(11AM EST – promoted by Nightprowlkitty)

With caveats, Barry Ritholtz sez the recession is over, and essentially that one couldn’t kill the remaining zombie perma-bears if you strapped them to a nuke and launched them into the Sun (which the true bears believe has already happened. The rest is just travel time.).

As a perma-bear who believes that the United States is manifestly in an advanced state of moral, political, and economic decrepitude, I found his breezy optimism startling, and potentially even “dangerous,” as in “the sound of great applause lauding folly, then a long period of silence” kind of dangerous.

But first, let me preface what I’m about to say with a rather disqualifying caveat. I’m not an economist. What I know about economics you could write on the back of a small envelope and still have room for a proof of the N-cuppability of sets (whatever THAT means!), a lecture on particle physics, and a comprehensive review of everything that is known about the vertebrate stress response system. So, by all means, disregard everything that follows.

Ritholtz cites a better-than-expected, upwardly revised Q3 GDP growth of 2.5% as evidence that “zombie bears” need to admit the new reality that the recession is over.

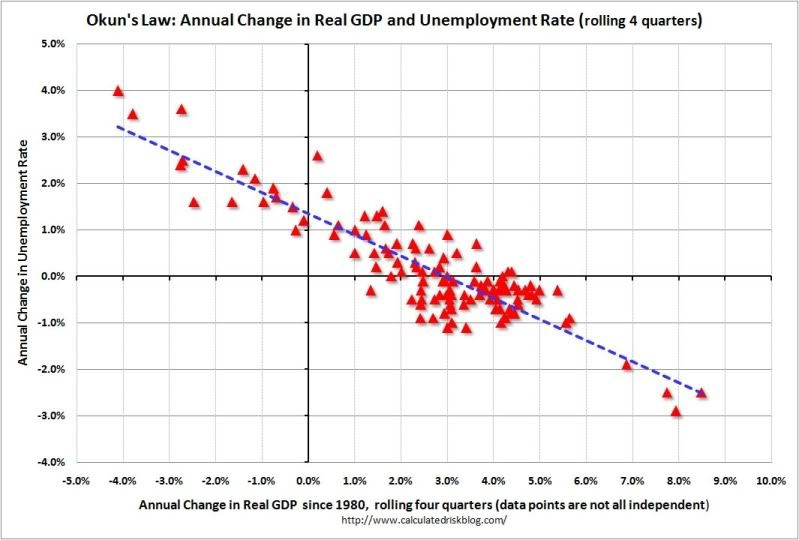

First, according to the chart below, a 2.5% rate of growth is not sufficient to reduce unemployment, which has been ranging between 10% and 22%, depending on your measure. In fact, the fitted line shows that unemployment even slightly worsens at that rate.

I, for one, do not “believe in” jobless recoveries. It is simply outside of what little inklings I may have regarding economics. To this surplus eater’s mind, it’s like a Venn diagram having two circles, one representing “joblessness” and one representing “economic recovery” that do not overlap at all. Corporate profits may be rolling in at a “break-neck” pace, but the fact that the outrageously remunerated and socially worthless harmful lugals are “sipping sweet ambrosia from the skull caps of the common man” only highlights the ever-deepening inequalities of the past 40 years and the dissolution of the middle class. For some, long-term unemployment may have delivered blows to career tracks in ways that are not recoverable. The damage is done. And ongoing.

Individual consumption is said to constitute some 65% to 70% of GDP, yet durable goods spending (cars, home appliances, furniture, personal computers…) is still well below average.

Many durable goods will not be bought any time soon, because housing still sucks. October clocked a new record low in new home sales. The housing crash continues, and Washington is making the housing crisis even worse, because luring people into debt for inflated house prices is fucking profitable, whereas crashing home prices kills bank and government assets, and is about to kill property taxes and municipal revenues.

Speaking of assets, I suppose the economic recovery would not really be a recovery if all of the banks were really insolvent, so it’s a good thing we have returned to mark-to-market accounting. Oh, wait. We didn’t? You mean still there has been no sceptical probing for price discovery? Are you shitting me? Is this the Twilight Zone? How can anyone call this a recovery without knowing whether the banks are even solvent?

As for QE II, with inflation at a record low of 0.6%, and heading into the deflationary toilet, despite QE I, well, there ya go.

