December 2011 archive

Dec 22 2011

Winter Wonderland

Dec 22 2011

On this Day In History December 22

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

December 22 is the 356th day of the year (357th in leap years) in the Gregorian calendar. There are nine days remaining until the end of the year.

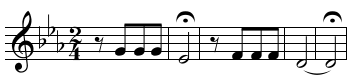

On this day in 1808, Ludwig von Beethoven’s 5th Symphony makes its world premier in Vienna.

Also premiering that day at the Theater an der Wien in Vienna were Beethoven’s Piano Concerto No. 4 in G major, Op. 58, and the Symphony No. 6 in F major, Op. 68-the “Pastoral Symphony.” But it was the Fifth Symphony that, despite its shaky premiere, would eventually be recognized as Beethoven’s greatest achievement to that point in his career. Writing in 1810, the critic E.T.A. Hoffman praised Beethoven for having outstripped the great Haydn and Mozart with a piece that “opens the realm of the colossal and immeasurable to us…evokes terror, fright, horror, and pain, and awakens that endless longing that is the essence of Romanticism.”

That assessment would stand the test of time, and the Fifth Symphony would quickly become a centerpiece of the classical repertoire for orchestras around the world. But beyond its revolutionary qualities as a serious composition, the Fifth Symphony has also proven to be a work with enormous pop-cultural staying power, thanks primarily to its powerful four-note opening motif-three short Gs followed by a long E-flat. Used in World War II-era Britain to open broadcasts of the BBC because it mimicked the Morse-code “V” for “Victory,” and used in the disco-era United States by Walter Murphy as the basis for his unlikely #1 pop hit “A Fifth Of Beethoven,” the opening notes of Beethoven’s Fifth Symphony have become a kind of instantly recognizable musical shorthand since they were first heard by the public on this day in 1808.

Dec 22 2011

Muse in the Morning

Dec 22 2011

My Little Town 2011121: Family Christmas Traditions

Those of you that read this regular series know that I am from Hackett, Arkansas, just a mile or so from the Oklahoma border, and just about 10 miles south of the Arkansas River. It was a redneck sort of place, and just zoom onto my previous posts to understand a bit about it.

Every family has certain traditions that they keep for whatever holiday that they hold dearest. When I was little, it was Christmas because my mum loved it so much. Here and here are some references to her.

As I sit here around 6:30 AM on Wednesday the 21st of December, less than a day from the solstice (thank goodness, as the short days are sort of getting to me), I recollect on what we used to do for Christmas.

This is sort of a stream of consciousness account of what I remember, a gemisch of recollections from when I first can remember to when I was older, and even with a bit of more recent history. That is not typical of my pieces here, but after all, it is Christmas.

Dec 21 2011

Winter Solstice: Return of the Sun

Cross posted by The Stars Hollow Gazette

The shortest day, the longest night, for those od us who reside in the Northern climes Winter Solstice is here. The sun reaches is most Southern destiny and touches for but a moment, the Tropic of Capricorn and immediately reverses her course. That moment will occur on December 22 at 12:30 AM EST.

The shortest day, the longest night, for those od us who reside in the Northern climes Winter Solstice is here. The sun reaches is most Southern destiny and touches for but a moment, the Tropic of Capricorn and immediately reverses her course. That moment will occur on December 22 at 12:30 AM EST.

The Winter Solstice is a special night for those who practice the craft and has a rich history from many cultures. In old Europe, it was known as Yule, from the Norse, Jul, meaning wheel. It is one of the eight holidays, or Sabbats, that are held sacred by Wiccans and Pagans around the world. In Celtic traditions it is the battle between the young Oak King and the Holly King:

the Oak King and the Holly King are seen as dual aspects of the Horned God. Each of these twin aspects rules for half the year, battles for the favor of the Goddess, and then retires to nurse his wounds for the next six months, until it is time for him to reign once more.

Often, these two entities are portrayed in familiar ways – the Holly King frequently appears as a woodsy version of Santa Claus. He dresses in red, wears a sprig of holly in his tangled hair, and is sometimes depicted driving a team of eight stags. The Oak King is portrayed as a fertility god, and occasionally appears as the Green Man or other lord of the forest.

