(9 am. – promoted by ek hornbeck)

One of the things we will have to include in post-capitalist environmental design is a new system of money. This diary is a preliminary investigation of this, continuing from the last diary on post-capitalist economic design. Here I will discuss in brief the fate of the US dollar, the idea of the “time dollar” as explained by the founders of the Echo Park Time Bank, and the ideas of Hutchinson, Mellor, and Olsen’s The Politics of Money.

(Crossposted on Big Orange)

The folks who think we desperately need a bailout to save “the economy” need to reflect upon, well, first they need to reflect upon the suggestion posed by Dean Baker:

The basic argument for the bailout is that the banks are filled with so much bad debt that the banks can’t trust each other to repay loans. This creates a situation in which the system of payments breaks down. That would mean that we cannot use our ATMs or credit cards or cash checks.

That is a very frightening scenario, but this is not where things end. The Federal Reserve Board would surely step in and take over the major money center banks so that the system of payments would begin functioning again. The Fed was prepared to take over the major banks back in the 80s when bad debt to developing countries threatened to make them insolvent. It is inconceivable that it has not made similar preparations in the current crisis.

In other words, the worst case scenario is that we have an extremely scary day in which the markets freeze for a few hours. Then the Fed steps in and takes over the major banks. The system of payments continues to operate exactly as before, but the bank executives are out of their jobs and the bank shareholders have likely lost most of their money. In other words, the banks have a gun pointed to their heads and are threatening to pull the trigger unless we hand them $700 billion.

If we are not worried about this worst case scenario (to be clear, I wouldn’t want to see it), then why should we do the bailout?

To my knowledge none of the bailout defenders on DKos has actually responded to such an argument with any degree of seriousness.

And if anyone here is still in search of alternative measures, do check out the recent Patriot Daily News Clearinghouse diary, and read the attached diaries it lists. There’s plenty there.

But, well, never mind. Odds favor an attempt to prop up a fictional economy which is so bloated at present that it will see its future in endless and repeated extortion of the American public. It’s easy to predict that the $700b is just a planned down payment. Some of you caught the Meteor Blades diary which discusses the $70 trillion credit default swaps market (in a world economy of a mere $65 trillion). Oh, sure, it all looks good on business portfolios, but how much of that paper (incl. hedge funds, CDOs, and so on) do you think is really backed by anything? Nobody really knows how big the eventual bailout will be — and so my suspicion is that that is why the administration demanded autocratic power over the money supply for the Secretary of the Treasury.

At any rate, all the signs point to one possibility: more bailouts, more money printed up, eventual panic selling of dollar-denominated assets, inflation. See gjohnsit’s most recent diary: gjohnsit is incorrect in presuming the bailout to have already passed, but has quite a bit of other useful information.

So when the bailout passes and the economy collapses (anyway) and, lo and behold, the public discovers itself to be in a state of debt peonage, people will be looking for something other than US dollars to put their time and resources into. So at that point we’ll be looking for alternative money systems. One such money system, already in place in several locations throughout the world, is the “time dollar.”

*****

This Sunday evening I went to a presentation on the “time dollar” at the Echo Park Film Center in Echo Park (in Los Angeles, of course). The presentation was hosted by the founders of the time bank. There were about fifteen people there (including the presenters); the Echo Park Film Center is a small room with a lot of films and posters.