David Rosenberg via Mish Shedlock:

The year started out with the U.S. core (excluding food and energy) consumer inflation rate at 1.8% YoY; now, it is at a record low 0.6%. This has occurred even with massive government stimulus, U.S. dollar weakness, a commodity boom and an ongoing inventory cycle. Imagine what would happen if these developments reversed course.

Imagine what would happen if these developments reversed course. But the reality is that if the deceleration of the past eight months persists, then the core inflation rate will become the core deflation rate by the second quarter of next year. Hence Bernanke’s quest for QE2.

Excluding shelter, core consumer prices actually deflated 0.05% (to the second decimal place) and this followed a 0.03% dip in September. The last time this metric declined in successive months was back in November-December 2008 when the financial system and the economy were imploding. Now, it is simply a case of a listless recovery failing to redress the vast amount of excess capacity overhanging the macro scene.

And, the deceleration has been very broadly based. Core goods prices have declined 0.24% for two months in a row, despite what commodities and the dollar have done. The YoY trend is now basically flat – it was 2% last March. Core services (which exclude energy) have been rising by only 0.1% or lower now for four months running and the YoY pace of 0.8% is a record low.

Just take a look at these sectors that are either deflating or disinflating:

• New car prices dipped 0.2% MoM last month, the first decline since April.

• Used car prices were down 0.9%, the second falloff in a row and the first back-to-back decline since the depths of despair in March-April 2009.

• Despite the surge in food costs, grocery chains only managed to raise prices 0.1% last month.

• Higher cotton prices have yet to filter through – apparel prices at the retail level fell 0.4% and are down in each of the past three months.

• Appliance prices deflated 1.2% in October, the second decline in as many months; furniture prices are down five months in a row. Clearly, the housing market has yet to stabilize or these items would still not be falling in price.

• Hotels saw a 1.3% price slide – negative now for three months in a row.

• Electronics prices dropped 0.1% in October and have deflated for four months running.

• Recreational services prices were off 0.3% and down for two months in a row.

• After deflating for just the second time ever in September, education prices were flat in October. The three-month trend, at0.5% at an annual rate, is the lowest this metric has ever beenfor most of the past decade, the price trend here was locked in a 6-8% band, and now it is negative. Goes to show how desperate the colleges are to draw in cash-strapped students.

• Communication service prices fell 0.2% in October and are down three months in a row.

• Toy prices slid 0.5% and have fallen now in seven of the past eight months.

• Personal care products slipped 0.3%, the second decline in a row.

• Despite higher fuel costs, airfares have been held to less than a 0.2% advance in each of the past two months.

• Jewellery prices fell 0.7% in October and are down in three of the past five months.

• The price of sporting goods was flat after three months of decline. Ditto for reading materials.

And don’t forget about Shedlock’s Bernanke Scorecard:

In case no one is keeping track, Bernanke has now fired every bullet from his 2002 “helicopter drop” speech Deflation: Making Sure “It” Doesn’t Happen Here.

Bernanke’s Scorecard

Here is Bernanke’s roadmap, and a “point-by-point” list from that speech.

1. Reduce nominal interest rate to zero. Check. That didn’t work…

2. Increase the number of dollars in circulation, or credibly threaten to do so. Check. That didn’t work…

3. Expand the scale of asset purchases or, possibly, expand the menu of assets it buys. Check & check. That didn’t work…

4. Make low-interest-rate loans to banks. Check. That didn’t work…

5. Cooperate with fiscal authorities to inject more money. Check. That didn’t work…

6. Lower rates further out along the Treasury term structure. Check. That didn’t work…

7. Commit to holding the overnight rate at zero for some specified period. Check. That didn’t work…

8. Begin announcing explicit ceilings for yields on longer-maturity Treasury debt (bonds maturing within the next two years); enforce interest-rate ceilings by committing to make unlimited purchases of securities at prices consistent with the targeted yields. Check, and check. That didn’t work…

9. If that proves insufficient, cap yields of Treasury securities at still longer maturities, say three to six years. Check (they’re buying out to 7 years right now.) That didn’t work…

10. Use its existing authority to operate in the markets for agency debt. Check (in fact, they “own” the agency debt market!) That didn’t work…

11. Influence yields on privately issued securities. (Note: the Fed used to be restricted in doing that, but not anymore.) Check. That didn’t work…

