(noon. – promoted by ek hornbeck)

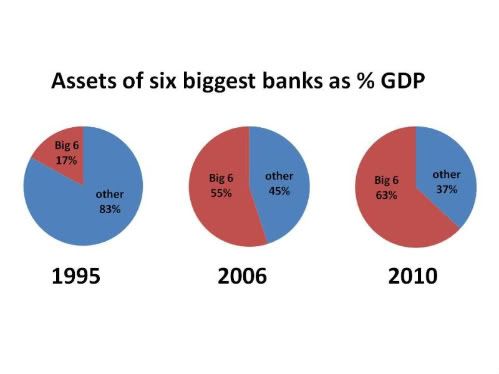

According to Peter Boone and Simon Johnson, the six largest banks currently have assets in excess of 63% of GDP:

The president is absolutely correct that our priority should be to limit the size of our largest banks and to reduce substantially the risks that can be taken by any financial entity that is backed, implicitly or explicitly, by the federal government. As a result of the crisis and various government rescue efforts, the largest six banks in our economy now have total assets in excess of 63 percent of GDP (based on the latest available data). This is a significant increase from even 2006, when the same banks’ assets were around 55 percent of GDP, and a complete transformation compared with the situation in the United States just 15 years ago, when the six largest banks had combined assets of only around 17 percent of GDP. If the status quo persists, we are set up for another round of the boom-bailout-bust cycle that the head of financial stability at the Bank of England now terms a “doom loop.”

In recent decades we have witnessed an ever-growing war-mongering police state merging power with private corporations that increasingly suck the wealth of our nation into fewer and fewer hands and grotesquely warp the political process using secrecy, bribery, extortion, theft, war-profiteering, revolving doors between government and the private sector, and propaganda through concentrated media ownership. The confluence and concentration of political, financial, media and technological leviathans has transformed us into a self-cannibalizing society.

Given the massive financialization engorging our economy and political system, and especially in the wake of destruction from the 2008 “financial crisis,” it remains shocking that the Supreme Court saw fit to decide yet another ideological 5-4 split favoring corporations, with Kennedy again providing the swing vote. The Citizens United ruling can only hasten the pace of our “doom loop,” which we literally cannot afford. The replacement Justice Stevens is a critical event that Obama cannot fumble.

After easily dismantling the empty case for nominating Elena Kagan to the Supreme Court (see also bmaz, here), Glenn Greenwald assembled a thorough, impeccable and steel-plated case in favor of an alternative, far more palatable nomination in The long, clear, inspiring record of Diane Wood. After reading the cases against Kagan and in favor of Wood, both “must reads” for anyone remotely concerned with restoring a semblance of balance to the Supreme Court, and hence to our leviathan government, any lingering doubts about whom Obama should nominate evaporate, e.g., see BTD. Greenwald’s strong, manifold defense of Wood is especially a pleasure to read on many levels and angles on this potential candidate, who if nominated, would go a long, long way to restoring some trust in the president who won the election on a platform of hope and change, but who so far has delivered little substantive change from the abominable and incontinent Bush years.

Of particular importance are Wood’s early and principled admonitions about checks on executive power, transparency, due process, accountability, civil rights, and the rule of law as we marched into the Iraq war, under false pretenses as it turns out, in her 2003 University of Chicago School of Law Review The Rule of Law in Times of Stress. Glenn writes:

At least as impressive as what she wrote in that article — probably more so — is when she wrote it. This was early 2003, when the nation was marching to the War on Iraq — the peak of the country’s repressive, 9/11-induced, Bush-revering climate. Half of the Democratic Party — and most of its leading officials (along with the media) — were serving as cheerleaders for the invasion and the rapidly expanding, uncontrolled Surveillance State, and were petrified of opposing or even questioning the Bush administration when it came to counter-Terrorism policies. Democratic careerists everywhere were desperately competing with one other to prove how militaristic and “tough on Terrorism” they were (or were staying silent due to fear of being marginalized).

