(10 am. – promoted by ek hornbeck)

The Invisible Hand

The Nobel Prize-winning economist Joseph E. Stiglitz, says: “the reason that the invisible hand often seems invisible is that it is often not there.” [7][8] Stiglitz explains his position:

Adam Smith, the father of modern economics, is often cited as arguing for the “invisible hand” and free markets: firms, in the pursuit of profits, are led, as if by an invisible hand, to do what is best for the world. But unlike his followers, Adam Smith was aware of some of the limitations of free markets, and research since then has further clarified why free markets, by themselves, often do not lead to what is best. As I put it in my new book, Making Globalization Work, the reason that the invisible hand often seems invisible is that it is often not there.

…

[continuing …]

Whenever there are “externalities” — where the actions of an individual have impacts on others for which they do not pay, or for which they are not compensated — markets will not work well. Some of the important instances have long understood environmental externalities. Markets, by themselves, produce too much pollution. Markets, by themselves, also produce too little basic research. (The government was responsible for financing most of the important scientific breakthroughs, including the internet and the first telegraph line, and many bio-tech advances.)

But recent research has shown that these externalities are pervasive, whenever there is imperfect information or imperfect risk markets — that is always.

http://en.wikipedia.org/wiki/I…

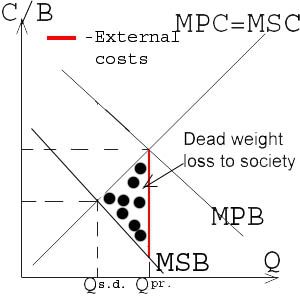

Externalities: Costs and Benefits, that no one ever fully accounts for — they just happen, silently, in the the background — both to the detriment, or the benefit of society as a whole … (those “unintended benefits” when they happen, by the way, are often labeled “Socialism” by our ill-informed fellow-citizens.)

Externality: Costs and Benefits

In economics, an externality or spillover of an economic transaction is an impact on a party that is not directly involved in the transaction. In such a case, prices do not reflect the full costs or benefits in production or consumption of a product or service.

For example, manufacturing that causes air pollution imposes costs on the whole society

On the other hand, an external benefit would increase the utility of third parties at no cost to them. Since collective societal welfare is improved, but the providers have no way of monetizing the benefit, less of the good will be produced than would be optimal for society as a whole. Goods with positive externalities include education, health care, and law enforcement.

http://en.wikipedia.org/wiki/E…

Funny, some “external cost”, should be plain for anyone to see …

Just probably not “profitable” to Account for?

The ‘invisible hand’ is blind to climate externalities and the value of natural resources

by Lester Brown, Grist.org — 18 Dec 2008

We are doing today exactly what Enron did. We are leaving costs off the books, but on a far larger scale. […] But if we incorporate all the indirect costs that the market omits when setting prices, a very different picture emerges. If we persist in leaving these costs off the books, we will face the same fate as Enron.

Ray Anderson, founder and chairman of Atlanta-based Interface, a leading world manufacturer of industrial carpet, is especially critical of economics as it is taught in many universities: “We continue to teach economics students to trust the ‘invisible hand’ of the market, when the invisible hand is clearly blind to the externalities and treats massive subsidies, such as a war to protect oil for the oil companies, as if the subsidies were deserved.

Can we really trust a blind invisible hand to allocate resources rationally?”

http://www.grist.org/article/A…

The lost to Society as a whole, in Market Supply-Demand terms, when the true Costs to Society, are NOT Priced in to the Quarterly Profit margin equations:

Costs And Benefits – Externalities

Goldman’s secret moral pathology

15 symptoms of a Wall Street disease destroying democracy and capitalism

By Paul B. Farrell, MarketWatch – Nov 24, 2009

MarketWatch — In “The Battle for the Soul of Capitalism” Jack Bogle no longer sees Adam Smith’s “invisible hand” driving “capitalism in a healthy, positive direction.”

Today, his “Happy Conspiracy” of Wall Street plus co-conspirators in Washington and Corporate America are spreading a contagious “pathological mutation of capitalism” driven by the new “invisible hands” of this new “mutant capitalism”

[…] Wall Street’s secret contagious pathology, with insiders like Lloyd Blankfein, Henry Paulson and others pocketing billions more of the firm’s profits than shareholders, evidence the new “mutant capitalism” has replaced Adam Smith’s 1776 version which historically endowed the soul of American democracy as well as our capitalistic system.

[…]

Today we’ll paraphrase news reports about 15 symptoms spreading “soul sickness” beyond the boundaries of this Goldman case study: These are the 15 signs of a moral pathology undermining not just banking but American democracy and capitalism.