The re-enactment of the battle is popular in some Wiccan rituals.

As we prepare for the longest night, we decorate our homes with red, green and white, holly, ivy, evergreen and pine cones. We honor the solar year with light. We place candles in the windows facing the North, South, East and West to ward off the darkness and celebrate the return of the sun/ With the setting sun, fires are lit in hearths and fire pits and kept burning to keep us warm until Sol returns at dawn.

There is food a plenty, roasts and stews and winter vegetables and sweets, chocolate and peppermint candy, apples and oranges and sweet breads. All these reminding us of the last harvest, the gifts of Gaia, Mother Earth and the hunts by Hern of the Wild Hunt. Of course there will be honeyed and spiced wine and hearty, dark beers, some made by friends who will join the festivities.

What ever your beliefs, or none, may the traditions and celebrations bring you peace and joy. Blessed Be. The Wheel Turns.

Dec 21 2011

Today on The Stars Hollow Gazette

Our regular featured content-

- On This Day In History December 21 by TheMomCat

- Punting the Pundits by TheMomCat

These featured articles-

- A Lump of Coal by ek hornbeck

- The Spiral Dance To The Bottom by TheMomCat

- Cranberry Canes by ek hornbeck

This is an Open Thread

Dec 21 2011

A Lump of Coal

Crossposted from The Stars Hollow Gazette

Obama and Geithner: Government, Enron-style

Matt Taibbi, Rolling Stone

POSTED: December 20, 10:06 AM ET

The notion that what Wall Street firms did was merely unethical and not illegal is not just mistaken but preposterous: most everyone who works in the financial services industry understands that fraud right now is not just pervasive but epidemic, with many of the biggest banks committing entire departments to the routine commission of fraud and perjury – every single one of the major banks, for instance, devotes significant manpower to robosigning affidavits for foreclosures and credit card judgments, acts which are openly and inarguably criminal.

Banks and hedge funds routinely withhold derogatory information about the instruments they sell, they routinely trade on insider information or ahead of their own clients’ orders, and corrupt accounting is so rampant now that industry analysts have begun to figure in estimated levels of fraud in their examinations of the public disclosures of major financial companies.

Beyond that, as Jeff points out, Obama is simply not telling the truth about the supposedly insufficient penalties available to regulators. Employing the famous "mistakes were made" use of the passive tense, Obama copped out in his December 6 speech by saying that “penalties are too weak.” As Jeff points out, what Obama should have said is that “the penalties my own regulators chose to dish out were too weak”

…

What makes Obama’s statements so dangerous is that they suggest an ongoing strategy of covering up the Wall Street crimewave. There is ample evidence out there that the Obama administration has eased up on prosecutions of Wall Street as part of a conscious strategy to prevent a collapse of confidence in our financial system, with the expected 50-state foreclosure settlement being the landmark effort in the cover-up, intended mainly to bury a generation of fraud.

…

Geithner and Obama are behaving like Lehman executives before the crash of Lehman, not disclosing the full extent of the internal problem in order to keep investors from fleeing and creditors from calling in their chits. It’s worth noting that this kind of behavior – knowingly hiding the derogatory truth from the outside world in order to prevent a run on the bank – is, itself, fraud!

…

Obama and Geithner are engaged in the same sort of activity, only they’re trying to prevent a run not on an individual bank, but the entire American financial services sector. Geithner seems really to believe that if fraud were aggressively policed, and the world made aware of the incredible extent of the illegality in our markets, that international confidence in the American financial sector would plummet and our economy would suffer – and suffer, incidentally, on Barack Obama’s watch.

…

(B)y taking a dive on fraud, and orchestrating mass cover-ups like the coming foreclosure settlement fiasco, what they’re doing instead is signaling to the world that not only are our financial markets corrupt, but our government is broken as well.The problem with companies like Lehman and Enron is that their executives always think they can paper over illegalities by committing more crimes, when in fact all they’re usually doing is snowballing the problem so completely out of control that there’s no longer any chance of fixing things, thereby killing the only chance for survival they ever had.

This is exactly what Obama and Geithner are doing now. By continually lying about the extent of the country’s corruption problems, they’re adding fraud to fraud and raising such a great bonfire of lies that they probably won’t ever be able to fix the underlying mess.

