It’s Still the Worst Deflation in US History

November 18th, 2009

By David Goldman

This morning’s news that housing starts “unexpectedly” dropped by 11 percent month on month is consistent with my grim view of the American economy. The crystal-meth monetary policy at the Fed makes everyone feel better, until they don’t. The nonstop rise in the price of dollar hedges tells us that it can’t last forever. Large balance sheets attached to the Fed’s money pump can show profits, and the price of spread assets (as PIMCO’s Bill Gross keeps emphasizing) is stupid rich. But at the capillary level, through, the economy is dying and gangrene is setting in.

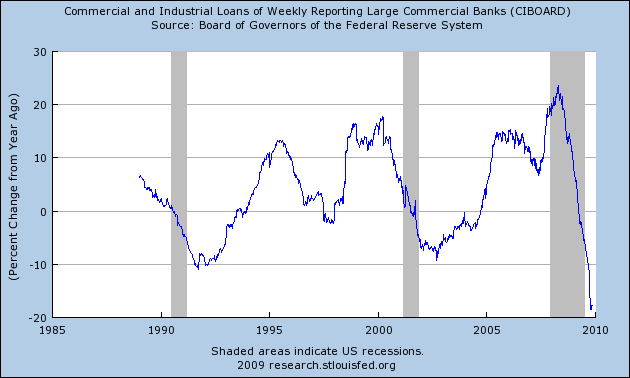

Here’s year on year growth in commercial and industrial loans from weekly reporting banks in the US:

A 20% decline year on year does not look like a recovery. In fact, it looks like nothing we have seen since the Great Depression. C&I loan growth lags the end of recessions, to be sure, but this extreme level of credit reduction suggests profound trouble.

35% or so of Americans work for enterprises with fewer than 100 employees, and 20% work (or used to work) for firms with fewer than 20 employees. The percentages of employment in smaller firms (less than 100 employees) are much higher in real estate (46%) and construction (77%) as of the 2004 Economic Census.

It isn’t just the 17.5% broad-measure unemployment number that we should worry about, but the massacre of smaller businesses, who are concentrated in the most vulnerable sectors: real estate, construction, and retail. Retail sales may get a temporary shot in the arm from cash for clunkers, and a combination of tax credits and (de facto) subsidized mortgage rates may hold up the bottom of the housing market for a short time. But today’s data show how fragile these matters are.

4 comments

Skip to comment form

Author

Steve Miller knows…

Cash Ain’t Nuthin’ But Trash.