(9 am. – promoted by ek hornbeck)

By now most people are aware of how Dubai got itself in over its head. What exactly is the perfect metaphor for Dubai’s excesses? The palm-tree shaped islands? The underwater hotel? The indoor ski resort? It all had the feel of Disneyland meeting the dot-com mania.

In the end it was all about borrowed money. Lots of it. In that context Dubai is not alone.

Dubai’s default has the world’s investors asking the question: Who’s next?

Practically on the same day that Dubai announced their debt default, Vietnam sent out its own warning.

Among Asian stock markets, “the biggest risk now is Vietnam,” said Mobius, who oversees about $25 billion of emerging-market assets and has about $1 million invested in Vietnam. “The government is taking measures which may cancel out each other.”

“On one hand they’re devaluing the dong, on the other hand they’re increasing money supply in order to keep economic growth going, and they’re raising interest rates,” Mobius said. “When there’s confusion and uncertainty, you know what happens, people sell. They don’t want to stick around.”

Vietnam has struggled with inflation for many years now. The memories of the climatic Asian currency crisis of 1997 are still fresh in people’s minds. People in the region are well aware that it all started with Thailand devaluing their currency.

The day before Dubai announced their intention to default, the Ukraine made a special effort to tell investors that they weren’t about to do the same.

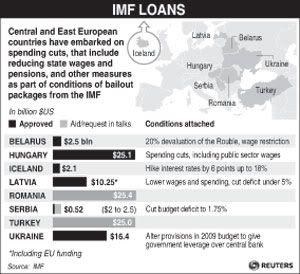

(Reuters) – Ukraine sought to calm foreign investors’ fears of a sovereign default after European markets wobbled last week on the consequences of the restructuring of a syndicated loan by the state railway firm. Investors have feared a state default throughout the year as the ex-Soviet state plunged deep into recession and most recently as the International Monetary Fund suspended its $16.4 billion bailout programme.

Like Dubai, the Ukraine was in trouble because of a state-owned business. Making it a particularly difficult situation worse is a collapsing economy, which contracted at a 15.9% rate in just the last quarter, straining the ability of the government to repay its foreign debts.

The Ukraine sits near the center of most of the world’s most pressing sovereign concerns – eastern Europe. Leading this group is Greece.

“As far as the bond vigilantes are concerned, the Bat-Signal is up for Greece,” said Francesco Garzarelli in a Goldman Sachs client note, Tremors at the EMU Periphery.

The newly-elected Hellenic Socialists (PASOK) of George Papandreou confess that the budget deficit will be more than 12pc of GDP this year, four times the original claim of the last lot. After campaigning on extra spending, it will have to do the exact opposite. “We need to save the country from bankruptcy,” he said.

Public debt in Greece is already at 100% and is expected to reach 135% by 2011. The current account deficit is over 14%. Efforts to balance this on the backs of workers has met with violent resistance.

Hungary seems to always be teetering on the edge of crisis.

With government debt totalling 80% of GDP, Hungary is most deeply in debt among the region’s countries. Therefore, it is no surprise that its 5-year CDS spread jumped 15 bp to 232 by last night, coupled with a weakening forint.

Hungary was not the only one of the region’s countries to feel the negative impact, for instance the CDS spreads of Bulgaria and Poland are the highest in 2.5 months, while Romania’s is at 3-month peak.

Hungary’s economy has contracted by over 7% from last year, and is still in recession, but that is positively rosy compared to the situation in the Baltic States.

Latvia’s economy contracted by 18.3 percent in the third quarter compared with the same period in 2008.

Estonia, meanwhile, posted a 2.8-percent contraction against the second quarter and 15.3 percent compared with 2008.

The price of homes in Latvia have fallen a staggering 59.7% in just the last year.

Repeated IMF bailouts in 2009 has kept many eastern European government from defaulting, but it hasn’t managed to get them out of their recessions. Bulgaria’s economy is shrinking at an increasing rate.

Strangely enough, the collapsing economices and falling currencies hasn’t kept the stock markets of the region from booming with massive inflows of hot money.

The Ukraine’s PFTS Index climbed 108 percent in the fact of a collapsing economy. Romania’s Bucharest Exchange Trading Index has risen 75 percent this year in U.S. dollar terms despite the government collapsing last month over economic concerns. Hungary’s benchmark Budapest Stock Exchange Index gained 84 percent this year.

Which, if any, of these nations will default in the coming years? It’s impossible to say for certain. However, one thing is for certain, people are looking harder now and asking tougher questions.

7 comments

Skip to comment form

Author

I honestly don’t know what else to say, except I wish I was sitting on a big fat pile of gold right now!

Somebody got it.

was once a poster child for neoliberal restructuring, or so said Michael Hudson…

Author

Here is a link to CDS prices on sovereign debt risk.

looked this weekend at my Washington State ira-401b_k_z What The Fuck Retirement, and the part that they manage is all diversified into 4? or 5 different funds which are a mix of … large caps and phony ass fake AAA bonds and some small cap index thingc … ???????

and they all own coke, microsoft, westinghouse and general motors … ummmmmmm … did I get that list right?? and baskets of all the accounting magic fortune 100 / 500 that EVERYBODY owns cuz … dow 30,000!!!!

leveraged buy outs free shareholder value … ?? WTF did that come from… that 80’s channelling ?? those 80’s music DVD concerts played backwards?

oh well, I grew up on welfare as a teen in the 70’s – we had all the USDA cheese and powdered milk and beans and fake eggs and …? stashed in the attic so no one would know we were that f’king broke.

In 30 years when I’m 79 I’ll be able to … live off of obama speeches?

rmm.