Author's posts

Nov 26 2009

Luladinejad: Brazil and Iran Sign Major Trade Agreements

Brazil and Iran: Welcome To The Luladinejad Axis, Pepe Escobar

As Ahmadinejad was coming from a visit to the Brazilian parliament in Brasilia on Monday, Lula was waiting for him, virtually alone. The embrace by Lula was sudden, spontaneous, extremely warm; it’s fair to assume Ahmadinejad was not expecting it. Those who saw it interpreted it as a graphic message.

Ahmadinejad did mean business: he traveled with 200 Iranian businessmen. In the long run, Brazil wants to export to Iran not only meat, grains and sugar, but also trucks and buses. And Iran wants to invest heavily in the oil industry, petrochemicals, agriculture, minerals and real estate. Lula will visit Iran in March or April 2010, also with a business caravan.

Lula and Ahmadinejad signed agreements on energy, trade and agricultural research in the latest round of what is becoming an increasingly warm embrace between Latin America and the Middle East.The meat of the matter was, of course, nuclear energy. US President Barack Obama admitted at the Group of 20 gathering in London this year that Lula “is the man” – and opinion polls back him up, with the Brazilian leader at present the world’s most popular political leader, with an approval rating of 79%; Obama has just slipped below 50%. So what is “the man” saying? He’s saying that Brazil supports Iran’s access to “peaceful nuclear energy”.

When Lula talks, world leaders do listen; nor is he shy about running through a roll call of those he “advises” on how to behave with Iran.

“I told Obama, I told [French President Nicolas] Sarkozy, I told [German Chancellor] Angela Merkel that we will not get good things out of Iran if we corner them. You need to create space to talk.” This is not only Lula talking – it’s BRIC (Brazil, Russia, India, China) talk. Carefully balancing his act, Lula at the same time defended the rights of “a safe and secure state of Israel”. read more…

Real News Network – November 25, 2009

Luladinejad

Pepe Escobar: How the West could learn from Lula’s way of playing politics

Nov 25 2009

Busted Open Thread

Study: CEOs cashed in before Wall Street meltdown

The CEOs of Bear Stearns and Lehman Brothers, the two investment banks that collapsed during last year’s financial meltdown, walked away with hundreds of millions of dollars in compensation even as the company’s shareholders lost everything, says a new report from Harvard Law School.

The top five executives at Bear Stearns made a total of $1.4 billion from bonuses and equity sales between 2000 and 2008, while the top five executives at Lehman Brothers made around $1 billion during that same period — the period during which the companies ran up the bad investments that would see them collapse in 2008, according to “The Wages of Failure” (PDF), a report from Harvard Law School’s Program on Corporate Governance.

Nov 23 2009

If At First You Don’t Succeed, etc…

When all the cards seem stacked against you, when the road is long and rocky and all uphill, when it seems that the whole world and everything in it tells you you can’t do it because you just don’t have it in your genes to do it… don’t listen to all the negative nellies, and whatever you do, don’t give up.

When all the cards seem stacked against you, when the road is long and rocky and all uphill, when it seems that the whole world and everything in it tells you you can’t do it because you just don’t have it in your genes to do it… don’t listen to all the negative nellies, and whatever you do, don’t give up.

Sometimes, no matter how hard it gets, no matter how many times you fall, you just gotta keep getting back up, and you just gotta get dressed up, and you just gotta keep on trying.

Even if your wheels fall off, or you go right off the road into the bushes, or you drive right into a rock wall, you just gotta get back up, brush yourself off, put on your best suit, smile at the doubters with a big ass toothy grin, and with steely eyed determination get back into the drivers seat, stamp on the gas pedal, and go for it.

Goal setting and determination is what separates the humans from the monkeys, I guess.

Never give an inch… and never give up.

Don’t never say never.

Success is one percent inspiration and 99 percent perspiration.

Whatever it is you’re trying to do, you can do it if you just keep on trying.

Nov 22 2009

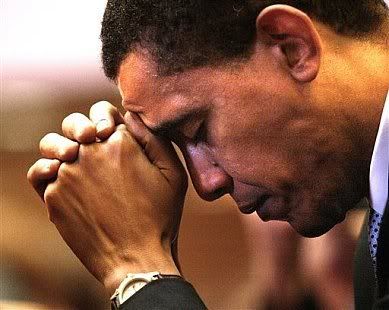

The President of the United States, 2009

Every man is guilty of all the good he didn’t do. — Voltaire

Nov 22 2009

It Still Lies Within

Hat tip to Alexa at NION for turning me on to this a couple of years ago. Unfortunately NION (Never In Our Names) is no more or I’d link to Alexa’s post. I hope she see’s this…

Hat tip to Alexa at NION for turning me on to this a couple of years ago. Unfortunately NION (Never In Our Names) is no more or I’d link to Alexa’s post. I hope she see’s this…

You already know the news.

