(4 pm. – promoted by ek hornbeck)

Cross posted from The Stars Hollow Gazette

Who could have possibly thought that by giving the banks a pass on foreclosure fraud with the 49 state agreement that there would be an increase in foreclosures? That prediction came from Mark Vitner, an economist with Wells Fargo:

“The immediate results are not going to be all that pleasant,” said Mark Vitner, an economist with Wells Fargo. His bank is one of the biggest lenders in Florida as well as a participant in the settlement. “The amount of foreclosures will actually increase and there will be some additional downward pressure on home prices.”

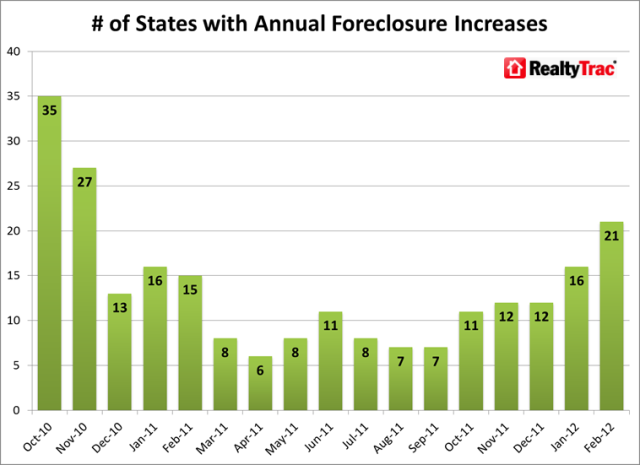

And foreclosures are on the rise in half of the major metro areas:

February foreclosure activity in the 26 states with a judicial foreclosure process increased 2 percent from January and was up 24 percent from February 2011, while activity in the 24 states with a non-judicial foreclosure process decreased 5 percent from January and was down 23 percent from February 2011.

Half of largest metro areas post annual increases in foreclosure activity

Ten of the nation’s 20 largest metro areas by population documented year-over-year increases in foreclosure activity in February, led by the Florida cities of Tampa (64 percent increase) and Miami (53 percent increase).The 10 metro areas with increases were all on the East Coast or in the Midwest, while most of the metro areas with year-over-year decreases in foreclosure activity were in the West, led by Seattle (59 percent decrease) and Phoenix (43 percent decrease).

The metro areas with the highest foreclosure rates among the 20 largest were Riverside-San Bernardino in California (one in 166 housing units), Atlanta (one in 244), Phoenix (one in 259), Miami (one in 264) and Chicago (one in 302).

Meanwhile robosigning has still not stopped. Matt Stoller at naked capitalism found according to the HUD Inspector General Report Well Fargo is still using it:

At the time of our review, affidavits continued to be processed by these same signers, who may not have been qualified, and these signers may not have adequately verified certain figures because they accessed a computer screen of data showing a compilation of figures instead of verifying the data against the information through review of the books and records kept in the regular course of business by the institution.

Stollers reaction deserves repeating:

I’m sorry, but WHAT THE $&*@!?!? I’m so glad Eric Holder has cut a deal with Al Capone while Capone is still on a shooting spree. And note, this isn’t just robosigning, this is potentially overcharging homeowners with junk fees and just generally not verifying accurate data on who owes what to whom. There really is no lesson here except “crime pays”.

And they are still stealing homes.

1 comments

Author