(9 am. – promoted by ek hornbeck)

The monied interests will continue robbing us blind until we make them stop and pry our money from their cold, dead hands.

Charles Hugh Smith points out that since 2007, public debt has increased by more than $6 trillion, yet GDP has remained virtually flat. (In constant 2005 dollars, there was zero growth. Zero, as in 0.0. Six trillion dollars plus is a lot of money for goose eggs. That’s pretty much the same thing as borrowing $6 trillion plus and losing it. No beanstalk, no golden goose, just losing it. That $6 trillion lost in the past four years does not include the $2.3 trillion that the Pentagon lost, literally fucking lost on September 10, 2001, the day before 9/11. But I digress.)

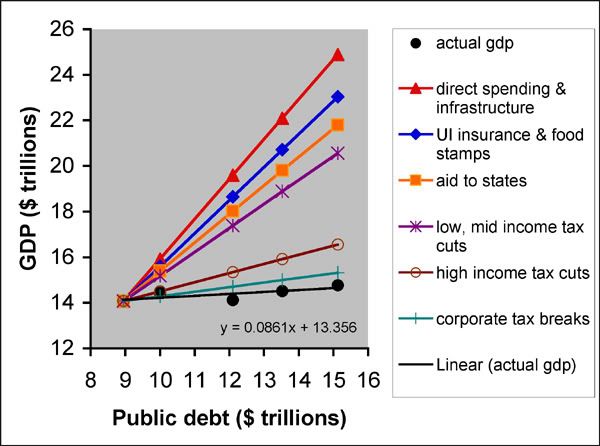

The filled black circles in the chart below (labeled “actual gdp”) shows our GDP “growth” as a function of our staggering increase in public debt between 2007 and 2011 (2011 GDP is projected based on our stupendous 1.8% growth rate in 2011 Q1, whereas 2011 public debt is based on the $1.6 trillion dollar increase in the deficit from 2010). You’ll notice that public debt increases more than $6 trillion on the horizontal axis from left to right, whereas GDP does not move up noticeably on the vertical axis. As the boys used to say in grade school, “She’s flat as a board.”

Ya gotta wonder, “What on god’s green earth happened to all that money?”

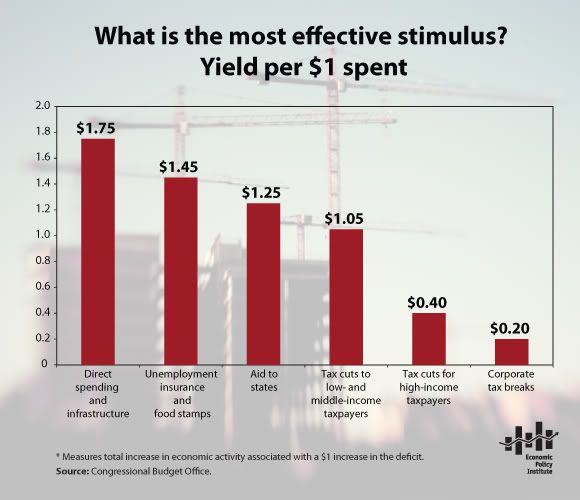

Before we go back to the graph above, let’s take a look at different ways we could have spent that $6 trillion in order to stimulate the economy. According to the Congressional Budget Office, spending dollars on different sectors produces substantial differences in overall economic activity. People at the bottom of the pyramid spend their money on necessities at the pyramid’s bottom, where it gets spent and re-spent multiple times by poor folk who have no choice but to spend and re-spend their money. This re-spending of a dollar is known as the multiplier effect, which by definition stimulates GDP.

The odious lugals siphoning wealth at the pyramid’s top, on the other hand, spend their massive surpluses on non-productive rent-seeking and money-for-nothing gambling, which is why giving money to those already having too much is thoroughly enervating to economic output. Paying off their gambling debts with our money is downright criminally insane.

