Last week we discussed the British composer Gustav Holst and the week before that Mendelssohn (boffo in Britain, I’m telling yah), and this week we’ve had a really excellent parody of I Am the Very Model of a Modern Major-General (which is of course nothing new, patter songs, particularly the very popular ones lyricized by W.S. Gilbert, are often laced with satiric contemporary references that performers update to reflect their own environment).

Last week we discussed the British composer Gustav Holst and the week before that Mendelssohn (boffo in Britain, I’m telling yah), and this week we’ve had a really excellent parody of I Am the Very Model of a Modern Major-General (which is of course nothing new, patter songs, particularly the very popular ones lyricized by W.S. Gilbert, are often laced with satiric contemporary references that performers update to reflect their own environment).

All of which means that it must be time to mention Arthur Sullivan.

Ok, I can see you shaking your heads out there, muttering WTF? It’s perfectly obvious to me. Major General is from the famous light Opera (sometimes called Operetta or Musical Theater), The Pirates of Penzance composed by Sullivan in collaboration with Gilbert. Holst idolized Sullivan until he changed his allegiance to (shudder) Wagner. Sullivan was the first recipient of the Mendelssohn Scholarship at the Royal Academy of Music when he was 14 years old.

See, clear as mud (and remember, mud spelled backwards is dum). The important thing about my jokes is that they amuse me.

I’ll spare you a recapitulation of my career as Ralph Rackstraw, let’s just say I’m big with captive audiences in school assemblies and relatives who are supportive of macaroni and glue pictures.

But let’s talk about Artie for a while. In the first place, he would have hated that nickname because he always considered himself a serious and dignified member of the conventional “Art” Music establishment and certainly not a mere tunesmith writing ephemeral crap for beer soaked groundlings in a Music Hall (which everyone knows is the next thing to a brothel anyway). He composed 23 Operas, only 14 in collaboration with Gilbert, 13 oratorios and other major orchestral works, and 2 Ballets. This in addition to many pieces of chamber music, piano sonatas, and hymns of which probably the best known is Onward Christian Soldiers.

But he fell into the company of Richard D’Oyly Carte, this kind of sinister Brian Epstein/Tom Parker character who made him fabulously wealthy by forcing him to write wildy popular ditties hardly worthy of his talent.

Though that was not the cause of his split with Gilbert, nope, they broke up over a carpet.

Throughout most of his association with Gilbert they had quarreled over the plots and themes of their work. Gilbert was a decided populist and Sullivan entirely bourgeoisie. They both considered themselves better than their commercially successful Operettas. It was most often Sullivan who would threaten to quit and eventually Gilbert would respond with a libretto that was at least not totally unacceptable to Sullivan’s refined sensibilities and aristocratic asprations, but in the end it was Gilbert who walked away.

D’Oyly Carte used a lot of the money generated by their partnership to build a theater dedicated to staging their productions, the Savoy. At best he wasted a lot of it on maintenance, at worst-

In April 1890, during the run of The Gondoliers, however, Gilbert challenged Carte over the expenses of the production. Among other items to which Gilbert objected, Carte had charged the cost of a new carpet for the Savoy Theatre lobby to the partnership. Gilbert believed that this was a maintenance expense that should be charged to Carte alone. Gilbert confronted Carte, who refused to reconsider the accounts.

After all, the carpet was only one of a number of disputed items, and the real issue lay not in the mere money value of these things, but in whether Carte could be trusted with the financial affairs of Gilbert and Sullivan. Gilbert contended that Carte had at best made a series of serious blunders in the accounts, and at worst deliberately attempted to swindle the others. It is not easy to settle the rights and wrongs of the issue at this distance, but it does seem fairly clear that there was something very wrong with the accounts at this time. Gilbert wrote to Sullivan on 28 May 1891, a year after the end of the “Quarrel”, that Carte had admitted “an unintentional overcharge of nearly £1,000 in the electric lighting accounts alone.”

So Gilbert sued Carte and won. Sullivan supported Carte during this dispute and for a while the former collaborators barely spoke and created solo works that were resounding flops. They were eventually reunited by their music publisher Tom Chappell, but their new productions (Utopia, Limited and The Grand Duke were not nearly as well received as their previous work.

Sullivan died in 1900, Gilbert in 1911. Sullivan was considered by almost all his “serious” contemporaries a wasted genius. Of course they all languish in deserved obscurity but you’ll find people like me performing H.M.S. Pinafore to this very day, partly because they are public domain (next time we chat about Sullivan I’ll try and concentrate on their copyright litigation).