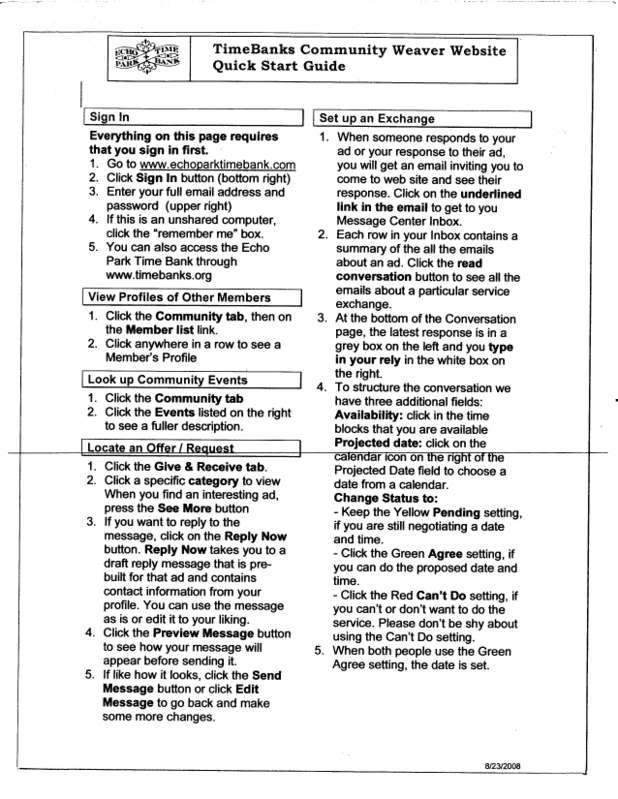

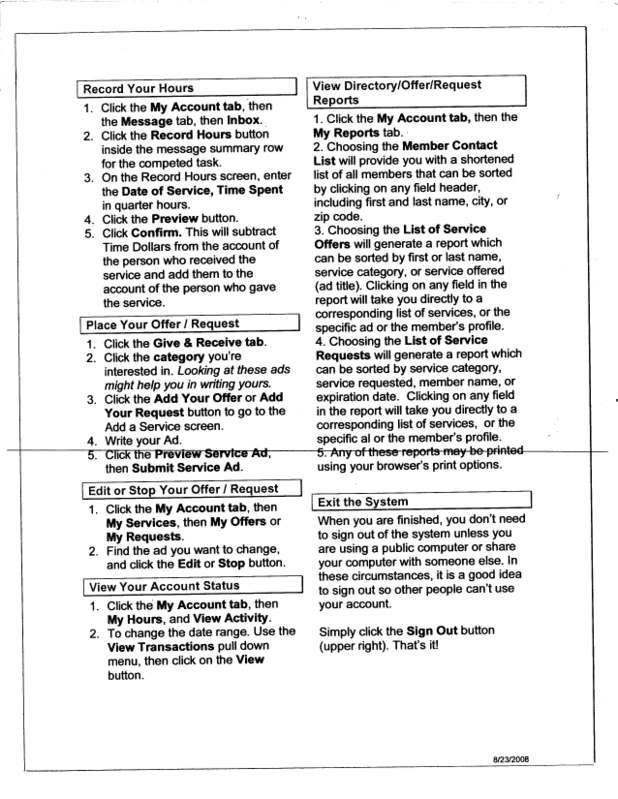

So what are “time dollars”? The presentation was about a system, wherein people would do favors for each other and record these favors in a system of “time dollars”; people would accumulate time dollars and go into time dollar debt, and the time dollars would then presumably circulate back to those who were in debt when they returned the favors they were done. Everyone’s time dollar accounts would be recorded in an online “bank” that would be accessible via computer.

This appears as a really good way of establishing the quid pro quo (Latin for “this for that”) arrangements which can really stimulate the growth of charity. Pretty often, the recipients of charity don’t feel like giving back. Maybe time dollars can convince them it’s a good idea.

The Echo Park “time dollar bank” had been promoted, prior to this meeting, by an article in the Los Angeles Times which came out in late June. Thus the founders of the time dollar bank had 25 members in their time dollar exchange association, and 100 applicants for membership, many of whom had been attracted by the article.

Practically all of the information about time dollars that I picked up can be found through the Echo Park Time Dollar Bank website and its linked pages. Please feel free to browse the system they’ve set up.

As part of the Sunday presentation, we watched two films about time dollar systems, one in an African-American community in Baltimore, the other in Gloucestershire in England. The presentations were quite different; the point the presenters made was that a time dollar system is going to have a set-up which will be unique to its location. The film about Baltimore had people doing neighborhood activities such as lawnmowing and snowshoveling, as well as a fashion show; the film about Gloucestershire was largely about the interaction between old and young people.

The last part of the presentation was a go-around, in which each participant named her/himself and discussed her/his abilities and needs. There were quite a few rather interesting people at the particular meeting I attended. I heard from plenty of writers, jack-of-all-trades types, teachers, and gardeners.

At the end of the presentation, everyone in the meeting room pretty much started to discuss the possibilities of collaboration with each other. Now there’s an innovation in the art of holding meetings: no money was discussed, yet ordinary people got together and talked about working for each other. I offered my services to someone who wanted a garden, and heard from a woman who needed a new roof.

*****

A time dollar system, from what I gathered from the presentation, is basically a system for establishing quid pro quo relationships, and a tool in social psychology. Its aim, from what I could tell from the films shown at the meeting, was to get people out of their homes, interacting with other people, and sharing the services they could perform for others.

The possible services could include anything: car washing, taking someone out to a museum, giving someone a ride in your vehicle, planting someone’s garden, and so on. The time dollars, themselves, were “values” placed upon the services which were exchanged, with (as a general standard) one dollar being worth one hour of work-time.

