Author's posts

Apr 06 2009

An HSR Station Grows at Transbay (SF), Grand Finale (pt 3)

Crosspost links collected at: Burning the Midnight Oil for Living Energy Independence

In Part 1, the testimony representing the Transbay Joint Power Authority, managing the Transbay project, resulted in such a pile of red herring left behind that it seemed that there was something fishy going on.

In Part 1, the testimony representing the Transbay Joint Power Authority, managing the Transbay project, resulted in such a pile of red herring left behind that it seemed that there was something fishy going on.

What that something fishy seemed to be was whether the Transbay Terminal “train box” was suited for serving as the main northern terminus for both California High Speed Rail (HSR) services and for Caltrain services.

But … what if the Transbay Terminal is not the terminus of the HSR services?

In that case, the problem turns from physical limits … to legal requirements that the design has to meet. A garbled version of that is showing up in the newspapers … join me beyond the fold as I try to ungarble the story.

Mar 29 2009

An HSR Station Grows at Transbay (SF) (pt 2)

Burning the Midnight Oil for Living Energy Independence

This is “part 2” of A Train Station Grows at Transbay … Hopefully not a Bonsai (pt. 1)

This is “part 2” of A Train Station Grows at Transbay … Hopefully not a Bonsai (pt. 1)

In Part 1, an effort was made to try to fit 8 High Speed Rail (HSR) trains per hour (tph), plus up to 8 Caltrain tph, into the proposed “train box” design for the Transbay terminal, which has 3 island platforms with a total of 6 platform tracks.

And the result is an ugly kludge that quite possibly cannot physically fit, and certainly would put a cramp on the operations of Caltrain. Since the 1999 San Francisco Proposition H made it a local ordnance for the Transbay Terminal to serve both High Speed Rail and Caltrain services, a design which is incapable of genuinely serving both certainly violates the spirit, if not the letter, of San Francisco law.

Mar 22 2009

A Train Station Grows At Transbay … (pt. 1)

… Hopefully its not a Bonsai

Burning the Midnight Oil for Living Energy Independence

Burning the Midnight Oil for Living Energy Independence

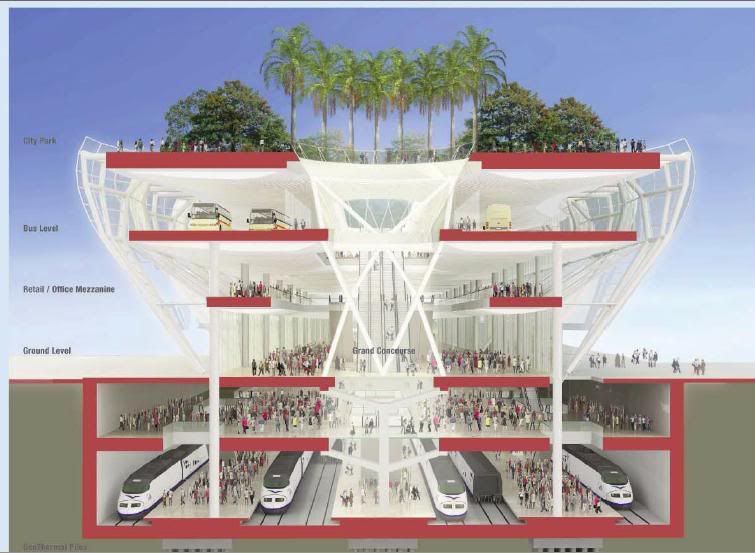

I was able to get an interesting look into the proposed future of Intercity Travel in the Bay at the Transbay Terminal (TBT) in San Francisco.

Senate Info Heairing on High Speed Rail in California

Note that I am not trying to give “objective reporting” on this issue but rather to give vent to my reaction to watching the hearing online … see The Troubling Discord Between Transbay and High Speed Rail Authorities for a less hot under the collar reaction.

One piece of information is that in California, when one public authority has the funding for sufficient staff and another doesn’t, and it comes to a fight, it is considered fair game for the staffed up authority to toss up spin and red herrings and biased analyses, confident that the other authority does not have the capacity to answer promptly.

