August 2011 archive

Aug 09 2011

Cartnoon

Aug 09 2011

Flowering Palm

Aug 09 2011

Muse in the Morning

Aug 09 2011

White House: Still Punching Hippies

Cross posted from The Stars Hollow Gazette

Yes, it an old video but it deserves resurrection from time to time. This is one of those times. When you’re failing and looking to blame someone blame the left, it’s all our fault. This is the fall back that the White House has consistently used since Barack Obama took office. I chuckled at Jon Walker’s article at FDL Action using the Scoobie Doo analogy of the White house tactic of laying the blame on the left for their failed policies from the pathetic health care bill to the Dodd-Frank reform bill and now the economically disastrous debt ceiling deal.

It would seem the White House is basically taking the perspective of a Scooby Doo villain in concluding why their brilliant plans fail. Hanging upside down in a comically oversize net with their rubber monster mask removed they yell, “we would have gotten away with it, too, if it hadn’t been for you meddling progressive bloggers!”

A meeting that took place recently with White House National Economic Council Director Gene Sperling and progressive advocacy groups was described as “tense” by Politico‘s Ben Smith:

Sperling faced a series of questions about the White House’s concessions on the debt ceiling fight and its inability to move in the direction of new taxes or revenues. Progressive consultant Mike Lux, the sources said, summed up the liberal concern, producing what a participant described as an “extremely defensive” response from Sperling.

Sperling, a person involved said, pointed his finger at liberal groups, which he said hadn’t done enough to highlight what he saw as the positive side of the debt package — a message that didn’t go over well with participants.

(emphasis mine)

If this has a familiar ring of “Groundhog’s Day”,, you’d be very correct. John Aravosis of AMERICAblog recalls attending one of those meetings in 2010 with Jared Bernstein, who was Chief Economist and Economic Policy Adviser to VP Biden:

I guess what struck me as most interesting about the meeting were two things. First, when Bernstein noted that, in trying to solve the country’s economic problems, the administration faces “budget constraints and political constraints.” By that, I took Bernstein to mean that the stimulus could only be so large last time, and we can only spend so much more money this time, because we’re facing a huge deficit, so there’s not much money to spend, and because the Hill and public opinion won’t let us spend more.

That struck me as GOP talking points winning the day, and I said so (Professor Kyle wrote about this very notion the other day on the blog). The only reason we’re facing a budget constraint is because we gave in on the political constraint. We permitted Republicans to spin the first stimulus as an abysmal failure, when in fact it created or saved up to 2m jobs. Since Democrats didn’t adequately defend the stimulus, and didn’t sufficiently paint the deficit as the Republicans’ doing, we now are not “politically” permitted to have a larger stimulus because the fiscal constraint has become more important than economic recovery.

And whose fault is that?

Apparently ours.

Bernstein said that the progressive blogs (perhaps he said progressive media in general) haven’t done enough over the past year to tell the positive side of the stimulus.

Jon Walker summed up this blame the left game that the White House is playing as another failure that faults everyone but themselves and their Republican allies:

If people see the the positive tangible effect that a policy has on their lives, they won’t care what anyone has to say about it. Likewise, if a handful of writers sign on to the White House Happy Talk PR campaign, bad policy will never become broadly popular. The administration’s failure to convince either bloggers or the public about the benefits of a particular action is most likely a signal that it is insufficient, ineffective, destructive or incompetent.

Personally, I am more that tired of being told by Obama supporters that we on the left are tea partying, Republicans and racist for criticizing President Obama’s right wing appeasement policies and his failure to follow up on his campaign promises. I’m tired of being told that by criticizing Obama I am emboldening the tea party, so I should STFU and go away. The truth be told they are the tea party Republican allies who are promulgating the right wing policies that will be the destruction of everything that has been gained since Franklin Roosevelt, all because of a well spoken bright shiny object has dazzled them and still does.

