(11 am. – promoted by ek hornbeck)

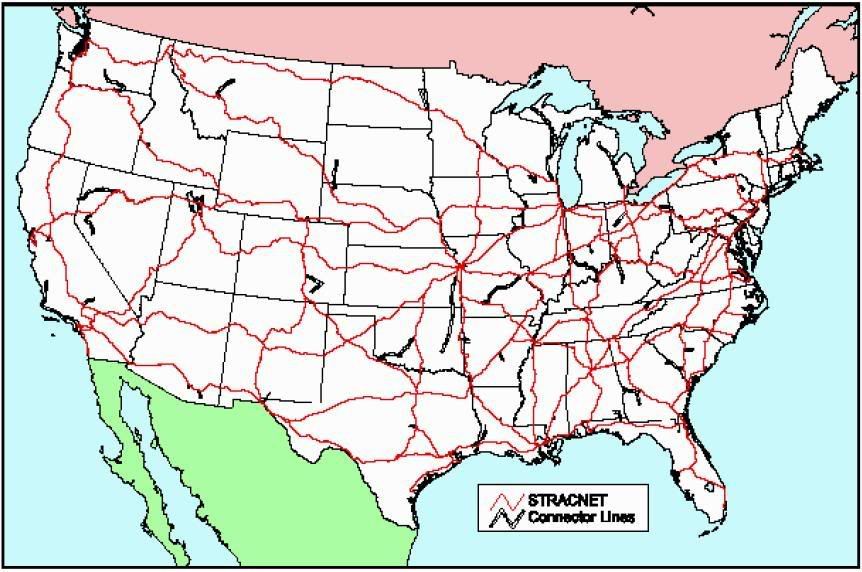

The Steel Interstate concept (tagpage) is one that I have been discussing, off and on, in my Sunday Train series. The basic idea is to electrify the Department of Defense STrategic RAil Corridor NETwork, STRACNET (right), and establish 100mph Rapid Freight Rail paths, to allow an estimated (Millenium Institute pdf) half of long haul trucking to shift to electric freight rail at a saving of about 10% of our current oil imports.

The Steel Interstate concept (tagpage) is one that I have been discussing, off and on, in my Sunday Train series. The basic idea is to electrify the Department of Defense STrategic RAil Corridor NETwork, STRACNET (right), and establish 100mph Rapid Freight Rail paths, to allow an estimated (Millenium Institute pdf) half of long haul trucking to shift to electric freight rail at a saving of about 10% of our current oil imports.

This diary is about how to overcome the only thing standing in its way: Public Finance. And that is to impose a $1/barrel tax on imported petroleum and petroleum products, and allocate 1% of any Carbon Fee to financing construction.

Burning the Midnight Oil for Living Energy Independence

Burning the Midnight Oil for Living Energy Independence

Objectives:

- Sustainable Energy Independence

- Sustainable long term Employment

- Front loaded Transitional Employment Now

- Reduced Climate Chaos Carbon Dumping

- Permanent Improvement in National Security

Public Finance

The key to this is that, unlike air and road freight, rail freight pays its own way. Therefore, if we subsidize the interest expense of the capital construction, user and access fees can repay the original capital cost. And that means that $1b annually can finance $20b~$33b of capital works – and once those capital works have been funded by access and user fees, it can fund another round.

We have imported over 4.5b barrels of petroleum and petroleum products since 2004 (Energy Information Agency), so a $1b tax will raise in excess of $4.5b. That is a capital base of $90b if bonds are sold at a 5% yield, to $150b if they are sold at a 3% yield.

Since it will take time to ramp up the program, I would propose that the $1/barrel tax be imposed in $0.25 increments each year. The tax would have an inflation escalator for the first ten years, kicking in at $0.05 increments, and then be frozen.

Turning to the Carbon Fee, the CBO estimate of Carbon Fee receipts in the latest climate bill is given below, with:

- what 1% of that amounts to

- the total capital funding, in a range from 5% to 3% bond yields

- the incremental capital funding, in the same range.

| Year |

Fees |

1% share |

Capital base |

Incremental |

| 2010 |

$0.9b |

$9m |

$180m~$300m |

|

| 2011 |

$39.1b |

$3191m |

$7.8b~$13b |

$7.6b~$12.7b |

| 2012 |

$59.1b |

$591m |

$11.8b~$19.7b |

$4b~$6.6b |

| 2013 |

$63.5b |

$635m |

$12.7b~$21.1b |

$0.8b~$1.4b |

| 2014 |

$90.6b |

$906m |

$18.1b~$30.2b |

$5.4b~$9.3b |

| 2015 |

$104b |

$1.04b |

$20.8b~$34.6b |

$2.6b~$4.4b |

| 2016 |

$112.3b |

$1.12b |

$22.4b~$37.4b |

$1.6b~$2.7b |

| 2017 |

117.6b |

$1.17b |

$23.5b~$39.2b |

$1.6b~$2.7b |

| 2018 |

$126.1b |

$1.26b |

$25.2b~$42.0b |

$1.7b~$2.3b |

| 2019 |

$132.3 |

$1.32b |

$26.4b~$44.1b |

$1.2b~$2.0b |

If the interest subsidy funding gets ahead of Steel Interstate projects available to fund, then the Federal Rail Authority would purchase ordinary Treasury bonds on the open market for a trust fund, and then sell those bonds on the open at the earliest opportunity when there are sufficient Steel Interstate projects available.

