As Lieberman deliberated, the new chair of the Democratic Senatorial Campaign Committee, Sen. Patty Murray (D-Wash.), told HuffPost that the party would consider supporting Lieberman if he returned to the fold.

Joe & George the President

The feeling of ill will is mutual: Lieberman said during the health care debate that one reason he opposed a Medicare buy-in compromise was that progressives were embracing it.

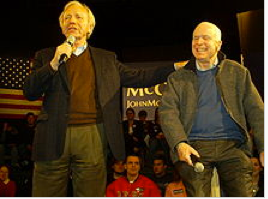

Joe & John the Presidential Candidate

March 20, 2003

” What we are doing here is not only in the interest of the safety of the American people. Believe me, Saddam Hussein would have used these weapons against us eventually or given them to terrorists who would have. But what we are doing here, in overthrowing Saddam and removing those weapons of mass destruction and taking them into our control, is good for the security of people all over the world, including the Iraqi people themselves.”

Joe and John in Iraq

September 29, 2011. 10 years and 18 days after 9-11 attacks on NYC

” It is time for us to take steps that make clear that if diplomatic and economic strategies continue to fail to change Iran’s nuclear policies, a military strike is not just a remote possibility in the abstract, but a real and credible alternative policy that we and our allies are ready to exercise.It is time to retire our ambiguous mantra about all options remaining on the table. It is time for our message to our friends and enemies in the region to become clearer: namely, that we will prevent Iran from acquiring a nuclear weapons capability — by peaceful means if we possibly can, but with military force if we absolutely must. A military strike against Iran’s nuclear facilities entails risks and costs, but I am convinced that the risks and costs of allowing Iran to obtain a nuclear weapons capability are much greater.

Some have suggested that we should simply learn to live with a nuclear Iran and pledge to contain it. In my judgment, that would be a grave mistake. As one Arab leader I recently spoke with pointed out, how could anyone count on the United States to go to war to defend them against a nuclear-armed Iran, if we were unwilling to go to war to prevent a nuclear-armed Iran? Having tried and failed to stop Iran’s nuclear breakout, our country would be a poor position to contain its consequences.

I also believe it would be a failure of U.S. leadership if this situation reaches the point where the Israelis decide to attempt a unilateral strike on Iran. If military action must come, the United States is in the strongest position to confront Iran and manage the regional consequences. This is not a responsibility we should outsource. We can and should coordinate with our many allies who share our interest in stopping a nuclear Iran, but we cannot delegate our global responsibilities to them.”

http://www.lobelog.com/lieberm…

http://lieberman.senate.gov/in…