Too little, too late.

Nevada AG Masto Sues LPS for Document Fraud

By: David Dayen, Firedog Lake

Friday December 16, 2011 12:16 pm

LPS did commit the document fraud. But they did it on behalf of mortgage servicers. So you can figure out the next step up the chain here. Masto is closing in on the big banks in a similar fashion as Martha Coakley did in Masachusetts.

LPS stands accused of a “pattern and practice of falsifying, forging and/or fraudulently

executing foreclosure related documents.” Nevada is a non-judicial foreclosure state, so these documents typically were the ones sent to county recording offices. But they were used as the basis for the foreclosure, and the documents were indeed fraudulent. So these are wrongful foreclosures, and thousands of them. The suit alleges that LPS forced employees to notarize up to 4,000 of these fraudulent documents every day. To get this done, they demanded their employees engage in forgery, to keep up the speed on the document processing, and they had their employees notarize documents without knowing the underlying material or without even witnessing the original signing, which is the purpose of notarization.And LPS lied about this, time and again, attributing the irregularities to “clerical errors” or other back office mistakes. Instead, this was policy. They cut corners to maximize profits and emphasize speed. And that included illegal document fraud.

Masto alleges other violations in the suit, including a kickback scheme whereby Nevadans paid for “attorney’s fees” that went right back to LPS. And by the way, this is not some fly-by-night organization; LPS is the industry leader in providing document processing for foreclosures. They do over half of all the foreclosure documents in the country. And nobody should believe that this sweatshop type of atmosphere was somehow limited to Nevada.

Masto asks in the suit for $5,000 per violation (remember they signed thousands of fraudulent documents every day) and $12,000 per violation if it was directed against an elderly or disabled person. Masto also wants a special monitor to “ensure that deceptive documents and practices are corrected and improper foreclosures are remediated.”

Harris Sues Fannie and Freddie for Information in Mortgage Investigation

By: David Dayen, Firedog Lake

Wednesday December 21, 2011 6:16 am

Kamala Harris, the Attorney General of California, sued government-sponsored enterprises Fannie Mae and Freddie Mac over information on foreclosures in California. Rather than the endpoint of the investigation, this is the beginning of it; Harris wants information out of Fannie and Freddie that they have so far been unwilling to provide.

…

The lawsuits in foreclosure fraud all have their own specialized nature. Martha Coakley has taken on the big banks for stealing homes. Beau Biden sued MERS. Eric Schneiderman is focusing on securitization. Catherine Cortez Masto charged LPS with systematic document fraud. And now Harris has targeted Fannie and Freddie. This puts her in conflict with the FHFA, an independent agency that has at times acted on its own, suing 17 banks over representations and warranties claims and even sharing information between its inspector general and Schneiderman. An FHFA attorney said the volume of information Harris requested was “staggering” and questioned whether Harris had the ability to issue the subpoenas.The importance of settling that question is obvious: if states can investigate Fannie and Freddie, even if they are under the auspices of a federal conservator, then they have access to the misdeeds of mortgage giants that currently own or guarantee over half of the market. The SEC did just bring civil fraud charges against former Fannie and Freddie CEOs and other executives on securities fraud, but Harris is looking into specific acts against borrowers in her state. If the subpoenas are upheld here, it could open the floodgates.

Meanwhile, there will be no settlement from Tom Miller and his crew by Christmas, as they miss yet another deadline. In fact, the banks are increasing their demands, essentially wanting immunity from CFPB regulations on past mortgage origination. So to those who say that we need a settlement to provide immediate aid to borrowers, well, there isn’t going to be any settlement, because the banks don’t want to give up more than a pittance and they want release from practically all liability.

Tom Miller Can’t Even Lie Well Anymore: Not Only No Deal By Christmas, As Promised, But Banks Upping Demands Even As Attorneys General Leave Table

Yves Smith, Naked Capitalism

Tuesday, December 20, 2011

We’ve commented previously on Tom Miller as the contemporary exemplar of what in the 1960s was called a credibility gap. Readers no doubt know that he is the lead negotiator on behalf of the state attorneys general in what was formerly called the 50 state attorney general [mortgage] settlement. (Notice separately how the state AGs are providing cover for several Federal banking regulators, HUD and the Department of Justice, which are also parties to this deal).

