The resignation of Attorney General Eric Holder was announced on Thursday afternoon by the White House. Mr. Holder was among Obama’s first nominees to the cabinet. The president-elect announced his selection on the same day he announced Hillary Clinton’s appointment as secretary of state, at a time when Guantanamo Bay closure, the torture of prisoners, and regulatory failure on Wall Street after the 2008 financial crisis was all looming in the air.

While his track record in the mainstream press today has been kind to him, painting him as the liberal voice in the Obama administration, his track record is less desirable. Mr. Holder signed off on the National Security Agency’s authority to sweep up the phone records of millions of Americans not charged with any crime. We remember him for the relentless pursuit of whistleblowers such as Chelsea Manning and Edward Snowden and Aaron Swartz. While these whistleblowers were upholding our constitution and the people’s right to know, he was not. He authorized the subpoena directed at journalists and approved the CIA killing of Anwar al-Awlaki, an American citizen working with al-Qaeda, instead of just having him arrested and giving him his day in court.

Financial frauds had a friend in Holder

by William K. Black, Al Jazeera

September 26, 2014 6:00AM ET

Eric Holder was U.S. attorney general at a time when the world desperately needed the nation’s chief law enforcement officer to hold accountable the elite bankers who oversaw the epidemic of fraud that drove the 2008 global financial crisis and triggered the Great Recession. After nearly six years in office, Holder announced on Sept. 25 that he plans to step down, without having brought to justice even one of the executives responsible for the crisis. His tenure represents the worst strategic failure against elite white-collar crime in the history of the Department of Justice (DOJ).

…

In addition to the failure to prosecute the leaders of those massive frauds, Holder’s dismal record includes 1) failing to prosecute the elite bankers who led the largest (by several orders of magnitude) price-rigging cartel in history – the LIBOR scandal, in which the world’s largest banks conspired to rig the reported interest rates at which the banks were willing to lend to one another, which affected prices on over $300 trillion in transactions; 2) failing to prosecute the massive foreclosure frauds (robo-signing), in which bank employees perjured themselves by signing more than 100,000 false affidavits in order to deceive the authorities that they had a right to foreclose on homes; 3) failing to prosecute the bid-rigging cartels of bond issuances in order to raise the costs to U.S. cities, counties and states of borrowing money in order to increase banks’ illegal profits; 4) failing to prosecute money laundering by HSBC for the murderous Sinaloa and Norte del Valle drug cartels; 5) failing to prosecute the senior bank officers of Standard Chartered who helped fund of terrorists and nations that support terrorism; and 6) failing to prosecute the controlling officers of Credit Suisse who for decades helped wealthy Americans unlawfully evade U.S. taxes and then obstructed investigations by the DOJ and Internal Revenue Service for many years.Holder and his defenders will respond to such charges by appealing to the size of the civil settlements the DOJ obtained from the major banks under his tenure. But his case is risible. First, the civil fines, while sounding large, would never be large enough to pose even the slightest risk that the banks’ capital would be impaired, because Holder and White House continue to embrace the too-big-to-fail doctrine, that the responsible banks are too important to the economy to allow the risk of their collapse. Such fines amount to the cost of doing business – a very lucrative one, in fact, for the controlling officers.

Second, the CEOs knew that they could trade off a slightly larger fine in return for complete immunity for themselves and other officers who might otherwise be flipped by federal prosecutors to testify against more senior officers. The fines, of course, would be paid not by the CEOs but by the banks they ran. Indeed, one of the lesser-known aspects of the crisis is that the DOJ almost never sued a banker (as opposed to a bank) and virtually never sought to claw back bankers’ fraud proceeds. It is telling that, as even Holder admitted last week, “A corporation may enter a guilty plea and still see its stock price rise the next day.”

Despite my grave misgivings, I proved too optimistic about Holder. I always thought he would prosecute at least one of the top bankers from the most infamous fraudulent lenders such as Citigroup, Countrywide, Ameriquest or Washington Mutual as a token legacy case. No, Holder refused to indict even one of them for leading any of the megabanks that engaged in fraudulent conduct that devastated the world economy. This is all well known, as I and other observers have explained repeatedly. What is not as well known, however, is that Holder refused to indict even non-elite financial CEOs, for example, at midsize mortgage banks that specialized in making fraudulent loans. Instead, he prosecuted hundreds of bit players and spread the disgraceful double lie that mortgage fraud was largely an ethnic crime that was committed almost exclusively by primarily ethnic borrowers rather than the officers controlling the lenders. Holder’s legacy in this sphere is that he was the one chasing black, brown and Russian-American mice while white lions roamed free.

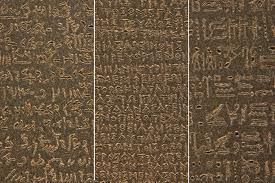

Thomas Young was one of the first to attempt decipherment of the Egyptian hieroglyphs, basing his own work on the investigations of Swedish diplomat Akerblad, who built up a demotic alphabet of 29 letters (15 turned out to be correct) and translated all personal names and other words in the Demotic part of the Rosetta Stone in 1802. Akerblad however, wrongly believed that demotic was entirely phonetic or alphabetic. Young thought the same, and by 1814 he had completely translated the enchorial (which Champollion labeled Demotic as it is called today) text of the Rosetta Stone (he had a list with 86 demotic words). Young then studied the hieroglyphic alphabet and made some progress but failed to recognise that demotic and hieroglyphic texts were paraphrases and not simple translations. In 1823 he published an Account of the Recent Discoveries in Hieroglyphic Literature and Egyptian Antiquities. Some of Young’s conclusions appeared in the famous article Egypt he wrote for the 1818 edition of the Encyclopædia Britannica.

Thomas Young was one of the first to attempt decipherment of the Egyptian hieroglyphs, basing his own work on the investigations of Swedish diplomat Akerblad, who built up a demotic alphabet of 29 letters (15 turned out to be correct) and translated all personal names and other words in the Demotic part of the Rosetta Stone in 1802. Akerblad however, wrongly believed that demotic was entirely phonetic or alphabetic. Young thought the same, and by 1814 he had completely translated the enchorial (which Champollion labeled Demotic as it is called today) text of the Rosetta Stone (he had a list with 86 demotic words). Young then studied the hieroglyphic alphabet and made some progress but failed to recognise that demotic and hieroglyphic texts were paraphrases and not simple translations. In 1823 he published an Account of the Recent Discoveries in Hieroglyphic Literature and Egyptian Antiquities. Some of Young’s conclusions appeared in the famous article Egypt he wrote for the 1818 edition of the Encyclopædia Britannica. One, two, three, one, two, three, one, two, three, one, two, three.

One, two, three, one, two, three, one, two, three, one, two, three.

In 2013 Aimee Stephens, an embalmer and Funeral Director told her boss at Harris that she was transitioning from male to female. Two weeks after that the owner of the funeral home chain fired here…telling her that what she proposed to do was “unacceptable.”

In 2013 Aimee Stephens, an embalmer and Funeral Director told her boss at Harris that she was transitioning from male to female. Two weeks after that the owner of the funeral home chain fired here…telling her that what she proposed to do was “unacceptable.”