Mar 21 2009

For lack of a better term, call it Capitalism

Burning the Midnight Oil for the Beauty Platform

Johnny Venom, in an extended comment on a Robert Oak post at The Economic Populist, says (note … much good stuff snipped, so click through):

My take on all this madness

What’s happening here is the collision of several realities:

1. You had institutions, who years if not decades, believing the hype they built themselves to sell to their clients. …

2. That you can’t simply create your own damn financial instrument to meet a client’s needs. …

3. Derivatives products work when they are designed well and implemented on a regulated environment. …

4. Many of these items will never be liquid. This brings us to today. The reality of the situation is that we now have to be discriminating between those derivatives that are somewhat liquid and those that aren’t. The former can have mark to market, but there needs to be a proper exchange for these things. Both the CME and ICE are going to have such a thing, and these banks should be made to trade them on it to get these things off their books. As for the iliquid ones, well unless our goal is to bankrupt these banks in some attempt to punish them, we will have to facilitate either a suspension of FASB 157 for these or some hybrid. …

5. Banks holding on to these illiquid derivative step children, that must be re-engineered, will have to realize they won’t get all their money back. …

6. Lastly, new accounting rules and financial regulations must be in place to keep in check the establishment of new positions. …

My response and thoughts after the fold.

Mar 17 2009

Turning Good Bank / Bad Bank on its head (UPDATE)

Burning the Midnight Oil for the Beauty Platform and Economic Populism

The problem with the “Good Bank / Bad Bank” (see also Dr. Seuss version) plan is, of course, … {drum roll}

The problem with the “Good Bank / Bad Bank” (see also Dr. Seuss version) plan is, of course, … {drum roll}

… in order to “rescue” banks that distributed a massive amount of contingency reserves as if it was income … by pretending that massive downsides did not exist …

… we “have to” reward the people who proved to be grossly incompetent in the core competency for senior executive management of a bank.

Except, as Joe Stiglitz points out, we don’t have to at all.

In other words, there is good and bad in the Good Bank / Bad Bank plan. And if we reverse who ends up with the Good Assets and who ends up with the Bad Assets, we can have all of the Good, and avoid most of the Bad.

UPDATE

Keith Olbermann cites “my” plan on the Tonight show … posted at the Big Orange

Mar 02 2009

The 110mph Triple-C passenger train: Ohio, Now Is The Time

Burning the Midnight Oil for a Brawny Recovery

This information from the Midwest High Speed Rail Blog, Ohio Proposed Budget Includes Developing Passenger Rail Between 4-5 Cities (who themselves give a h/t to Transportation for America):

As part of a two-year, $7.5 billion proposed budget, Ohio plans to continue developing passenger rail service connecting four cities Cleveland, Columbus, Dayton and Cincinnati (DispatchPolitics) – and possibly including a link to Toledo. Rail advocacy group All Aboard Ohio supports the so-called “3-C” plan and describes it here.

Feb 15 2009

You’re From Ohio, You Idiot, Don’t Screw With Our Train

Burning the Midnight Oil for a Brawny Recovery

“Tell me how spending $8 billion,”

asked House Minority Leader John Boehner (R-OH) on the floor,

“in this bill to have a high-speed rail line between Los Angeles and Las Vegas is going to help the construction worker in my district.”

(h/t Matthew Yglesias)

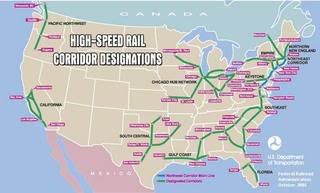

Now, lets look at the Federally Designated Corridors — and you have to have a designated corridor to get any of the $8b.

Yup, no corridor to Vegas. Oh, and what’s that we see … two, count ’em TWO corridors through Ohio … Cleveland to Chicago and Cleveland / Columbus / Dayton / Cincinnati.

Feb 14 2009

The Broken Political Economy of the Bail-Out

Burning the Midnight Oil for a Brawny Recovery

Joseph Stiglitz on the Political Economy of the Bail-Out: Who’s At the Table?

