( – promoted by buhdydharma )

We have been told that Wall Street Investment firms are “Too big to Fail” — But that does NOT Mean they are “Too Big for Accountability”!

The Question boils down to,

Who Does the Congress Represent anyways —

The American People, or the Global Bankers (and their Lobbyists) ?

And Will the People bother to care about Wall Street Regulation this time around?

Since I’m assuming we will, here’s some essential background on the Wall Street Meltdown mess:

Credit Default Swap (CDS)

What Does Credit Default Swap (CDS) Mean?

A swap designed to transfer the credit exposure of fixed income products between parties.

http://www.investopedia.com/te…

CDS’s are an easy way to transfer Credit Risk — Check!

What ARE the Toxic Assets Everyone is Talking about?

Some CDOs are bundles of subprime and other mortgages sold in “tranches” (when you use a fancy word which sounds French, people assume it must be good). The rating agencies like Moody’s, S&P and Fitch’s gave crazily high AAA ratings to many of the tranches on the assumption that real estate prices wouldn’t fall nationwide.

They did, and so the CDOs plummeted in value and became “toxic”.

[…]

Similarly, there were huge CDS bets made that the companies buying or selling CDOs would stay solvent. When those companies started becoming insolvent, the CDS became toxic.

http://georgewashington2.blogs…

CDS are big Credit bets, on the big investment bets, made on risky Over-rated subprime CDO mortgages — Check!

The Big Takeover

The global economic crisis isn’t about money – it’s about power.

How Wall Street insiders are using the bailout to stage a revolution

Matt Taibbi — rollingstone — Mar 19, 2009

The CDS was popularized by J.P. Morgan, in particular by a group of young, creative bankers who would later become known as the “Morgan Mafia,” as many of them would go on to assume influential positions in the finance world. In 1994, in between booze and games of tennis at a resort in Boca Raton, Florida, the Morgan gang plotted a way to help boost the bank’s returns. One of their goals was to find a way to lend more money, while working around regulations that required them to keep a set amount of cash in reserve to back those loans. What they came up with was an early version of the credit-default swap (CDS).

In its simplest form, a CDS is just a bet on an outcome. Say Bank A writes a million-dollar mortgage to the Pope for a town house in the West Village. Bank A wants to hedge its mortgage risk in case the Pope can’t make his monthly payments, so it buys CDS protection from Bank B, wherein it agrees to pay Bank B a premium of $1,000 a month for five years. In return, Bank B agrees to pay Bank A the full million-dollar value of the Pope’s mortgage if he defaults. In theory, Bank A is covered if the Pope goes on a meth binge and loses his job.

When Morgan presented their plans for credit swaps to regulators in the late Nineties, they argued that if they bought CDS protection for enough of the investments in their portfolio, they had effectively moved the risk off their books. Therefore, they argued, they should be allowed to lend more, without keeping more cash in reserve.

http://www.rollingstone.com/po…

CDS are big Unregulated Credit bets — using your Money (ie your Capital), as insurance, on the big investment bets, on those VERY risky Over-rated subprime CDO mortgages — Check!

SO

Keeping a minimum level of Banking Funds on Reserve: Bad!

Leveraging all our Money, on Risky CDO’s and CDS’s: Good!

— Double Check!

Luckily for those Wheeler-dealer Investment Bankers, they had a strong Ally at the Fed, all too willing to “look the other way” with regards to these new risk-shifting investments, over-the-counter (OTC) derivatives.

Such loosely monitored OTC derivatives, would soon morph into the viral CDS derivatives, which would ultimately bring down the Biggest of Wall Street Firms aka, the “Too Big to Fail” cohort.

Alan Greenspan believes Markets can DO NO HARM! — Triple Check!

Since presumably, he saw the Movie “Wall Street”, and believes “Greed is Good” as stated in that Movie. (Funny he must have missed the ending?)

Testimony of Chairman Alan Greenspan

The regulation of OTC derivatives

Before the Committee on Banking and Financial Services, U.S. House of Representatives

July 24, 1998

GREENSPAN: In my testimony I shall step back from these issues of immediate concern and address the fundamental underlying issue, that is, whether it is appropriate to apply the Commodity Exchange Act (CEA) to over-the-counter derivatives (and, indeed, to financial derivatives generally)

[…]

GREENSPAN: To be sure, a few, albeit growing, types of OTC contracts such as equity swaps and some credit derivatives have a limited deliverable supply.However, unlike crop futures, where failure to deliver has additional significant penalties, costs of failure to deliver in OTC derivatives are almost always limited to actual damages.

