I just read this over at http://www.cryptogon.com, which is a great site. He doesn’t tell you who wrote it either, but he links to it. It’s succinct but covers the bases, and is brutally to the point.

In short, it might be the best thing I’ve read regarding the current disastrous situation in this country.

It’s titled “Common Sense 2009”

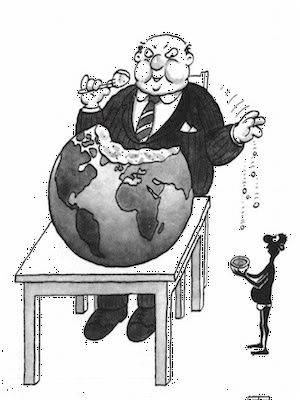

The American government — which we once called our government — has been taken over by Wall Street, the mega-corporations and the super-rich. They are the ones who decide our fate. It is this group of powerful elites, the people President Franklin D. Roosevelt called “economic royalists,” who choose our elected officials — indeed, our very form of government. Both Democrats and Republicans dance to the tune of their corporate masters. In America, corporations do not control the government. In America, corporations are the government.

This was never more obvious than with the Wall Street bailout, whereby the very corporations that caused the collapse of our economy were rewarded with taxpayer dollars. So arrogant, so smug were they that, without a moment’s hesitation, they took our money — yours and mine — to pay their executives multimillion-dollar bonuses, something they continue doing to this very day. They have no shame. They don’t care what you and I think about them. Henry Kissinger refers to us as “useless eaters.”

But, you say, we have elected a candidate of change. To which I respond: Do these words of President Obama sound like change?

“A culture of irresponsibility took root, from Wall Street to Washington to Main Street.”

There it is. Right there. We are Main Street. We must, according to our president, share the blame. He went on to say: “And a regulatory regime basically crafted in the wake of a 20th-century economic crisis — the Great Depression — was overwhelmed by the speed, scope and sophistication of a 21st-century global economy.”

This is nonsense.

The reason Wall Street was able to game the system the way it did — knowing that they would become rich at the expense of the American people (oh, yes, they most certainly knew that) — was because the financial elite had bribed our legislators to roll back the protections enacted after the Stock Market Crash of 1929.

Congress gutted the Glass-Steagall Act, which separated commercial lending banks from investment banks, and passed the Commodity Futures Modernization Act, which allowed for self-regulation with no oversight. The Securities and Exchange Commission subsequently revised its rules to allow for even less oversight — and we’ve all seen how well that worked out. To date, no serious legislation has been offered by the Obama administration to correct these problems.