Aug 09 2011

Countdown with Keith Olbermann

If you do not get Current TV you can watch Keith here:

Aug 08 2011

Today on The Stars Hollow Gazette

Our regular featured content-

- On This Day In History August 8 by TheMomCat

- Punting the Pundits by TheMomCat

- Evening Edition by ek hornbeck

These featured articles-

- Sunday Train: Pushing for a Rapid Rail HSR Station in Ravenna, Ohio by Bruce McF

- White House: Still Punching Hippies by TheMomCat

These weekly features-

- Pique the Geek 20110807: Human Papilloma Virusby Translator

- Monday Business: 2.48% by ek hornbeck

This is an Open Thread

Aug 08 2011

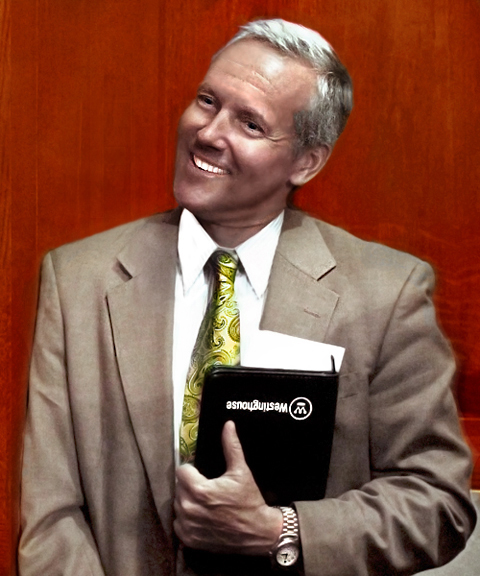

A Nuclear Lobbyist

Westinghouse Nuclear and the rest of the nuclear industry had a very good day in the US Senate on Tuesday, August 2, 2011, and although Senators Dick Durbin and Barbara Boxer actually mentioned Fukushima, the five NRC Commissioners agreed to do absolutely nothing about anything, unless you count “reviewing” whatever and “re-evaluating” whatever else as doing something, and then you can rejoice about plans for…

Re-evaluating earthquake and flooding hazards.

Reviewing with operators the location and operation of “hardened vents” that are supposed to get rid of any hydrogen created in an accident so that it does not cause explosions, as it did at the Japanese reactors.

Reviewing the status of extra pumps, hoses and other emergency equipment added after the terrorist attacks of Sept. 11, 2001.

And…

Making sure operators are trained in the use of that emergency equipment.

So Westinghouse Nuclear was grinning from ear to ear, and that’s all there was to it.

Aug 08 2011

Where Stephen Thanks His Super PAC Contributers

Stephen thanks his contributors to his Super PAC with a special call out to Suq Madiq, his dad, Liqa Madiq and his mom, who still uses her maiden name, Munchma Quchi. He did warn his affiliates he was going “low”.

Aug 08 2011

Tax Holiday

Oh, not anything as marginally useful and progressive as a payroll tax (which I don’t endorse as being useful in any event in comparison to really useful, progressive and stimulative things like extension of Unemployment benefits and increase in Food Stamps and Women and Infant Care).

Nope, we want to allow corporations to repatriate their tax dodge overseas money at 5 cents on the dollar, losing $70 billion a year in public revenue and enabling not investment in jobs, but instead stock buybacks that reward corrupt CEOs with increased compensation.

(h/t Gaius Publius @ Americablog)

Aug 08 2011

2.48%

Crossposted from The Stars Hollow Gazette

Monday Business Edition

That, dear readers, is the interest rate the United States is paying on it’s 10 year Treasuries today after the downgrade. This is LESS than we were paying on Friday.

Frankly it could and should be 0%. Far from being a neoliberal, I fall on the modern monetarist side of the fence and can find no rational explanation that we issue debt at all except outdated emotional attachments to a Gold Standard that hasn’t existed for almost 40 years and a conscious, if unspoken, government policy of subsidizing the extremely wealthy.

