This is just breaking within the past hour or so.

Below is the press release from the ‘Restore the Gulf.gov’ site along with the initial draft agreement.

Still looking at the news articles just coming online.

Apr 21 2011

This is just breaking within the past hour or so.

Below is the press release from the ‘Restore the Gulf.gov’ site along with the initial draft agreement.

Still looking at the news articles just coming online.

Apr 19 2011

Cross posted from The Stars Hollow Gazette

A balanced budget with a surplus? No way not happening. Well it seems that there is a counter proposal by the Congressional Progressive Caucus that does just that.

The CPC proposal:

• Eliminates the deficits and creates a surplus by 2021

• Puts America back to work with a “Make it in America” jobs program

• Protects the social safety net

• Ends the wars in Afghanistan and Iraq

• Is FAIR (Fixing America’s Inequality Responsibly)What the proposal accomplishes:

• Primary budget balance by 2014.

• Budget surplus by 2021.

• Reduces public debt as a share of GDP to 64.1% by 2021, down 16.5 percentage points from

a baseline fully adjusted for both the doc fix and the AMT patch.

• Reduces deficits by $5.6 trillion over 2012-21, relative to this adjusted baseline.

• Outlays equal to 22.2% of GDP and revenue equal 22.3% of GDP by 2021.

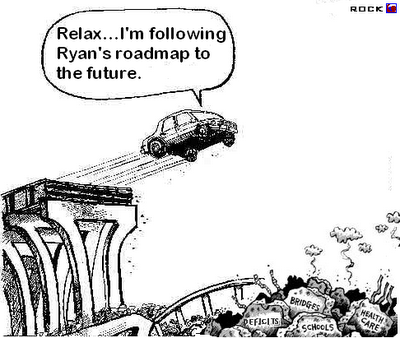

There was debate this morning in the House about the austerity budget put forward by Tea Party Rep. Paul Ryan’ (R-WI) that decimates Medicaid and Medicare. When Rep Keith Ellison asked Rep. Todd Rokita (R-IN) when the Ryan budget plan would produce a surplus, Rokita was clueless:

ELLISON: When does the Ryan budget create a surplus?

ROKITA: The budget proposed and voted on by the committee – […]

ROKITA: With responsible, gradual reforms to the drivers of our debt, like Medicare and Social Security, this budget will balance –

ELLISON: I asked the gentlemen when the Ryan budget created a surplus. He could have given me a year. He didn’t. That’s because he’s probably embarrassed about when that is. Let me tell you when the Progressive Caucus comes to surplus: 2021. That is known as a responsible budget.

According to the Congressional Budget Office (CBO), Ryan’s budget will not produce a surplus until 2040 (pdf). The Economic Policy Institute looked that the Progressive Caucus budget. Their analysis said that it who produce a $30.7 billion surplus in 2021 (pdf).

h/t to Travis Waldron at Think Progress

Apr 18 2011

Reprint from US UNCUT Daily Kos Site:

On Friday, the San Francisco branch of US Uncut temporarily took over the San Francisco branch of Bank of America.

This is what happened:

<

Now we want you to do the same thing, with or without musical accompaniment – and we’re going to tell you how.

As the video says, the government claims we’re broke, and is slashing necessities for working and retired Americans. Meanwhile, corporate tax cheats like Bank of America and GE rake in billions in profit – and pay back zero in taxes.

Something’s wrong here – and tomorrow, on Tax Day 2011, Americans are going to stand as one and point it out.

We currently have over 100 actions planned for tomorrow. Click here to find your local US Uncut action. Not seeing one nearby that works for you? Then start your own – it’s SUPER easy.

Tomorrow, let’s show the powers that be that Americans are seriously opposed to cutting schools, firefighters, police, healthcare, job creation…and seriously in favor of corporations actually paying their taxes.

Thank you,

The US Uncut Team

P.S. You can learn more here about how the San Francisco action was planned and carried out.