The piece I have selected is not a collaboration with Gilbert but does have a connection. It is a traditional “Grand” Opera, Ivanhoe. It was originally staged at the Royal English Opera House which was built by Carte expressly for the purpose. While moderately successful itself, Carte was unable to find enough suitable productions to make the Hall profitable and the Opera House was a commercial failure.

Unfortunately it’s in 13 parts so I’ll embed the playlist and hope that works-

Obligatories, News and Blogs below.

Obligatories

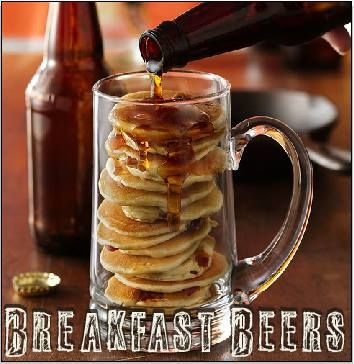

Welcome to The Breakfast Club! We’re a disorganized group of rebel lefties who hang out and chat if and when

we’re not too hungoverwe’ve been bailed outwe’re not too exhausted from last night’s (CENSORED)the caffeine kicks in. Join us every weekday morning at 9am (ET) and weekend morning at 10:30am (ET) to talk about current news and our boring lives and to make fun of LaEscapee! If we are ever running late, it’s PhilJD’s fault.

I would never make fun of LaEscapee or blame PhilJD. And I am highly organized.

The fault, dear Brutus, is not in our stars, but in ourselves, that we are underlings.

–Julius Caesar (I, ii, 140-141)

This Day in History

News

In a Shift, Obama Extends U.S. Role in Afghan Combat

By MARK MAZZETTI and ERIC SCHMITT, The New York Times

NOV. 21, 2014

President Obama decided in recent weeks to authorize a more expansive mission for the military in Afghanistan in 2015 than originally planned, a move that ensures American troops will have a direct role in fighting in the war-ravaged country for at least another year.

Mr. Obama’s order allows American forces to carry out missions against the Taliban and other militant groups threatening American troops or the Afghan government, a broader mission than the president described to the public earlier this year, according to several administration, military and congressional officials with knowledge of the decision. The new authorization also allows American jets, bombers and drones to support Afghan troops on combat missions.

In an announcement in the White House Rose Garden in May, Mr. Obama said that the American military would have no combat role in Afghanistan next year, and that the missions for the 9,800 troops remaining in the country would be limited to training Afghan forces and to hunting the “remnants of Al Qaeda.”

…

The internal discussion took place against the backdrop of this year’s collapse of Iraqi security forces in the face of the advance of the Islamic State as well as the mistrust between the Pentagon and the White House that still lingers since Mr. Obama’s 2009 decision to “surge” 30,000 American troops to Afghanistan. Some of the president’s civilian advisers say that decision was made only because of excessive Pentagon pressure, and some military officials say it was half-baked and made with an eye to domestic politics.Mr. Obama’s decision, made during a White House meeting in recent weeks with his senior national security advisers, came over the objection of some of his top civilian aides, who argued that American lives should not be put at risk next year in any operations against the Taliban – and that they should have only a narrow counterterrorism mission against Al Qaeda.

…

“There was a school of thought that wanted the mission to be very limited, focused solely on Al Qaeda,” one American official said.But, the official said, “the military pretty much got what it wanted.”

…

In effect, Mr. Obama’s decision largely extends much of the current American military role for another year. Mr. Obama and his aides were forced to make a decision because the 13-year old mission, Operation Enduring Freedom, is set to end on Dec. 31.

When Is a War Over?

By ELIZABETH D. SAMET, The New York Times

NOV. 21, 2014

Ascertaining the logical limits of a campaign presents not merely a strategic but a psychological challenge to its architects and its participants. The longer an expedition’s duration, the harder it becomes to know precisely what constitutes the end, as our wars in Vietnam, Iraq and Afghanistan demonstrate. But campaigners with a shifting purpose can derail even a comparatively short war. Disagreement over the conflict’s proper scope led to the breach between President Harry S. Truman and Gen. Douglas MacArthur over Korea. Truman fired the popular general, a decision for which he was initially vilified, to prevent a limited war from becoming a third world war.

“Now, many persons, even some who applauded our decision to defend Korea, have forgotten the basic reason for our action,” the president explained in April 1951. Truman “considered it essential to relieve General MacArthur so that there would be no doubt or confusion as to the real purpose and aim of our policy.”