If I could make you laugh, or ease your mind, I would – and I’d feel better, too.

I’m not giving up. I hope you won’t, either.

The power of peace lies within each of us.

–Willy WhitefeatherHope, by Willy Whitefeather

Nov 20 2009

The Players Are Writing The Rules, & Nothing Is Preventing Another Banking Crisis

This is the second in a series of interviews with Political Economist Tom Ferguson. Yesterday we saw him saying that the stimulus program was far too small, a much larger one is still needed, and predicted that the Democrats must start a new jobs program to bring economic growth to the bulk of the population or face losing badly in the 2010 mid-terms.

Today he continues his talk with Paul Jay and says that the Obama Administration asked for too little in the banking bill, nothing is preventing another banking crisis, the big players in the banking industry are writing their own regulations and colluding against the public to profit from every boom and bust cycle at your expense. The Federal Reserve must be reined in.

Real News Network – November 20, 2009

Nov 20 2009

Goldman, Geithner, & Summers: A Fall From Grace In The Making?

Three weeks ago on October 28, Henry Blodget at The Business Insider wrote that:

Three weeks ago on October 28, Henry Blodget at The Business Insider wrote that:

When the historians finally finish sorting through the appalling decisions that have been made in the past two years, this one will probably be at the top of the heap.

Last fall, as AIG began to realize how screwed it was, it started negotiating with the counterparties to all the credit default swaps it had written. One of the AIG’s goals was to persuade these counterparties–including Goldman Sachs–to accept

buyoutsdiscounts of as much as $0.40 cents on the dollar.These sorts of negotiations are exactly what should happen when a company gets in trouble. It goes to its creditors and says, look, we can’t pay you everything, so here’s your choice: Take something, or take your chances in banktuptcy court. (And, in this case, this wouldn’t have been much of a choice, given the standing of CDS holders in the liquidation line).

But then Tim Geithner, head of the New York Fed, stepped in.

A few weeks later, the counterparties–all of whom voluntarily did business with AIG and understood the risks–were bailed out at par: 100 cents on the dollar.

Thus began the most nauseating giveaway in the history of the country.

Bloomberg has the whole sickening story:

By Sept. 16, 2008, AIG, once the world’s largest insurer, was running out of cash, and the U.S. government stepped in with a rescue plan. The Federal Reserve Bank of New York, the regional Fed office with special responsibility for Wall Street [run by Tim Geithner], opened an $85 billion credit line for New York-based AIG. That bought it 77.9 percent of AIG and effective control of the insurer.

The government’s commitment to AIG through credit facilities and investments would eventually add up to $182.3 billion.

Beginning late in the week of Nov. 3, the New York Fed, led by President Timothy Geithner, took over negotiations with the banks from AIG, together with the Treasury Department and Chairman Ben S. Bernanke’s Federal Reserve. Geithner’s team circulated a draft term sheet outlining how the New York Fed wanted to deal with the swaps — insurance-like contracts that backed soured collateralized-debt obligations…

Part of a sentence in the document was crossed out. It contained a blank space that was intended to show the amount of the haircut the banks would take, according to people who saw the term sheet. After less than a week of private negotiations with the banks, the New York Fed instructed AIG to pay them par, or 100 cents on the dollar. The content of its deliberations has never been made public…

The New York Fed’s decision to pay the banks in full cost AIG — and thus American taxpayers — at least $13 billion. That’s 40 percent of the $32.5 billion AIG paid to retire the swaps. Under the agreement, the government and its taxpayers became owners of the dubious CDOs, whose face value was $62 billion and for which AIG paid the market price of $29.6 billion. The CDOs were shunted into a Fed-run entity called Maiden Lane III.

Read the whole story (and then marvel about how Tim Geithner is now Treasury Secretary) >

Nov 19 2009

Stimulate or Lose the 2010 Midterms

Thomas Ferguson is a political scientist and author who studies and writes on politics and economics, often within an historical perspective. He is a Political Science professor at the University of Massachusetts Boston, a contributing editor of The Nation, and is also the author of several books, the most recent of which is Golden Rule: The Investment Theory of Party Competition and the Logic of Money-Driven Political System.