Apr 17 2011

Robert Pollin is Professor of Economics at the University of Massachusetts in Amherst, and is a founding co-director of the Political Economy Research Institute (PERI). His research centers on macroeconomics, conditions for low-wage workers in the U.S. and globally, the analysis of financial markets, and the economics of building a clean-energy economy in the U.S. His books include A Measure of Fairness: The Economics of Living Wages and Minimum Wages in the US and Contours of Descent: US Economic Fractures and the Landscape of Global Austerity.

In February 2010 Pollin talked with Paul Jay of The Real News Network and during the interview outlined a careful combination of job-generating public investments, incentives to mobilize private investment, and policies that protect economically vulnerable populations that can create the economic, regulatory and policy environment that Obama could have already been using to create 18 million jobs and lower the unemployment rate to only 4 percent by 2012 – a proposal that has never been given any serious consideration by the Obama administration, policy makers or mainstream media.

Instead the Obama administration chose to continue listening to people like Ben Bernanke whom Obama had re-nominated as Federal Reserve Chairman in August 2009, and who, as the top bank regulator in the country, had played a central role in the creation of the ongoing economic crisis we are experiencing.

In another interview published today, Pollin again talks with Paul Jay discussing Obama’s speech the other day in which he made clear that he is more or less taking on the argument that the big problem is the debt and that austerity for the masses is his plan for reducing it, pointing out that Obama is accepting the notion of the debt being a bigger problem than a recession, that Obama’s premise is “wrong to begin with”, and that:

Apr 17 2011

Cross Posted from The Strs Hollow Gazette

Will there be another “cave exploration by our Spelunker-in-Chief? Despite President Obama speech on Wednesday and his

Will there be another “cave exploration by our Spelunker-in-Chief? Despite President Obama speech on Wednesday and his demand request for a “clean bill” to raise the debt ceiling, there are those who have their doubts about Obama resolve to stand his ground considering his past capitulations in the name of bipartisanship for the last two years.

Now Sen. Jim DeMint (R-SC) has threatened to filibuster the bill should it not contain “other fiscal reforms” like a balanced budget amendment.

A top conservative senator on Thursday indicated he is willing to go to extreme lengths to prevent a vote on raising the debt ceiling, even if it hurts the Republican Party politically.

Sen. Jim DeMint (R-S.C.) said on the conservative Laura Ingraham Show he is considering filibustering an upcoming vote to raise the nation’s $14.3 trillion debt limit if it doesn’t contain other fiscal reforms.

While the Senate Minority Leader Mitch “The Human Hybrid Turtle” McConnell (R-KY) has said that the ceiling should be raised to avoid the dire consequences, he would like to see it passed with only Democratic votes.

Mr. McConnell is discouraging his colleagues from filibustering a vote to increase the federal debt limit because he knows that, if push came to shove, some of his colleagues would almost certainly have to vote yea. He’d rather it pass in a 51-vote environment, where all of the votes could come from Democrats, than in a 60-vote environment, where at least seven Republicans would have to agree to a cloture motion.

In the same New York Times article by Nate Silver the consequences of failing to raise the debt ceiling would lead to another recession:

If the Congress does not vote to increase the debt ceiling – a statutory provision that governs how many of its debts the Treasury is allowed to pay back (but not how many obligations the United States is allowed to incur in the first place) – then the Treasury will first undertake a series of what it terms “extraordinary actions” to buy time. The “extraordinary actions” are not actually all that extraordinary – at least some of them were undertaken prior to six of the seven debt ceiling votes between 1996 and 2007.

But once the Treasury exhausts this authority, the United States would default on its debt for the first time in its history, which could have consequences like the ones that Mr. Boehner has imagined: a severe global financial crisis (possibly larger in magnitude than the one the world began experiencing in 2007 and 2008), and a significant long-term increase in the United States’ borrowing costs, which could cost it its leadership position in the global economy. Another severe recession would probably be about the best-case scenario if that were to occur.

