(10 am. – promoted by ek hornbeck)

Everyone that isn’t a partisan Republican is celebrating the recent string of good economic news regarding the GDP, unemployment rate, and manufacturing numbers. And for good reason. After three years of stagnant economic conditions, and all sorts of global financial problems, the working class of America is finally getting some belated relief.

However, let’s not kid ourselves. There are economic indicators that are not only not recovering – they are getting worse.

Instead of getting caught up with this brief respite of good economic news, with the implication that we can relax now, we should instead be viewing this interlude as a last opportunity to avoid another economic crisis. We should be pushing harder for reform, not relaxing.

That’s why I want to bring your attention to these issues.

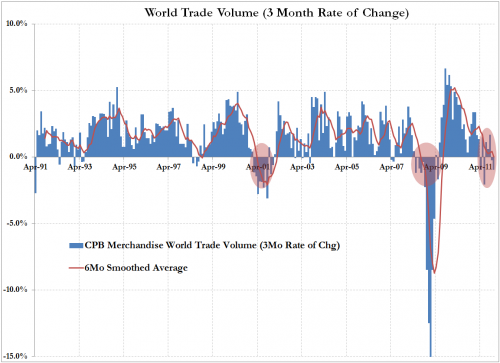

There is some debate in the field of economics whether the Baltic Dry Index (an index of international shipping prices) is either a leading indicator or a coincidence indicator, but no one accuses it of being irrelevant.

For instance, in the summer of 2008 the Baltic Dry Index crashed several months before Lehman Brothers went under.

The BDI is giving warning signs again.

This is, of course, directly reflected in world trade.

It’s hard to imagine the world economy going strong while world trade is shrinking. This includes our growing manufacturing recovery that is so dependent on exports.

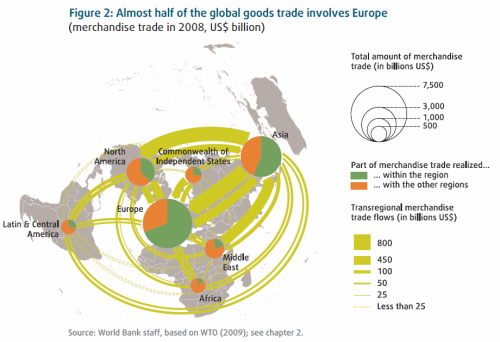

And the reason world trade is shrinking? Because so much of it is tied to Europe.

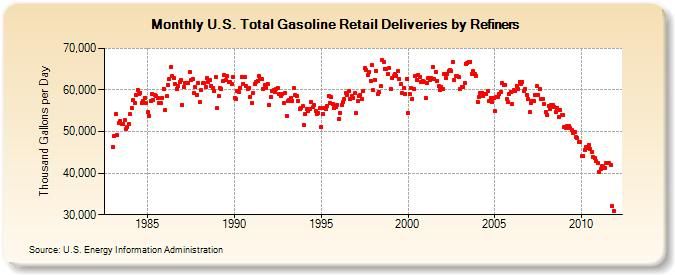

You may think that the numbers from America’s economy are all turning up, but that would be incorrect.

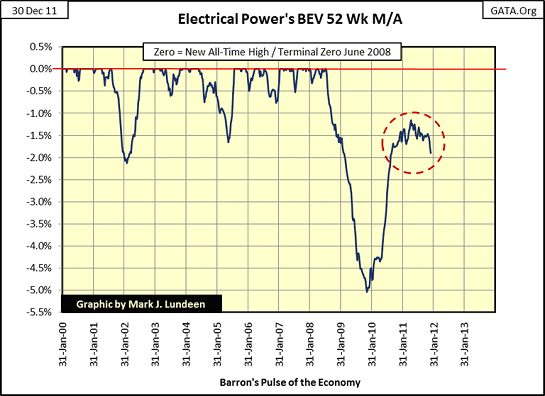

It’s hard to see an economic recovery that doesn’t require more gasoline (especially with our economy so dependant on autos), but what about a recovery without energy too?

Something is wrong here. Seriously wrong. America didn’t suddenly get dramatically more energy efficient when the recession hit.

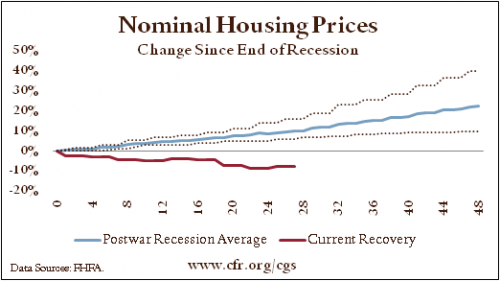

Let’s not forget the primary reason for the 2008 economic collapse – housing.

