Cross posted from The Stars Hollow Gazette

High Speed Frequency Trading (HFT) has been known to rattle traders and disrupt the stock market but has yet to be harnessed by regulators, until now.

Germany Acts to Increase Limits on High-Speed Trades

by Melissa Eddy and James Kanter

Chancellor Angela Merkel’s government approved draft legislation on Wednesday that foresees imposing additional controls on such trading. The proposed measures include requiring that all high-frequency traders be licensed, requiring clear labeling of all financial products traded by powerful algorithms without human intervention and limiting the number of orders that may be placed without a corresponding trade. Traders who violate the limits, which would be set once the law took effect, would face a fine.

“Computer-generated algorithmic transaction involves a variety of new risks,” Germany’s finance ministry said in a statement. “Germany is reacting to these risks with legislation that will create more transparency, security and a better overview.”

The legislation, which is subject to approval by both houses of Parliament, was written with an eye toward similar legislation being discussed in Brussels that could eventually apply across the European Union, which has 27 member nations, the official said.

A prime example of what happens when HFT runs amok occurred in August this year by Knight Match, a system used by high speed trades, nearly bankrupted the trading company Knight Capital that lost $440 million in 45 minutes.

Knight was saved by a hastily assembled $400 million from a consortium of investors, but it appears the damage to Knight’s reputation with customers, particularly high frequency traders, will take longer to repair. Knight says the volume numbers, which were compiled by stock market and technology research firm Tabb Group, exclude the trading glitch, which happened on August 1st. Knight was forced to shut down its systems for part of that day. The volume drop shows that traders shied away from Knight longer than just in the days following the trading glitch. A Knight spokeswoman says the company won’t comment on whether trading volumes rebounded in September until early next month.

The HFT system has caused some concern in Washington. At a Senate Banking Committee hearing trading professional expressed the the fears of investors:

It no longer is your parents’ or grandparents’ stock market. Rather, it’s become a Wild West of trading, with errant technology too often in control and setting stocks, commodities, currencies and futures up for violent moves that could make the $1 trillion flash crash of May 2010 look tame by comparison, testified David Lauer, who has designed trading technology and worked as an analyst for Allston Trading and Citadel Investment Group.

“U.S. equity markets are in dire straits,” Lauer said. “We are truly in a crisis.”

He noted that “retail investors have been fleeing the stock market in droves” and that the Chicago Booth/Kellogg School Financial Trust Index shows “investor confidence is nonexistent – with only 15 percent of the public expressing trust in the stock market.”

Rather than buying a stock and holding onto it, institutions using high-frequency trading buy and sell stocks constantly in milliseconds, or much faster than a blink of the eye. Lauer said about 50 to 70 percent of the volume of trading in the stock market now takes that form. Often trading systems send out phony trades aimed at manipulating others into buying or selling. The activity can mislead legitimate traders working for mutual funds, pension funds or individuals to buy a stock at too high a price or sell it at too low a price.

The system is also riddled with fraud:

A New York-based brokerage allowed overseas clients to run a scheme aimed at distorting stock prices by rapidly canceling orders, according to the U.S. Securities and Exchange Commission.

Clients of Hold Brothers On-Line Investment Services were “repeatedly manipulating publicly traded stocks” by placing and erasing orders in an illegal strategy designed to trick others into buying or selling, the SEC said today in a release. Hold Brothers, its owners, and the foreign firms Trade Alpha Corporate Ltd. and Demonstrate LLC agreed to settle allegations that the New York broker failed to supervise customers and pay $4 million in total SEC fines.

The SEC complaint targeted practices that abused high-speed computer trading on American equity venues. As high-frequency activity has grown in recent years, the agency’s efforts to stop fraudulent practices such as “layering” or “spoofing” have extended to the automated trading tactics.

However, the SEC has been called the “Barney Fife” of regulators when it comes to regulating HFT and their competence has been questioned:

But the agency is clearly outgunned when it comes to dealing with high-frequency trading, many experts agree. And a new lawsuit goes so far as to accuse the SEC of covering up high-speed fraud so nobody will know just how incompetent it really is, Courthouse News reports.

In the suit, a Wisconsin company called EMM Holdings accuses the SEC of not investigating a Houston high-speed trading firm called Quantlab Financial. According to EMM, Quantlab is perpetrating fraud amid all the high-speed churning and burning it does in the stock market. EMM notes that Quantlab has been flagged six times in the past eight years by the Financial Industry Regulatory Authority, the brokerage industry’s self-regulatory body, for not properly documenting its trades. EMM thinks this is evidence that Quantlab is trying to cover up some fraud, and it has asked the SEC (pdf) for any documents showing an investigation of Quantlab. The SEC has refused (pdf), on the grounds that doing so might interfere with law-enforcement activities. EMM has sued the SEC to force it to give up whatever goods it has on Quantlab.

Trouble is, it’s not entirely clear if the SEC is actually investigating Quantlab at all. EMM argues in its complaint that the only way the SEC could deny its record request is “if there is an on-going and active investigation.” And EMM accuses the SEC of letting this investigation fester, hoping the statute of limitations will run out.

“Given [the SEC’s] near complete abdication of its prosecutorial duties during the 2008 financial crisis, inaction and delay may unfortunately have become [the SEC’s] modus operandi for dealing with complex financial malfeasance,” EMM said in its complaint.

At least the Germans are willing to take the “bull by the horns” by limiting the ability of these trades to disrupt the market with rules that would slow trading, curb the volume and make it more expensive for traders to cancel large volumes of orders.

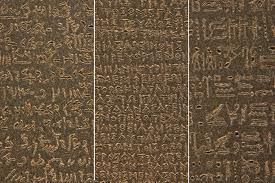

Thomas Young was one of the first to attempt decipherment of the Egyptian hieroglyphs, basing his own work on the investigations of Swedish diplomat Akerblad, who built up a demotic alphabet of 29 letters (15 turned out to be correct) and translated all personal names and other words in the Demotic part of the Rosetta Stone in 1802. Akerblad however, wrongly believed that demotic was entirely phonetic or alphabetic. Young thought the same, and by 1814 he had completely translated the enchorial (which Champollion labeled Demotic as it is called today) text of the Rosetta Stone (he had a list with 86 demotic words). Young then studied the hieroglyphic alphabet and made some progress but failed to recognise that demotic and hieroglyphic texts were paraphrases and not simple translations. In 1823 he published an Account of the Recent Discoveries in Hieroglyphic Literature and Egyptian Antiquities. Some of Young’s conclusions appeared in the famous article Egypt he wrote for the 1818 edition of the Encyclopædia Britannica.

Thomas Young was one of the first to attempt decipherment of the Egyptian hieroglyphs, basing his own work on the investigations of Swedish diplomat Akerblad, who built up a demotic alphabet of 29 letters (15 turned out to be correct) and translated all personal names and other words in the Demotic part of the Rosetta Stone in 1802. Akerblad however, wrongly believed that demotic was entirely phonetic or alphabetic. Young thought the same, and by 1814 he had completely translated the enchorial (which Champollion labeled Demotic as it is called today) text of the Rosetta Stone (he had a list with 86 demotic words). Young then studied the hieroglyphic alphabet and made some progress but failed to recognise that demotic and hieroglyphic texts were paraphrases and not simple translations. In 1823 he published an Account of the Recent Discoveries in Hieroglyphic Literature and Egyptian Antiquities. Some of Young’s conclusions appeared in the famous article Egypt he wrote for the 1818 edition of the Encyclopædia Britannica.

Welcome to the

Welcome to the