A partial recap: Miller started by promising criminal prosecutions, then reneged. He has refused to do investigations, then had the temerity to try to claim they took place). He said there would not be a big waiver on mortgage liability, when as we discussed, that was the only thing Miller & Co. could offer that would get a deal to the numbers he had unwisely committed himself to (north of $20 billion). And several state attorneys general have walked from the deal precisely because they object to the plan in motion: a big release for an impressive-sounding number, when they have an inadequate idea of how much questionable activity is being forgiven.

Dec 21 2011

New Rebel Alliance: NY Attorney General & FHFA Inspector General

Cross posted from The Stars Hollow Gazette

New York State attorney General Eric Schneiderman and Steve Linick, the inspector general supervising Fannie and Freddie and the Federal Housing Finance Agency (FHFA) have joined forces giving the NY AG access to documents and depositions taken by the FHFA Office of Inspector General as part of its investigation into mortgage and securities fraud perpetrated against Fannie and Freddie. As Yves Smith at naked capitalism points out this is a “well deserved slap in the case to the Department of Justice”:

I’m not certain of the precise scope of powers of the FHFA inspector general. But typically, federal inspector generals have limited scope of action. They can only subpoena documents and cannot subpoena witnesses. And, of course, they are not prosecutors and cannot launch cases. The theory of IGs is that if they uncover something unsavory, they’ll hand it off to the Department of Justice. But as a former IG has pointed out, the DoJ does not take case leads from the IGs unless they are fully fleshed out, and that is well nigh impossible to do in the absence of speaking to witnesses.

The Department of Justice has AWOL on the mortgage and banking beat, no doubt to avoid ruffling powerful possible Obama donors. Inspectors general are in theory independent, and on top of that, the FHFA is an independent agency and is not running the Administration playbook (I’ve been told by people involved in bank regulation that Geithner has tried pressuring FHFA acting chief DeMarco to no avail).

So what does the FHFA inspector general do, certain that Eric Holder will ignore any misdeeds he finds? Turn to another prosecutor who can bring cases that can bring cases that are national in scope.

According to Shahien Nasiripour writing for the Financial Times this alliance could “make it easier for authorities to bring fraud charges against Wall Street companies”.:

Investigators will be able to share documents and findings, and pool resources, according to people familiar with the co-operation agreement. It was signed in recent weeks by Eric Schneiderman, New York attorney-general, and Steve Linick, the inspector general supervising Fannie and Freddie as well as the Federal Housing Finance Agency , the regulator responsible for the two taxpayer-owned home loan financiers.

The collaboration escalates Mr Schneiderman’s probe of about a dozen banks and mortgage insurers as part of a broad investigation into whether banks properly bundled hundreds of billions of dollars worth of home loans into now-soured securities sold to investors.

The New York attorney-general is armed with the state’s Martin Act, considered one of the most powerful prosecutorial tools in the country. The law allows Mr Schneiderman to investigate anyone doing business in New York and to bring cases without having to show that the accused intended to commit fraud. State prosecutors need only prove that a fraud was committed, which state courts have defined as “all deceitful practices contrary to the plain rules of common honesty”.

The law allows Mr Schneiderman to pursue civil and criminal probes, and to seek felony criminal convictions. The Martin Act confers broader powers than federal securities laws used by agencies like the US Securities and Exchange Commission, which must show intent when bringing fraud cases. Previous New York prosecutors such as Eliot Spitzer have wielded the law to extract billions of dollars from Wall Street firms for alleged wrongdoing.

In conjunction with with lawsuits from Delaware’s Beau Biden, Massachusetts’ Martha Coakley and Nevada’s Catherine Cortez Masto, this is really great news. As David Dayen at FDL says “this is an end run around the justice department”:

Recall that Linick has recently come out with some explosive reports, including a report that the GSEs know about foreclosure fraud back in 2003. So that’s a wealth of knowledge from which to draw, and the IG can compel some more of it, though as said above they are somewhat limited. If Schneiderman sought these documents and depositions by himself, federal regulators could have overruled him. Now he can just use Linick as a conduit.