There is no reason to believe either equity swaps or credit derivatives can influence the price of the underlying assets any more than conventional securities trading does.

[…]

GREENSPAN: Instead, the Federal Reserve believes that the fact that OTC markets function so effectively without the benefits of the CEA (Commodity Exchange Act) provides a strong argument for development of a less burdensome regulatory regime for financial derivatives traded on futures exchanges.To reiterate, the existing regulatory framework for futures trading was designed in the 1920s and 1930s for the trading of grain futures by the general public. Like OTC derivatives, exchange-traded financial derivatives generally are not as susceptible to manipulation and are traded predominantly by professional counterparties.

http://www.federalreserve.gov/…

Surprise, surprise, OTC Derivative Market were NOT Self-Regulating. They did NOT Self-Correct. Rather they Crashed and Burned.

Greenspan has the gall to feign an Ooops! … And that makes everything OK now?

Mortgage Foreclosures, Massive Bank Bailouts, Unchecked Unemployment, crashed 401K and Pension Plans — and all he can say is Ooops!!!

Greenspan admits he made a mistake

http://www.youtube.com/watch?v…

Waxman: Where do you think you made a mistake then?

Greenspan: I made a mistake in presuming that the self interest of organizations, specifically Banks and others, were such, as if they were best capable of protecting their own shareholders.”

Huh? Speak up, Mistro? … What’s that you say, MR. Business-as-Usual?

Markets AREN’T self-regulating? Consumers CAN and DO get hurt?

Umm … Does that mean we MIGHT just need some “Watchdogs” when our life savings are being risked, by the Bankers, afterall?

Da … ya Think!?!

Who fired that Wall Street Sheriff Spitzer guy, anyways?

Dylan Ratigan interviews

Arianna On “Too Big To Fail” Banks: We Need To Fundamentally Change This Corrupt System (VIDEO on HuffingtonPost) — 09-14-09

The major banks remain “too big to fail,” which means the whole system is constantly in peril, and they have returned to the risky practices that created the crisis in the first place.

Arianna says: “We are still being held hostage. If we don’t fundamentally change this corrupt system, we are basically going to be held hostage again.”

http://www.huffingtonpost.com/…

Elizabeth should get some serious Press for these Statements — Progressives are you taking a few notes?

Elizabeth Warren: The Financial Services Lobby is out in full force! They are thundering through the Halls of Congress. And they are thundering through the Halls of Congress, on every single aspect of change in the rules.

What were really talking about is a lot people, with a lot of money, who are pushing Congress — Just to Do Nothing!

… a lot people, with a lot of money, who are pushing Congress — Just to Do Nothing!

So in other words we still got ‘Business as Usual’ in Washington DC —

Those with the Gold — Make the Rules!

Dylan Ratigan interviews

Elizabeth Warren: “Until We Have A Credible Liquidation Threat, We Don’t Have Capitalism In America” (VIDEO on HuffingtonPost)

09-14-09

She concluded with three things she would like to see implemented:

1) A consumer financial protection agency.

2) Regulation of the credit rating agencies.

3) New laws that protect the system from banks that are “too big to fail.”

Warren told Ratigan: “Until we have a credible liquidation threat, we don’t have capitalism in America. It just doesn’t work without that.”

http://www.huffingtonpost.com/…

“Credible Liquidation Threat” ???

Does she mean, putting the Fear of Accountability, back into the Banking System?

The Fear of carrying their OWN Risks — When they decide to take on that next “sure fire” Investment — guaranteed to net them 30%, with absolutely NO Downside, to themselves!?!

That kind of “Credible Liquidation Threat”??

How Outrageous! … Who’s running this Casino anyways? I want to speak with Management! If I can’t be free to place my bets, how can I ever earn back all that money? … those Bankers will demand, no doubt.

Chairwoman Warren explains the Risk-transfer problem, in the referenced Video above, as follows:

Elizabeth Warren: We just also put out a report from the Congressional Oversight Panel pointing out, that the Toxic Assets that were on the Books of the Banks a year ago — you remember when Secretary Paulson came to us and said to Congress —

Dylan Ratigan: Of Course.

Elizabeth Warren: ‘Give us $700 Billion!’ Do you remember the reason? ‘So that we can remove those Toxic Assets from the Books of the Banks.’