The bill will not get to the Senate until sometime in May. When it does reach the “upper” chamber, it most likely will be loaded with hundreds of riders from the House Tea Party Republicans. The President and the Senate Democratic leaders have a limited choices. However, if that choose to stand their ground and push for that “clean bill”, there could be “savior”, Wall St., which stands to lose billions or more if the US defaults on its debt. As David Dayen at FDL suggests this is a plausible solution. But is it possible considering Obama’s inability to win at this “Congressional Game of Chicken”?

Apr 15 2011

Cross posted from The Stars Hollow Gazette

Oh, wouldn’t this be lovely? Now lets see if Timmy and Bill can convince Eric that there is nothing to see here.

Goldman Sachs Misled Congress After Duping Clients, Levin Says

Goldman Sachs Group Inc. (GS) misled clients and Congress about the firm’s bets on securities tied to the housing market, the chairman of the U.S. Senate panel that investigated the causes of the financial crisis said.

Senator Carl Levin, releasing the findings of a two-year inquiry yesterday, said he wants the Justice Department and the Securities and Exchange Commission to examine whether Goldman Sachs violated the law by misleading clients who bought the complex securities known as collateralized debt obligations without knowing the firm would benefit if they fell in value.

The Michigan Democrat also said federal prosecutors should review whether to bring perjury charges against Goldman Sachs Chief Executive Officer Lloyd Blankfein and other current and former employees who testified in Congress last year. Levin said they denied under oath that Goldman Sachs took a financial position against the mortgage market solely for its own profit, statements the senator said were untrue.

Goldman criticised in US Senate report

By Tom Braithwaite in Washington and Francesco Guerrera and Justin Baer in New York,

Financial Times

April 14 2011 00:15 | Last updated: April 14 2011 00:15

US Senate investigators probing the financial crisis will refer evidence about Wall Street institutions including Goldman Sachs and Deutsche Bank to the justice department for possible criminal investigations, officials said on Wednesday.

Carl Levin, Democratic chairman of the powerful Senate permanent subcommittee on investigations, said a two-year probe found that banks mis-sold mortgage-backed securities and misled investors and lawmakers.

“We will be referring this matter to the justice department and to the SEC (Securities and Exchange Commission),” he said. “In my judgment, Goldman clearly misled their clients and they misled Congress.”

Last year, Goldman paid $550m to settle SEC allegations that it defrauded investors in Abacus, a complex security linked to subprime mortgages.

Naming Culprits in the Financial Crisis

By Gretchen Morgenson and Louise Story

New York Times

A voluminous report on the financial crisis by the United States Senate – citing internal documents and private communications of bank executives, regulators, credit ratings agencies and investors – describes business practices that were rife with conflicts during the mortgage mania and reckless activities that were ignored inside the banks and among their federal regulators.

The 650-page report, “Wall Street and the Financial Crisis: Anatomy of a Financial Collapse,” was released Wednesday by the Senate Permanent Subcommittee on Investigations…

……The result of two years’ work, the report focuses on an array of institutions with central roles in the mortgage crisis: Washington Mutual, an aggressive mortgage lender that collapsed in 2008; the Office of Thrift Supervision, a regulator; the credit ratings agencies Standard & Poor’s and Moody’s Investors Service; and the investment banks Goldman Sachs and Deutsche Bank.

“The report pulls back the curtain on shoddy, risky, deceptive practices on the part of a lot of major financial institutions,” Mr. Levin said in an interview. “The overwhelming evidence is that those institutions deceived their clients and deceived the public, and they were aided and abetted by deferential regulators and credit ratings agencies who had conflicts of interest.”

Apr 15 2011

Cross posted from The Stars Hollow Gazette

The House and Senate will put the finishing touches on last week’s budget crisis over the budget for 2011. While the President and the Republicans were busy in front of the cameras praising themselves for “victory”, the Congressional Budget Office was counting the “beans”. Remember the much publicized $38.5 billion in cuts? Well, it will only reduce the deficit by $352 million. That is less than 1% in claimed savings:

The House and Senate will put the finishing touches on last week’s budget crisis over the budget for 2011. While the President and the Republicans were busy in front of the cameras praising themselves for “victory”, the Congressional Budget Office was counting the “beans”. Remember the much publicized $38.5 billion in cuts? Well, it will only reduce the deficit by $352 million. That is less than 1% in claimed savings:

The Congressional Budget Office estimate shows that compared with current spending rates the spending bill due for a House vote Thursday would pare just $352 million from the deficit through Sept. 30. About $8 billion in cuts to domestic programs and foreign aid are offset by nearly equal increases in defense spending. […]

The CBO study confirms that the measure trims $38 billion in new spending authority, but many of the cuts come in slow-spending accounts like water-and-sewer grants that don’t have an immediate deficit impact.

