( – promoted by buhdydharma )

Way back in March of 2009, Rachel explained the “Highway Robbery” which happened on Wall Street, using a few simple word-pictures. (ie. simple Frames). These perhaps deserve a quick review …

Rachel Maddow – Cops and Robbers

Link to Rachel’s very humorous Clip

Great Framing Rachel! … I love it, when Progressive Talkers, make learning FUN! The simpler the Word-Pictures, the better the Frame!

“Is our childrens learning?” as George W. used to ask.

Could be, … Maybe we just needed to “Turn the Page” …

In that previous clip, Rachel explains our [still] current Wall Street Regulatory problem as follows …

It’s like “Cops and Robbers”, with the Regulators on Horseback and the Robber Barron in Spaceships.

Not much has changed in a hundred years, has it?

Rachel nails it! The Culprits can be traced back to 2 De-regulation Acts, that turned Wall Street, into a modern day version of the Wild Wild West:

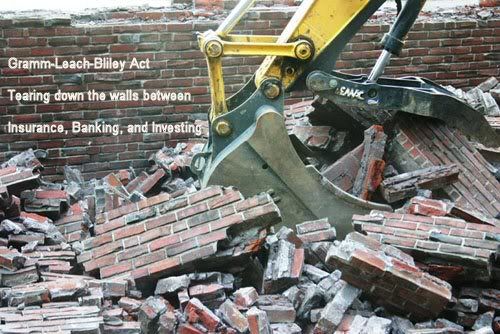

[Gramm-Leach-Bliley Act] repealed part of the Glass-Steagall Act of 1933, opening up competition among banks, securities companies and insurance companies.

The Gramm-Leach-Bliley Act (GLBA) allowed commercial and investment banks to consolidate. For example, Citibank merged with Travelers Group, an insurance company, and in 1998 formed the conglomerate Citigroup, a corporation combining banking and insurance underwriting services under brands including Smith-Barney, Shearson, Primerica and Travelers Insurance Corporation.

Glass-Steagall Act of 1933, was in response to the massive Wall Street losses, and Bank Runs, that directly caused the Great Depression. The Law put up “a safety wall” between the Businesses of Banking, Investing, and Insurance:

BUT the Gramm-Leach-Bliley Act of 1999, tore down those “quaint dividers” and their “unbearable burden of Regulation” (good one, Rachel!)

It has resulted in massive 21st Century “Highway Robbery”, but on the scale of Billions and Trillions:

Too bad, it’s no longer a “Laughing Matter” — as if it ever was.

Rachel’s other De-Regulation Culprit, in this Robbery Saga:

Commodity Futures Modernization Act of 2000

The “Enron loophole”

The Commodity Futures Modernization Act of 2000 has received criticism for the so-called “Enron loophole,” 7 U.S.C. §2(h)(3) and (g), which exempts most over-the-counter energy trades and trading on electronic energy commodity markets. The “loophole” was drafted by lobbyists for Enron working with senator Phil Gramm[3] seeking a deregulated atmosphere for their new experiment, “Enron On-line.”[4]

The Commodity Futures Modernization Act of 2000, made it “legal” to ignore the Real Risk of Investments. Such reckless “hedging” is bad enough, but when combined with De-Regulation Culprit One — No WALLS between Markets — those Billionare Barons could now take those risks, using Other People’s Money, like your Pension, like your College Saving plan, like your Mortgage. With such a free-wheeling system, Robber’s get the all the Gains, WE get all the Pains, when the Risk Level inevitably rises to a level that “floods the house”:

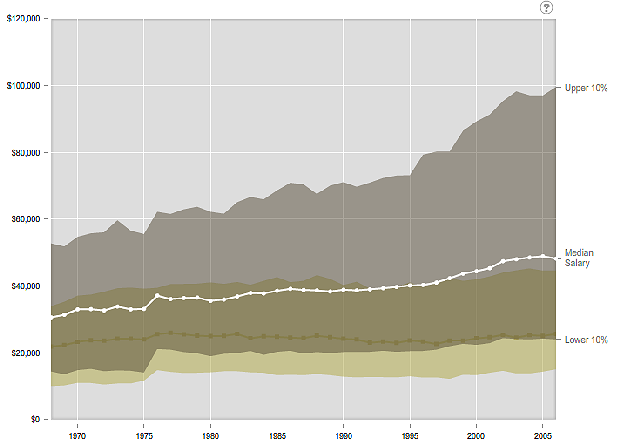

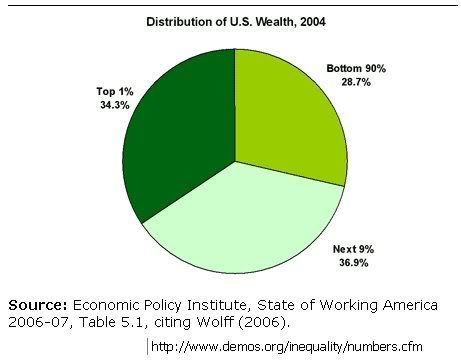

And what is the result of Privatizing all the Gains, and Nationalizing Socializing all the Pain?

No doubt, we still have “robber barons” in this day and age. They just dress better, and hide behind rage, spin, and evasion.

But the goal is the same, those with the Gold make the Rules.

This is why we STILL need Transparency, and Accountability in Government —

and Public Financing of Campaigns, too!

AND Why we STILL need serious Re-regulation of Wall Street too!

It is the People’s Turn, this time around — or at least it should be!

Hey People —

While were at it, Why not levy a 1/2 Cent Tax on every Share of Stock Traded?

That would put some serious brakes, on the Wall Street Casino attitude! It would be an excellent source of some MUCH-NEEDED Revenue too!

Isn’t time those “Highway Robbers”, start paying their “dues” to Society, too?

Could be, “We are learning, afterall?” … (Who’s House IS this, anyways?)

George W. would be SO Proud!

6 comments

Skip to comment form

Author

for making Wall Street pay their share.

The 1993 Gigantic Sucking Sound of Ross Perot is resident in memory. As is China and India’s carbon exemption status well before Big Al made it a modern household word.

After that it was Sarbanes-Oxley and attending the corpo-fascism classes of “compliance” modeled after that unique combination of Soviet and Nazi propaganda techniques.

Oh well, off again for survivalist/spiritual retreat training deep in the woods of Maine.

It’s so quaint define short-term gain as 1 year. raise capital gains taxes on assets held less than a year. While we’re at it, why don’t we do the same for commodities, ie; oil. Let’s say a 35% tax on oil futures(profits) not held for delivery. So that the company wouldnt need any payday loans.

The idea would be to stop the speculation, at least from the US or US based or a subsidiary of a US based company.

Author

from one of the cheerleaders

who got us in this mess …

http://www.youtube.com/watch?v…