(9 am. – promoted by ek hornbeck)

copyright © 2009 Betsy L. Angert. BeThink.org

Today, Timothy Geithner garners much attention. Initially, when introduced on the national scene, people pondered; “Who is he?” The former President of the Federal Reserve Bank of New York has an impeccable résumé. Some said his record speaks for itself. Average Americans might have admired his ascendancy. Taxpayers could have appreciated that a man of his age would wish to manage the complexity of the United States coffers. Countless may have considered the enormous challenge he accepted; yet, not comprehend, for Secretary Geithner, this may have been the plan.

Early on, Treasury Secretary Timothy F. Geithner had his sights set high. As a child, born to an affluent, and influential family, he learned that all he desired could be his. He saw the potential for power in political prospects. The practicality of a profitable purpose also was apparent to Tim. When a lad, there was no reason for Timothy to reflect on the concrete pavements beneath his feet. Geithner would not have supposed he would work as a laborer. Nor had he likely seen himself as one among the swarms of ordinary citizens. His personal history may have helped him to know, he would not have to pound the streets to seek pennies for his pocket. Unconventional as his life had been, Timothy Geithner might have imagined as others did; he was destined for greatness.

Maternal grandfather, Charles F. Moore, was an adviser to President Dwight D. Eisenhower. Through his elder, young Tim became attuned to the Capitol. He also grew to understand the capital that could be accrued away from the Hill. Grandpop Moore also served as a Vice President of Ford Motor Company. “Public Relations” was his claim to fame.

“Dad,” Peter F. Geithner, did well independently of his father-in-law. He acquired and distributed much wealth in his work with the Ford Foundation. Granted, the company connection may have served to benefit Peter. Nonetheless, had the legal association been absent, an emotional bond born from friendship would have helped clinch a deal. Networks we fashion, as Timmy might have realized at an early age, can be a force to be reckoned with.

As a tot, Timothy Geithner absorbed lessons as we all do. Perchance, he had higher aspirations than most. He hoped to meld the muscle of money with the clout of civil service. Mister Geithner, throughout his life saw effective ways in which to maneuver. Likely he heard tales that taught him the nuance of negotiation, and tasted the nectar of success.

In college, and later in his professional career, Mister Geithner achieved much. Still, the former New York Federal Reserve Chair, understood, he could accomplish more. At June 2008 conference he spoke of what might reap greater rewards for those in the banking industry. Former Treasury Secretary Henry M. Paulson Junior convened an economic summit. Financially, the country was in a fiscal crisis. Indeed, the United States was well on its way to a monetary collapse; however, only the few economic “experts” know of the impending doom. The dollar was of little value. It was predicted soon, American currency would be virtually worthless.

Thus, Secretary Paulson sought advice from his fellow fiscal stewards. As the man who oversaw the most powerful and prominent banks in the nation, Mister Geithner was among these. In response to a query from the then Head of Treasury, what emergency controls could the government employ, in an attempt to confront the tumultuous economic crisis? The fine fellow, confident in his well-established connections, spoke with the lack of temerity exuded by one who savored many triumphs. Geithner stated; “There is gold in them there hills.” The gelt Tim Geithner knew would be available if only he asked for it was in the pockets and purses of the taxpayers.

As the supreme authority for the most formidable Federal Reserve, Timothy Geithner felt he could assert what other Administrators might not imagine feasible. Mister Geithner suggested Secretary Paulson insist that “Congress give the President broad power to guarantee all banking debt.” Michele A. Smith, then an Assistant Treasury Secretary, overhead the statement. She affirmed the truth of the allegation; the then New York Fed Chair had said. Let us seek the impossible. Government securities or gratuities to cover all arrears, was what Timothy Geithner wished for.

Apparently, at the time the proposal was not considered for more than a moment. Other economic experts protested the possibility. Financial fellows proclaimed the idea was “politically untenable.” It could leave taxpayers in the lurch, responsible for trillions of dollars in liabilities. Nonetheless, Timothy Geithner was not deterred. He knew where the dollars were hidden and how to obtain vast treasures. Capable of great strides and able to rise to the top of hills others have yet to climb, Tim Geithner secured his associations. The Hill he planned to climb was the one in Washington, District of Columbia.

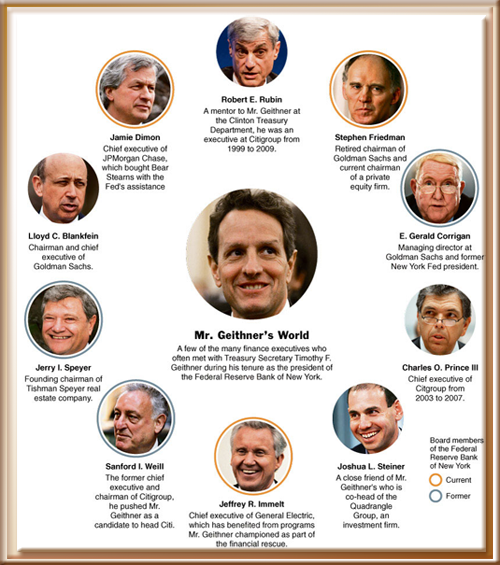

An examination of Mr. Geithner’s five years as president of the New York Fed, an era of unbridled and ultimately disastrous risk taking by the financial industry, shows that he forged unusually close relationships with executives of Wall Street’s giant financial institutions.

His actions, as a regulator and later a bailout king, often aligned with the industry’s interests and desires, according to interviews with financiers, regulators and analysts and a review of Federal Reserve records.

