Cross posted from The Stars Hollow Gazette

Sen. Bernie Sanders has already decided that he will not vote to approve President Barack Obama’s replacement for Timothy Geithner, Jack Lew, AS Treasury Secretary, with good reason. It seems that Mr. Lew, who currently is the president Chief of Staff, does not think that deregulation had a role in the housing crash. This is Sen. Sanders’ statement:

Jack Lew is clearly an extremely intelligent person and I applaud his many years of public service to our country. I believe that he will be confirmed by the Senate. Unfortunately, he will be confirmed without my vote. At a time when the middle class is collapsing and millions of workers are unemployed, I do not believe he is the right person at the right time to serve in this important position.

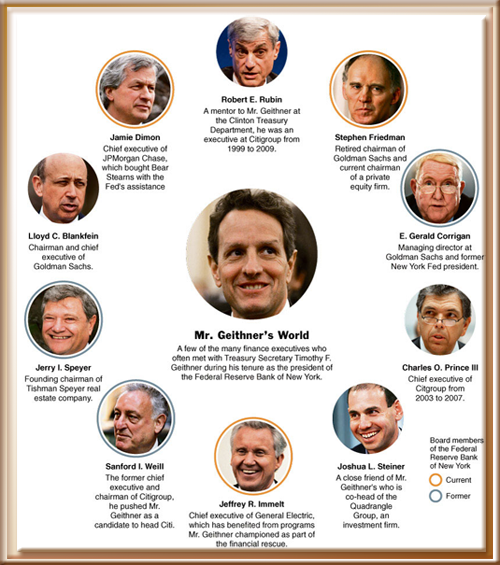

As a supporter of the president, I remain extremely concerned that virtually all of his key economic advisers have come from Wall Street. In my view, we need a treasury secretary who is prepared to stand up to corporate America and their powerful lobbyists and fight for policies that protect the working families in our country. I do not believe Mr. Lew is that person.

We don’t need a treasury secretary who thinks that Wall Street deregulation was not responsible for the financial crisis. We need a treasury secretary who will work hard to break up too-big-to-fail financial institutions so that Wall Street cannot cause another massive financial crisis.

We don’t need another treasury secretary who believes in ‘deficit neutral’ corporate tax reform. We need a treasury secretary willing to fight to make sure that large, profitable corporations pay their fair share in taxes to reduce the deficit and create jobs.

We don’t need a treasury secretary who will advise the president that he should negotiate with the Republicans to cut Social Security, Medicare, and Medicaid benefits. We need someone who is going to strengthen these programs.

We don’t need another treasury secretary who believes that NAFTA and Permanent Normal Trade Relations with China have been good for the American economy. We need someone in the White House who works to fundamentally re-write our trade policy to make sure that we are exporting American goods, not American jobs.

Matt Taibbi, contributing editor for Rolling Stone magazine, and William Black, associate professor of economics and law at the University of Missouri-Kansas City, a white-collar criminologist and former senior financial regulator, joined Amy Goodman and Juan Gonzalez at Democracy Now! to discuss why Jack Lew is a “failure of epic proportions”

Transcript can be read here

At Huffington Post, Prof. Black also described Mr. Lew’s role as OMB Chief during the Clinton administration, that set the stage for our current economic and financial problems, his path to Wall St. and back through the “revolving door” to the Obama administration. He calls Mr. Lew “another brick in the Wall Street on the Potomac,”

From CBS News:

Obama is clearly comfortable bringing another ex-Wall Streeter into an administration that, beyond a recent ratcheting up of populist rhetoric, has done relatively little to rein in the financial industry.

That, in turn, reflects the ease with which Washington hands like Lew shuttle between the Street and the Hill. Case in point: Lew’s predecessor as budget chief, Peter Orszag, left the agency and joined Citi as vice chairman of global banking. A job in politics is no longer a back-door to a lucrative job in banking — it’s a red carpet. The revolving door keeps spinning.

The Citi alternative investments] division ultimately lost billions. As for Lew, he naturally made big bucks during his three-year stint at Citi, including a [roughly $950,000 bonus in 2009 — after the company’s federal bailout.

Lew helped establish finance policy under President Clinton. [..]

Lew’s predecessor as chief of staff was William Daley. Daley is a lawyer. Daley was on the executive board of J.P. Morgan-Chase during the crisis and before that he was on Fannie Mae’s board of directors. Daley is a member of “Third Way’s” controlling board. Third Way is a Pete Peterson ally that lobbies in favor of austerity and cuts to the safety net. It pushes Wall Street’s, and Pete Peterson’s, greatest dream — privatizing Social Security. Privatization would allow Wall Street to increase its profits by hundreds of billions of dollars in fees for managing our retirement savings. [..]

The obvious aspects of this pattern include: (1) Obama prefers to have Wall Street guys run finance (despite coming to power because Wall Street blew up the world), (2) the revolving door under Obama that connects Wall Street and the White House has been super-charged, and (3) even very short stints in Wall Street have made Obama’s finance advisers wealthy. The obvious is vitally important, and it is largely ignored by the most prominent media. The obvious aspects help explain why Obama’s economic policies have been incoherent, ineptly explained, inequitable, and often slavishly pro-Wall Street at the expense of our integrity and citizens. [..]

Prof. Black gives examples of the less obvious aspects of the pattern that compound problem of Pres. Obama appointing people who have failed, not just professionally, but ethically and morally. It is an eye opening, scathing critique of an administration that is trying to force a destructive policy of austerity and why Jack Lew is a terrible choice for Treasury Secretary.