Author's posts

May 19 2010

The Creative Math of BP’s 20, no 40%, Containment

BP has claimed that the new 4 inch Pipe inserted into the 21 Riser pipe is siphoning off 20% of the leaking oil. And then they updated that figure to 40% the next day.

Sounds good on the Morning News, but how did they get those numbers?

I spent a fair amount of time trying to figure out the cross-sectional area of a 4″ Pipe vs the cross-sectional area of a 21″ Riser Pipe (minus its reported .812″ wall thickness)

And those calcs ended up: roughly 4.4% of the larger [inner] area would be covered by the smaller [outer] area — BUT all that was just a Red Herring — it turns out due to this BP picture (and its large rubber gaskets)

Looks good on Paper. Could the insert pipe with its many rubber stoppers actually be blocking up to 40% of the leaking oil from the larger pipe?

Yet one wonders, where did that 40% number come from, especially since BP is not all that keen on measuring and monitoring?

May 16 2010

Maybe, ‘Farming’ the Wind and Sun, CAN Work?

Wind Farm Makes Money While Rancher Sleeps

Grover, CO – CBS4 — Jan 25, 2008

Rancher George Ehmke said he was eager to be part of the wind project.

“Never dreamed we’d ever have anything like this out here,” Ehmke said. “We have been putting up with this wind all our life. We might as well make something off of it.”There are 35 massive turbines now perched on his land. The blades spin almost constantly.

[…]

Old time ranchers had one use for the wind — to fill their stock ponds.“Well we live in a changing world,” Ehmke said. “I’m just glad to see it. We’re using the wind for something besides pumping water.”

[…]

Ehmke said his payout from producing wind power will keep his family’s ranch profitable for the next generation.“Yeah, I make money in my sleep I guess,” he said.

Nice ‘Work’, eh? … if you can get it.

May 14 2010

Deep Water Engineer explains how to Stop the Gushers — Updated with BP info

I was listening to the Diane Rehm Show on NPR yesterday,

when I heard this Oil Rig Engineer call in

and explain a “common sense” way to put a halt to the Oil Gusher in the Gulf.

He was a shocked by BP’s incompetent, “shotgun” approach —

to contain the mess, as most of us have been.

Here’s the eye-opening clip, with my transcript of Engineer Henry’s simple advice to BP.

The Gulf Coast Oil Spill and the Future of Offshore Drilling

May 13, 2010

“Oil Rig Henry” starts his Engineering lesson, at Time Mark 40:20

My transcript of the his Engineering insights, and simple containment and shut-off recommendations, follows next:

May 14 2010

It’s basically a giant Experiment: Corexit 9500, Oil, just Add Water Column

Cool, being a life-long Science fan, I have always liked Experiments …

But I generally prefer those of the ‘Controlled Experiment’ variety. Those fly-by-night Variety, like combining a jet of Hair Spray with a tiny Lighter flame, always left me a little frightened.

Funny, I’m starting to feel that way again …

As the oil gushes from the broken well head at the sea floor, Rader says it has the potential to contaminate each layer of the water column that, “directly exposes those animals to toxicity, at the surface including the very sensitive surface zones where not only sea turtles and marine mammals and sea birds can be oiled, but also where the highways for fish larvae exist. And then as it rains back into the abyss over a much wider area carrying toxicants back into the deep sea where ancient corals and other sensitive ecosystems exist.”

One response strategy has been to use dispersants or anti-freeze-like chemicals to break the oil up into smaller globules.

[…]

It is a choice, he says, between two bad options. While the chemicals may protect birds and other wildlife by dissipating the slick before it reaches shore, their toxicity in the Gulf could harm fish and other marine life.

May 12 2010

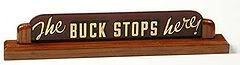

Where does the Buck Stop, when it comes to BP Oil?

There used to be a day when the ‘Blame Game’ was just NOT an option. There used to be a time, WHEN Action was called for, Action was taken.

My oh my, how times have changed.

“The buck stops here” is a phrase that was popularized by U.S. President Harry S. Truman, who kept a sign with that phrase on his desk in the Oval Office. (Footage from Jimmy Carter’s “Address to the Nation on Energy” shows the sign still on the desk during Carter’s administration.) The phrase refers to the fact that the President has to make the decisions and accept the ultimate responsibility for those decisions.

May 09 2010

Why aren’t other companies doing this? Employees wonder.

Michael Moore’s new film puts spotlight on Petaluma company

By Jeremy Hay, Press Democrat

In “Capitalism: A Love Story,” which opens today around the country, Moore takes aim at what he characterizes as a capitalist culture run amok.

He holds up the bakery – with 117 employees and $24 million in annual revenues – as an example of a successful capitalist alternative, where workers are as powerful as executives, profits are shared equally and workers are valued for more than their labor.

“This could be potentially a new model,” said Cory Fisher, a field producer and researcher for Moore. “A way for workers to feel engaged and not marginalized, and that they have a stake in their future.”

[…]“They stood out,” she said. “They’re successful, their workers are able to make a living wage, they seem empowered and happy and you just start to look around and wonder, “Why aren’t other companies doing this?”

Why aren’t other companies doing WHAT?

Starting their own, Employee Owned Business.

May 08 2010

Could the Stock Market ‘Bungee Jump’ … to Zero, Next Time?

In case you missed it the stock market lost about a 1000 points a few days ago — all in a matter of minutes.

It was in “free fall” — market traders were bailing left and right.

