Cross posted from The Stars Hollow Gazette

The pessimistic opinion of a looming second recession that has been expressed by economists who have gotten it right in the past is finally being recognized by the traditional media.

After a two-year rebound, recession risks rise

by Tom Petruno

The U.S. economy has officially been out of recession for two years, but fear of falling back into the abyss has dogged the recovery every step of the way.

Now, the prospect of recession no longer is a fringe view.

snip

The almost universal belief was that global growth would accelerate in the second half of the year. But that view has been fading fast this summer.

“We’re seeing a pattern of data that look very similar to what you see at a turning point in the economy,” said Michael Darda, chief economist at MKM Partners in Stamford, Conn. And he doesn’t mean a turning point to better times.

A key measure of U.S. consumer confidence has crashed to a 30-year low. Stock market volatility has become gut-wrenching. And prospects in the manufacturing sector, one of the few true bright spots of the recovery, have dimmed markedly.

snip

Of course, whether GDP growth contracts or is just slightly positive may feel exactly the same to many Americans, particularly the jobless, and to the country’s countless struggling small businesses.

The danger is that, if another recession becomes official, it could feed on itself as consumers and businesses that might otherwise have spent money decide not to, opting instead to hoard more cash.

“It can be a self-fulfilling phenomenon when households and businesses just stop in their tracks,” (MKM Partners chief economists, Michael) Darda said.

Dangerously Close to Recession

By Joachim Fels & Manoj Pradhan

US and Europe dangerously close to recession: Our revised forecasts show the US and the euro area hovering dangerously close to a recession – defined as two consecutive quarters of contraction – over the next 6-12 months. The US growth disappointment in 1H11, when GDP advanced by an annual average rate of less than 1%, illustrates the brittleness of the US recovery in the face of external shocks (oil, Japan earthquake), despite ongoing QE2 and fiscal stimulus at the time. While the current quarter should still show some rebound in growth to around 3% from the very low bar in 1H, much of this rebound is likely due to temporary factors such as the ramping up of auto production as supply disruptions from the Japan situation ease. The most critical period for the US economy will likely be 4Q11, when we may see some fallout from the heightened volatility of risk markets, and 1Q12, when we get an automatic tightening fiscal policy if, as our US team currently assumes, this year’s fiscal stimulus measures will expire.

This from the economist who predicted the 1st recession before anyone else and was booed off the stage:

Roubini: Risks of global recession are greater than 50%

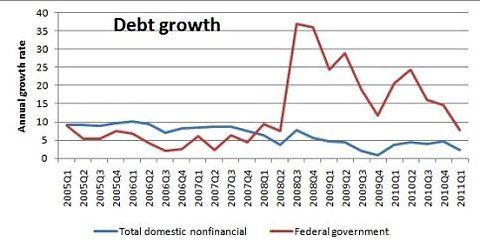

“In dealing with large debt, there should be a cutback on costs in both the public and private sectors, an attempt reduce overtime and adding to savings. Also, to avoid a second recession, banking requires more relaxed policies “says Roubini.

“There is too much debt, both in the government and in the private sector. The debt cannot be reduces except by saving, by strong economic growth or through the dangerous method of inflation, says Roubini. But if population and companies consumption do not restart, then you risk to remain in recession. ”

“Business does not help the economy, because there are risks. They aren’t investing because there is excess capacity,they are not hiring because there is insufficient demand. Here is the paradox. If you do not hire workers, there isn’t enough money for workers’ income, there isn’t enough consumer confidence and consumption is insufficient, “says Roubini.

To most Americans we never got out of the first recession as Atrios points out the linger unemployment rate at 9% is unacceptable:

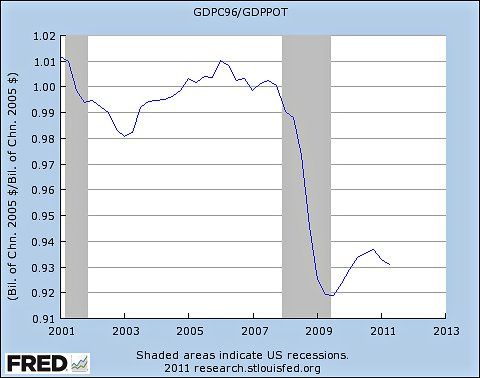

The point is we never got out of the last recession, and whether GDP growth is barely positive or barely negative doesn’t matter all that much.

Cutting the Payroll tax again will not substantial increase the GDP or create jobs. It will hurt the Social Security fund by reducing the payroll contributions. Creating jobs that will rebuild and improve roads, schools and other crumbling infrastructure will. If private industry won’t do it, then the government must.