1. Gross denial of any moral damage caused by their rampant greed2. Narcissistic egomaniacs with secret ‘God complexes’

3. Paranoid obsessives about secrecy, guilt and non-disclosure

4. Power-hungry need to control government using Trojan Horses

5. Borderline personalities who regularly ignore conflicts of interest

6. Pathological liars incapable of honesty even with own investors

7. Sole fiduciary duty to insiders, not investors, never the public

8. Moral issues are PR glitches, violations of ‘don’t get caught’ rule

9. Charitable donations are tax and PR opportunities, not moral issues

10. When exposed in a massive fraud, feign humility, fake an apology

…

for the last 5 signs of the Mutant Capitalism

SO, what ever happened to Adam Smith’s “Invisible Hand”, in the modern era of Super-charged Capitalism?

If recent Wall Street events are any guide, Capitalism’s “Invisible Hand” may indeed have “mutated” into a force, never quite intended, by its founding author?

Chairman of the Board and Chief Executive Officer

Goldman Sachs Group, Inc.

Officer since January 2004

Lloyd Blankfein Total Compensation 2008 $1,113,771.00

Lloyd Blankfein, Billionaire Goldman CEO — he’s obvious Too-Big-to-Fail!

Fiscal 1998 Compensation Information

Henry M. Paulson, Jr., $12,700,000

1998: Co-Chairman and Co-Chief Executive Officer

(1999: Director, Chairman and Chief Executive Officer)

Poor Henry! — HOW in the world — will he keep up with his peers?

No worries, you see Henry, started off, with a “silver spoon” in his pocket …

The Goldman Sachs Group, Inc.

Common Stock

This is an initial public offering of shares of common stock of The Goldman Sachs Group, Inc. This prospectus relates to an offering of 55,200,000 shares in the United States and Canada.

Per Share, Total

Initial public offering price $53.00 $3,657,000,000

Prospectus dated May 3, 1999.

http://www2.goldmansachs.com/s…

Shares Beneficially Owned

Prior to [Goldman’s Common Stock] Offerings —Directors and named executive officers:

Number, Percent

Henry M. Paulson, Jr. 4,132,235 1.1%

http://www2.goldmansachs.com/s…

4,132,235 shares x $53.00 offer price = $219,008,455.00

Henry Paulson: 1999 Goldman Director, and Instant Billionaire, since 1998 — AND primary Architect of the unprecedented Wall Street Bailout giveaway, with Goldman Sachs the prime benefactor.

Adam Smith told us, Markets would be “Self-Correcting” … and this was the Mantra of Greenspan too, for the last decade — during the entire era of Deregulation.

So how’s that “Correction”, working out for you?

Well, IF you’re TOO-BIG-TO-FAIL — Markets can be coerced to Correct, to your personal Benefit.

(Just ask Hank Paulson, and his fellow wrecking crew.)

BUT, if you’re TOO-SMALL-TO-NOTICE — Markets can destroy your personal Nest Egg, in a blink of an eye, no less.

(Just ask anyone on Main Street.)

PBS’ Bill Moyers with Vanguard Funds founder John Bogle

Short Recap

Entire Moyer’s Interview

BILL MOYERS: This story in THE NEW YORK TIMES this week. What do you think when you read a story like that?

JOHN BOGLE: Well, first, it’s a national disgrace. Simply put. And there are some things that must be entrusted to government and some things that must be entrusted to private enterprise. And what we see there, at least in my judgment, is that we’ve taken medical care, healthcare and going from making it a profession in which the patient is the object of the game – preserving the patient “first do no harm” as Hippocrates would say or would have said and turn that into a business. And so, it’s a bottom line. I’ve often said we’re in a bottom line society. We’re measuring the wrong bottom line.

BILL MOYERS: What does it say to you that the real owners of the nursing home, the private investors have created this maze of smoke and mirrors that make it virtually impossible to find out who the owners really are?

JOHN BOGLE: Well, that’s so typical of much that’s going on in American finance, the way we structure these financial instruments, which are stock certificates or debt instruments. But it’s the same thing of the removal of your friendly, local neighborhood bank holding the mortgage and being able to work with you when you fall on hard times to some unnamed, often unknown, financial institution who couldn’t care less.

BILL MOYERS: These private equity firms that own these nursing homes wouldn’t even talk to THE NEW YORK TIMES. They won’t talk to reporters. I mean, there’s no accountability to the public.

JOHN BOGLE: There’s no accountability. And it’s wrong. It’s fundamentally a blight on our society.

[…]JOHN BOGLE: Actually, I think it’s fair to say it’s in jeopardy. But there’s one sense that it’s not in jeopardy. And that is, ultimately, the system will correct. The bigger the boom, I fear, the bigger the bust. In other words, you pay the price. It’s not a self sustaining system at this kind of a level.