Back in April 2009 Ferguson was interviewed by Real News CEO Paul Jay, and at the time called the Obama/Geithner/Summers economic/stimulus plans a “recipe for disaster”.

Today, Ferguson again talks with Jay, and with the hindsight of the past 7 months now says that the stimulus program was far too small, a much larger one is still needed, and predicts that the Democrats must start a new jobs program to bring the economic growth to the bulk of the population or face losing badly in the 2010 mid-terms.

Real News Network – November 19, 2009

Nov 19 2009

Cut Up Your Credit Cards

Hat tip to Armando for this: GOP Protects Credit Card Companies, at your expense of course…

If Democrats can’t make something out of this they deserve to lose their majority and be sued for political malpractice.

Moments ago, Senate Republicans blocked a Democratic proposal to freeze credit card rates on existing balances through the holiday season. The bill, sponsored by Senate Banking Committee Chairman Chris Dodd (D-Conn.), would prevent credit card companies from hiking rates and fees on existing balances until the industry reforms passed by Congress earlier this year take effect. Although a few provisions of that law took hold in August, most don’t launch until February or August of 2010. In the meantime, many card companies are hiking rates and fees to beat the law.

“The industry has tried to make one last grab at their customers’ pocketbooks,” Dodd said, just before asking for the consent of Republicans to pass the bill unanimously.

No dice. Sen. Thad Cochran (R-Miss.) objected “on behalf of several senators on this side of the aisle.” There’s no word yet which other lawmakers he was referring to.

Nov 18 2009

Obama Says Guantanamo Will Not Be Closed By His Own Deadline

According to The Washington Post this morning Obama said in an interview with Fox News’ Major Garrett in China that he will not fulfill his promise to have the Guantanamo Bay prison closed by his own self-imposed deadline of January 2010.

He also said to Garrett that he is not disappointed about not closing it.

He is still hopey changey though, although he did say that he “knew this was going to be hard”, and that it is “also just technically hard”. Perhaps the doors are too heavy and it takes a long time to get them open.

He refuses now to set a new deadline, except for effectively maybe someday, presumably so that he won’t be blamed for missing it again.

His interview with Garrett is scheduled to air on Fox at 6:00AM this morning…

Nov 18 2009

Palin says yes to 2012 presidential run

Sarah Palin dropped a heavy hint Tuesday that she might seek to run for the White House in 2012 as champion of America’s Republican right.

Speaking to ABC television’s Barbara Walters, the former running mate in John McCain’s failed 2008 presidential bid gave every appearance of releasing a trial balloon.

“That certainly isn’t on my radar screen right now, but when you consider some of the ordinary-turning-into-extraordinary events that have happened in my life, I am not one to predict what will happen in a few years,” she said.

She stated her desire was to “help our country.” Then, asked if she would play a “major” role in the 2012 presidential election, she answered: “If the people will have me, I will.“

Nov 18 2009

CenterShot: The Myth Of The Middle (reprise)

After reading Tocque’s comment a few minutes ago in which he said

“Obama is the best weapon the bank-o-crats have ever had. He’s destroyed the left in this country and probably globally.“,

and to which I responded with

“I don’t think he’s destroyed the left. I think what he’s done is shown up most of what the media has long called the left to be center right and full of shit. The real left hasn’t gone anywhere. It’s right here on the page, for example…“,

I thought it was time, for what it might be worth for people who weren’t here at DD then, to repost this (originally from July 03, 2008).

Lately there has been a growing and increasingly loudly voiced call from some of the more extreme centrists and from the DLC itself pushing the idea that to win elections – the upcoming 2008 presidential election comes to mind for some strange reason – and gain power Democrats will have to move sharply to the right, and that liberals and progressives are dooming America to successive rethuglican administrations.

Lately there has been a growing and increasingly loudly voiced call from some of the more extreme centrists and from the DLC itself pushing the idea that to win elections – the upcoming 2008 presidential election comes to mind for some strange reason – and gain power Democrats will have to move sharply to the right, and that liberals and progressives are dooming America to successive rethuglican administrations.

Sunday morning, March 11, 2007 in “Where Is America’s True Center?” David Sirota wrote that:

The purported proof of such an assertion by Democratic Leadership Council mouthpieces Elaine Kamarck and Bill Galston was this finding:

“In 2004, only 21 percent of voters called themselves liberal, while 34 percent said they were conservative. The rest, 45 percent, characterized themselves as moderate.”

The Washington media joined with Kamarck and Galston in billing this as an extraordinary finding that proved once and for all that Democrats must become more “moderate” or “conservative” because so few voters labeled themselves “liberal.”