12. Offer fixed-term loans to banks at low or zero interest, with a wide range of private assets deemed eligible as collateral (…Well, I’m still waiting for them to accept bellybutton lint & Beanie Babies, but I’m sure my patience will be rewarded. Besides their “mark-to-maturity” offers will be more than enticing!) Anyway… Check. That didn’t work…

13. Buy foreign government debt (and although Ben didn’t specifically mention it, let’s not forget those dollar swaps with foreign nations.) Check. That didn’t work…

Now, it seems to this surplus-eating, non-economist that no one dares look down at the chasm below. Assessing reality accurately would shatter any residual, if delusional confidence in the system. And although we’ve have taken many shocking blows over the past decade, on top of a 40-year period of more slowly, but ever-deepening degradation, the wrecking crew is not done. The hammer blow that will fall the hardest and fastest, price discovery, is yet to come.

Oh, and one more thing. As I said above, our decrepitude is comprehensive. There is no way Washington will or can do anything correctly. I’ll let Chalmers Johnson have the last word on that:

If present trends continue, four sorrows, it seems to me, are certain to be visited on the United States. Their cumulative impact guarantees that the United States will cease to bear any resemblance to the country once outlined in our Constitution. First there will be a state of perpetual war leading to more terrorism against Americans wherever they may be and a growing reliance on weapons of mass destruction as they try to ward off the imperial juggernaut. Second, there will be a loss of democracy and constitutional rights as the presidency fully eclipses Congress and is itself transformed from an’executive branch’ of government into something more like a Pentagonized presidency. Third, an already well-shredded principle of truthfulness will increasingly be replaced by a system of propaganda, disinformation, and glorification of war, power, and the military legions. Lastly, there will be bankruptcy, as we pour our economic resources into ever more grandiose military projects and shortchange the education, health, and safety of our fellow citizens.

Now, whether one believes that it was just pointless military spending that bankrupted us, which is doubtful to me, considering the wild, hypertrophied incentive states of our socially worthless harmful Wall Street malefactors, pouring billions upon billions into pointless, aggressive wars certainly isn’t helping. EVIDENTLY, THEY CANNOT STOP THEMSELVES.

With all due respect to Mr. Ritholtz, count me as “Still Waiting for the Big One.”

And here’s a good bonus interview with Johnson:

23 comments

Skip to comment form

Author

Perhaps I’m just shell-shocked from the Bush years.

😉

We are the former USA. Whatever we become it will be different than what came before. When justice and rule of law goes you just have gov’t by decree. We have no guarantees of civil liberties–the Constitution has been shredded so it is now a time of emerging neo-feudalism whether we admit it or not that is the system we live under. “Fortunately” we have, still, amazing riches so “the economy” will keep going–it will take some time to impoverish most of us so let’s have have more parties! I mean that very seriously.

… but a “jobless recovery” has always been a very live possibility. Japan went through years of jobless recoveries at a time between successive certainly-not-unemployment-less recessions in their Lost Decade.

The Great Depression had one complete business cycle of recession and recovery and then another recession and was into its second recovery before we consider it to have ended in the heat of WWII spending.

Recession and recovery are business cycle words. They talk about growth and decline of GDP. In other words, a recovery is recovery of GDP. And GDP is not identical to the economy, so “a recovery” is obviously not necessarily a “recovery in the economy”.

One measure of one thing is never a complete picture of the economy. Declaring that the end of the recession in 2009 and the beginning of the recover guarantees that we are not in a depression is like someone comes into the emergency room with a gunshot wound in their hand, and you take their temperature, which is normal, and so you send them home.

After the Great Compression, and before the outbreak of the Second Gilded Age, we could confidently say that if GDP was recovering that employment and economic activity as a whole was recovering. But we can no longer say that, because we have set up an economy where capturing every last cent of a 2% or 3% economic growth for the top 1% of the population is standard course, and there is only any growth in the middle of the economy if by accident the Fed is too slow to prevent it.

Edward Harrison writes about credit markets and other monetary issues from a libertarian perspective at Seeking Alpha and his own blog Credit Writedowns, and after a relatively non-technical discussion of quantitative easing, he also provides a terse summary of Obama’s self-inflicted dilemma…

So without exactly endorsing Krugman’s opinion that the original stimulus was too small, Harrison still arrives at exactly the same conclusion that there’s not much chance of spending our way out of joblessness.

And in this context, “austerity” is more or less synonymous with “misery.”