According to the NYT, Goldman Sachs and other banks sold their customers collateralized debt obligations, or C.D.O.’s, and then bet heavily that these investments would fail.

Goldman Saw It Coming

Before the financial crisis, many investors – large American and European banks, pension funds, insurance companies and even some hedge funds – failed to recognize that overextended borrowers would default on their mortgages, and they kept increasing their investments in mortgage-related securities. As the mortgage market collapsed, they suffered steep losses.

“The simultaneous selling of securities to customers and shorting them because they believed they were going to default is the most cynical use of credit information that I have ever seen,” said Sylvain R. Raynes, an expert in structured finance at R & R Consulting in New York. “When you buy protection against an event that you have a hand in causing, you are buying fire insurance on someone else’s house and then committing arson.”

The woeful performance of some C.D.O.’s issued by Goldman made them ideal for betting against. As of September 2007, for example, just five months after Goldman had sold a new Abacus C.D.O., the ratings on 84 percent of the mortgages underlying it had been downgraded, indicating growing concerns about borrowers’ ability to repay the loans, according to research from UBS, the big Swiss bank. Of more than 500 C.D.O.’s analyzed by UBS, only two were worse than the Abacus deal.

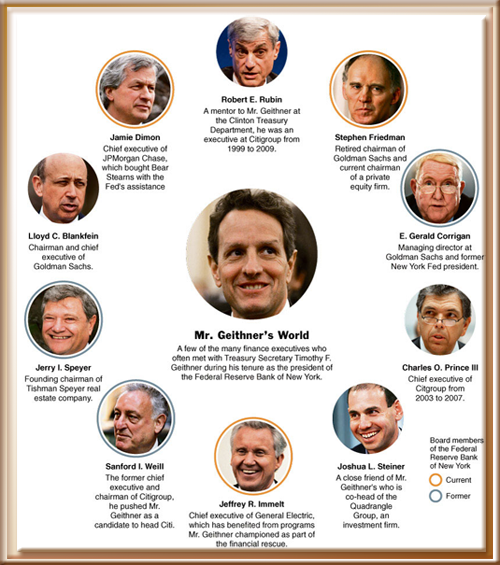

http://www.nytimes.com/2009/12…

Lewis Sachs, left, who oversaw C.D.O.’s before becoming a Treasury adviser (ie he works for Geithner now) , and John Paulson, whose company profited as the housing market collapsed.:

So, basically, not only are we not regulating these guys, we’re rewarding them– and more importantly promoting them into the government to run the show–where they presumably steal directly from the US Treasury.

How is this different from what Mussilini had in mind as a system of government? Such a constant revolving of government, military, and corporate figures, that the lines are entirely blurred.