In 2003, Secretary of Defense Donald H. Rumsfeld used different language to address essentially the same problem when he asked, “Are we winning or losing the Global War on Terror?” in a memo in October of that year. “Today, we lack metrics to know.” The metrics of 2014 are hardly more definitive.

Americans are uncomfortable with the prospect of an endless war yet deeply uncertain about the natural scope of the campaigns launched by the Authorization for Use of Military Force, signed into law by President George W. Bush on Sept. 18, 2001, against those responsible for the terrorist attacks a week before. This uneasiness and confusion have dominated the new century. Afghanistan was eclipsed by Iraq, Iraq by Afghanistan, and then the entire effort by what we have taken to calling war weariness on the part of a spectating public. A periodic revival of interest in Libya, Syria and elsewhere notwithstanding, much of that public long ago wearied even of watching, while a small percentage of Americans have been commuting to the wars.

…

In their 10th year on the march the Macedonians told Alexander they would go no farther. They had conquered Persia, endured three years of enervating guerrilla warfare in the mountainous terrain of northern Afghanistan and Iran, crossed the Hindu Kush, and reached the banks of the Beas River, in the Punjab. The campaign’s sense of purpose had begun to drift. The army’s march had taken it off the map into territory heretofore known to the Greek world only through rumor and legend.Initially billing his campaign as one of Panhellenic vengeance against the Persians, Alexander united the Greek city-states, restored territories lost in the Greco-Persian Wars and liberated Greeks living under Persian control. By the time his army mutinied in India, however, this goal – only partly the stuff of spin – had been accomplished while the initial clarity of the campaign evaporated. As the second-century Greek chronicler Arrian reports, the Macedonians had wearied of watching Alexander perpetually “charging from labor to labor, danger to danger.” Faced with the prospect of an apparently endless quest, they turned their thoughts toward home.

…

Alexander informed his disgruntled troops, “As for a limit to one’s labors, I, for one, do not recognize any for a high-minded man, except that the labors themselves should lead to noble accomplishments.” He assured them that “those who labor and face dangers achieve noble deeds, and it is sweet to live bravely and die leaving behind an immortal fame.”To which Coenus, reputedly one of the most faithful Macedonians, replied, “If there is one thing above all others a successful man should know, it is when to stop.” Persuaded to turn around despite his fury at the mutineers, Alexander meandered with his army through India’s Gedrosian Desert and Iran for another three years before dying of fever in Babylon.

…

Alexander is sufficiently self-aware to understand the vanity of his quest but unable to turn back: “I see that I’m to be / Hurried about the world perpetually, / And that I’ll never know another fate. / Than this incessant, wandering, restless state!” Asked repeatedly by the rival rulers he encounters what he wants in the end, Alexander finds it increasingly difficult to come up with an answer. There’s an insight here into the psychology of long campaigns, which tend to exhaust our ability to make sense of them.

Where Is the Outrage Over Foreign Exchange Manipulation?

By Mayra Rodríguez Valladares, The New York Times

November 20, 2014 11:54 am

First and foremost, it is people that are at the heart of all these banking scandals. Yes, the traders manipulated the foreign exchange rates, but the directors, senior executives and investors in banks’ bonds and stocks, collectively, set and influence the tone for a bank’s culture of ethics.

…

For their part, senior executives extol the virtues of their banks without mentioning ordinary citizens and the effect that a badly managed bank has on them. At a recent Harvard Business School and John F. Kennedy School of Government finance conference, for example, Douglas L. Braunstein, vice chairman of JPMorgan Chase, told the audience that “this was the best time to join investment banks,” because they were “very well capitalized.”Never mind that the process for how banks come up with the risk inputs into banks’ regulatory capital to sustain unexpected losses is very flexible and not transparent. And Mr. Braunstein did not mention his bank’s involvement in scandals including improper foreclosures, the “London Whale” trading loss, the London interbank offered rate (Libor) or the foreign exchange manipulation investigations. Those episodes present a different narrative than that of “the banks are doing much better than during the financial crisis.”

Some journalists and shareholders have characterized the foreign exchange fines as very high. Thomson Reuters calculated that a recent $3.4 billion settlement for five banks was about 20 percent higher than the one for Libor manipulation.

Does that matter? Until board directors and senior executives are held accountable, these scandals will continue to occur, even if the fines get higher. The Swiss Financial Market Supervisory Authority has announced that currency traders would be restricted to a 200 percent bonus based on the traders’ base salary. This is what passes for big punishment these days.

