Author's posts

Apr 30 2010

Who will build the World’s Largest Solar Power Plant?

Within the space of six hours, the world’s deserts receive more energy than all the people in the world consume in a year. The only question we have to answer is:

“How can this radiant energy be economically transformed into useful

energy and transported to consumers?”The DESERTEC Concept provides a solution to this.

[…]

In order to meet today’s global power demand […] it would suffice to equip about 3/1000th of the world’s deserts (about 90,000 km2) with solar collectors of solar thermal power plants. About 20 m2 of desert would be enough to meet the individual power demand of one human being day and night — all this absolutely CO2 free.

[pg 6] Europe’s Desertec project Red Paper (pdf)

The Race is ON — to find the World’s Largest Solar Footprint!

Here are some of the contenders …

Large-scale photovoltaic power plants

Ranks 1 – 50

Apr 29 2010

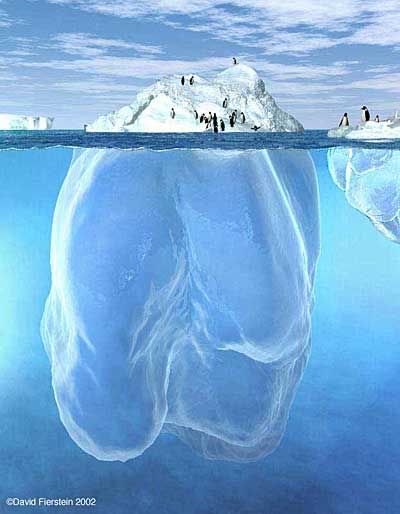

Externalities, Momentum, and the Cost of Inaction

Healthy Economies are based on Minimizing Costs, while Maximizing the Social Benefits. Or at least they should be.

Yet our Corporate-driven Economic system, far too often focuses on Discounting the Costs, while Maximizing their Profits. Profits for the enlightened owners, NOT for Society at large. Both the long-term and local Costs, generally get swept under the rug, in such a competitive landscape.

And that is a recipe for long-term Planetary Disaster.

Every economic transaction is some sort of trade-off between Cost vs Benefits. Problems arise however, when most of those Costs (to the Planet and to Society) remain Hidden, just below the surface — completely “External” to any quick-hit P&L calculations and Statements.

The accurate Pricing of such “External” factors — both short-term and long-term — is KEY to whether or not, WE leave the world a better place than we found it.

“Externalities” have a way of creeping up on you, and “extracting payment”, sometimes when you least expect it.

Apr 27 2010

Senate Subcommittee: The Role of Credit Rating Agencies

I saw Krugman on the TVeee over the Weekend. Something he said, made me think the Goldman Email Gate, was a big Mis-Direction.

So I decided to follow up on that hunch; I took to the Intertubes, and began to follow his trail of breadcrumbs …

Berating the Raters

By Paul Krugman, NYTimes — April 25, 2010

No, the e-mail messages you should be focusing on are the ones from employees at the credit rating agencies, which bestowed AAA ratings on hundreds of billions of dollars’ worth of dubious assets, nearly all of which have since turned out to be toxic waste. And no, that’s not hyperbole: of AAA-rated subprime-mortgage-backed securities issued in 2006, 93 percent – 93 percent! – have now been downgraded to junk status.

What those e-mails reveal is a deeply corrupt system. And it’s a system that financial reform, as currently proposed, wouldn’t fix.

Apr 25 2010

Derivatives: An Investment on Nothing!

Warren Buffet gave a prophetic pronouncement back in 2003 about the Derivatives market, seeing the exponential dangers of this “paper-thin” type of investment.

Buffet did not mince words. He called them “financial weapons of mass destruction“:

Buffett warns on investment ‘time bomb’

BBC – 4 March, 2003

The derivatives market has exploded in recent years, with investment banks selling billions of dollars worth of these investments to clients as a way to off-load or manage market risk.

But Mr Buffett argues that such highly complex financial instruments are time bombs and “financial weapons of mass destruction” that could harm not only their buyers and sellers, but the whole economic system.

[…]Some derivatives contracts, Mr Buffett says, appear to have been devised by “madmen”. […]

Apr 22 2010

The Six Degrees of Species Extinction

— Experts estimates that we are losing 137 plant, animal and insect species every single day due to rainforest deforestation. That equates to 50,000 species a year. As the rainforest species disappear, so do many possible cures for life-threatening diseases.

— Nearly half of the world’s species of plants, animals and microorganisms will be destroyed or severely threatened over the next quarter century due to rainforest deforestation.

— Rainforests once covered 14% of the earth’s land surface; now they cover a mere 6% and experts estimate that the last remaining rainforests could be consumed in less than 40 years.

— One and one-half acres of rainforest are lost every second with tragic consequences for both developing and industrial countries.

Apr 21 2010

With Derivatives, you can Bet on anything — Even the Weather!

Introduction To Weather Derivatives

Introduction To Weather Derivatives

by Felix Carabello, Associate Director, Environmental Products, Chicago Mercantile Exchange

Weather: Risky Business

It is estimated that nearly 20% of the U.S. economy is directly affected by the weather, and that the profitability and revenues of virtually every industry – agriculture, energy, entertainment, construction, travel and others – depend to a great extent on the vagaries of temperature. […]

In a 1998 testimony to Congress, former commerce secretary William Daley stated, “Weather is not just an environmental issue; it is a major economic factor. At least $1 trillion of our economy is weather-sensitive.”

[…]

If there were only some way, to “Hedge that Bet” — against the ever present risk of Foul Weather.

No Worries — Where there’s a Market Risk, there’s always a Wall Street Way!