Yet in the midst of all that, here was Diane Wood stepping out way beyond the restraints typically accepted by federal judges, and carefully — though emphatically — warning of the dangers all of this posed and the rights being trampled upon, at a time when few others were willing to do so. She obviously knew that writing this article could harm her future career prospects in countless ways. It turned out years later that expressing such critiques became essentially safe and mainstream (which is when Elena Kagan finally got around to uttering a few meek platitudes about John Yoo in 2007), but it was far from clear back then that this would happen. In 2003, forcefully objecting to the radical Bush/Cheney vandalizing of our political system as a serious threat to liberty — and insisting on the need for courts to put serious limits on that assault — was nothing short of heroic, especially for someone who harbored ambitions for future political or judicial advancement.

Wood’s anti-authoritarian heroism contrasts sharply with Kagan’s Cheney-esque views on executive power, and is precisely the courage and conviction real progressives should crave. While I strongly urge everyone to read Glenn’s masterful case, if you haven’t already, I’d like to focus on one other very appealing aspect of his argument in Wood’s favor, specifically Wood as a student of international and anti-trust law and as Clinton DOJ official prosecuting anti-trust cases. As bmaz noted, in contrast to Wood’s history of prosecuting anti-trust cases and ruling from the bench on the 7th circuit, Kagan’s experience arguing cases in court is, to be overly-generous, tissue thin.

Writes Glenn:

Wood’s ability to craft legal opinions to induce conservative judges to join her opinions is renowned, as is the respect she commands from them through unparalleled diligence and force of intellect. As a political matter, she’d have a long list of right-wing judges and professors at Chicago (where she still teaches) lined up to vouch for her, thus blunting efforts to depict her as some kind of Far Leftist. Her expertise in anti-trust and business law is (a) especially relevant now given the cases likely to come before the Court in the wake of the financial crisis and (b) rare for a federal judge on the liberal/Democratic side. The similarity between her jurisprudence and Justice Stevens’ is striking and easy to document, thus ensuring that (at the very least) she will maintain the Court’s balance; unlike a Kagan selection, there is no risk Wood will move the Court to the Right and, in some important respects, could very well do the opposite.

[emphasis mine]

In addition to Diane Wood’s principled, courageous convictions against the prevailing grain of ceding unlimited authority to Cheney’s incontinent Leviathan during the Iraq war, Wood’s expertise in business law, and particularly in anti-trust prosecution, should not be underestimated as we enter extremely perilous economic times.

Further, that she is capable of crafting opinions that induce rightwing acquiescence is particularly important at this time of global financial crisis, and particularly important for the complexion of the court, across party lines. As Jeff Rosen wrote,

But the area in which she would bring the greatest degree of intellectual diversity is in her specialty: antitrust law. There are, on the current Court, no economic populists in the mode of William O. Douglas, who boasted that he wanted “to bend the law against the corporations and in favor of the environment.” The current Democratic justices, led by former antitrust scholar Stephen Breyer, are relatively moderate on antitrust enforcement. (During its first two terms, the Roberts Court heard seven antitrust cases and decided all of them in favor of the corporate defendant.) Wood’s scholarly record suggests she might be more vigorous. She came to argue for voluntary cooperation among international antitrust agencies in the hope that cooperation may eventually lead the way to binding agreements between countries about how to police international economic competition.

For many people on the so-called “left,” a dubious appellation for what may otherwise simply be a well-grounded apprehension of rampant oligarchy, the mere election of Barack Obama brought a perceived (perhaps closer to imaginary) relief from the political crisis that was the Bush II, and indeed the Clinton, Bush I, and Reagan… years.

Indeed, the ongoing political crisis has only since deepened, and the symptoms are now further manifesting themselves as a nearly fatal and ongoing “financial crisis,” the outcome of which may yet, and some argue must entail complete economic collapse, as the disease may have progressed intractably beyond reversal, the body politic being beyond reclamation.