How has that been doing?

Housing normally leads us out of a recession. Instead it has continued to drag on the economy. This also means that it drags directly on the financial system.

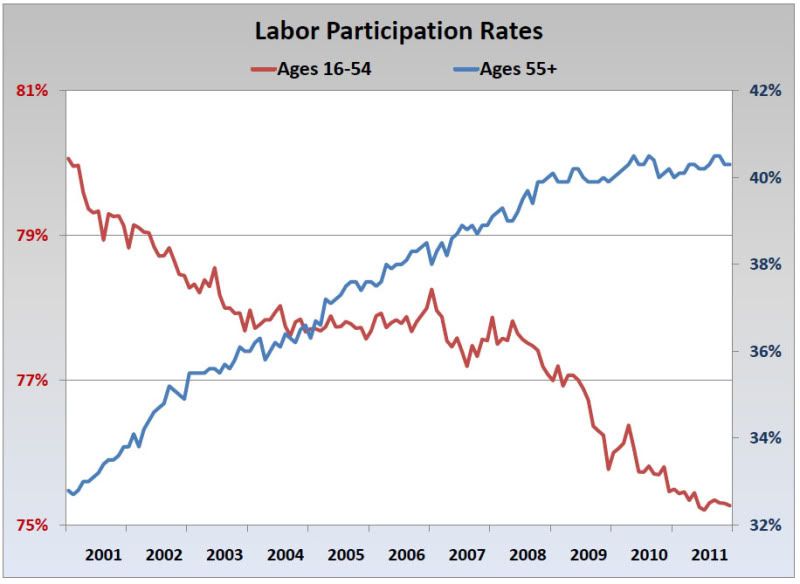

Finally, let’s look at the labor force.

We all know that the unemployment rate is dropping, but there are two disturbing trends that are accompanying that rate.

A boom in hiring usually brings people into the workforce. It doesn’t shrink it. Notice that most of the shrinking labor force happening on the younger side, not from retiring Boomers.

So why is the workforce still shrinking?

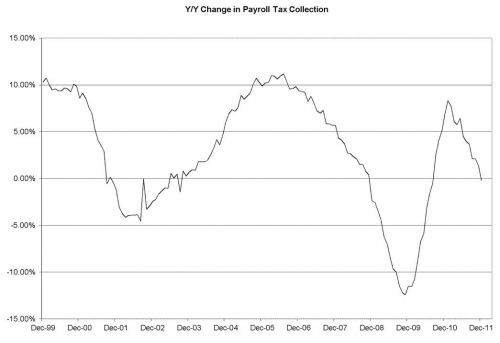

If there are more jobs and payroll taxes are going down, then the most likely reason is because the new jobs pay sh*t wages. That would also explain why people aren’t re-entering the workforce.

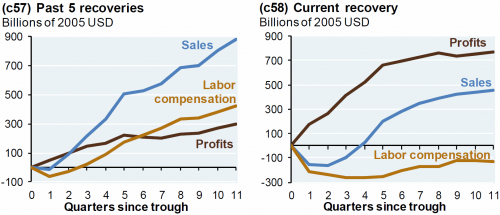

This trend is reflected even more dramatically in this chart.

Profits aren’t trickling down to workers. It’s being sucked up by corporate stock and bond holders (the 1%).

This isn’t a doom-and-gloom diary. This is a diary about not becoming complacent from 4-6 months of decent economic news. This slight bounce we’ve seen could vanish just as quickly as it arrived. The need for serious economic reforms is even more urgent today than it was four years ago.

The TBTF banks need to be broken up. The derivatives market needs to be regulated. The casino economy must end. Fair trade must replace free trade. And those are just starters.

7 comments

Skip to comment form

Author

Thought I would change things up a bit.

People have been so focused on individual indicators lately that they haven’t looked at a full spectrum economic essay.

Of course there are very negative credit market indicators too, but I didn’t have any of those charts handy.

just whut I wuz thinking.

and nearly 11 million homeowners with $700 billion in negative equity, wages still falling, I can’t imagine why anyone is cheering except maybe the banks with the latest bailout from the mortgage fraud agreement.

The galactic suck factor of current establishment globalist oriented economic recovery indicators is designed to intentionally pacify that growing American population of “preppers”.

The US housing industry is dead. That used to be American dream of upward social mobility via housing is history. I am 56 and as such have viable witness and testimony about normal things my father’s generation did to financially advance themselves through hard work which is now “illegal” and is also being socially engineered out of the do it yourself former american culture.

think about it. They don’t want uncontrolled wasting of limited resources which limit their profit/control margin potentials.