BILL MOYERS: Do we need new rules?

JOHN BOGLE: One thing is, I believe, to have a federal standard of fiduciary duty for money managers. They’ve come from eight percent ownership of American business to 74 percent ownership of American business. It’s staggering, over unbelievable change. Without any rules as to how they’re supposed to behave. We have state laws of proven investing and fiduciary duty and things of that nature. But they don’t seem to be working. And our founding fathers actually thought about having a federal statute — a federal corporate chartering statute. I think we probably need one because if some of the states step up and say improve their governance provisions, corporations will move to another state. So the state system I don’t think can prevail.

So a federal standard of fiduciary duty which demands that our pension trustees and our mutual fund directors make sure that those pension funds and mutual funds are operated in the prime interest of those who have entrusted their money to them.

Diarist Note: WTF!!?? We need a law for this ??? That’s what it’s come to apparently …

And that includes responsibility for corporate governance. And it will ultimately turn to be focused more on long term investing.

When I came into this business in the 1950’s, it was a business focused on the wisdom of long term investing. We changed in that period to a business that is focused on the folly of short term speculation. And think about this for a minute. If you’re a true investor holding a company for the long term, you’re well aware that the value in that company is company’s earnings compounded over time, developing new products and services, developing efficiencies — trying to size up the proper corporate strategy, you know, making the company more valuable. But, in the folly of short term speculation, you’re just thinking will that stock be worth more or less six months from now or a year from now?

[…]Now, what is the job of a corporation when they buy into a mutual fund management company? It’s to earn a return on the capital they invest in that company. It’s not to earn a return on the capital of the investors who invested with that mutual fund. Now, in fairness, they want to earn as much money as they can for the fund shareholders. But, not at their own expense.

What we’ve done is have you know, what I call in the book, a pathological mutation of capitalism from that old traditional owners’ capitalism to a new form of capitalism, which is Manager’s Capitalism. The evidence is quite compelling that today corporations are run in a very important way to maximize the returns of its managers at the expense of its stockholders.

BILL MOYERS: Its CEOs.

JOHN BOGLE: Its CEOs, well, the upper level of five or six top officers. And they get enormous amounts of pay for actually doing very little. I’m a businessman. Listen, we all– we chief executives get an awful lot of credit that we don’t deserve.Real work in companies is done by the people who are getting themselves together and doing the hard work of making companies grow–

BILL MOYERS: And, yet, these–

JOHN BOGLE: every day.

BILL MOYERS: These are the people who most often get laid off, right?

JOHN BOGLE: They get laid off. And, of course, the ironic part of that is they often get laid off – used to be called downsizing. But, of course, in today’s America, it’s called right sizing. They get laid off. That reduces expenses. That increases earnings and that means the CEO gets more.

http://www.pbs.org/moyers/jour…

SOOOO, Super-charged Capitalism is “Self-Correcting”, again, for WHO, exactly?

Perhaps for those Money Managers with their hand of the lever?

Yet such extreme measures, may lead to extreme consequences, for those on the TOO-SMALL-TO-NOTICE side of the Ledger — you know us meager Taxpayers. We must bear the brunt, of whatever Capitalism, DECIDES to Mutate into next.

John C. Bogle – The Battle for the Soul of Capitalism

more nitty gritty details — video clip interview

Dean Lawrence R Velvel interviews John C. Bogle, founder of the Vanguard Group, Inc. and president of the Bogle Financial Markets Research Center, about his book The Battle for the Soul of Capitalism. Bogle analyses what went wrong in Corporate America, from pension plans to corporate profits to mutual funds to stock options to corporate greed.

Adam Smith (and Greenspan) taught us, Markets are “Self-Correcting” …

Yet, one of the Capital Market’s most respected CEO’s John C. Bogle, is telling us otherwise.

According to him, Capitalism has mutated, due to uncontrolled greed, and unless Wall Street’s Money Managers start looking out for the long-term interests of their actual Customers, instead of their own short-term gains, for the current CEO’s — well, the NEXT Market Self-Correction could truly Bankrupt the entire System — Henry Paulson’s Billionaire Bank Account, notwithstanding!

The Battle for the Soul of Capitalism, by John C. Bogle

Book Reviews

“This is an important book for the post-Enron era. In his characteristic hard hitting style, one of the legends of the mutual fund industry presents an insider’s view of what’s wrong with corporate America and what can be done to improve it.”

— Burton G. Malkiel, Princeton University

Simply put, capitalism has too many characters and not enough men of character. When one of the few tells us that the system he loves is ailing, and how he’d fix it, we had best listen.”

