(8:30PM EST – promoted by Nightprowlkitty)

By Ashley Carson, the Executive Director of OWL- The Voice of Midlife and Older Women and www.SocialSecurityMatters.org

This week the New York Times decided to scare the bejeezus out of everyone by publishing several articles with slanted statements about Social Security. I’d like to revisit some key points in Williams Walsh’s piece from March 24 – statements from her article are in bold below.

“The bursting of the real estate bubble and the ensuing recession have hurt jobs, home prices and now Social Security.”

First of all, the real estate bubble was predicted and no one listened. In fact, it was predicted, ignored, and it is a large cause of the economic downturn and part of the larger deficit. We had to bail out banks and other financial institutions because everyone ignored the warnings about the real estate bubble. The bursting of the housing bubble doesn’t hurt Social Security the program, in fact, Social Security, the program, is designed to withstand just such miscalculations by our nation’s top economists.

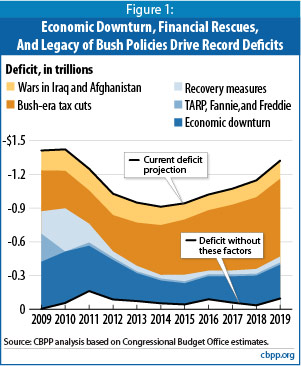

The causes of our deficit are approximately $1.5 trillion to the wars in Iraq and Afghanistan, $1.2 trillion due to the Bush-era tax cuts, $0.9 trillion for financial rescues and recovery measures including TARP, Fannie and Freddie. As indicated by the above figures, clearly Social Security is not causing the deficit.

“…payments have risen more than expected during this downturn, because jobs disappeared and people applied for benefits sooner than they had planned.”

Of course Social Security payments have risen more than expected, that’s what it’s there for. In fact, it doesn’t get any more American than Social Security. You pay in, your money is invested in US Treasury bonds, and then upon reaching retirement age, injury or loss of a parent or spouse you get money back. We have all paid our taxes and paid them so diligently that there is an enormous surplus in the Social Security trust fund that we have then borrowed to pay for other things (i.e. defense spending).

“When the level of the trust fund gets to zero, you have to cut benefits,” said Alan Greenspan.

Okay, fine – but let’s get real about when the trust fund will get to zero. The most recent report of the Social Security Trustees says that the trust fund gets to zero at 2037 – or “the year of reckoning” as Ms. Walsh calls it. Let’s be clear, this doesn’t mean that in 2037 you get $0, that all of the taxes you have paid over your entire working life vanish into thin air. It means that in 2037 the number of people receiving benefits will outweigh the people paying in making it only possible to pay you 75% of your guaranteed benefit. This is the WORST case scenario. I’m confident that we can avoid this worst case scenario if we can come to consensus on some minor changes over the next TWENTY-SEVEN YEARS. What other government program to we talk about fixing because there may or may not be a problem in almost three decades?

“The long-term costs of Social Security present further problems for politicians, who are already struggling over how to reduce the nation’s debt.”

The problems of politicians in struggling to reduce the debt should be wholly unrelated to Social Security. Social Security isn’t part of the deficit. Congress borrowed the money from Social Security because it runs a surplus and they owe the money back when it’s needed.

So is Congress going “trim the debt” by just declaring that they aren’t going to repay their loan? No, instead they are going to tell us that the one and only solution is to only pay us back part of the loan in the form of reduced Social Security benefit payments. On average, Social Security recipients receive about $13,000 annually. The figure drops to $11,000 annually for older women. Hey Congress, older women can’t live on less – in fact let’s talk about benefit increases to keep grandma out of the homeless shelter.

“Although Social Security is often said to have a “trust fund,” the term really serves as an accounting devise…”

By accounting devise, are we talking about revenues and expenditures? Because wow, a $2.5 trillion surplus is a damn good year in accounting terms…

Yes, outlays will exceed revenue eventually but not for 27 years. In business terms, knowing that you will continue to run in the black for that many years is quite reassuring and unparalleled in business or any other government program.

Benefit cuts or “raising the retirement age” another common refrain in Washington both mean the same thing: benefit cuts. We have already raised the retirement age, most people won’t collect benefits until 67. If Congress truly believes that most Americans want to work well into their seventies, good luck getting re-elected.

I say lower the retirement age, raise the cap slightly (only impacting the highest income individuals) and make everyone happy. People want to retire and young people want jobs. Problem solved.

PS. Don’t panic, you can wait 2-3 decades to make any of the tough decisions if you want some time to mull this over.

Ashley Carson is the Executive Director of OWL- The Voice of Midlife and Older Women and www.SocialSecurityMatters.org

3 comments

Social Security is a government program and the U.S. government contrary to what we may hear in corporate media and from bond vigilantes – the U.S. government cannot go insolvent.

Social Security is a government program and the U.S. government contrary to what we may hear in corporate media and from bond vigilantes – the U.S. government cannot go insolvent.