The monied interests will continue robbing us blind until we make them stop and pry our money from their cold, dead hands.

Charles Hugh Smith points out that since 2007, public debt has increased by more than $6 trillion, yet GDP has remained virtually flat. (In constant 2005 dollars, there was zero growth. Zero, as in 0.0. Six trillion dollars plus is a lot of money for goose eggs. That’s pretty much the same thing as borrowing $6 trillion plus and losing it. No beanstalk, no golden goose, just losing it. That $6 trillion lost in the past four years does not include the $2.3 trillion that the Pentagon lost, literally fucking lost on September 10, 2001, the day before 9/11. But I digress.)

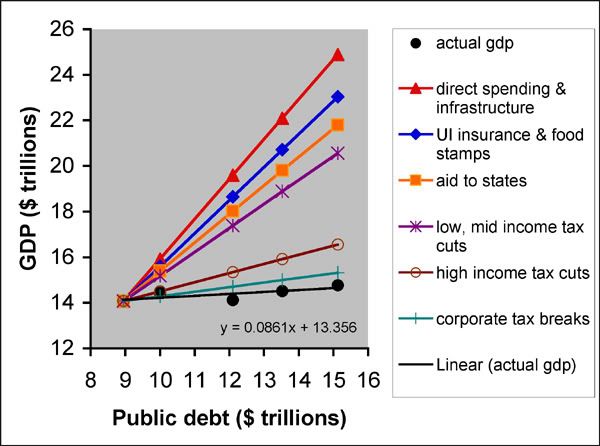

The filled black circles in the chart below (labeled “actual gdp”) shows our GDP “growth” as a function of our staggering increase in public debt between 2007 and 2011 (2011 GDP is projected based on our stupendous 1.8% growth rate in 2011 Q1, whereas 2011 public debt is based on the $1.6 trillion dollar increase in the deficit from 2010). You’ll notice that public debt increases more than $6 trillion on the horizontal axis from left to right, whereas GDP does not move up noticeably on the vertical axis. As the boys used to say in grade school, “She’s flat as a board.”

Ya gotta wonder, “What on god’s green earth happened to all that money?”