Those Toxic Assets remain on the Books of the Banks. They are still there today. They continue to pose a Risk to the American Taxpayer — and they continue to tell us ‘We haven’t changed the rules’.

And until we change the Rules — we AREN’T Safe. The Risk-Takers are going to take all of the Up-side, and the American Taxpayers are going to be the Chumps, who are going to Pay on the other end, everytime it goes down.

[…]

Let’s face it, There are NO Lobbyists on the behalf of the American People. The Lobbyists are about a very narrow Interest Group. The Lobbyists are focused on how they can maximize their Profits, at the expense of the rest of us.

Wow she spells it out, doesn’t she?

NOW, Will the Administration listen to her? Will they take her advice?

Will they even invite her to the Strategy Table?

After all she’s only in charge of the Congressional Oversight Panel (COP) which was created to insure the interests of the People are being met, during this Bank Bailout fiasco (aka. Socialism for the Super-Wealthy)

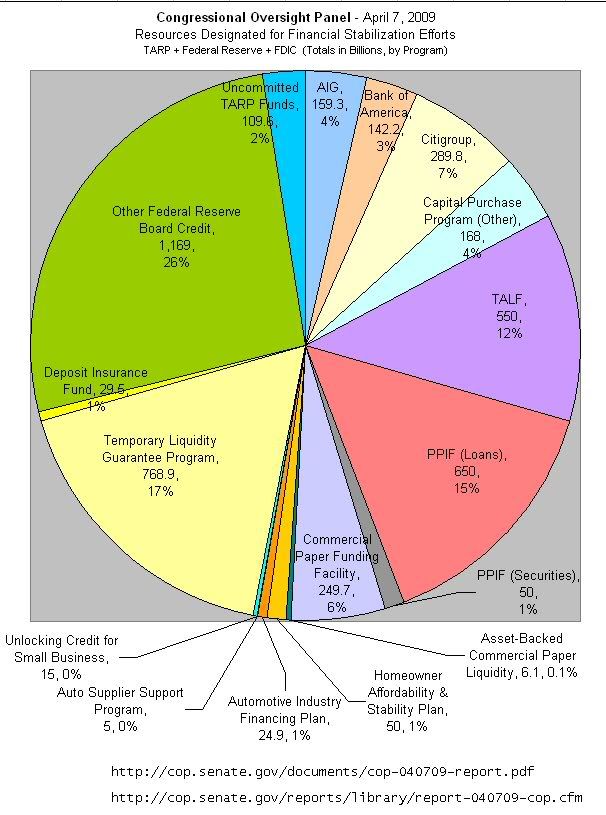

Congressional Oversight Panel — August 2009 Report

The Continued Risk of Troubled Assets

http://www.youtube.com/watch?v…

Elizabeth Warren: [concludes …] But so long as the underlying problem of ‘Troubled Assets’ remains unresolved, our long-term financial stability remains at risk.

Elizabeth Warren pursues Oversight, through the TARP Maze – April 2009

Bubble Economics — and the Cycles of Boom and Bust

Hedging their bets — about exactly WHO owns your Mortgage?

“Business as Usual” policies are really “Too Big to Ignore” this time around.

“Too big to Fail” — does NOT Mean “Too Big for Accountability”!!

And the People ARE paying attention, this time around.

It’s time to Re-regulate the OPM Managers and the OPM Speculators!

(OPM = Other People’s Money)

P.S. When your in front of a Congressional Oversight Committee, explaining the weighty issues of Global Financial Collapse —“Ooops!” is NOT a good enough excuse! — NOT as far as Accountability goes, anyways!!

WHO IS in Charge of this Casino, Anyways?

Ooops! … just doesn’t pay back all those, worthless Bankers’ Credit Slips, now does it?

It’s the American People, who are always left, paying the Bill.

One more thing — Check! please … give it Wall Street and their Lobbyists. Thanks!

5 comments

Skip to comment form

Author

We really start supporting, those Officials,

WHO support US, the People.

Don’t you think?

Watching Geithner openly defy her makes plain how heavily stacked the odds are against Elizabeth Warren, but she keeps fighting. She is one of the last decent public advocates in a government rotted out by corruption. It is Elizabeth Warren who should be Treasury Secretary, not one of Henry Kissinger’s wind-up toys.

Author

The Coming Collapse of the Middle Class

http://www.youtube.com/watch?v…

She methodically unveils the mystery to explain why Americans are suffering economically.

Hat-tip to WarOnError, for this Lecture Series Video