The projects themselves consist of constructing of electrical overhead infrastructure for existing Heavy Freight rail corridors and for additional Rapid Rail track for priority freight and higher speed passenger rail, as well as the track and signaling cost for the Rapid Rail track. Depending on required Rapid Rail capacity and existing heavy freight traffic, the publicly owned Rapid Rail track will either be double track, bi-directional 10mile:50mile track, or 10mile:50mile passing upgrades to the existing heavy freight track. All of the Rapid Rail track will be equipped with Positive Train Control systems to allow safe mixing of passenger and medium freight.

A given Steel Interstate projects is under the management and ownership of a Regional Development Corporation established for that purpose. Electric trains that use the system pay a User Fee for the electricity, which includes refunding the cost of the electrical infrastructure. Trains that use the Rapid Rail infrastructure also pay an Access Fee, which includes refunding the cost of the track and signal infrastructure.

Employment Impacts

Employment Impacts

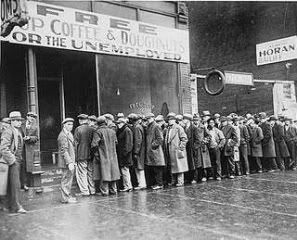

Over time, one of the two the main employment impact offered by the system is the protection of the US economy from oil price shocks. We have experienced main three oil price shocks in the last 40 years, and each of the three has been followed by a recession. Each recession reduces economic activity, and reduces employment.

Now, in the magical mystery fantasy world of mainstream economics, on recovery, the economy is attracted back to the growth path it was on before the recession hit. However, out here in the real world, the growth path is determined by decisions people make and the context in which they make those decisions. If the US is repeatedly hit harder by oil price shocks than other high income nations, that means that skills-intensive, income sensitive industries that involve traded goods and services will have a greater tendency to locate elsewhere.

Add on top of that the impact of the Reagan/Bush/Clinton/Bush labor market policies, and it can now take over a year after the start of a GDP-recovery before there is a recovery in employment opportunities. And combine that with the impact of the Reagan/Bush/Clinton/Bush policies to shift incomes from the middle class to the highest income 0.1% on the income ladder, and it can now take over two years before ordinary incomes start to recover after the start of a GDP recovery.

We are in a period when oil supplies can no longer expand rapidly in response to new demand from oil consumers, and so we should expect a number of serious oil price shocks in the generation ahead. And the first oil price shock that we can ride out without experiencing a recession will be a substantial short term and long term employment boost.

The second main employment impact offered by the system is the reduction in our gaping structural trade deficit. Our structural trade deficit has been obscured by the fact that so much of our trade deficit is energy and consumer good, and demand for both has dropped more rapidly than our exports have dropped. However, that is just a cyclical effect of the recession – if our economy recovers, but we do nothing about the import dependency, the trade deficit is going to head right back up to unsustainable levels of 4%, 5% or higher.

The second main employment impact offered by the system is the reduction in our gaping structural trade deficit. Our structural trade deficit has been obscured by the fact that so much of our trade deficit is energy and consumer good, and demand for both has dropped more rapidly than our exports have dropped. However, that is just a cyclical effect of the recession – if our economy recovers, but we do nothing about the import dependency, the trade deficit is going to head right back up to unsustainable levels of 4%, 5% or higher.

That trade deficit costs jobs. The income that leaks out of our economy is demand that is not recirculating inside our economy. And, indeed, since a dollar retained inside the economy can then be spent, generating additional income, generating additional spending on US production of goods and services, a dollar leaking out in imports costs more than $1 worth of domestic production.

That is, if on average $0.67 in income earned in the US leaks out of circulation (in imports, wealth accumulation and taxes) and $0.33 is spent on US production, that means that the average dollar created to finance new investment stays in circulation an average of 1.49 times, generating a total of $1.49 in US economic activity. Cut that leakage by a penny to $0.66, and the average dollar created to finance new investment stays in circulation an average of 1.51, generating $1.51 in US economic activity.