The FHFA, over which Linick monitors, sued 17 banks for securities fraud earlier this year. So you’re almost seeing a consolidation of lawsuits and actions between Schneiderman and a rogue independent housing agency. It’s really nice to see.

Another step in getting justice for homeowners.

Dec 21 2011

On this Day In History December 21

Cross posted from The Stars Hollow Gazette

This is your morning Open Thread. Pour your favorite beverage and review the past and comment on the future.

Find the past “On This Day in History” here.

December 21 is the 355th day of the year (356th in leap years) in the Gregorian calendar. There are 10 days remaining until the end of the year. This is a frequent day for the winter solstice to occur in the northern hemisphere and summer solstice to occur in the southern hemisphere.

On this day in 1968, Apollo 8, the first manned mission to the moon, is successfully launched from Cape Canaveral, Florida, with astronauts Frank Borman, James Lovell, Jr., and William Anders aboard.

Apollo 8 was the first human spaceflight to leave Earth orbit; the first to be captured by and escape from the gravitational field of another celestial body; and the first crewed voyage to return to planet Earth from another celestial body-Earth’s Moon. The three-man American crew of mission Commander Frank Borman, Command Module Pilot James Lovell, and Lunar Module Pilot William Anders became the first humans to directly see the far side of the Moon, as well as the first humans to see planet Earth from beyond low Earth orbit. The 1968 mission was accomplished with the first manned launch of a Saturn V rocket. Apollo 8 was the second manned mission of the Apollo program and the first manned launch from the John F. Kennedy Space Center.

Originally planned as a second Lunar Module/Command Module test in an elliptical medium Earth orbit in early 1969, the mission profile was changed in August 1968 to a more ambitious Command Module-only lunar orbital flight to be flown in December, because the Lunar Module was not ready to make its first flight then. This meant Borman’s crew was scheduled to fly two to three months sooner than originally planned, leaving them a shorter time for training and preparation, thus placing more demands than usual on their time and discipline.

After launching on December 21, 1968, Apollo 8 took three days to travel to the Moon. It orbited ten times over the course of 20 hours, during which the crew made a Christmas Eve television broadcast in which they read the first 10 verses from the Book of Genesis. At the time, the broadcast was the most watched TV program ever. Apollo 8’s successful mission paved the way for Apollo 11 to fulfill U.S. President John F. Kennedy’s goal of landing a man on the Moon before the end of the decade.

Dec 21 2011

Pobrecitos

Crossposted from The Stars Hollow Gazette

As atrios says- LEAVE THE RICH ASSHOLES ALOOOOOOONE!

Bankers Seek to Debunk Attack on Top 1%

By Max Abelson, Bloomberg News

Dec 20, 2011 12:01 AM ET

The top 1 percent of taxpayers in the U.S. made at least $343,927 in 2009, the last year data is available, according to the Internal Revenue Service. While average household income increased 62 percent from 1979 through 2007, the top 1 percent’s more than tripled, an October Congressional Budget Office report showed. As a result, the U.S. had greater income inequality in 2007 than China or Iran, according to the Central Intelligence Agency’s World Factbook.

…

“Rich businesspeople like me don’t create jobs,” Nick Hanauer, co-founder of aQuantive Inc., an online advertising company he sold to Microsoft Corp. for about $6 billion, wrote in a Dec. 1 Bloomberg View article. “Let’s tax the rich like we once did and use that money to spur growth.”Two out of three Americans support raising taxes on households with incomes of at least $250,000, according to a Bloomberg-Washington Post national poll conducted in October.

…

“It’s simply a fact that pretty much all the private- sector jobs in America are created by the decisions of ‘the 1 percent’ to hire and invest,” Rosenkranz, 69, said in an e- mail. “Since their confidence in the future more than any other factor will drive those decisions, it makes little sense to undermine their confidence by vilifying them.”

…

Cooperman, 68, said in an interview that he can’t walk through the dining room of St. Andrews Country Club in Boca Raton, Florida, without being thanked for speaking up. At least four people expressed their gratitude on Dec. 5 while he was eating an egg-white omelet, he said.

And here I thought jobs were created by “Small Businesses.”

Update: lambert @ Corrente. Krugman. Felix Salmon.

Dec 21 2011