— Cliff Asness Ph.D., Managing and Founding Principal, AQR Capital Management

“Bogle describes the continuous struggle for control of our capitalistic system, the odds being heavily in favor of the managers. Individual investors and beneficiaries remain helpless, intermediaries are passive or conflicted, and boards not yet effective. You owe it to yourself to read this book and reflect on his call for further federal intervention to restore some balance.”

— Ira Millstein, Senior Partner, Weil, Gotshal & Manges LLP

“Once again Jack Bogle is the clearest and most courageous voice pointing out critical flaws in our governance and financial system but also showing in constructive, brilliant ways how to make the timely repairs.” — Jeffrey Sonnenfeld, Yale University

http://yalepress.yale.edu/yupb…

We’ve been warned …

and still the old Band, plays on …

http://www.youtube.com/watch?v…

Thankfully we may still have time,

to Actually Account for all those Hidden Externalities …

Time will tell … Happy Holidays, people!

I’m just thankful for, the fact the extreme FOX fanatics are still “just a Fringe demographic” …

but just wait, that unanswered “worker’s angst” is bound to Mutate too.

Afterall, That is what “Self-Correction”, is all about … change, adapt, survive.

So Buyer Beware … with some purchases, there are No Exchanges, No Guarantees …

15 comments

Skip to comment form

Author

here’s to the little guys and gals,

Someday, we’ll get our Bail Out too.

Right after, we get our Ponies!

sort of reminds me of The Black Hand.

It’s time we took religion out of politics, out of economic policy, out of everything.

Let’s get back to common sense, making things work, thinking about “the common good” and that sort of thing.

All this other bullshit is pure magical thinking.

Alan Greenspan’s magical thinking, via his “libertarianism” is what destroyed the economy.

Enough of that bullshit.

Hope you don’t mind some thoughts that your diary brought to mind for me. Maybe I can get a better understanding by reading your book, but it seems that insurance is a good example of an externality-generating monster, economically and politically.

In the “health” insurance industry alone there have to be an awful lot of voters who would rather contemplate a president’s birthplace or a neighbor’s rotten socialism than the possibility that in striving every day to survive by returning more profit to their business than the colleague beside them, they are actually causing everyone in the US to pay twice as much as any other nation for the privilege of staying alive. After all, man is driven by the desire to improve his own condition. Not “our” own condition.

The health insurance industry feeds plenty of others, and thus more people with a stake in believing patently absurd fearmongering from their puppetmasters. Whether he did it well or not, it occurs to me that President Obama went after healthcare reform before a serious jobs program because he saw not just the real and pressing immediate need for improvement, but also because we need a symbol that within the capitalist system, HERE is the line below which we will not go to compel the weak to serve the powerful. Competition for the betterment of society should not be fueled by fear of imminent death.

It takes a cold individual to consider the hard reality of the current state of capitalism and pretend that the answer lies in less interfernce from the public sector, which is our last defense.

Unfortunately, without financial regulatory reform or a stand against the military industrial complex, there can be no shift in the public trust from those with the money bags to our fellow citizens. Any hope for change depends upon legislation, and the number of Americans still brainwashed by free market fundamentalism is too great to seriously threaten status quo legislators with losing their power.

Later economists like Veblen and Galbraith were well aware that the herd mentality, evidenced by pecuniary emulation and conspicuous consumption, were what makes turning the battleship so difficult. The generals currently winning the class war would be easy to oust if they didn’t have so many troops.

Thanks for the thought-provoking diary.

Hank Paulson’s Goldman Sachs compensation of over 12 mil per year comes to $32,876 per day, including saturdays and sundays. $32,876 is a decent yearly salary for many Americans, for Paulson it could be a day at the golf course.

When asked how he did it, he noted that it was the “invisible hand of the market”.

… was self-correcting, he was talking about competitive markets – and eliminating the constraints on business behavior that result from competitive markets is one thing that businessmen have long done:

Indeed, the people that are most convinced that Adam Smith wrote The Wealth of Nations as a song of praise to capitalism are the ones less likely to have actually read it, and who are certain to have never read Adam Smith’s Theory of Moral Sentiment.

Indeed, the allocation of Third Party Costs (aka External Costs) are an excellent example of the kind of thing which would demand the limitation of market operation under the Theory of Moral Sentiment.

As to why its as bad as it is – that was our Great American Innovation of Corporate Capitalism, which we led the way in developing in the late 1800’s, and which helped lead to the Long Depression of 1873-1879, the Depression of 1893-1897, and the Great Depression of 1929-1939. Ever since the New Deal, there have been those seeking to restore Gilded Age economic conditions, because it allows some of the wealthy to be a little bit more wealthy, and simply ignoring or explaining away the fact that it brings with it far more massive and long-lasting periodic economic crises than ever happened when we had the New Deal institutions intact.