The “financial crisis” is really a symptom of the disease of an ongoing political crisis, wherein the positive feedback between wealth concentration and political power eventually resulted in the hijacking of the entire political class, including the office of President, resulting in further wealth concentration and outright looting of public monies.

Noam Chomsky isn’t exactly shocked, shocked! to discover the hijacking of politicians by greedy bankers, but he does find it noteworthy:

To take just one illustration of the operation of really existing market democracy, Obama’s primary constituency was financial institutions, which have gained such dominance in the economy that their share of corporate profits rose from a few percent in the ’70s to almost one-third today. They preferred Obama to McCain and largely bought the election for him. They expected to be rewarded and were. But a few months ago, responding to rising public anger, Obama began to criticize the “greedy bankers” who had been rescued by the public and even proposed some measures to constrain them. Punishment for his deviation was swift. The major banks announced prominently that they would shift funding to Republicans if Obama persisted with his offensive rhetoric.

Obama heard the message. Within days, he informed the business press that bankers are fine “guys.” He singled out for special praise the chairs of two leading beneficiaries of public largess, JP Morgan Chase and Goldman Sachs and assured the business world that, “I, like most of the American people, don’t begrudge people success or wealth” – such as the bonuses and profits that are infuriating the public. “That’s part of the free market system,” Obama continued, not inaccurately, as the concept “free market” is interpreted in state capitalist doctrine.

This should not be a great surprise. That incorrigible radical Adam Smith, speaking of England, observed that the principal architects of power were the owners of the society, in his day the merchants and manufacturers, and they made sure that policy would attend scrupulously to their interests, however “grievous” the impact on the people of England, and, worse, the victims of “the savage injustice of the Europeans” abroad. British crimes in India were a primary concern of an old-fashioned conservative with moral values, a category that a Diogenes might search for today.

A modern and more sophisticated version of Smith’s maxim is political economist Thomas Ferguson’s “investment theory of politics,” which takes elections to be occasions when groups of investors coalesce to invest to control the state by selecting the architects of policies who will serve their interests. It turns out to be a very good predictor of policy over long periods. That should hardly be surprising. Concentrations of economic power will naturally seek to extend their sway over any political process. It happens to be extreme in the US, as I mentioned.

Dick Durbin was less voluble, but pithier.

Sen. Dick Durbin (D-Ill.) has been battling the banks the last few weeks in an effort to get 60 votes lined up for bankruptcy reform. He’s losing.

On Monday night in an interview with a radio host back home, he came to a stark conclusion: the banks own the Senate.“And the banks — hard to believe in a time when we’re facing a banking crisis that many of the banks created — are still the most powerful lobby on Capitol Hill. And they frankly own the place.”

As was Congressman Peterson:

“The banks run the place,” Mr. Peterson said. “I will tell you what the problem is — they give three times more money than the next biggest group. It’s huge the amount of money they put into politics.”

Everything I’ve read about Diane Wood suggests that she’s equipped to persuade and even go toe-to-toe with our authoritarian, corporation-favoring conservative justices on two of the most critical issues of our time: a Hobbesian-like unitary executive and the financial leviathans. That would be change I could believe in.

8 comments

Skip to comment form

Author

when they really collapse in few years it isn’t going to be pretty……….

aggregation is the enemy of stability…..

it is the source of the cyclic collapse pattern………..

This is a good choice. Will we get her? That’s a different matter.

the American body politic. The fact that there was a lot of thought put into our Constitution really doesn’t mean shit. Thought ended on the Western frontier. “Every man for himself” crowded out everything in its way. Stereotypical group think was born out of tunnel vision, an ironic phenomenon considering the vast open spaces of the new continent.

IMHO, Democracy never took hold culturally. Americans don’t have a clue what they want and no intellectual or philosophical underpinnings to provide guidance. Most of the questions asked at the confirmation hearings are pathetic, just as pathetic as the so called debates for president. What goes around, comes around.

With Obama, I always expect the worst; and so far, I haven’t been disappointed.