The graph below shows how money spent on stimulating the economy is multiplied in terms of overall economic activity depending on who gets the money.

The biggest bang for the buck comes from direct spending and infrastructure investment, giving people jobs to build things that need to be built, not unlike the WPA of Franklin Roosevelt during the Great Depression. We’ve got a lot of people out of jobs these days, and the American Society for Civil Engineers gave us an overall “D” grade on our crumbling infrastructure, collapsing bridges, failing levees and dams, torn up roads, water systems, sewers. Putting the unemployed to work fixing economically vital and failing infrastructure seems like a match made in Heaven for stimulus spending. Every dollar spent this way generates $1.75 in economic activity. Given our propensity for for plundering oil, I reckon we could stand investing in renewable energy projects, too.

The second biggest bang for the stimulus buck, if you can’t give people jobs for whatever reason Friends of Wall Street will never cop to, because we would hang them from the nearest standing superstructure affording a mass dangling of investment bankers and politicians, is just to give unemployed and hungry people money and food stamps. Simply paying them to be unemployed, and paying to feed them, too, produces $1.45 in economic activity for every dollar spent. That sure beats losing $6 trillion plus.

Now imagine if the state budgets were suffering (close your eyes and think real hard!). The third best way to stimulate the economy is to simply give money to the states. Homogenize that! Just borrowing money and giving it away to people who really, really need it.

The rest of the “disbursement” programs, i.e., tax cuts, don’t really work to stimulate the economy. Tax cuts for the poor and middle class are more or less a break even affair, a dollar-for-dollar juicing of the economy. Tax cuts for the rich and corporate tax breaks are about the most wasteful stimulus imaginable. It’s a damned shame that Obama’s stimulus package was made of 40% tax cuts, and that he renewed Bush’s tax cuts for the rich, and failed to tax the corporations in the least, but oh, what the heck. It’s his first time at The Masters and he only completely whiffed it on the first 18 holes.

I’ve plotted how GDP would have grown based on these different multipliers supplied by the Congressional Budget Office, so go ahead and take another gander at the graph at the top and throw yourself a good little fit about where we are ($6 trillion plus in the hole and zero growth) compared to where we could be (a helluva lot better off), had the geniuses ruling our lives not been hell bent on rendering us common folk into bone-crushing poverty and soul-destroying degradation of interminable debt-slavery in order to make their claims on their gambling losses whole. Tell me how losing our jobs, pensions, houses, Medicare, and Social Security to pay off their gambling losses makes any sense!

Notice how “actual gdp,” the zero-growth, goose eggs, Oops! What did I do with that $6 trillion? most resembles the tax cuts for the rich and corporate psychopaths scenario. The pathetic multiplier for “actual gdp” is merely the slope of the best-fitting line to “actual gdp.” Eight and half cents on the dollar? Jiminy Christmas. You could have had $1.75 of economic gain per dollar of debt, but somehow you ended up with…somebody pocketing over 90 cents for every dollar borrowed and spent. If it makes you wanna crack someone on the beak, I’d be helpless to prevent it, because the devil gifted me with a mean “bystander effect” the size of Jupiter when it comes to our criminal ruling elite.

For those who have read this far, I’m treating you (courtesy of Thers) to a very catchy tune from an Irishman who is “cantakerous pissed” about the crooks wreaking havoc and misery in his country. It’s simply called, “We want blood,” and I think you may find the chorus rousing:

Strangely, the yearly deficits continue to grow, getting bigger year by year, even though the economy is barely treading water, and appears ready to go under as wars rage on, housing continues tanking, unemployment doesn’t budge, and so on. Then there are those “too big to fail” banks and their black hole balance sheets.

Expect nothing but vaudeville from Eric Holder and his clowns at DoJ, even as Tim Geithner continues raiding government pensions and Bernanke revs up the presses for Obama’s re-election.

1 comments

Author

Anthony Weiner’s dick.