(11 am. – promoted by ek hornbeck)

ProPublica Unemployment Insurance Tracker:

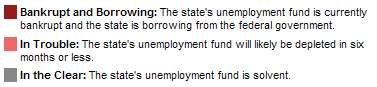

The unemployment insurance system is in crisis. A record 20 million Americans collected unemployment benefits last year, and so far twenty-five states have run out of funds and been forced to borrow from federal government, raise taxes, or cut benefits. In many other states the situation is deteriorating fast. Using near real-time data on state revenues and the benefits they pay out, we estimate how long state trust funds will hold up.

(Hover your mouse over states on the map to see the current Trust Fund Balance for each state, and the Future Prediction of the balance, or the current Borrowed Amount if a state is in the red)

Click on a state [below] to find the latest, plus detailed historical data and charts, and details on tax increases and benefit cuts.

AK – AL – AR – AZ – CA – CO – CT – DE – FL – GA – HI – IA – ID – IL – IN – KS – KY – LA – MA – MDME – MI – MN – MO – MS – MT – NC – ND – NE – NH – NJ – NM – NV – NY – OH

OK – OR – PA – RI – SC – SD – TN – TX – UT – VA – VT – WA – WI – WV – WY

The U.S. has 53 separate unemployment insurance systems. Each is free to set its own policies within broad federal guidelines and some states have well-funded systems, while many have let their reserves dwindle because of unsustainably low taxes or high benefits. Some states offer generous benefits to a wide spectrum of workers, while some offer much smaller benefits to a restricted group.

- Graphic Unemployment Tax Increases and Benefits Changes in 2010, by Olga Pierce, January 19, 2010

- Two Dozen States’ Unemployment Funds in the Red, Nine More Within Six Months, by Olga Pierce, January 19, 2010

- Payroll Taxes Rise for Employers, by Olga Pierce, January 19, 2010

- Unemployment Insurance Buckles After Years of Underfunding, by Olga Pierce, ProPublica – June 3, 2009

18 comments

Skip to comment form

Author

They built a formula. For formula details, check out ProPublica’s Nerd Page.

The links in the post should all open in a new window or tab.

This took me awhile – let me know if any links are broken so I can fix them…

Author

How Can A Poor Man Stand Such Times And Live

Is it the states or the Fed?

in a year or two since it is obvious that there is no structural reason why employment should increase to any significant extent?

rates of state income tax and the solvency of state unemployment programs. Tennessee has no state income tax. City of Memphis has a sales tax of 9.25 I think.

LA and Miss are very poor states but are solvent. However, the wages are so low that I reckon there are larger numbers of working poor in the south who aren’t making much more than northerners who are getting unemployment.

Florida unemployment rate highest in 25 years

But there’s really no place for most to go to as there are already way to many looking at openings in their own backyards!