The chief executive of the Royal Bank of Scotland, Ross McEwan, noted that “to say that he was angry was an understatement.” So how angry is he? Only angry enough to announce a compensation review and “possible clawbacks that could take six months.”

It is the continued high pay that incentivizes traders to take excessive risks, while all too often also completely disregarding compliance processes, not to mention ethics. Every time board directors or senior bank executives lament new regulatory capital standards and the cost of compliance, they demonstrate that they continue to see risk managers, compliance officers and auditors as inconvenient cost centers that stand in the way of making money. And when the traders make money, even those risk managers, auditors or compliance officers who suspect wrongdoing can look the other way, since all employees’ bonuses are positively impacted when the whole bank makes money.

At the very least, it is not only the bonuses of manipulators, but also those of their bosses that should be clawed back and given to the treasuries of the banks’ home countries. Perhaps then, just maybe, taxpayers would be paid back even a bit for their bailout money that certainly could be spent on education, infrastructure or other projects whose benefits rightly belong to the taxpayers. It is they who ended up being the real bank shareholders by being forced to bail out failed banks.

Britain Drops Its Challenge to Cap on Banker Bonuses

By Jenny Anderson, The New York Times

November 20, 2014 7:17 am

Britain on Thursday dropped its challenge to the European bonus cap after an adviser to the Court of Justice of the European Union rejected all of the country’s claims.

George Osborne, the chancellor of the Exchequer, said in a letter to the governor of the Bank of England that the case faced “minimum prospects for success” and that the government would abandon its efforts.

The Court of Justice opinion dealt a serious blow to British efforts to challenge the law, which limits bankers’ bonuses to the equivalent of their annual salaries, or to two times their base salaries if the company’s shareholders approve it.

…

“As expected, it looks like the bonus cap is here to stay,” said Paul Randall, head of incentives at the law firm Ashurst, “and that could lead to further regulation if basic, nonperformance-related salaries rise as a result.”He continued: “The Governor of the Bank of England has suggested this week that fixed pay may itself need to be clawed back, leaving the whole pay package exposed.”

Some European lawmakers applauded the advocate general’s opinion. Philippe Lamberts, the co-president of the Green group in the European Parliament who played an important role in getting the law passed, welcomed the opinion and said he hoped the judges would take a similar view.

But it was “disappointing that the U.K. government is using every trick in the book to try and undermine the bonus cap, despite its overwhelming popularity as a piece of regulation,” Mr. Lamberts said in a statement. The British government appeared to be seeking “to maintain the obscene and distorted levels of remuneration of bankers in the City of London,” he said.

Police refuse to rule out use of rubber bullets and teargas in expected Ferguson protests

Jon Swaine, The Guardian

Friday 21 November 2014 19.01 EST

Authorities around Ferguson, Missouri, have refused to make significant concessions to proposed “rules of engagement” from protesters, in advance of unrest expected to follow an announcement on whether a white police officer will be charged for killing a black 18-year-old.

In a formal response from police chiefs to a 19-point set of requests from a coalition of groups demonstrating over the death of Michael Brown, authorities agreed only to basic demands such as prioritising “preservation of human life”.

Requests for police to rule out using armoured vehicles, teargas and rubber bullets, as they did repeatedly in answer to unrest in August, were rejected by police chiefs. So was a call for journalists and legal observers not to be considered participants and to “be allowed to do their jobs freely”.

…

(T)he response from the so-called unified police command – comprising chiefs from the St Louis metropolitan police, St Louis County police and Missouri state highway patrol – refused to rule out mass arrests and the containment tactic known as kettling. Chiefs also declined a request to be more tolerant of what protesters called “minor lawbreaking”, such as the throwing of water bottles, which has on past nights prompted a firm crackdown from police.A request that “intimidation and harassment of protesters will not tolerated” met with a response from police that demonstrators “should renounce harassment of police officers and the release of personal information by protesters”.

Authorities were unable to explain why officers at the Ferguson police headquarters had on the previous two nights swiftly emerged in riot gear to deal with nonviolent protests. Five people were arrested on Wednesday night and three on Thursday.

Asked why the officers had responded immediately with such equipment, Daniel Isom, Missouri’s director of public safety, said: “I don’t know why. I can’t say why.” Asked if they had been incorrect to do so, he said: “I don’t know that they were incorrect.”