In addition to the broad based jobs impact, there is also the impact of the work building the system itself. This work is capital investment, so it tends to be front-loaded. It is not going to be available as quickly as a “Cash for Caulkers” program will be, which can generate a wave of economic activity next year – because even with assured finance, it will take about a year to get the planning finished and get the construction of the Steel Interstate projects up and running. However, unlike the capital investment in the conversion of our electrical supply to domestic renewable power sources, it will involve substantial construction work by the time of the 2012 elections, and even greater construction work in progress in the lead-up to the 2016 elections.

Automatic Stabilizer Effects

In addition to stimulating sustainable economic activity, this system is designed to also stabilize economic activity.

The first part of that is the basic system of providing ongoing interest subsidy to capital funding. When new Steel Interstate construction bonds are sold, the funds that are raised will depend on yields in bond markets. During strong economic conditions, the funds raised will be lower, and so there will be less construction taking place for a given amount of interest subsidy. When the economy slumps, the funds raised by a given interest subsidy will increase.

User Fee and Access Fee receipts will tend to decline during a downturn, as will crude oil imports – but the leverage effect is much stronger, so the net effect is to boost construction activity during any economic slowdown.

And there is no need for Congress or an Administration to recognize that there is a slowdown, plan a response and get it passed into law, and implement the response. Instead, as soon as capital markets react to any downturn by shifting funds out of equity markets into bond markets, the capital funding available to construct new Steel Interstates automatically expands.

Indeed, this means that the Steel Interstate program does not just “stimulate” during a recession – it also stimulates during a period of sluggish economic growth. Which makes it well suited for building out way out of the economy of sluggish growth that has been built by the fundamental Reagan/Bush/Clinton/Bush economic policy regime.

Looking to the Future

Looking to the Future

This is just one dimension of changing the Sluggish Recovery system we have been experiencing since the 1990’s into a Brawny Recovery, similar to the recoveries we used to have in the 50’s and 60’s, but built on a more ecologically sustainable foundation. We also need “Cash for Caulkers”, a Feed-In tariff for Domestic Sustainable Renewable Power, a massive program for providing oil-independent local transport with existing, mature technology, and an overhaul of our agricultural policy to shift from paying farmers to destroy the planet toward paying farmers to promote thriving ecosystems.

And we will be designing and building that foundation in far more than a single wave – we will, indeed, need to be learning by doing as we go, and so the experience of the first wave will be critical to the design of the second wave, and the second wave to the third round, and so on. If we have a wave of “foundation building” each decade, then a multi-generation task like this implies at least five waves before we can be confident that we have a living and livable foundation for our economy.

It is, however, an crucial part of the first wave. 1 BTU of electric rail freight can replace 20 BTU’s of diesel motor freight. The technology is already well established and mature, and we already have a system in place in the Pentagon for identifying strategically essential rail freight corridors.

However, if this is adopted, eventually we will have Rapid Electric Freight Rail systems in place. And a set of institutions that were developed to finance their construction.

First, these public finance institutions can maintain the systems. That will be possible with the User Fees and Access Fees, without further subsidy.

Indeed, the User Fees and Access Fees will be set at a level to refund the original capital cost, which will be greater than the maintenance cost. So once they have fully refunded their own capital cost, they represent a revenue source for further Energy Independent transport development.

My proposal is that the Regional Development Corporations are chartered with the future in mind. That is, a particular Regional Development Corporation is chartered to manage and finance the construction of a particular set of Steel Interstate corridors. As a given corridor is refunded, it can then use a certain portion of the fee revenue for other purposes:

- Infrastructure costs of connecting and complementary Steel Interstate corridors not on the STRACNET itself

- Infrastructure costs of oil-independent local freight transport

- Infrastructure costs of oil-independent local passenger transport

Conclusions

Its silly to have a conclusions section in an essay that represents a collection of conclusions I have reached over the past ten months. It is smart to build these Steel Interstates, and stupid not to build them.

So instead, I end with a question. How in the hell do we get Congress and the Administration to do what is smart to do, when there seems to be a strong preference on the part of Congresses and Administrations over the past thirty years to do what is stupid to do?

Beds are Burning: Tck Tck Tck Campaign

6 comments

Skip to comment form

Author

the big one. There are simple smart solutions for most of our woes but the ‘squid on the face of humanity’ has control of the purse strings and ‘the pump don’t work as the vandals stole the handle.’ I’m not being flippant but until we the people actually remove this from our face were not going to get any solutions at all, were going to get cash for clunkers, duct tape, caulk, and Tie Vac at 50% off.

That being said great essay. I appreciate your work and truly ‘hope’ that despite my pessimism, solutions like this will be implemented. So far it seems most likely that changes that benefit the environment and the economy will be regional and local. When they built the transcontinental rail they were in expansionist Manifest Destiny mode now they have global pillaging and geopolitical for short term profit and gambling as a motivation.

thanks for the essay and the sane solutions.