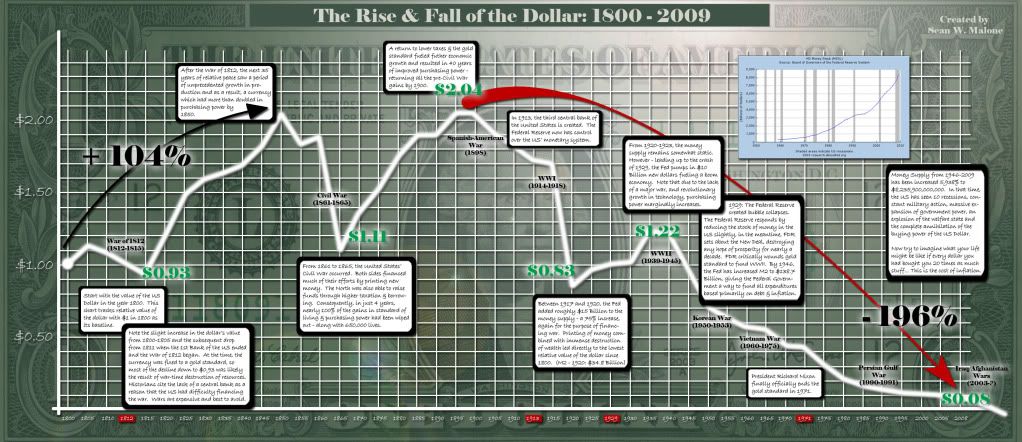

Rise & Fall Of The US Dollar: 1800 – 2008

Sean W. Malone, Saturday, August 29, 2009 at Logicology

click the image to view full size

so you can read the notes on it

(you may have to click it again to magnify it once you have the large image open)

Hopefully, more and more people will start waking up to the problems going on. But just knowing isn’t enough. As my roommate asked, when I showed her the chart; “What can we do about this?”

Step one is to end the Federal Reserve system once and for all. Andrew Jackson was right in 1832, and Ron Paul is right today. As I pointed out the other day, of course – when Andrew Jackson stopped the 2nd Bank of the United States from renewing its charter, dozens of miniature versions of fiat-currencies came into play instead. That was a bit of a hazard, clearly – and can be avoided by having a transition directly into commodity based representative money. This could, and probably would be a return to a gold standard, for obvious reasons… But unfortunately the lost ground we’ve made in the last century is – for now anyway – just gone. Any return to a gold standard would require that virtually all of the current M1 or M2 money supplies in the United States be apportioned against gold by weight. This would probably significantly bump up the price of gold in the short term, but eventually – as we return to a solid currency and get our balance sheets back in order, I have every confidence that we can get back up to 1800 levels, and ultimately 1900 monetary value and beyond.

There is no good reason why prices shouldn’t be coming down year after year.

Under an inflationary system, wages lag behind the rise in prices. As a result, you don’t earn anymore money – but your dollar is worth less, in kind of a perpetual feedback loop until things come to a serious head.

The remaining competitive/Capitalist elements in the US economy has fortunately been enough to keep people from starving to death, but with the same level of production – and no inflation, or even deflation… It’s not hard to imagine the massive standard of living increases we could have seen as a result. More stuff being chased after by the same amount of money is an incredibly good thing.

And sure – over time, wages will come down too (meaning that it’s a bit hyperbole to say that everyone gets 20x the purchasing power, since people’s salaries would be lower) but the beauty of an essentially deflationary monetary system is that wages will still lag behind the shift in currency value, so instead of constantly chasing after higher and higher prices with stagnant wages, you’ll be enjoying the benefits of lower and lower prices for goods as your wages change more slowly. This is a great thing… Think about a world where instead of whining about needing a raise to cope with the increase in the cost of living – your cost of living keeps going down, and your boss has to be the one to ask you to lower your salary instead!

The current system is beyond insanity… It’s time to stop destroying wealth and start creating some.

6 comments

Skip to comment form

Author

Ben Bernanke has yet to be fully unleashed. He’s only been nominated to keep his job as chairman of the fed.

Wait till he’s been confirmed. 🙁

the relative value of the USD versus what?

population growth chart?

Our “future” is being planned for us!

Canada has such an entity, as well, as does a European life entity. Yep, the “biggies” are ALL making the decisions of the future for the entire f..king world!

Unless and until we can find a means of harnessing these “jackasses of humanity” in, we are truly doomed as a democracy.