As Alex Seitz-Wald at Think Progress notes budget cuts helped Obama save some programs from the worst cuts “the fact remains that the cuts will be harmful to the economy and to the people who depend on valuable social safety net programs that will have their budgets cut.”

There is also the damage by $8.4 billion cut from the State Department and foreign aid budgets, a 14% budget reduction, that will affect some “critical diplomatic tools”

[C]hopping off $122 million from the U.S. Agency for International Development’s operating expenses and more than $1.4 billion from the State Department’s Economic Support Fund may cost us the ability to help critical countries transition to democracy, including Egypt and Tunisia. Turning our back on such assistance now is particularly problematic given how vulnerable nascent democracies in the Middle East and North Africa, as well as elsewhere, are to upheaval and violence.

It leaves military budget nearly intact so that any saving are wiped out by inflated defense spending”. The budget deal was suppose to cut $18.1 billion but Defense Secretary Robert Gates called for at least $540 billion for FY2011 and this budget deal funds DOD “just north of $530 billion” a figure that includes military construction.

That’s some victory, Barack.

Apr 14 2011

William K. Black is an Associate Professor of Economics and Law at the University of Missouri – Kansas City (UMKC). He was the Executive Director of the Institute for Fraud Prevention from 2005-2007. He has taught previously at the LBJ School of Public Affairs at the University of Texas at Austin and at Santa Clara University, where he was also the distinguished scholar in residence for insurance law and a visiting scholar at the Markkula Center for Applied Ethics.

In April 2009 Black alleged in an explosive interview with Bill Moyers that American banks and credit agencies had conspired to create a system in which so-called “liars loans” could receive AAA ratings and zero oversight, amounting to a massive “fraud” at the epicenter of US finance, equated the entire US financial system to a giant “ponzi scheme” and charged Treasury Secretary Timothy Geithner, like Secretary Henry Paulson before him, of “covering up” the “truth”.

Black was litigation director of the Federal Home Loan Bank Board, deputy director of the FSLIC, SVP and General Counsel of the Federal Home Loan Bank of San Francisco, and Senior Deputy Chief Counsel, Office of Thrift Supervision. He was deputy director of the National Commission on Financial Institution Reform, Recovery and Enforcement.

Black’s 2005 book, The Best Way to Rob a Bank is to Own One is a classic insider’s account of how financial super predators brought down the S&L industry with massive accounting fraud. Paul Volcker praised its analysis of the critical role of Bank Board Chairman Gray’s leadership in reregulating and resupervising the industry:

Bill Black has detailed an alarming story about financial – and political – corruption. The specifics go back twenty years, but the lessons are as fresh as the morning newspaper. One of those lessons really sticks out: one brave man with a conscience could stand up for us all.

Apr 12 2011

Cross posted from The Stars Hollow Gazette

Nobel Prize laureate Joseph Stiglitz has consistently pointed out that the US is on the wrong track for economic recovery and that the continued support for the money pit of Iraq and the shifting the countries wealth to the 2% elite will be the downfall of economics growth, He recently wrote an excellent article in Vanity Fair, Of the 1%, by the 1%, for the 1%, pointing out that even the wealthy will come to regret this path.