Apr 20 2010

Obligations of Debt — Collateralized

How does your Obligation to make your Mortgage Payments, turn into some unseen Investor’s “Income Stream”?

Easy — thanks to Derivatives and CDO’s (Collateralized Debt Obligation).

For the mere Price of Admission, those unseen Investor’s get to divvy up your Mortgage Payments, among themselves — long as they “promise to pay off” that Debt, WHEN, for whatever reason, you are no longer able to make those Obligatory Payments …

Piece of Cake!

Geesh … WHAT could ever go wrong with this picture?

Apr 18 2010

Tale of 2 Countries: Small Business, Growth, and Green Jobs

The USA:

Jobs: Small Business Loans Are The Mountain Blocking Economic Recovery

Phillip Williams — Apr 17, 2010

Why Small Business Loans Are Important

The economy has lost 8.4 million jobs since the start of the recession. Small businesses employ the majority of the American workforce, although the largest single employer is still the federal government.

When the economy starts to recover small businesses rely on loans to bring up their inventory levels. Large banks and smaller institutions have been reluctant to introduce new loans after the failure of a large number banking institutions.

Small banks do not have the resources to start lending again, and the number of new loans have gone down since the start of the recession.

Banks that received funds from the Troubled Asset Relief program. The larger banks that were branded as too big to fail have also reduced the number of new loans they make to small businesses. They have reinvested the funds in lower-return, lower-risk treasury bonds instead.

Apr 15 2010

Mortgage Fraud — just another Scheme of the Shadow Bankers

Bill Gross, head of PIMCO, is credited with coining the term “Shadow Banking System”. A few years ago he warned about its reckless behavior and how they could wreck the Economy.

Bill Gross Calls it “Shadow Banking System”

Bill Bonner, The Daily Reckoning Australia — Jan 22, 2008

Banks recognize that not all their loans will be repaid. They operate on margins of safety, with reserves set aside for when things go wrong. But in the worlds of swaps, hedge funds and derivatives…slick operators can invest billions with no margins of safety…and no reserves. The result, Gross says, could be catastrophic.

Turns out this blunt-speaking Mutual Fund Manager — WAS Right!

Apr 11 2010

An Ant’s Rant

The Ant and the Grasshopper Fable

An Aesop’s Fable

In a field one summer’s day a Grasshopper was hopping about, chirping and singing to its heart’s content. An Ant passed by, bearing along with great toil an ear of corn he was taking to the nest.

“Why not come and chat with me,” said the Grasshopper, “instead of toiling and moiling in that way?”

“I am helping to lay up food for the winter,” said the Ant, “and recommend you to do the same.”

“Why bother about winter?” said the Grasshopper; we have got plenty of food at present.” But the Ant went on its way and continued its toil. When the winter came the Grasshopper had no food and found itself dying of hunger, while it saw the ants distributing every day corn and grain from the stores they had collected in the summer.

Then the Grasshopper knew:

[The Moral of the Story: ]

It is best to prepare for the days of necessity.

http://www.aesops-fables.org.u…

Them damn Socialist Ants! — always trying to feed their Fellow Ants!

They’re enough to ruin a lavish picnic …

Apr 10 2010

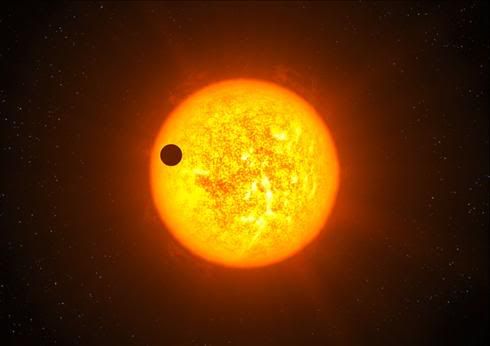

New Planet Discovered in the Goldilocks Zone — Imagine the Possibilities

Newly Found Planet Could Hold Water

March 22, 2010 [fair warning: FoxNews Link]

A newly discovered gas giant planet may have an interior that closely resembles those of Jupiter and Saturn in our own Solar System, and may hold water, the building block of life.

The newly found Corot-9b is one of a class of heavenly bodies called exoplanets — planets like Earth and Saturn that are discovered outside of our solar systems. More than 400 have been found so far, and of the billions of stars in the sky, many are likely to have planets.

[…]

Although the planet itself is a gas giant and hence has no solid surface to stand on, what if it possessed a moon like Saturn’s Titan? If the temperature were towards the lower end of the estimated range, then any moon would be an ice ball. If it were towards the upper end, it would be rather too hot for liquid water. But what if it were somewhere in the middle … ?

New worlds await.

But do we have the ingenuity to challenge the obstacles, and one day … Manage to Reach Them?

Apr 07 2010

Today the most famous Person is Mickey Mouse.

During the 2000 debates, George W. Bush spoke at a sixth-grade level (6.7) and Al Gore at a seventh-grade level (7.6).

In the 1992 debates, Bill Clinton spoke at a seventh-grade level (7.6), while George H.W. Bush spoke at a sixth-grade level (6.8), as did H. Ross Perot (6.3).

In the debates between John F. Kennedy and Richard Nixon, the candidates spoke in language used by 10th-graders.

In the debates of Abraham Lincoln and Stephen A. Douglas the scores were respectively 11.2 and 12.0.

In short, today’s political rhetoric is designed to be comprehensible to a 10-year-old child or an adult with a sixth-grade reading level. […]

Voltaire was the most famous man of the 18th century.

Today the most famous “person” is Mickey Mouse.

America the Illiterate

Chris Hedges — Nov 10, 2008 (pg 2)

I think, I’m detecting some sort of trend here …