Cross posted from The Stars Hollow Gazette

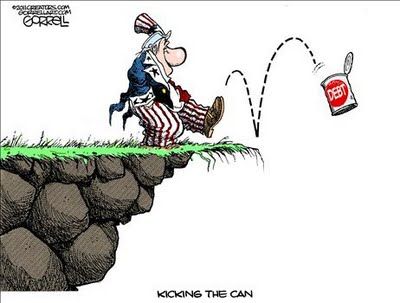

Once again the Republicans in Congress are threatening to refuse to raise the debt ceiling in order to get concessions from the Obama administration. Those concessions would involve severe cuts and changes to the social safety net that our most vulnerable citizens rely on to stay out of poverty but would not solve the so-called problem of the US debt obligations and deficit spending. We’ve been down this road before and it resulted in the extension of the Bush tax cuts and an increase in the deficit.

Once again the Republicans in Congress are threatening to refuse to raise the debt ceiling in order to get concessions from the Obama administration. Those concessions would involve severe cuts and changes to the social safety net that our most vulnerable citizens rely on to stay out of poverty but would not solve the so-called problem of the US debt obligations and deficit spending. We’ve been down this road before and it resulted in the extension of the Bush tax cuts and an increase in the deficit.

This could all be rendered irrelevant quite easily and very legally by the minting of one or more platinum coins in denominations determined by the Treasury Secretary. Here’s the law, 31 USC § 5112 – Denominations, specifications, and design of coins:

§ 5112. Denominations, specifications, and design of coins

(a) The Secretary of the Treasury may mint and issue only the following coins: [..]

(k) The Secretary may mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.

Those coins would be deposited with the Federal Reserve and used to make good on the obligated debt of the United States. This is a legitimate option for President Barack Obama and the argument has been made that it may be his duty to order the minting of Trillion Dollar Platinum Coins to protect the US from failing to pay its obligations. Here is the explanation of what a trillion dollar coin does from blogger letsgetitdone at Correntewire:

If the Mint coins money in denominations appropriate for commonplace retail transactions than the coins involved can be exchanged among parties as needed. But what happens if the Mint coins platinum money with face values in the trillions of dollars? Then that money can’t be used for exchange as a practical matter, because there are no buyers who will accept the trillion dollar coins in exchange. So, if the Treasury wants to use such coins to fill the public purse with money it can later spend on debt repayment or Congressional deficit appropriations, it must transform high face value coins into divisible money; i.e. reserves in its Fed spending account. [..]

In the case of $One Trillion proof platinum coin, the profits are its face value minus a few thousand dollars. So that amount would be “swept” into the Treasury General Account (TGA), which is the account used by Treasury to perform Government spending.

A very good way to look at high value platinum coins is that they are legal instruments for the Treasury to use the unlimited “out of thin air” reserve creation authority of the Fed to fill the public spending purse, the TGA, for public purposes. In effect, platinum coin seigniorage involves the Treasury commandeering the power of the Fed to create reserves and place them in the TGA, perhaps, depending on what the Treasury chooses to do, in the many Trillions of dollars.

The coin’s value is not limited to one trillion dollars, according to the law, the Treasury Secretary sets the value. Letsgetitdone makes the argument for a $60 trillion coin that would be a political game changer:

{..} because it institutionalizes the idea that there is a distinction between appropriations, the Congressional mandate to spend particular amounts on particular goods and services, and the capability to spend the mandated accounts by having the funds (electronic credits) in the public purse (the TGA). In a fiat currency system, the capability always exists if the legislature provides for it under the Constitution, as it has under current platinum coin seigniorage legislation.

But the value of the $60 T coin, and the profits derived from it, is that it is a concrete reminder of the Government’s continuing ability to buy whatever it needs to meet public purposes, and its continuing ability to harness the authority of the Central Bank to create reserves to support the needs of fiscal policy. It demonstrates very clearly that the Government cannot run out of money, and that the claim that it can is not a valid reason for rejecting spending that is in accordance with public purpose.

So, please keep in mind the distinction between the capability to spend more than government collects in taxes, and the appropriations that mandate such spending. The capability is what’s in the public purse, and it is unlimited as long as the Government doesn’t constrain itself from creating credits in its own accounts. With coin seigniorage its capability could be and should be publicly demonstrated by minting the $60 T coin, and getting the profits from depositing it at the Fed transferred to the Treasury General Account (TGA).

On the other hand, Congressional appropriations, not the size or contents of the purse, but whether the purse strings are open or not, determines what will be spent, and what will simply sit in the purse for use at a later time. So there is a very important distinction between the purse and the purse strings. The President can legally use coin seigniorage to fill the purse, but only Congress can open the purse strings through its appropriations.

Is there anything congress could do to stop the president from issuing a coin like that? No, there isn’t. Could they impeach him? Well they could try, but I doubt they would get 67 votes in the Democratic held Senate. Nor would impeachment of a president who rescued the economy be very popular with the public.

Last year during the last budget hostage situation, Jack Balkin, Knight Professor of Constitutional Law at Yale Law School, wrote this:

Like Congress, the president is bound by Section 4 of the 14th Amendment, which states that “(t)he validity of the public debt of the United States, authorized by law . . . shall not be questioned.” Section 4 was passed after the Civil War because the framers worried that former Southern rebels returning to Congress would hold the federal debt hostage to extract political concessions on Reconstruction. Section 5 gives Congress the power to enforce the 14th Amendment’s provisions. This does not mean, however, that these provisions do not apply to the president; otherwise, he could violate the 14th Amendment at will.

Section 4 requires the president not to put the validity of the public debt into question. If the debt ceiling is not raised in time, there will not be enough incoming revenues to pay for all of the government’s bills as they come due. Therefore he has a constitutional obligation to prioritize incoming revenues to pay the public debt: interest on government bonds and any other “vested” obligations. [..]

An angry Congress may respond by impeaching the president. However, if the president’s actions end the government shutdown, stabilize the markets and prevent an economic catastrophe, this reduces the chances that he will be impeached by the House. (After all, he saved the country.) Perhaps more important, the chances that he will be convicted by a two-thirds vote of the Senate, which has a Democratic majority, are virtually zero.

Since Pres. Obama is no longer faced with reelection and the Republicans in the House are again threatening to default on its obligations without deep cuts to the social safety net and protect the 1% from tax hikes, there is no reason for the President not to mint that coin.

These are the articles by letgetitdone that were referenced and are all well worth reading:

Coin Seigniorage: A Legal Alternative and Maybe the President’s Duty

Beyond Debt/Deficit Politics: The $60 Trillion Plan for Ending Federal Borrowing and Paying Off the National Debt

Origin and Early History of Platinum Coin Seigniorage In the Blogosphere

What Does The Trillion Dollar Coin Do?

The Trillion Dollar Coin Is A Conservative Meme

This past week calls by Republicans to not raise debt ceiling got little push back from the talking heads this Sunday as Senate Minority Leader Mitch McConnell made the morning rounds

This past week calls by Republicans to not raise debt ceiling got little push back from the talking heads this Sunday as Senate Minority Leader Mitch McConnell made the morning rounds  While he is on vacation in Hawaii, President Barack Obama will ask Congress to

While he is on vacation in Hawaii, President Barack Obama will ask Congress to