t’s no use pretending that what has obviously happened has not in fact happened. The upper 1 percent of Americans are now taking in nearly a quarter of the nation’s income every year. In terms of wealth rather than income, the top 1 percent control 40 percent. Their lot in life has improved considerably. Twenty-five years ago, the corresponding figures were 12 percent and 33 percent. One response might be to celebrate the ingenuity and drive that brought good fortune to these people, and to contend that a rising tide lifts all boats. That response would be misguided. While the top 1 percent have seen their incomes rise 18 percent over the past decade, those in the middle have actually seen their incomes fall. For men with only high-school degrees, the decline has been precipitous-12 percent in the last quarter-century alone. All the growth in recent decades-and more-has gone to those at the top. In terms of income equality, America lags behind any country in the old, ossified Europe that President George W. Bush used to deride. Among our closest counterparts are Russia with its oligarchs and Iran. While many of the old centers of inequality in Latin America, such as Brazil, have been striving in recent years, rather successfully, to improve the plight of the poor and reduce gaps in income, America has allowed inequality to grow.

(emphasis mine)

This is well worth the time to read the entire piece and save it as a reference as this country sinks further into the morass and becomes a “Banana Republic”as the Tea Party Republicans try to drag this country back to the 19th century by repealing laws that protect children and workers.

Stiglitz also appeared on Democracy, Now! with Amy Goodman and Juan Gonzalez to discuss his article and the current US “budget crisis” that has been fabricated by the right wing, Obama and the ever beholding MSM:

This week Republicans unveiled a budget proposal for 2012 that cuts more than $5.8 trillion in government spending over the next decade. The plan calls for sweeping changes to Medicaid and Medicare, while reducing the top corporate and individual tax rates to 25 percent. We speak to Nobel Prize-winning economist Joseph Stiglitz, who addresses the growing class divide taking place in the United States and inequality in a new Vanity Fair article titled “Of the 1, by the 1, for the 1%.” Stiglitz is a professor at Columbia University and author of numerous books, most recently Freefall: America, Free Markets, and the Sinking of the World Economy. “It’s not just that the people at the top are getting richer,” Stiglitz says. “Actually, they’re gaining, and everybody else is decreasing… And right now, we are worse than old Europe.” includes rush transcript

Apr 11 2011

cross-posted from Main Street Insider

Much of the authority of the Consumer Financial Protection Bureau (CFPB) is schedule to go into effect in July, which means that between now and then, attempts by House Republicans to limit that authority are going to intensify. This week’s episode of 90 Second Summaries examines some of those attempts.

Though these bills are unlikely to see real action on their own, look for a measure of this sort to be included as a rider on some must-pass piece of legislation.

Apr 08 2011

Cross posted from The Stars Hollow Gazette

The Federal Government is being held hostage by a few radical right corporate puppets that want to destroy this country’s social safety net and further shift the wealth from majority to the wealthy with more tax cuts for corporations, millionaires and estates and destroy Medicare and Mediciad for the elderly and neediest Americans. The assault is now be led by the pretty boy, Paul Ryan (R-WI), who defeated Russ Feingold in November (a lot of buyer’s remorse in that state). Last night President Obama had a late night meeting with Senate Majority Leader, Harry Reid and Speaker of the House John Boehner with no success at a compromise to avoid a shut down of the federal government this weekend. For what’s at stake here, Mike Lux hits it on the head, “All the hue and cry about this year’s budget fight – whether or not we’ll have a government shutdown; whether we’ll cut $33 billion or $40 billion out of the remainder of this year’s budget – is a minor sideshow compared to the implications of the Ryan budget.”

The Federal Government is being held hostage by a few radical right corporate puppets that want to destroy this country’s social safety net and further shift the wealth from majority to the wealthy with more tax cuts for corporations, millionaires and estates and destroy Medicare and Mediciad for the elderly and neediest Americans. The assault is now be led by the pretty boy, Paul Ryan (R-WI), who defeated Russ Feingold in November (a lot of buyer’s remorse in that state). Last night President Obama had a late night meeting with Senate Majority Leader, Harry Reid and Speaker of the House John Boehner with no success at a compromise to avoid a shut down of the federal government this weekend. For what’s at stake here, Mike Lux hits it on the head, “All the hue and cry about this year’s budget fight – whether or not we’ll have a government shutdown; whether we’ll cut $33 billion or $40 billion out of the remainder of this year’s budget – is a minor sideshow compared to the implications of the Ryan budget.”