Our Masters of the Universe aren’t particularly bright. I find their constant caterwauling about “uncertainty” particularly revealing. Far from being brave risk takers, they’re cowardly morons miserably longing for the days of the “carry trade” when you could get Yen at 0% interest, convert it, and park it in Treasuries at 5% with zero risk.

They only like fixed games and the natural and desired state of capitalism is government sanctioned mercantilist monopolies using the military and police power of the nation to eliminate competition.

East India Company anyone? There’s your real Tea Party.

What the market is telling us today is that there is in fact NO risk that the United States will not pay off its debts in dollars, the currency in which they’re incurred. The market is also telling us that the almighty Dollar has NO SUBSTITUTE as the International Reserve Currency. It is the only one that exists in sufficient quantity to do the job and we are the only nation that is willing to accept the penalty in terms of a permanent trade deficit. Last week both China (incidentally lower rated than the U.S.) and Switzerland explicitly acted to limit the use of their currency for this purpose, because they aren’t willing to cede control of it to the market.

In fact what was the strongest candidate to replace the Dollar, the Euro, is taking a pummeling today despite the European Central Bank finally deciding to use their market power to limit the allowable decline in value (and consequent rise in interest) of Spanish and Italian bonds.

Yup, they’ve decided to “print” their way out and despite immediate negative impact there is no doubt that over the short and medium term the bond vigilantes, particularly those who have taken leveraged short positions, are going to get a buzz cut if not a shaving. In other words a thoroughgoing asskicking.

Even with our existing legal constraints (predicated on a now non-existent gold standard system in which we are forced to sell bonds before Treasury spends), Treasury/Fed have other tools to counteract the alleged effect of this downgrade. Mr. Bernanke can simply call up the NY Fed and gives Mr. Dudley instructions to buy all the 10-year UST on offer to keep the US 10 year at, say 2.5%. It is an open market operation, which the Fed performs all the time. And the banks cannot lend out these reserves, so it’s not inflationary (see here for more explanation). Then, as Rob Parenteau and I have noted before, every time some so-called “bond market vigilante” tries to push it above 2.5% by shorting Treasuries, the Fed can slam their face into the concrete by having the open market desk buy the hell out of UST until the 10 year yield is back to 2.5%. Burn Fido enough times, yank his chain enough times, and like the Dog Whisperer, he gets it and stops.

Credibility, Chutzpah And Debt

By PAUL KRUGMAN, The New York Times

Published: August 7, 2011

(T)he rating agencies have never given us any reason to take their judgments about national solvency seriously. It’s true that defaulting nations were generally downgraded before the event. But in such cases the rating agencies were just following the markets, which had already turned on these problem debtors.

And in those rare cases where rating agencies have downgraded countries that, like America now, still had the confidence of investors, they have consistently been wrong. Consider, in particular, the case of Japan, which S.& P. downgraded back in 2002. Well, nine years later Japan is still able to borrow freely and cheaply. As of Friday, in fact, the interest rate on Japanese 10-year bonds was just 1 percent.

…

These problems have very little to do with short-term or even medium-term budget arithmetic. The U.S. government is having no trouble borrowing to cover its current deficit. It’s true that we’re building up debt, on which we’ll eventually have to pay interest. But if you actually do the math, instead of intoning big numbers in your best Dr. Evil voice, you discover that even very large deficits over the next few years will have remarkably little impact on U.S. fiscal sustainability.

…

The truth is that as far as the straight economics goes, America’s long-run fiscal problems shouldn’t be all that hard to fix. It’s true that an aging population and rising health care costs will, under current policies, push spending up faster than tax receipts. But the United States has far higher health costs than any other advanced country, and very low taxes by international standards. If we could move even part way toward international norms on both these fronts, our budget problems would be solved.

What the market is also telling us is that our economy sucks. That these huge corporate earnings are largely illusionary in the absence of demand and that Washington’s austerity policy, endorsed by Barack Obama and the Democratic Party, is a flat, abject failure.

Why do you think stocks are going down and (downgraded) bonds are going up? It’s because they are less attractive investments than the 2.48% Treasuries in a continuing Depression.