(11 am. – promoted by ek hornbeck)

The world’s five biggest AAA-rated states are all at risk of soaring debt costs and will have to implement austerity plans that threaten “social cohesion”, according to a report on sovereign debt by Moody’s. The US rating agency said the US, the UK, Germany, France, and Spain are walking a tightrope as they try to bring public finances under control without nipping recovery in the bud. It warned of “substantial execution risk” in withdrawal of stimulus.

Here’s the sanitary definition of “austerity measure” from the Financial Times:

Austerity measure:

An official action taken by a government in order to reduce the amount of money that it spends or the amount that people spend. [1]

-Financial Times Lexicon

For years, I have not understood the left’s obsession with electing more, better Democrats. Barack Obama and two Democratic majorities in Congress are traitorously corrupt quislings of the first division, belonging wholly to the criminal profiteering industries. The year-long healthcare “debate” never happened, was never going to happen. And while it’s not irrelevant that we got totally screwed, even being complete losers on that count is utterly swamped by even more pertinent, forbidding, and unfeeling facts on the ground.

Most people are far too complacent when it comes to the consequences of a shrinking economic system. Many claim that we can easily downsize to smaller homes and smaller lives, since there’s so much we don’t really need anyway, that we will move in together and return to “good” conversations, growing our own tomatoes and all that. But that’s just not going to happen voluntarily, not on a large and wide scale. The human mind has no reverse. It doesn’t even have a steering wheel. We are built for one of two things: go forward or crash. It looks like there’s no forward left before a major crash happens first. It also looks like there’s not a whole lot of people who realize this.

William Black, former bank regulator and expert in white collar crime and fraud (from the orders of magnitude smaller Savings & Loans crisis), gladly busted some heads in this 2009 interview with Bill Moyers. Black basically said what we all by now know: the meltdown was caused entirely by fraudulent lending and securities, and that criminal activity was being covered up by the CEOs, Geithner et al, and yes, Barack Obama. The “AAA” assets were still toxic, and we need to find out what assets are worth and who’s who in the criminal zoo. Black’s frank and cogent recapitulation of the original problem is worth reviewing (28 min total):

Notice that Black says that, like torture, the government is legally bound to prosecute fraud, based on laws passed during the S & L crisis. The current crime is orders of magnitude bigger. It was fraud then, and it’s fraud now. Go ahead and bitch about Bush all you want, no problems there, but the current egregious lack of law enforcement is a purely Democratic phenomenon.

Approximately one year after Black’s head-busting, nothing has changed, except: Obama has settled in as the new criminal executor in chief, the CEOs are richer than ever due to extravagant and ostentatiously-strutting-and-clucking-peacocks-on-acid bail-outs, “the tidal wave of liquidity that raises all the most elegantly appointed ships right before it razes all buildings,” while the American people are still losing jobs and houses, and remain on the hook for massive criminal fraudulence due to those bail-outs. Oh, and we are heading into the second and third waves of this tidal wave crisis.

Sure, we’ve had multiple rounds of elaborate and luxurious bail-outs for the wealthy. The investing classes are feeling positively giddy, once you understand that risky investment in high-yield bonds has now exceeded pre-crash levels:

In my book, that can only mean one thing:

The Wiggin’ Banksters are Back, Baby!

(graphic via Jesse, who notes that 36% of Congress are lawyers.)

Thank you, Barack Obama. Your failure to enforce laws exceeds your epically failed presidency, and dooms us all.

Remember when Timmy G was encouraging the continuation of rampant speculation to aid growth, and said “there will be no second wave?” I do. We already have a high foreclosure rate and a huge shadow inventory of un-foreclosed delinquencies that would look terrible if they were on the books. We continue to have bank “assets” marked-to-future-growth-fantasies. Jobs have not turned the corner. Yes, there was a mini-lull in the worst news during the tidal wave in liquidity in between mortgage resets. The tidal wave in unprecedented liquidity was really no match for the tidal wave in criminal fraud. The Fed and Government Sponsored Entities (Freddie, Fannie, Ginnie) remain engorged and choking on the giant, mercury-filled fish. Now what?