Mike explains just what those some of those implications are for senior citizens:

With his proposal, Ryan will radically cut and privatize Medicare, ending the guarantee of health care to our senior citizens; radically cut Medicaid and throw it into a block-grant program that will end any guarantee of coverage for the poor, people with disabilities, and many, many children; deliver breathtakingly large tax cuts to the wealthy while raising taxes for the middle class. As far as I can tell, more than 90 percent of his cuts impact either low-income people or senior citizens who are currently middle class but might no longer be if these Social Security and Medicare cuts go through. As to who benefits, while some things remain vague (like which middle-class taxes will have to go up to cut down the revenue losses because of lower taxes in the high-end brackets), it is likely that more than 90 percent of the benefits go to the very wealthy, who not only get to keep their Bush tax cuts but get some big and lucrative new tax cuts besides. As Citizens for Tax Justice (pdf) notes, under Ryan’s proposal, the federal government would collect $2 trillion less over the next decade, yet require the bottom 90 percent to actually pay higher taxes. Ryan leaves a lot details out, but if you read in between the lines, it is clear that the reason certain details are missing is because of how awful they are.

snip

Without Social Security, Medicare, and Medicaid, retirees would live in poverty, and family incomes would be wiped out trying to take care of parents, grandparents, and disabled family members. Without unions, wages and benefits would be ever more stagnant, or would decline in many sectors. Without student loans, fewer young and poor people would make it onto the first rungs of the ladder into the middle class. Without rebuilding our infrastructure and investing in our schools, fewer American businesses would be able to compete in the world economy. Without research and other government investments, the technological breakthroughs that have helped fuel our economic growth over the last 70 years would stop happening. And without some restraint on the power of multinational companies, our economy would be rocked by more financial collapses, and our pluralistic democracy will get more and more dysfunctional.

And this is what the callously, heartless, self centered, Tea Partier, Republican Eric Cantor said the other day:

So 50 percent of beneficiaries under the Social Security program use those moneys as their sole source of income. So we’ve got to protect today’s seniors. But for the rest of us? Listen, we’re going to grips with the fact that these programs cannot exist if we want America to be what we want America to be.”

According to the Congressional Budget Office‘s (CBO) analysis of Ryan’s plan:

1. SENIORS WOULD PAY MORE FOR HEALTH CARE

2. ELDERLY AND DISABLED WOULD LOSE MEDICAID COVERAGE

3. THIRTY-TWO MILLION AMERICANS WOULD LOSE HEALTH COVERAGE (pdf)

4. SHORT TERM DEBT INCREASES RELATIVE TO CURRENT LAW

5. NO CONFIRMATION ON TAX REVENUES (pdf)

The rest of it is even worse and pure fantasy that included “wildly optimistic revenue assumptions that dramatically changed the effect the plan would have on the federal debt.”

OK, Barack, it’s time for you to not cross that line you drew and stand up for the people.

Apr 07 2011

Dmitri Orlov is an interesting commentator. He has been claiming publically since about 2006 that the U.S. is on the edge of collapse similar to what the Soviet Union went through only a bit worse. He was born in Russia and experienced first-hand the privation of the post-Soviet period which, if you dug a little, was pretty bad. Interestingly this collapse had been predicted up to a decade before it happened but was not widely reported because of the Reagan agenda of demonizing the Soviet Union as an existential threat to the U.S.

Orlov along with people like James Howard Kunstler and many others on both the right and left-in fact, my monitoring of this movement shows a real blurring of left/right distinctions that is interesting in itself. I won’t go into the merits of Orlov’s predictions here but only want to say that the movement towards survivalism and a fascination and even longing for a collapse seems to be spreading in this country. I don’t believe this movement is irrational at all. Why do I say that? Because it should be very clear that we are in a kind of serious decline, not just economic decline, but serious political and social decline that we ought to wake up to or Orlov’s collapse scenarios may in fact take place.