Burning the Midnight Oil for Real World Economics

NB. New Oil links are now located at the Midnight Oil Blog

A while ago, as an off-shoot of the Beauty Platform, I set out a Beautiful Bail-Out plan.

A while ago, as an off-shoot of the Beauty Platform, I set out a Beautiful Bail-Out plan.

Two key parts were: 50:50 on money going to help regular home buyers to extricate themselves from the mortgage meltdown, and on bailing out the finance sector from the mess they got themselves into …

… and having the finance sector bail out consisting of both unloading dubious assets and issue of Senior Preferred shares with heavy strings attached.

Now, the Administration did not, in fact, listen to me, but when Senator Dodd was complaining about what banks had done with their bail out money, waddya know … I got a perfect three out of three on what strings needed to be attached to the money:

- Limits on Mergers and Acquisition

- No payments of any other dividends

- Limits on Executive Compensation

… until the Senior Preferred Dividend had been paid for four quarters straight … and kicking back in if the firm in the future ran into problems meeting the Senior Preferred Dividend.

But … does the Beautiful Bail Out model extend to the Big Three?

Cross-posted from the new, improved,

Cross-posted from the new, improved,

The thing about the New Deal … it provided a lot of “relief”

The thing about the New Deal … it provided a lot of “relief” Excerpted from

Excerpted from

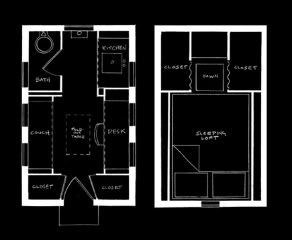

For example, these above are from

For example, these above are from  Tumbleweed only sells the finished houses that can be towed as a trailer … for the very largest of their houses, like the 770 square foot monster the Ernesti (pictured above left, at the size that 770 sq. feet must seem in the age of McMansions), they only sell plans, as it must be built on site.

Tumbleweed only sells the finished houses that can be towed as a trailer … for the very largest of their houses, like the 770 square foot monster the Ernesti (pictured above left, at the size that 770 sq. feet must seem in the age of McMansions), they only sell plans, as it must be built on site.