect their prospects of receiving health insurance.

“We’re outraged that they are asking doctors to violate the sacred trust of patients to rat them out for medical information that patients would expect their doctors to handle with the utmost secrecy and confidentiality,” said Dr. Richard Frankenstein, president of the California Medical Association.

Stuck in the middle are too many people afraid to disclose information that might cause them to be denied health insurance or be denied coverage for chronic conditions that require care.

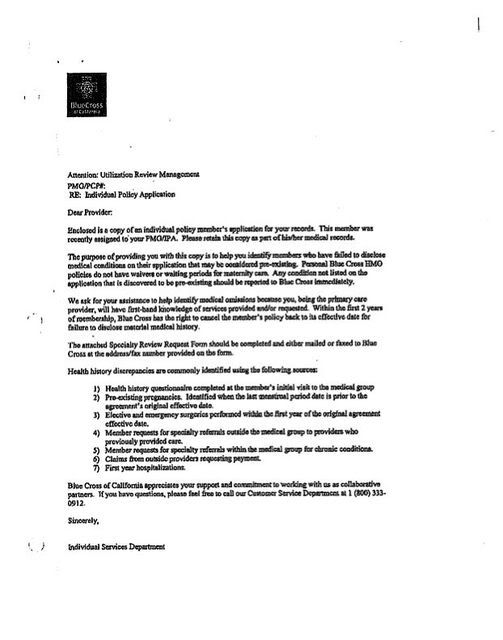

Here is a copy of the letter Blue Cross of California sent out to physicians in its network who provide care to its 3 million individual policy holders. Note that they emphasize that any health discrepancy on the application form can be used to drop coverage at any time during the first two years of coverage. If you disclosed that you have been treated for hypertension or were evaluated by a cardiologist or previously had a cancer, Blue Cross would have not have issued you a private coverage (outside of group coverage by an employer). If you did not disclose every detail of your history, the company can deny you coverage, even for conditions that have nothing to do with your previous history.

Blue Cross is one of several California insurers that have come under fire for issuing policies without checking applications and then canceling coverage after individuals incur major medical costs. The practice of canceling coverage, known in the industry as rescission, is under scrutiny by state regulators, lawmakers and the courts.

Patients in a raft of lawsuits accuse the insurers of canceling coverage over honest mistakes and minor inconsistencies on applications that they contend are purposely confusing. Victims of cancer and other serious medical problems often are unable to get new coverage once their insurance has been rescinded and they may go without treatment when they need it most. Suddenly swamped by medical debt, some people have lost homes and businesses.

– Source

This is a system that benefits no one but the insurance industry. People lucky enough to survive cancer have to spend the rest of their lives fighting insurance companies and trying to avoid bankruptcy. This is immoral. This is unconscionable.

Lynne Randolph, a spokeswoman for the state Department of Managed Health Care, said the agency would review the letter. Blue Cross is fighting a $1-million fine the department imposed in March over alleged systemic problems the agency identified in the way the company rescinds coverage.

A spokesman for state Insurance Commissioner Steve Poizner said the Insurance Department had not received any complaints about Blue Cross’ letter. But because the medical association had sent a copy of its complaint to the department, the letter is “on our radar now,” spokesman Byron Tucker said.

The letter is “extremely troubling on several fronts,” Tucker said. “It really obliterates the line between underwriting and medical care. It is the insurer’s job to underwrite their policies, not the doctors’. Doctors deliver medical care. Their job is not to underwrite policies for insurers.”

– Source

Blue Cross has a history of rescinding coverage as a way drop coverage for people who have the audacity to incur high care costs during their first two years. Rather than change its ways when it got caught, it is looking for a new way to deny coverage.

Maybe health insurance companies like Blue Cross should be required to disclose all the executive compensation and stock options, bonuses given for auditors who deny coverage, and other overhead costs, which now typically account for at least 30 percent of every premium dollar collected. John Edwards was absolutely right. If we cap overhead at 15 percent and stop exclusions for pre-existing conditions, we would get a lot more bang for our health insurance buck.

Here is a comment to the abbreviated version of this story that appeared in the Wall Street Journal.

Most of America still has no clue what hellthcare nightmares the privately insured, or in my case, unable to get insurance, I’m unmarried and work for a very small start up that cannot afford a health plan. And so far none of the private companies I’ve been referred to will accept me due to past conditions/prescriptions I was probably misdiagnosed on to begin with. I am at a loss as to what to do, probably have to give up my dream of starting a new company and just stay home and die slowly once something bad happens. And I’m a VFW. What a country.

Comment by Jeff R in Tx

9 comments

Skip to comment form

Nice presentation of some typically shit tactics by the health insurance agencies.

thanks for this!

Author

Larry Glasscock, CEO of WellPoint made just under 20 million dollars in compensation last year. Check out the link here. Counting all of his salary, bonuses, stock options, and other compensation together, it amounts to a paltry $19,565,276.

If there is any follow up to this, sets a scary precedent.

Golden parachute worth 1.78 billion. CEO of Unite Health Care.

This United

http://www.zwire.com/site/news…

Not surprised in the least. mAssachusetts mandates the purchase of insurance, shitty insurance the government fails to regualte.

ucc