With the Greek Euro Debt crisis, serving as a back-drop — Stock Prices in rapid decline, was the last thing Institutional Fund managers wanted to see. Kind of makes you want to sell ‘before it’s too late’ too.

Many of them did.

But then almost magically, the stock market fall slowed, paused, and then begun a similarly rapid return. The bungee chord dynamic, reached its limit — and thankful — rebounded.

But what if next time, the Market gets spooked like that, and goes into a cascade of frenzied selling … what if the next time …

It just keeps falling ? say goodbye to those 401k and Pension funds [if you haven’t already, that is].

May 07 2010

MMS rubber-stamped BP’s drilling plan & Assurance of No Eco Risk

US oil regulator ‘gave in to BP’ over rig safety

Firm allowed to drill without devising plan to cope with blow-out

By David Usborne, independent.uk, US Editor — Friday, 7 May 2010

As crude oil continued to pour out of control into the Gulf of Mexico yesterday, questions were being asked over the relationship between BP and regulators in Washington amid allegations that the company was allowed to drill the deepwater well without filing plans for how it would cope with a blow-out like the one now in hand.

May 06 2010

Futures Exchange warns: That $100 Oil = $4 a gallon Gasoline

Crude Oil Futures: Crude Oil Tops $100 for 2018 on Threat From BP Spill

Energy Markets

Margot Habiby, Bloomberg – May 5, 2010

Crude oil futures for delivery in 2018 surged above $100 a barrel this week as the BP oil spill in the Gulf of Mexico led the government to consider a halt in future drilling.

The crude oil futures contract dated furthest into the future jumped after President Barack Obama said no new offshore drilling leases should be issued until a “thorough review” of the April 20 rig explosion. […]

Crude oil futures for delivery in December 2018 rose to $100.38 a barrel May 3 on the New York Mercantile Exchange, the highest settlement since Jan. 20. […]

“You may not pay today, but we will pay tomorrow,” Phil Flynn, vice president of research at PFGBest in Chicago, said in a report.

[…]

“That $100 oil equates to pretty close to $4 a gallon gasoline” in the U.S., said Bruce Bullock, director of the Maguire Energy Institute at Southern Methodist University in Dallas. “We know when it hit $3 a gallon two years ago drivers started to get concerned, and at $4 a gallon demand evaporated.”

May 05 2010

Chris Hayes to Olbermann: ‘Our’ Gulf Oil gets sold on World Markets

This was a stunner.

With all the hoopla about how America desperately needs to become “Energy Independent” — and SO the “urgent need” to Drill off OUR Shorelines — well it turns out, all that Drilling and Spilling, is just for Barrels of Oil, destined for resale on the World Markets!

Turns out — “Our” Gulf Oil is just another “fungible global commodity“!

Huh, what? Fungy-what? Does that mean it’s “more fun”?

No. Fungible simply means something is “interchangeable”. That One unit of something (like a barrel of Oil) is worth just as much as any other Unit of that same something. One Ounce of Gold, is exchangeable with any other Ounce of Gold.

Or as Chris Hayes succinctly put it:

There’s NO barrels marked somewhere, “Foreign.”

Say What? I thought we were risking our precious Ecosystems, to “free ourselves” from the need of Foreign Oil — to increase our “Domestic Reserves”?

If British Petroleum, can pump it and dump it, on the Global Marketplace, where one Barrel of Oil is identical to every other Barrel (assuming no disastrous spills of course) —

Then what the Hell is the Point?

May 04 2010

BP’s containment problems, may go further than Oil.

BP’s containment problem is unprecedented

The company must stop a relentless gush of oil nearly a mile below the surface, in a situation that hasn’t been dealt with before.

By Jill Leovy, LATimes — April 30, 2010

The problem with the April 20 spill is that it isn’t really a spill: It’s a gush, like an underwater oil volcano. A hot column of oil and gas is spurting into freezing, black waters nearly a mile down, where the pressure nears a ton per inch, impossible for divers to endure. Experts call it a continuous, round-the-clock calamity, unlike a leaking tanker, which might empty in hours or days.

[…]

And “everything is bigger and more difficult the deeper you go,” said Andy Bowen, a research specialist who works with undersea robotics at the Woods Hole center. “Fighting gravity is tough. It increases loads. You need bigger winches, bigger cables, bigger ships.”An analogy, he said, is the difference between construction work on the ground versus at the top of a mile-high skyscraper.

Gee … sounds kind of Dangerous …

May 02 2010

Chalk it up as Incidental Costs — 4 Days Profit is a Bargain

March 24, 2009

RIKI OTT: […] Exxon promised to make us whole. You know, “You’re lucky you have Exxon.” We hadn’t even gone to court by 1993. We had fish run collapses, bankruptcies, divorces, suicides, you know, domestic violence spikes, substance abuse spikes. The town was just unraveling. And we were waiting for somebody to help us: the State of Alaska, the federal government, the court system, Exxon. Nobody. And–

AMY GOODMAN: There were 33,000 plaintiffs.

RIKI OTT: There are 32,000 claims, 22,000 plaintiffs.

[…]

AMY GOODMAN: You’ve said that is not just an environmental disaster, but a crisis in democracy.RIKI OTT: It is a democracy crisis. The question we started asking as our lawsuit went on and on and on, and we didn’t get paid, was how did corporations get this big, where they can manipulate the legal system, the political system? What happened here?

[…]AMY GOODMAN: How many animals died?

Riki Ott, author, community activist, marine toxicologist and former fisherma’am. She is author of Not One Drop: Betrayal and Courage in the Wake of the Exxon Valdez Spill.