So when you want a service performed, and are willing to put up the time dollars for it, you go through the procedure listed below on your computer:

Well, that’s how the bookkeeping end of the time dollar system works.

The whole system, of course, was rather general, as the presenters explained: the exact exchange of time dollars was to be worked out beforehand between those doing the exchanging. In short, the entire system was vulnerable to abuse, and was thus based on a matter of trust between community members and friends. People had to fill out applications in order to be part of the time dollar bank, and give reliable references as evidence of their trustworthiness. The Echo Park Time Dollar Bank had not yet gotten to the point of requiring security checks on its members.

A time dollar bank, then, becomes a cause for a festival of friends, an ongoing communal interaction of sorts. What people find out, when they join a time dollar bank, is that practically everyone has something of value to contribute to practically everyone else. Thus, instead, of asking, “what skills of mine are billable?”, with time dollars we tend to ask, “what can I do for my friends and neighbors?”

Regular dollars are based on trust, too, but for the most part they’re based on a form of bad trust, trust that has gone rancid some time ago but which people cling to for the sake of survival. Time dollar banks are an attempt at creating a new form of dollar trust. The Politics of Money says about this sort of system that:

Time dollars and LETS schemes are being seen as a solution to problems of poverty and the vailure to fund public services properly. To the extent that LETS schemes mop up symptomatic problems thrown up by conventional finance, they are tolerated by governments. If they become more successful, however, governments may act to suppress or control them. (189)

Thus the ultimate solution to the problem of money, beyond time dollars or “LETS” (limited exchange trading system) schemes (which are like time dollars), is to gain real control over our government.

What the credit crunch, and the time dollar bank, do is to make us ask, once again, “what is money?” Here is where we rely upon the wisdom gained in Hutchinson, Mellor, and Olsen’s The Politics of Money.

Money is basically a claim upon labor-time. This is the essence of money as it stands in the debt-based money system; it is even more clearly the point of a time dollar system. Money wouldn’t be worth anything if nobody worked for it.

In a debt-based money system, money is created when debt is incurred. The banks are granted a power which is called seigniorage — and so when you take out their loans or use their credit cards they create money so you can use it, as well as a record of debt, signifying that you must at some point return to them the money that was created in your name.

Since practically all activity in a debt-based money system is financed through debt, the tendency of such a system is to produce more and more debt, with the result that the system itself spins out of control. The contradiction, here, is that the banks can create a potentially infinite amount of money, but the sum amount of labor-time that the pool of money can claim does not expand. Thus inflation, where each unit of money decreases in value as more units of money flood the market.

Inflation in our present-day American economy has been avoided through a condition known as “dollar hegemony.” The enormous sums of money our government spends (the “national debt“) are held by foreign banks, who must invest this money in Treasury bills in order to prop up the value of the dollar reserves they currently own. When the US government increases the national debt, the additional debt-paper winds up in the hands of these same foreign banks. Thus the US government has been granted a blank check, which it has largely spent upon military expenditures. The problem is that the increased strain upon dollar hegemony can eventually result in an outbreak of panic dollar selling, with devaluation abroad and inflation at home the results.

Now, the time dollar system is not a full-fledged alternative to the money system so much as it is a way of taking labor-time out of the money system and granting it to a few participants. An alternative to a debt-based money system would be a credit-based money system, as described in the writings of the originator of “social credit” theory, Clifford Hugh Douglas (1879-1952) (see chapter 6 of The Politics of Money). The idea of social credit is that the power to create money, seigniorage, is granted to the people who work for it, who are granted power over the money supply. (What sort of democratic mechanism would grant them such power would have to be decided separately.) Social credit would be granted to people for two reasons:

1) Consumer credits, intended to grant individual members of society a basic standard of living (insofar as the people can create such a standard)

2) Producer credits, intended to make up for the start-up costs of business so that said costs are not passed on to consumers through high prices.

Thus, as with time dollars, you don’t have the problems of power inequity and investor manipulation that you see with debt-based money, because the people are in charge of the money.

Whenever a general default occurs within the debt-based money system, as with the current mortgage crisis, this tends to reveal the fictional nature of the “value” created when money is created by banks. Thus perhaps it is a time for experiments such as the “time dollar,” social credit and so on, to help us rethink the human relationships which are currently embodied in money.

This is really all I should be saying about this topic in a diary that is already too long: more later.

4 comments

Skip to comment form

Author

There are alternatives.

Thanks cass.