Cross posted from The Stars Hollow Gazette

Most of us already know that tax cuts, especially for the wealthy, do not create jobs nor do they stimulate economic growth. But there are those who are still pushing this unicorn myth. So here are some facts:

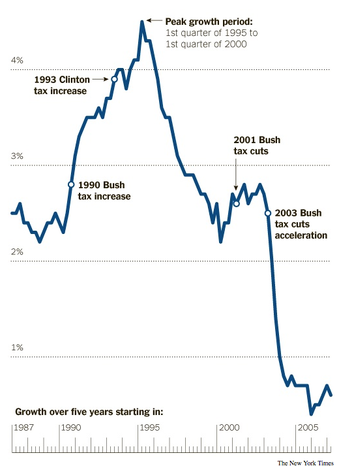

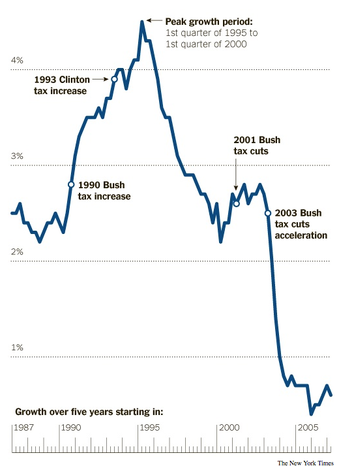

One of the first things you notice in the chart is that the American economy was not especially healthy even before the financial crisis began in late 2007. By 2007, remarkably, the economy was already on pace for its slowest decade of growth since World War II. The mediocre economic growth, in turn, brought mediocre job and income growth – and the crisis more than erased those gains.

One of the first things you notice in the chart is that the American economy was not especially healthy even before the financial crisis began in late 2007. By 2007, remarkably, the economy was already on pace for its slowest decade of growth since World War II. The mediocre economic growth, in turn, brought mediocre job and income growth – and the crisis more than erased those gains.

The defining economic policy of the last decade, of course, was the Bush tax cuts. President George W. Bush and Congress, including Mr. Ryan, passed a large tax cut in 2001, sped up its implementation in 2003 and predicted that prosperity would follow.

The economic growth that actually followed – indeed, the whole history of the last 20 years – offers one of the most serious challenges to modern conservatism. Bill Clinton and the elder George Bush both raised taxes in the early 1990s, and conservatives predicted disaster. Instead, the economy boomed, and incomes grew at their fastest pace since the 1960s. Then came the younger Mr. Bush, the tax cuts, the disappointing expansion and the worst downturn since the Depression.

That was the conclusion from David Leonhardt’s new column today for The New York Times, and it was precisely the finding of a new study from the Congressional Research Service, “Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945” (pdf).

That study concluded that not only did tax cuts for the upper brackets did not stimulate growth, they are associated with increasing income disparity:

The top income tax rates have changed considerably since the end of World War II. Throughout the late-1940s and 1950s, the top marginal tax rate was typically above 90%; today it is 35%. Additionally, the top capital gains tax rate was 25% in the 1950s and 1960s, 35% in the 1970s; today it is 15%. The average tax rate faced by the top 0.01% of taxpayers was above 40% until the mid-1980s; today it is below 25%. Tax rates affecting taxpayers at the top of the income distribution are currently at their lowest levels since the end of the second World War.

The results of the analysis suggest that changes over the past 65 years in the top marginal tax rate and the top capital gains tax rate do not appear correlated with economic growth. The reduction in the top tax rates appears to be uncorrelated with saving, investment, and productivity growth. The top tax rates appear to have little or no relation to the size of the economic pie.

However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution. As measured by IRS data, the share of income accruing to the top 0.1% of U.S. families increased from 4.2% in 1945 to 12.3% by 2007 before falling to 9.2% due to the 2007-2009 recession. At the same time, the average tax rate paid by the top 0.1% fell from over 50% in 1945 to about 25% in 2009. Tax policy could have a relation to how the economic pie is sliced-lower top tax rates may be associated with greater income disparities.

In another study that was cited in an article by tax expert David Cay Johnston, Owen M. Zidar, a graduate economics student at the University of California at Berkeley, and a former staff economist on the White House Council of Economic Advisers for President Obama, looked at which tax cuts did stimulate economic growth:

He reasoned that “if tax cuts for high income earners generate substantial economic activity, then states with a large share of high income taxpayers should grow faster following a tax cut for high income earners.” The data show that tax cuts at the top, though, do not result in faster growth in states with more high-earners.

“Almost all of the stimulative effect of tax cuts,” Zidar found, “results from tax cuts for the bottom 90 percent. A one percent of GDP tax cut for the bottom 90 percent results in 2.7 percentage points of GDP growth over a two-year period. The corresponding estimate for the top 10 percent is 0.13 percentage points and is insignificant statistically.” [..]

That fits with the argument made over the last century by a variety of business leaders – carmaker Henry Ford and retailer Edward Filene among them – that the path to economic growth lies in workers making enough (and having enough after taxes) to buy goods and services.

These facts need to be pounded ad nauseum to Congress and the White House, no matter which party is in charge.

(All emphasis mine)

One of the first things you notice in the chart is that the American economy was not especially healthy even before the financial crisis began in late 2007. By 2007, remarkably, the economy was already on pace for its slowest decade of growth since World War II. The mediocre economic growth, in turn, brought mediocre job and income growth – and the crisis more than erased those gains.

One of the first things you notice in the chart is that the American economy was not especially healthy even before the financial crisis began in late 2007. By 2007, remarkably, the economy was already on pace for its slowest decade of growth since World War II. The mediocre economic growth, in turn, brought mediocre job and income growth – and the crisis more than erased those gains.

Originally published in David Claypoole’s American Daily Advertiser on September 19, 1796 under the title “The Address of General Washington To The People of The United States on his declining of the Presidency of the

Originally published in David Claypoole’s American Daily Advertiser on September 19, 1796 under the title “The Address of General Washington To The People of The United States on his declining of the Presidency of the