(9 am. – promoted by ek hornbeck)

(Editor’s note: My sincerest apologies, I had planned to post this thing up this morning. But alas, my hard drive with the notes ended up saying it would mimic John McCain’s economic plan, and collapse on me. Several hours later looking for a hard drive and attempting to reinstall Vista, I’m up and running. So this is an abbreviated version of what I had planned. Once again, sorry, rest assured I will make up for this. )

Right now, you probably have heard that Lehman Brothers is no more, and the Merrill Lynch is now a vassal of Bank of America. Well things on the manufacturing side ain’t looking that great.

By the numbers

Two big economic indicators relative to manufacturing were released today. First the Empire State Manufacturing Survey, secondly we have the Industrial Production figures. The Empire numbers is a snapshot of manufacturing activity in New York state. Industrial Production gives us a reading on the physical output of our nation’s mines, factories and utilities. This last one has a sister reading, Capacity Utilization, that comes out at the same time. Cap figures tells us how much faculty is being used.

The New York survey, which is a questionnaire sent to 175 CEOs of manufacturing companies in the state, came back with worse than expected numbers. Consensus was between a – 2.0 to a plus 6.0. Anything above 0 means those surveyed predict growth. Today, the Empire State Survey gave a reading of – 7.0, far below than what was expected for the month of September. The previous month’s reading was, to give reference, a positive 2.0.

We now proceed with the two major indicators, Industrial Production and Capacity Utilization. While the Empire State survey is important, these two give you a better idea nationally. Still, New York’s indicator is important as what happens there tends to mirror it’s neighbors Ohio and Pennsylvania. Like the previous indicator, these two are pointing to a slowing in the economy.

Industrial Production in the previous month saw a measly 0.2% increase, not much I tell you. Today we saw the complete opposite, as the latest figure for saw a negative 1.1%! Consensus was for either a flat 0 or a smaller decrease of 0.7%.

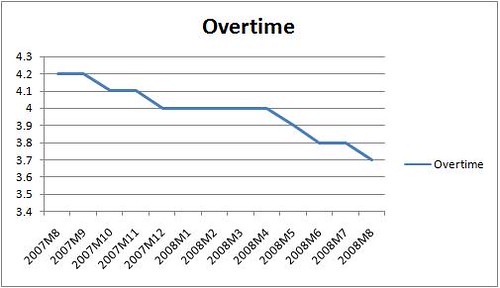

What we have here is proof of the cutbacks in such operations as automobile manufacturing and industries related. Also in metals, plastics, furniture and apparal (well what’s left made here). Overall our factories are not running at peak capacity and there is no signs of a return to growth. But before I go into that, please look at the chart below.

(data of hourly overtime from Bureau of Labor Statistics)

Sorry, had to make the chart in Excel, as the original data went back to 1952! I needed only more recently quarterly data. What you see above, is the average hourly overtime given in the fields of manufacturing. This goes back one year, and as you can see, we have already been in a steady decline. Now in the past, I cheered on that we saw some sort of a resurgence in manufacturing, but alas I was wrong. The data above is now only proving that what we really had was simply a stalling of the drop.

The reason I wanted you to see that was so you can see how everything gels together. Some folks (*cough* Larry Kudlow) like to throw all sorts of data in your face, but in the end all they are doing is a game of three-card Monty. I always believed that average folks should see how the puzzle pieces come together. So now that we approach, Capacity Utilization, you’ll see the growing downward trend.

Matching up with that overtime chart, you see that while Cap Util was going up, overtime was flat. So was there really growth or not? Go ahead, take a look, one could almost say they scratch themselves out. I’m under the suspicion, that outside a few industries, that we were simply witnessing the usage of domestic labor over normally cheaper labor because of the fall of the dollar. That overall growth was actually nil. So in relative terms, one could say we grew, but in absolute terms, that takes the former on it’s head. It’s like saying my hot dog stand is doing better than your hot dog stand, but only because today my product is cheaper, yet I’m still not hiring another worker or adding more hours. The demand for my product is the same. Ok, dumb example, but I hope you see where I’m going here with this.

Because, if there really was absolute growth in manufacturing, then the jobs picture would have looked better. But we reported, that in fact, that employment has gotten worse.

Payrolls across the economy has dropped this month…again! Officially, the unemployment rate now stands at 6.1%. Consensus was the rate would be within 5.6-5.8%, north of the previous month’s 5.5%. What we got was far above that.

The nitty gritty part is that we lost another 84,000 jobs for August. I say another, because the previous month the US economy jettisoned 51,000 jobs in July and 100,000 jobs in June. From manufacturing to the services sector, saw major losses. I don’t have the exact figure before my, but CNN is right now saying that for the year we have lost 600,000 jobs! That, my friend is the Bush-McCain/Palin economy for you!

– excerpt from “NEWSFLASH: Unemployment hits above 6%!!!“, Docudharma.com, 2008

Though, in all this, there is one good piece of news out of falling Capacity Utilization. Unless new factories are built, often when we reach 90%+ in Cap Util, this leads to bottlenecks and such. That, in the end only serves to goose up inflation. So, no inflation or a deflationary motivator, I guess that’s good news.

Cross posted on

The Economic Populist –

A Community Site for Economics Freaks and Geeks

1 comments

Author

Thanks for reading my latest entry. Normally I would say let’s beat those Republicans and such, but instead if it’s ok, I’d like to wish a fond farewell to Richard Wright. Now, perhaps many of you aren’t Pink Floyd fans. I am, so I was sad to hear that Wright left us, after fighting cancer. Rest in peace.