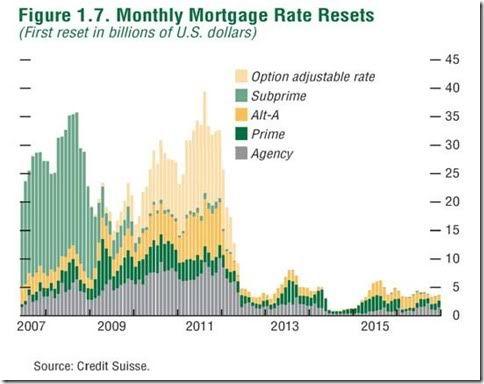

Alt-a and option arm have just begun resetting, and won’t peak for a few more months in 2010, with a third bigger wave coming at us in 2011. And the engorged Fed is 99% plus finished with buying up the last round of garbage.

We are just getting started on Tidal Wave 2.0

Via Ed Harrison:

I should note parenthetically that as you read reports about the mortgage and credit markets during the next few months, it will be extremely important to pay attention to the time period being discussed. For example, we are seeing articles with very recent datelines that are drawing conclusions based on relatively pleasant data from the fourth quarter of last year, which reflects the end of the reset lull that was completed with the low in September.

To reiterate what the reset curve looks like here, the 2010 peak doesn’t really get going until July-Sep (with delinquencies likely to peak about 3 months later, and foreclosures about 3 months after that). A larger peak will occur the second half of 2011. I remain concerned that we could quickly accumulate hundreds of billions of dollars of loan resets in the coming months, and in that case, would expect to see about 40% of those go delinquent based on the sub-prime curve and the delinquency rate on earlier Alt-A loans. Notably, by 2005, the credit score allowed on Alt-A loans fell to about 620, which is consistent with sub-prime. And not surprisingly, the later in the housing bubble the loan was made, the higher the delinquency rate has been right out of the gate.

According to Meredith Whitney, our bursting bubble has yet another down-leg:

Americans are already psychologically broken. Paranoid. Delusional. Aggressive. Ignorant. Self-satisfied. Weak-minded. Intolerant. Bigoted. Uneducated. Indebted. In-authentically hyper-religious. Immoral. Gluttonous. Greedy. Extravagant. Unrestrained.

What happens when you really test them economically? When the next tidal wave hits? When real austerity measures kick-in? When the safety net is utterly looted? When even more hours are lost? When pensions go bust? When things get bare-bones bleak?

21 comments

Skip to comment form

Author

will they prosecute malfeasance, fraud, and disobedience of the laws under the new Health Insurance Bailout bill?

I think not.

you know, the one that has all 5s on its face (eliminating the inconvenience of waiting until the arrival of a magic hour before having the first drink of the day), this writer still has friends and acquaintances who absolutely insist that there is no time like today to purchase real estate.

Although I could be completely mistaken, and wouldn’t be disappointed if that were the case, I would equate purchasing real estate, even at sharply reduced prices today, to the feat of attempting to catch a falling knife in mid-air.

For there to be a meaningful reversal in the drop in housing prices, median housing prices will need to fall faster and further than real median disposable incomes. Even if one takes a significant lead over the other, its competitor will eventually, albeit belatedly, diminish it’s competitors lead.

The matter of nothing being done to reign in corporate greed, governments (at all levels) continuing to shred any and all remaining remnants of the social safety net; no cost containment in the areas of energy, health care, and higher education; companies still being rewarded for shipping our jobs overseas; and our country’s continued surrender of self-determination to external powers (i.e., multinationals) via suicidal trade agreements such as NAFTA, WTO, etc., any improvements in our condition will prove to be temporary and illusory.

… Economics Strikes Back, causing more of what discredited it in the first place.

Moody’s will downrate bonds of governments that do not kowtow to the International Banker’s Club? Moody’s?

Where were Moody’s when the FIRE sector was repackaging chickenshit as chicken nuggets?

I’ll tell you where they were: they were printing the label, “genuine chicken product”.

Great essay as usual. At best we will have rather bracing austerity. The question is whether or not we will have general collapse and a breakup of the country. Since the Republican Party has already enrolled in the latter — they block everything because they want the U.S. to evolve into a neo-feudal society I think we have a decent chance of that happening.

I’ve been checking out Dmitry Orlov

Here’s the full version of his lecture of over a year ago. Below an exerpt: