January 26, 2011 archive

Jan 26 2011

got a guess?

Jan 26 2011

Two Polls: Keep Your Hands Off Social Security

The New York Times reports on a poll that shows while “Americans overwhelmingly say that in general they prefer cutting government spending to paying higher taxes”

Yet their preference for spending cuts, even in programs that benefit them, dissolves when they are presented with specific options related to Medicare and Social Security, the programs that directly touch the most people and also are the biggest drivers of the government’s projected long-term debt.

Nearly two-thirds of Americans choose higher payroll taxes for Medicare and Social Security over reduced benefits in either program. And asked to choose among cuts to Medicare, Social Security or the nation’s third-largest spending program – the military – a majority by a large margin said cut the Pentagon. . . . . .

Asked what Congress should focus on, 43 percent of Americans say job creation; health care is a distant second, cited by 18 percent, followed by deficit reduction, war and illegal immigration.

If Medicare benefits have to be reduced, the most popular option is raising premiums on affluent beneficiaries. Similarly, if Social Security benefits must be changed to make the program more financially sound, a broad majority prefers the burden fall on the wealthy. Even most wealthy Americans agree.

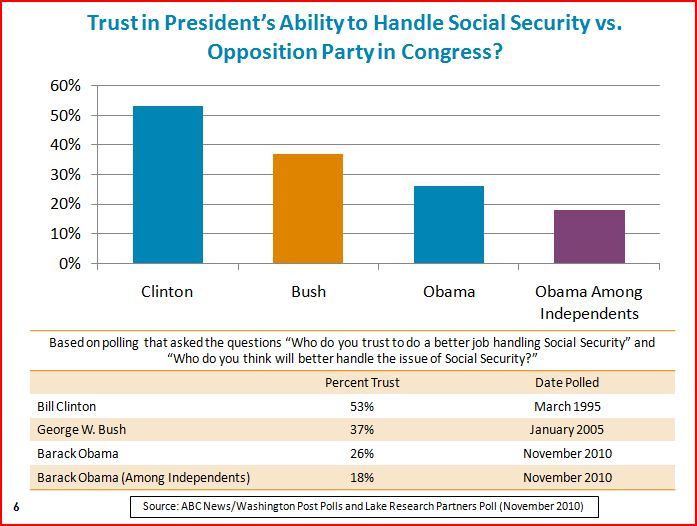

Meanwhile, Social Security Works has a series of slides assembled from past polls that clearly indicate that Americans don’t trust President Obama’s handling of Social Security. In fact, as Richard (RJ) Eskow points out in the article, they trust him even less that they trusted George W. Bush.

The Republican privatization attempt was thought to have contributed significantly to that party’s Congressional losses in 2006. Yet the president refuses to say that he won’t cut Social Security, and he continues to have kind words for the reckless, inhumane, and unneeded proposals of his Deficit Commission co-chairs (the Commission was unable to agree to a plan).

In this climate, with these numbers, any attempt by the president to cut Social Security could only be described in one phrase: Political malpractice. Is that where he’s headed? Or will he surprise us all by delivering a stirring, unequivocal defense of Social Security? After all the suspense and fear over this issue, that would be a political moment for the ages.

But if he’s going to have a change of heart, he better act fast. The damage is already considerable. As Social Security Works explains, the 20-point advantage Democrats had on this issue for the last 15 years has evaporated, and trust in President Obama is roughly half of what it was for President Clinton on the same issue. Obama’s performance is even worse among those much-sought-after independent voters. Only 18 percent of them trust him on this issue.

It won’t bode well for the Senate Democrats either:

It would be comforting to be able to say that this is all a misunderstanding and that the president will keep his promise to defend Social Security. But we can’t do that. His silence about Social Security, especially after Harry Reid’s stemwinding defense of the program, is disturbing. Reid and other members of the Senate and House are on the front line, and any attempt by Obama to triangulate and propose “bipartisan” cuts will devastate them. That’s why there are reports like The Hill‘s of a strategic split between the president and Democrats in Congress: They’re afraid he’s going to sell them out for a personality-driven reelection campaign that suits his needs, not his party’s or the country’s.

Obama will be committing political suicide and taking the Senate Democrats with him if he doesn’t start listening to his base, now.

Jan 26 2011

Human Rights: A Quaint & Obsolete Relic

Bradley Manning’s detention conditions got worse this week. He is now being held in total isolation in the brig at the Quantico, VA Marine Base. As has been reported by his friend David House, the only visitor he is allowed besides his lawyer, Manning’s mental and physical condition has been deteriorating steadily during his seven month long detention. Manning has no history violence or disciplinary infractions and that he is a pre-trial detainee not yet convicted of any offense.

Last Friday Jane Hamsher reported on Manning’s detention and a complaint that has been filed protesting his abuse:

For over five months, Bradley Manning has been held under Prevention of Injury (POI) watch at the Quantico Brig against the recommendations of three forensic psychiatrists. Manning’s attorney, David Coombs, has filed an Article 138 Complaint under the Uniform Code of Military Justice, asserting that this represents an abuse of Brig Commander James Averhart’s discretion.

Coombs’ complaint was filed after the Brig Commander placed Manning under “suicide risk” and MAX custody earlier this week, which made his conditions dramatically worse. Glenn Greenwald broke the story about the inhumane conditions of Manning’s pre-trial confinement last month, shortly before the New York Times reported that the Justice Department strategy regarding Wikileaks was to “persuade” Manning to testify against Julain Assange.. . . . .

Bradley Manning has not been convicted of anything. Abusing his mental health classification while attempting to “persuade” him to testify against Julian Assange has alarming echoes of the techniques used to elicit false confessions from terrorist suspects. It should alarm everyone that we could be watching pre-trial coersion becoming acceptable American shores. If so, we can all wave goodbye to “innocent until proven guilty.”

Today Jane, accompanied by David House, went to Quantico to visit Manning and deliver a protest petition to brig officials. Instead they were detained at the gate and harassed by the MP’s who readily admitted they were ordered to do so.

Between 1:00 – 1:30 MPs took their IDs and made them sign a form that they could not deviate to the brig or else they would be considered trespassing. At this time, one of the MPs asked for Hamsher’s auto insurance card. MP Gunnery Sgt. Foster informed Hamsher that her car would be towed after declining to accept a digital copy of Hamsher’s insurance card. House and Hamsher offered to drive off the base but were denied, despite being detained only ten feet inside the base’s perimeter. The MPs then took the Social Security numbers, phone numbers and addresses of House and Hamsher.

Around 1:40 the tow truck arrived and MPs instructed House and Hamsher to leave their vehicle, informing them that their vehicle would be searched. At 2:00 pm House observed military officers arriving and entering the MP outpost which oversaw their detainment. House expressed concern that he would miss Manning’s visiting hours but was told that he could neither exit nor move forward to the base. No explanation for House and Hamsher’s detainment was provided until, and they were held until 2:50 when they were informed they could leave the base. They were detained for two hours up until Manning’s visitation time period expired at 3:00 pm.

House and Jane have visited Manning in the past but not since Amnesty International filed a complaint to Defense Secretary Robert Gates calling for an investigation into the conditions of Manning’s confinement. The Amnesty International complaint came on the heals of the United Nations’ special rapporteur on torture, Juan E. Mendez, submitting a formal inquiry about the conditions of Manning’s detention. House was banned today from seeing Manning. One of the question now is will he be banned in the future because of his reports on Manning’s condition under these harsh conditions.

I look around at the reports about the resumption of the military commissions at Guantanamo and the new policies on the use of Miranda in terrorist interrogations and I wonder is this still the United States? What happened to our principles of justice, not that they ever favored the underprivileged? Is this country turning into the new Soviet Russia?

Jan 26 2011

Perp Walks Part 2

Crossposted from The Stars Hollow Gazette

The next part of my story centers around frauds 6, 7, 8, and 9 of 11 criminal frauds.

AMBAC is a Monoline Insurer and they offer-

Bond insurance is a service whereby issuers of a bond can pay a premium to a third party, who will provide interest and capital repayments as specified in the bond in the event of the failure of the issuer to do so. The effect of this is to raise the rating of the bond to the rating of the insurer; accordingly, a bond insurer’s credit rating must be almost perfect.

The premium requested for insurance on a bond is a measure of the perceived risk of failure of the issuer.

The economic value of bond insurance to the governmental unit, agency, or company offering bonds is a saving in interest costs reflecting the difference in yield on an insured bond from that on the same bond if uninsured. Insured securities ranged from municipal bonds and structured finance bonds to collateralized debt obligations (CDOs) domestically and abroad.

AMBAC is suing Bear Stearns (JP Morgan Chase).

The Ambac Suit: Bear Stearns Execs Double-Dipped, Committed Criminal Fraud on Investors

By: David Dayen Tuesday January 25, 2011 11:01 am

The mortgage traders at Bear, who now are spread out across the financial sector, sold purposefully bad securities to investors – emails revealed show that they told superiors they were selling “a sack of shit.” They got data on their pools of mortgages bundled up in securities deals that came back with high percentages of bad underwriting or even loans already slipping into default. They falsified that data for the rating agencies to get AAA ratings, never told the investors about the bad loans in the pools, and sold the shit as gold. But it gets worse.

…

They got paid by the investors for selling the mortgage-backed security, AND they got paid by the originator for taking back the bad loan. So Bear traders made money on the same mortgage twice. Only the investors could force a put-back on an originator after the security was sold – Bear Stearns didn’t have a legal claim on the loan after they sold it. They did so anyway.There is no legal universe under the sun where that isn’t just criminal fraud and theft. Ambac eventually discovered that 80% of the loans in its MBS had an early payment default. They were corrupted and substandard from the moment they received them, so awful that Bear Stearns was forcing the bank to take them back – even though they didn’t own the loans.

This Ambac suit names the actual decision-makers, Marano and two others who are working at Goldman Sachs and Bank of America. JPMorgan, which now owns Bear Stearns, is named in the lawsuit as well, as a responsible party. It seems that this is a pretty standard repurchase lawsuit, but Ambac added accounting fraud to the claim to double the award owed to them.

The original Atlantic article-

E-mails Suggest Bear Stearns Cheated Clients Out of Billions

Teri Buhl, The Atlantic

Jan 25 2011, 1:01 AM ET

Former Bear Stearns mortgage executives who now run mortgage divisions of Goldman Sachs, Bank of America, and Ally Financial have been accused of cheating and defrauding investors through the mortgage securities they created and sold while at Bear. According to e-mails and internal audits, JPMorgan had known about this fraud since the spring of 2008, but hid it from the public eye through legal maneuvering. Last week a lawsuit filed in 2008 by mortgage insurer Ambac Assurance Corp against Bear Stearns and JPMorgan was unsealed. The lawsuit’s supporting e-mails, going back as far as 2005, highlight Bear traders telling their superiors they were selling investors like Ambac a “sack of shit.”

…

According to the lawsuit, the Bear traders would sell toxic mortgage securities to investors and then sell back the bad loans with early payment defaults to the banks that originated them at a discount. The traders would pocket the refund, and would not pass it on to the mortgage trust, which was where it should have gone to be distributed to the investors who owned the bonds. The Marano-led traders also cut the time allowed for early payment defaults, without telling the bond investors. That way, Bear could quickly securitize defective loans, without leaving enough time for investors to do their own due diligence after the bonds were sold and put-back any bad loans to Bear.The traders were essentially double-dipping — getting paid twice on the deal. How was this possible? Once the security was sold, they didn’t have a legal claim to get cash back from the bad loans — that claim belonged to bond investors — but they did so anyway and kept the money. Thus, Bear was cheating the investors they promised to have sold a safe product out of their cash. According to former Bear Stearns and EMC traders and analysts who spoke with The Atlantic, Nierenberg and Verschleiser were the decision-makers for the double dipping scheme, and thus, are named as individual defendants in the suit.

…

Last week, JPMorgan CEO Jamie Dimon said it will take years to get through mortgage litigation risk the bank inherited and had set aside around $9 billion for litigation-related risk. Yet in the bank’s January earnings call, Dimon suggested that the bank may not have to buy back any soured mortgages from private investors and said that the issue is “not that material” for JPMorgan. Still, Ambac recently won a court order in December to add accounting fraud against JPMorgan to its suit, which can double or triple lawsuit awards. So it’s hard to tell whether America’s largest bank is prepared to pay for the sins of Bear. JPMorgan did fight tooth and nail for the Ambac suit not to be made public, however, because the firm argued it could damage the reputations of senior bank executives currently working in the industry. Individuals named as defendants in the amended complaint include: Jimmy Cayne, Alan “ACE” Greenberg, Warren Spector, Alan Schwartz, Thomas Marano, Jeffrey Mayer, Mary Haggerty, Baron Silverstein, Jeffrey Verschleiser, and Michael Nierenberg. But the court chose to fold these individuals into the charges against JPMorgan as the case goes through appeal.

JPMorgan is not the only firm in trouble-

Countrywide Accused in Lawsuit of ‘Massive Fraud’

By Karen Freifeld, Bloomberg News

Jan 25, 2011 5:54 PM ET

Bank of America Inc.’s Countrywide Financial unit, acquired by the bank in 2008, was accused of “massive fraud” in a lawsuit by investors who claim they were misled about mortgage-backed securities.

TIAA-CREF Life Insurance Co., New York Life Insurance Co. and Dexia Holdings Inc. are among a dozen institutional investors who filed the complaint yesterday in New York state Supreme Court.

Jan 26 2011

Perp Walks

Crossposted from The Stars Hollow Gazette

As I’ve pointed out before one of the confusing things about Bankster Fraud is that there are no less than 11 different criminal frauds that are all lumped together.

In my next piece I’m going to examine one particular part of this puzzle, but I should note that starting tomorrow we’re going to be one step closer to the jump-suited perp walks we’ll need to see in order to unwind this discredited neo-liberal disaster of an economy with the release of the Financial Crisis Inquiry Commission report which recommends investigation by the Department of Justice for Criminal Prosecution.

Financial Crisis Commission Finds Cause For Prosecution Of Wall Street

Shahien Nasiripour, The Huffington Post

01/24/11 07:29 PM

(T)he decision to refer cases for potential prosecution could provoke a different conclusion: It may yet satisfy public craving for what Treasury Secretary Timothy Geithner once referred to as the “very deep public desire for Old Testament justice.”

…

The commission drew on testimony from less prominent senior executives with intimate knowledge of how Wall Street engaged in modern-day financial alchemy, turning mountains of dubious mortgages into seemingly rock-solid investments rated as safe as American Treasury bonds.Richard Bowen, former chief underwriter for Citigroup’s consumer-lending unit, testified that, in the middle of 2006, he discovered more than 60 percent of the mortgages the bank had purchased from other firms and then sold to investors were “defective,” meaning they did not satisfy the bank’s own lending criteria.

Keith Johnson, former president of Clayton Holdings, one of the top mortgage research companies, testified that some 28 percent of the loans given to homeowners with poor credit examined by his firm for Wall Street banks failed to meet basic standards. Yet nearly half appear to have been sold to investors regardless, he added.

FCIC Will Refer Report to Authorities for Potential Criminal Prosecution

By: David Dayen, Firedog Lake

Tuesday January 25, 2011 6:00 am

Many have found themselves disappointed in the FCIC’s work to this point, be it their inability to gain headlines, their inability to issue subpoenas without bipartisan cooperation, or even the commission’s personnel. But lest we forget that the FCIC uncovered, virtually by itself, the enormous mortgage bond scandal, based on testimony they gathered from Clayton Holdings in October. William D. Cohan said at the time that this strong, if pulled properly, could lead to justice:

…

This could be the building block for the criminal referrals, or it could be something deeper. But we know it will be backed up by a voluminous amount of evidence. In addition to their long report on the origins of the crisis, Yves Smith notes that the FCIC will release audio archives of all of their interviews with hundreds of witnesses. She was one of them. They will also release all the source documents, which is crucial.As for the report itself, the Democratic version promises to be extremely satisfying to those who recognize quickly that corporate greed, deregulation and a financial industry determined to sidestep oversight entirely with the shadow banking system caused the crisis. One official told Reuters that Commission Chair Phil Angelides subscribed to the “vampire squid” view of the crisis, recalling the famous turn of phrase Matt Taibbi used to describe Goldman Sachs.

Jan 26 2011

Muse in the Morning

Jan 26 2011

On Done Deals, Or, Sometimes Losing Is How You Win

We have been talking a lot about Social Security these past few weeks, even to the point where I’ve missed out on talking about things that I also wanted to bring to the table, particularly the effort to reform Senate rules.

We’ll make up for that today with a conversation that bears upon both of those issues, and a lot of others besides, by getting back to one of the fundamentals in a very real way…and today’s fundamental involves the question of whether it’s a good idea to keep pushing for what you want, even if it seems pointless at the time.

To put it another way: when it comes to this Administration and this Congress and trying to influence policy…if Elvis has already left the building, what’s the point?

Jan 26 2011

Community Manager Appreciation Day!

Matt Haughey (Metafilter founder) at Gel 2010 from Gel Conference on Vimeo.

Yesterday was the second annual “Community Manager Appreciation Day”!

:::sigh:::

Fuck my life….

I run this place: http://www.freespeechzoneblog.com

Jan 26 2011

Apocalypse Just Means the unvieling

Now what if this were true. At 5000 dollars a plate it should be.

Is it just another CT scam or like the real world is CT going mainstream.

http://news.exopoliticsinstitu…

Most definitely more on this later.

Jan 26 2011

Two War Movies

I watched two war movies this weekend. The luminous 1944 movie: Since You Went Away, a movie chock full of old fashioned Hollywood stars (and good ones at that) and a gritty 2010 movie,The Green Zone. Both these films were excellent, put me in a contemplative state and impressed me once again of the power of moving images with sound.

Since You Went Away, directed by John Cromwell (a journeyman studio director) and produced (and written for the screen by David Selznick) from a novel by Margaret Buell. The cinematography of shadows and flickering, filtered soothing light was Stanley Cortez’ and Les Garmes’ and it is something to behold. (Cortez won an academy award) I’ve seen the film before but it seemed to be in pristine tones this time, so the film may have been salvaged and restored – and a glorious restoration it is. Keep in mind that WW II was a necessary war (black and white war, one could say)- and in 1944 the tehnical skills of that medium was at it apex.

It starred Claudette Colbert as Anne Hilton, Jennifer Jones and Shirley Temple as her daughters, Joseph Cotton as Lt. Commander Tony Willett, Monty Woolley as Col. William G. Smollen, Robert Walker as Corporal William G. Smollett II and Hattie McDaniel as Fidelia and the bitchy stand-in for all immoral, hoarding, selfish, unpatriotic Americans and the necessary dark shadowy female – Agnes Moorhead.

I’ve never seen Claudette Colbert better – never. Her role as a central force, a touchstone of the family during the dark years of conflict was an exercise of empathy, elegance, relaxed confidence and quiet determination to keep the home as “normal” as possible even with the background of war. There was no clanging patriotism in this movie – only quiet scenes like Jennifer Jones’ work with the wounded boys at the nearby hospital as she worked as a nurses’ aid. Her growth from a l7 year old schoolgirl to a young woman witnessing the aftereffects of war on young men not much older than herself is clearly registered on her young, innocent face and in the kind of sympathy only a child can evince. Because the two adults in the film were muted and strong at the center – Jennifer becomes a better young actress before our eyes. While in the beginning Jennifer was somewhat overwrought – that changes completely. Shirley Temple was the younger sister and the weakest of the cast but she played her role well enough – a ’40s young teenager, funny and quirky.

Joseph Cotton (whom I liked very much for once) played the stock character role of a male suitor who lost out to the husband who is away at war and remains a bit in love with Anne. But he puts a bite into that role – a dangerous bite and his welcome charm and playful sophistication (hiding a deeply patriotic naval officer – he has a Navy Cross we discover) are a welcome force in the household of four women. He looked pretty good in those whites. (Not as good as Redford in The Way We Were, but who ever did) Heck, I welcomed his presence myself. At times, I considered myself a fifth woman in the home. If there is a heaven, I’d like to visit Anne some day – show up spontaneously in her l944 life. Offer myself as a new neighbor, with a cake or pie (I saved my stamps for the sugar) and in the hopes she would offer me a cup of coffee. Of course, she would and I could enjoy that comfortable home. The family is upper middle class – but not in today’s sense but in that time when the home seemed just about right, not over the top but furnished warmly with those beautiful white billowing curtains and lovely chairs covered in chintz. Ever notice all those chairs in the 40’s films. Think it may have been because people actually sat around and talked instead of watching television.

To Be Continued