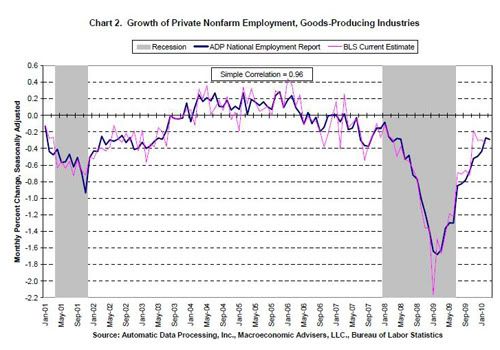

The monthly jobs report from ADP always appears about a week before the BLS announces their numbers, with the additional difference that ADP only measures private-sector employment, which once again declined in March 2010 by about 23,000 jobs, in contrast to what you might call a consensus forecast that private-sector payrolls would increase by 50,000.

Republicans are busily spinning this decline as yet another demonstration that Obama’s stimulus has failed, and they are especially busy spinning right now because the BLS is expected to report a significant increase in payrolls, because their numbers include public-sector employment, which just got a boost from the Census.

“Everyone understands that temporary census hiring may inflate the statistics released on Friday, but the American people will rightly continue to ask, ‘Where are the jobs?'”

Meanwhile Tim Geithner is also busy lowering expectations to make the BLS report on Friday look like a happy surprise!

“The economy’s growing now, that’s the first step,” Geithner said during an appearance on NBC’s “Today” show. “But the unemployment rate is still terribly high, and it’s going to stay unacceptably high for a long time.”

The bottom line, or at least a line about half way to the bottom, is that for the first time in any month since February 2008, more jobs have been created than lost, which means that the spindly little line of of net change in total public and private employment will probably creep above zero!

And now that we know, or almost know that, what exactly do we know, or almost know?

Not much.

………………………………………………………………………………………………………………

Update: The BLS posted their new unemployment numbers this morning, and just as Republicans feared and Democrats hoped, about 162,000 jobs were added to payrolls in March 2010.

And of course the usual cloud of mystery surrounds those numbers.

Since the BLS counts 15,000,000 as unemployed in their top count, and 162,000 jobs were added, you might expect unemployment to decrease in about the same ratio as 162,000/15,000,000.

In that ratio, unemployment would have fallen at least a wee little bit, maybe to 9.6%. More jobs, less unemployment! Right?

Wrong.

One catch, among many catches, is that many of the newly employed hadn’t been “officially unemployed” before they got their new jobs.

They appeared out of nowhere! Or at least, out of nowhere where anyone was counting them as “unemployed.” They weren’t officially looking for jobs, until they heard about some jobs to look for, with the Census, for example, and then…

They looked!

2 comments

Author

Among the exotica of current “explanations” why consumer spending has recovered so much faster than employment, Darryl Demos’ blog on CNBC deserves special mention.

Darryl explains this mystery with a peculiar statistic: “household productivity.”

This is the percentage of households with 2 or more “earners.”

For example, when mom and dad both work, regular household expenses may be more or less covered by one “earner,” while the other “earner’s” income is available for consumer goodies.

“Household efficiency” has increased because more and more households include multiple “earners,” and it will probably increase even more in our dismal future, as more and more young adults are forced to share tiny apartments, and more and more “little earners” (formerly known as children) are forced to get jobs.

Author

And meanwhile, according to U-6, the most comprehensive measure of unemployment and under-employment, the situation actually got slightly worse in March, while U-6 increased from 16.8 to 16.9%.