Or as your humble correspondent wrote at Obama’s Emergency Banking Act of 2009 (European Tribune) … (below the fold)

Feb 09 2009

Getting the Bail-Out Right: Stimulus versus Bail-Out and Debt versus Leverage (Updated)

Burning the Midnight Oil for the Next American Revolution

Jerome a Paris at the European Tribune focuses in on the central problem of the Financial crisis, and therefore the central problem of the Bail-Out:

Jerome a Paris at the European Tribune focuses in on the central problem of the Financial crisis, and therefore the central problem of the Bail-Out:

But, pontificating aside, the reality is that we had a large scale grand robbery of the past few years. To make it simple: the Fed printed money, gave it for free to rich people, who lent it to poor people at at nice profit instead of paying them wages; reimbursement was possible only if house prices went up, and that lasted for a while. The rich made out like bandits on their assets, financial or otherwise, and the poor thought they were more or less keeping up with the Joneses (the reality was a large-scale transfer of wealth from one group to the other, no bonus points for guessing which was which). Now that it’s no longer the case, the poor lose their house, stop paying their debt at some point, put the banks in a pickles, and the economy unravels. Except that the banks are being bailed out, which means, fundamentally, saving the owners of financial assets (bank bondholders specifically, and bond holders in general) at the expense of taxpayers, thus having the goverment validate and consolidate the past transfer of wealth.

So leverage is the central problem … or rather, the central problems:

So leverage is the central problem … or rather, the central problems:

- For those looking to hold onto their ill-gotten gains, how to maintain the maximum amount of wealth while they deleverage, which means how to convert what was always in a large part fantasy wealth into actual claims on actual productive capacity

- For the other 99% of us, how to prevent those who obtained fantasy wealth from converting it into real wealth at our expense

Feb 05 2009

The Parable of the Cherry Muesli Bar (1996)

Burning the Midnight Oil for the Next American Revolution

A little something to remind people that some of these subjects were being discussed before blogs came into existence … recycled from the ecol-econ mailing list at Communications for a Sustainable Future (CSF), in Colorado, and, thanks to the wonders of the WWW, with pictures added.

…………………..

Alan McGowan [Hi, Alan] writes:

… McClellan seems convinced that humans have opened a new chapter of evolution with technology, and he writes of technology as if it were as autopoietic as organic life. In fact all technology is dependent on humans to maintain it, and through humans, on the life support services of ecosystems. Technology is not a new form of postbiological life, it is part of the extended phenotype of human life, just as the beaver dam is part of the extended phenotype of beavers. It is part of biology — a fragile part, every bit as dependent on the maintenance of biological integrity and healthy ecosystems as we humans are — because technology is human behavior, human culture, human traits. …

And my commentary, after the fold

Jan 26 2009

Transport Stimulus: Doing It Right

Adapted from an entry at Burning the Midnight Oil for Living Energy Independence … links to crossposts may be found there.

OK, so, to make an egregiously long story merely excessively long, a very strange thing happened on the road to the Stimulus Package. As Rep. Oberstar told the U.S. Conference of Mayors:

OK, so, to make an egregiously long story merely excessively long, a very strange thing happened on the road to the Stimulus Package. As Rep. Oberstar told the U.S. Conference of Mayors:

That is why we set forth this $85-billion initiative from our committee. It’s been reduced in the final going. We expect that it’ll come out somewhere around $63 billion, but $30 billion for highways.

The reason for the reduction in overall funding … was the tax cut initiative that had to be paid for in some way by keeping the entire package in the range of $850 billion.

As I described in Transport Stimulus: You’re Doing It Wrong, actual effective stimulus spending was shortchanged — and in particular spending with substantial long term economic and strategic benefits — to “pay for” tax cuts.

In reality, if we want to be able to “afford” tax cuts, what we need first and foremost is growth, and economic growth requires effective government investment in the infrastructure of a New Energy Economy.

Jan 18 2009

Transport Stimulus: You’re Doing It Wrong

Burning the Midnight Oil for Energy Independence (crosspost links at the blog)

There is this big emphasis on “shovel ready projects” in the Stimulus Bill … but now that the details are coming out, we can see that in transport, its just a load of horseshit used as an excuse for supporting business as usual.

The headline numbers are $30b highway spending, $10b for public transport and rail:

- Transit Capital Assistance, $15.9b in shovel ready projects, $6b in funding

- Amtrak, more than $10b in capital backlog, $0.8b in funding

- Fixed Guideway Infrastructure Investment, $50b capital backlog, $2b in funding

- Capital Investment Grants, $2.4b in already approved projects, $1b in funding

I got a “shovel-ready” project for you … shoveling out the bullshit from the Bush Administration Department of Transport and replacing the pandering to the oil companies with a concern for America’s Economic Future.