Bankers think they have to behave badly. Let’s remind them they’re human

Andre Spicer, The Guardian

Friday 21 November 2014 04.27 EST

There is something in the culture of banking that lends itself to making otherwise fairly good people do bad things. That’s the finding of a new study published in the journal, Nature. And it may simply confirm the suspicions of many following endless news of bankers being outed for bad behaviour.

The list is almost endless: manipulating the foreign exchange market, Libor and the gold market; mis-selling interest-rate swaps, mortgage-backed securities and payment protection insurance; aiding money laundering; disregarding sanctions on a country; tax avoidance; providing compromised investment advice; trading scandals – the list could go on.

In total, these fines have directly cost banks more than $100bn in the US alone. Some have suggested this could soon bring the total bill for fines since 2008 to more than $300bn.

And, however astronomical this number sounds, the fines are just the start of it. There are legal fees, processes of internal change, consultants and, of course, new risk and compliance departments whose costs need to be met. On top of this, there are huge reputational costs. One recent study of UK banks found that for every £1 they paid out in fines they lost £9 off their share price. So banks would probably do well to address this seemingly fundamental issue of having a corrupt culture, as shown in this study.

…

Much of this lying and cheating can be attributed to the small population of bankers who were quite happy to lie about almost every flip of the coin if it benefited them. But the study indicates that simply prompting a person in the financial services industry to think about themselves as a banker means they are more likely to cheat.At this stage you might object, and say that identity is not the crucial factor at work here. Maybe it was just thinking about money that led to the bad behaviour? The study also tested members of other professions who, when prompted to think about themselves in professional terms, did not lie and cheat more. There was no difference among the cheaters and non-cheaters in terms of competitiveness.

Cheating was also not simply the result of people thinking that everyone else was doing it and so it was OK. What seemed to prompt bankers to cheat on this test was when they thought of themselves as bankers.

What is more, it is not just that people who identify as bankers tend to lie and cheat more than the general population. In fact, the study showed that this behaviour was expected of them by others. This can be seen when participants were asked how often they thought bankers would cheat on this test (when compared with other interest groups). Respondents tended to think that bankers would cheat more than prison inmates on the test.

Texas finally approves history textbooks amid religious and political concerns

Associated Press

Friday 21 November 2014 17.30 EST

Friday’s 10-5 vote, with all Republicans supporting the books and Democrats opposing them, was the first of its kind since 2002. The books will be used for at least a decade.

Mavis Knight, a Dallas Democrat, said she couldn’t support books adhering to the 2010 academic standards.

…

Texas is such a large state that textbooks written for it can influence the content of classrooms materials sold elsewhere around the nation – though that national clout may be waning. A 2011 state law allows school districts to buy books both on and off the board list. Technology, including electronic lessons, has also made it easier for publishers to design content for individual states.The final vote was supposed to be tame, but an effort earlier in the week to give preliminary approval collapsed, with board members raising concerns about a series of issues, including Moses, Muslims and the Common Core, a national set of curriculum standards in math and English that’s forbidden by Texas law.

The cocoa crisis: why the world’s stash of chocolate is melting away

Tamasin Ford, Jonathan Vit, Rupert Neate, Tania Branigan and Emine Saner, The Guardian

Friday 21 November 2014 13.18 EST

It’s the world’s favourite sweet treat – and this week one of the industry’s biggest players warned that supplies could soon be running low. Guardian writers around the world report on the causes of the problem, from disease and crop failure to the rise of the chocolate crisp.

House panel finds no intelligence failure in Benghazi attacks

By Greg Miller, Washington Post

November 21 at 8:53 PM

An investigation by the Republican-led House Intelligence Committee has concluded that the CIA and U.S. military responded appropriately to the attacks on U.S. facilities in Benghazi, Libya, in 2012, dismissing allegations that the Obama administration blocked rescue attempts during the assault or sought to mislead the public afterward.

…

The committee also found “no evidence that there was either a stand down order or a denial of available air support,” rejecting claims that have fed persistent conspiracy theories that the U.S. military was prevented from rescuing U.S. personnel from a night-time assault that killed U.S. Ambassador Christopher Stevens and three other Americans.

…

(T)he panel’s findings were broadly consistent with the Obama administration’s version of events. Previous investigations have reached similar conclusions, but the House committee’s report may be seen as more credible by critics of the administration’s handling of Benghazi because the panel is controlled by Republicans.

…

The committee concluded that there was no intelligence failure prior to the attacks, and that militants with links to al-Qaeda were involved. But more than two years later, it said, “the intelligence was and remains conflicting about the identities, affiliations, and motivations of the attackers.”

