Cross posted from The Stars Hollow Gazette

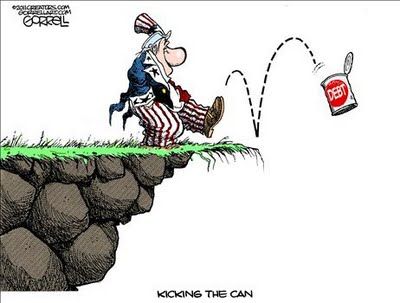

Round and round, downward, repeating the same mistakes, shoveling good money after bad, all to save themselves.

ECB lends Europe’s banks a massive €489 billion over unprecedented 3-year period

FRANKFURT, Germany – The European Central Bank flipped its credit tap wide open Wednesday to help Europe’s troubled banking system, allowing hundreds of nervous banks to take out a record €489 billion ($639 billion) in loans.

The move was the biggest ECB infusion of credit into the banking system in the 13-year history of the shared euro currency. It aimed to keep the Europe’s debt crisis from choking off credit to businesses – since a credit crunch could cause a continent-wide recession that would make the debt loads hanging over the 17 nations that use the euro even harder to pay.[..]

Although the ECB credits can help banks and the economy get through the crisis, they don’t attack the cause of Europe’s problems – too-large amounts of government debt – or convince markets that European governments can get a grip on their public finances. And it doesn’t remove one of the main reasons why banks remain wary of lending to each other – their thin levels of capital reserves against potential losses.

All that means despite the massive influx of cash, Europe’s debt crisis will still be churning in the New Year.

Spain awaits a painful dose of medicine

It was an election victory the polls had predicted. Second guessing what policies Mariano Rajoy will pursue has not been so easy. Behind his centre right party is a huge parliamentary majority, ahead of him what seems to be a contagious European disease, debt.

Healing the Spanish economy teetering on the edge of recession will be painful, where, when and how will the medicine be administered?

He has promised deep spending cuts announcing he aims to cut the budget deficit by 16.5 billion euros in 2012 and yet such action needs to be balanced against measures to stimulate growth.

Successful Spanish Debt Auction

PARIS – Spain’s borrowing costs plummeted Tuesday at a debt auction, helping to lift the euro and stocks, as the European Central Bank began rolling out a new lending program that could encourage banks to buy euro-zone government bonds. [..]

The central bank’s policy move “is something very big,” Mr. Fransolet said, but he questioned whether it represented “a complete change of direction” for the euro zone.

“I think you need a lot of other things,” he said. With a huge round of government debt up for refinancing next year, he added, “The jury is still out.”

In a reminder of the sword hanging over the heads of European leaders, Fitch Ratings warned that the AAA rating it has assigned to the debt issued by the euro-zone bailout vehicle, the European Financial Stability Facility, “largely depends on France and Germany retaining their AAA status.”

Italian economy shrinks by 0.2% fuelling recession fear

Italy’s economy shrank by 0.2% in the three months to the end of September, fuelling fears of a recession in the eurozone giant.

The figures, released by the country’s official statistical agency, Istat, show the first contraction in the Italian economy since 2009.

Italy’s government has predicted the economy will contract by 0.4% in 2012.

Earlier this month, the government announced an austerity plan to “save Italy”.

The package of emergency austerity measures included raising taxes on the assets of the wealthy, increasing pension ages, and a major drive to tackle tax evasion. Italian Prime Minister Mario Monti also said he would give up his own salary as part of the effort.

However, analysts expect Italy’s economy will struggle for some time yet.

Moody’s gives UK high scores but warns of ‘challenges’

Ratings agency Moody’s has given the UK high scores for economic governance but warns the country it faces “formidable and rising challenges”.

In its annual guidance for investors, Moody’s says the UK has “significant structural strengths” and deserves its top AAA rating.

But it says weakness in the eurozone could hold back growth and weaken the government’s debt-cutting plans.

Rating agency opinion affects the cost of borrowing.

This is only because England has a sovereign currency

On the other side of the globe from Herr Prof.Krugman:

I’ve been reluctant to weigh in on the Chinese situation, in part because it’s so hard to know what’s really happening. All economic statistics are best seen as a peculiarly boring form of science fiction, but China’s numbers are more fictional than most. I’d turn to real China experts for guidance, but no two experts seem to be telling the same story.

Still, even the official data are troubling – and recent news is sufficiently dramatic to ring alarm bells.

The most striking thing about the Chinese economy over the past decade was the way household consumption, although rising, lagged behind overall growth. At this point consumer spending is only about 35 percent of G.D.P., about half the level in the United States.

So who’s buying the goods and services China produces? Part of the answer is, well, we are: as the consumer share of the economy declined, China increasingly relied on trade surpluses to keep manufacturing afloat. But the bigger story from China’s point of view is investment spending, which has soared to almost half of G.D.P.

While he is on vacation in Hawaii, President Barack Obama will ask Congress to

While he is on vacation in Hawaii, President Barack Obama will ask Congress to