In a pair of recent interviews and an exchange of e-mail messages, Mr. Geithner defended his record, saying that from very early on, he was “a consistently dark voice about the potential risks ahead, and a principal source of initiatives designed to make the system stronger” before the markets melted down.The New York Fed is, by custom and design, clubby and opaque. It is charged with curbing banks’ risky impulses, yet its president is selected by and reports to a board of directors dominated by the chief executives of some of those same banks. Traditionally, the New York Fed president’s intelligence-gathering role has involved routine consultation with financiers, though Mr. Geithner’s recent predecessors generally did not meet with them unless senior aides were also present, according to the bank’s former general counsel.

Perchance, the New York Federal Reserve Chairs who came to the office before Mister Geithner were not of similar stock, or had they been, their own interest in money was not wedded to a desire to mount a more glorious golden Capitol Dome. Tim Geithner was different. As was evident at the 2008 conference, other guardians of greenbacks did not think to give government greater authority over the affairs of banks. Tim Geithner’s history, however, led him to believe the best could be achieved, at least for him personally, if he mixed business and pleasure.

Mr. Geithner’s reliance on bankers, hedge fund managers and others to assess the market’s health – and provide guidance once it faltered – stood out.

His calendars from 2007 and 2008 show that those interactions were a mix of the professional and private rendezvous.

He ate lunch with senior executives from Citigroup, Goldman Sachs, and Morgan Stanley, at the Four Seasons restaurant or in their corporate dining rooms. He attended casual dinners at the homes of executives like Jamie Dimon, a member of the New York Fed board and the chief of JP Morgan Chase.

Mr. Geithner was particularly close to executives of Citigroup, the largest bank under his supervision. Robert E. Rubin, a senior Citi executive and a former Treasury secretary, was Mr. Geithner’s mentor from his years in the Clinton administration, and the two kept in close touch in New York.

For Timothy Geithner, the trailblazer, all roads led to the White House and the wealth that could be seen best from the ultimate Hill. Early on, in school, in social settings, and on the political scene, Mister Geithner secured relationships that would realize a firm future in government, just as his grandfather had. He did as his Dad did to grow gold in his business ventures. Ultimately, Timothy F. Geithner was appointed Secretary of the Treasury.

In this most powerful fiscal and physical position Tim Geithner was able to garner greater control over all banking policies. What he had proposed in the summer of 2008 was never a prescription. It was a prophecy for what he would do. The impossible became the probable in recent months. Banks were indeed, bailed out. Plans for more power to be assigned to the government, to Mister Geithner are in the works. More money is meant to be funneled to the financial institutions.

Joseph E. Stiglitz a Nobel Prize recipient and Economist at Columbia, is critical of much Mister Geithner has done. The actions of the current Secretary suggest that he came to share Wall Street’s regulatory philosophy and world view.

“I don’t think that Tim Geithner was motivated by anything other than concern to get the financial system working again,” Mr. Stiglitz said. “But I think that mindsets can be shaped by people you associate with, and you come to think that what’s good for Wall Street is good for America.”

No one can be sure. However, it could be. Apples do not fall from trees. Birds of a feather may flock together. A child born to affluence is better able to aspire.

Main Street and Wall Street may never meet, or at least not until those whose sights are set high step down and see how the common folk live. The gold on the Hill does not glitter on pavements union workers walk. Nor do small business owners, everyday, ordinary, average American taxpayers reside on boulevard of bullion. No, these avenues are reserved for persons such as Timothy F. Geithner, Secretary of Treasury.

Reference for the Geithner Reality . . .

- Who is Timothy Geithner? The Wall Street Journal. November 21, 2008

- Dollar Declines as Geithner’s Bank Comments Erode Refuge Appeal, By Ye Xie and Oliver Biggadike. Bloomberg. April 21, 2009

- Family describes Geithner ’83’s youth, By Kate Farley. The Dartmouth. Friday, October 3, 2008

- Ford Foundation Links Parents of Obama and Treasury Secretary Nominee. The Chronicle of Philanthropy . December 03, 2008

- N.Y. Fed chief an unconventional, but compatible, choice, By Brian C. Mooney. The Boston Globe. November 25, 2008

- Office of Public Relations (Ford Motor Company) records subgroup, 1903-1987 (bulk 1942-1978). Henry Ford Museum. Horizon Information Portal

- The Presidential Papers of Dwight David Eisenhower. The Dwight D. Eisenhower Memorial Commission. August 1958

- Geithner, Member and Overseer of Finance Club, By Jo Becker and Gretchen Morgenson. The New York Times. April26, 2009

- Records of the Office of the Special Assistant for Executive Appointments. Eisenhower Archives. 1952-61

- The Capitol Extensions and New Dome, By William C. Allen. Chapter 4

- Treasury Articles on Treasury. The New York Times.

- Nomination of Michelle A. Smith., Hearing before the Committee on Finance, United States Senate, One Hundred Sixth Congress. Joyner Library.

- Citigroup, Articles. The New York Times.

- Citigroup, Articles. The New York Times.

- Goldman Sachs, Articles. The New York Times.

- Jamie Dimon, Articles. The New York Times.

- In Wake Of GM Ouster, Unions Demand Obama Fire Bank Of America CEO, By Greg Sargent. TruthOut from The Plum Line. March 31, 2009

- Geithner Goes From Zero to Hero? Not So Fast, By John Nichols. The Nation. March 24, 2009

3 comments

Author

How will his reign transform the Treasury Department?

At the rate that he is printing money, the history of the US dollar as the backing currency for the world is about to end. China and Russia have both declared that it is time to remove the US dollar as backing currency. I don’t know if either of them has a alternative, but the sentiment for a change is out there, and it can’t be too long before that desire is echoed more broadly.

Every trillion printed is another nail in the coffin of the US. Geithner is the ultimate trickle down man, with no view of Main Street at all.