New York Fed Didn’t Want Goldman Sachs to Embarrass Itself

By Matt Levine, Bloomberg News

Nov 21, 2014 5:30 PM EST

The Fed’s job as a banking supervisor is “to ensure the safety and soundness of financial institutions.” It’s supposed to look out for their well-being. The banks that the Fed supervises are under constant threat, mostly from themselves. They could make risky loans, or do dumb trades, or be taken by rogue traders, or lose the confidence of investors, or ruin their reputations and see their businesses dry up. Any of those things would be bad for the bank that did it. And the Fed’s job is to prevent banks from doing things that are bad for themselves.

So reputational risk is just another risk that banks face, and that supervisors are supposed to guard against.

…

Remember, the Fed’s role is not to enforce, it’s to supervise, literally to look over. You go look over what a bank is doing, you look over it for a while, and you go home, exhausted from all that looking. You’re done! “Boy we did a lot of supervising today,” you think. What more is there to do? Your job is not to make trouble, or at least, your job is not measured in units of how much trouble you make. Cops (and prosecutors) are measured on the trouble they make — arrests, prosecutions, convictions — but supervisors are not.The measure of a supervisor’s job is, did your bank blow up today? And the success rate is almost 100 percent. Every day that your bank doesn’t blow up, you have more evidence that you’re doing a great job, honestly too good a job, you could probably dial it back a bit. Of course some days your bank does blow up, and those days are uncomfortable, but, really, that was a while ago, things are probably better now.

…

The Fed’s institutional goals are to make sure that banks are safe and sound and not, you know, crippled.

You’ll shoot your eye out: Watchdog lists ’10 worst’ holiday toys

By Richard Valdmanis, Reuters

Wed Nov 19, 2014 1:43pm EST

A plastic battle hammer for 3-year-olds, a glow-in-the-dark bow and arrow set and a pencil that doubles as a slingshot are on the short list of the most dangerous children’s toys this holiday season.

…

“Toy guns, bottle rockets and bows and arrows on the list this year may seem exciting and intriguing to children, but have the real potential to lead to tragic, sometimes deadly consequences,” W.A.T.C.H. said in a press release.Topping the list is the Air Storm Firetek Bow, manufactured by Zing, which can shoot glowing arrows with bulbous tips up to 145 feet. Zing marketed the bow alongside the roll-out of adventure film “Hunger Games II,” in which the main character is an archer.

Blogs

- New Report Highlights “Revolving Door” Between Government and LNG Firms, By: BrandonJ, Firedog Lake

- Mark Udall and the Unspeakable, By: David Swanson, Firedog Lake

- Note to Dudley: Everyone Questions the NY Fed’s Motives – For Good Reasons, By William K. Black, New Economic Perspectives

- Elizabeth Warren Blasts New York Fed President William Dudley, by Yves Smith, Naked Capitalism

- Masaccio: Piketty Shreds Marginal Productivity as Neoclassical Justification for Supersized Pay, by Ed Walker, Naked Capitalism

- Glenn Greenwald’s No Place to Hide, Reviewed by the CIA, By Hayden Peake, The Intercept

- Chris Christie-Appointed Judge Rules On ‘Under God’ In Pledge. Guess How That Turned Out, by Richard Rowe, Crooks and Liars

- D.C. City Council Cracks Down On Cops Seizing People’s Assets For Police Use, by Nicole Flatow, Think Progress

- Everything We Know So Far About The Oil Rig Explosion In The Gulf Of Mexico, by Emily Atkin, Think Progress

- Report Says Customs And Border Protection Shoved 12,000 Unanswered FOIA Requests Into Boxes And Forgot About Them, by Tim Cushing, Tech Dirt

- So, If Someone Could Just Kill A Child And Let The FBI And DOJ Get Their Anti-Phone Encryption Legislation Going, That Would Be Great, by Tim Cushing, Tech Dirt

- Ireland Asks EU To Support Microsoft In Legal Battle Involving Competing Jurisdictions, by Glyn Moody, Tech Dirt

- The Very Model Of A Pro Obama Partisan by: BertieRustle, The Stars Hollow Gazette

- NSA Spying Reform Defeated by ISIS and GOP, by: TMC, The Stars Hollow Gazette

- Speaking for the Dead: Transgender Day of Remembrance, by: Robyn, DocuDharma

- Transgender Day of Celebration: Unlikely Sources, by: Robyn, DocuDharma

- A Fish Rots From The Head Down, by: ek hornbeck, DocuDharma

The Executioner’s Song

1 comments

Author