The financial news from Europe is getting increasingly distressing.

A new EU report warns that economic conditions in Portugal and Spain could “result in a high ‘snowball’ effect on the government debt.”

French financial group AXA says “there is a fatal flaw in the system and no clear way out.” They are predicting the Eurozone to break in half or completely disintegrate in the next 18 months.

Over 13% of Europe’s investors are betting on a Black Monday-style collapse in stock prices (think 1987).

Tag: depression

Jun 15 2010

Europe’s Black Swans

Jun 12 2010

Book Review: Leighninger’s Long-Range Public Investment (2007)

Book Review: Leighninger, Jr., Robert D. Long-Range Public Investment: The Forgotten Legacy of the New Deal. 1st ed. 1 vol. Columbia, SC: University of South Carolina Press, 2007.

(crossposted at Orange and Firedoglake)

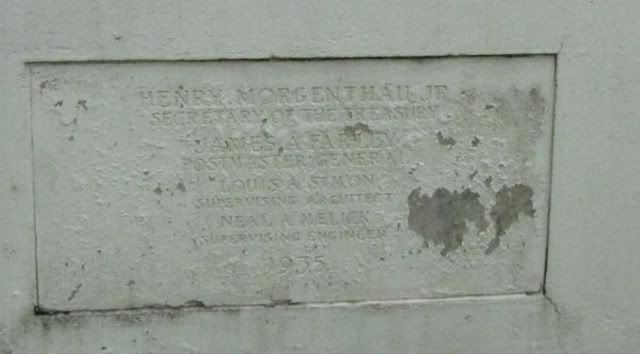

(Inscription found on the Claremont, California post office)

May 28 2010

Flashing warning signs of a double-dip

“By allowing persistent declines in the money supply and in the price level, the Federal Reserve of the late 1920s and 1930s greatly destabilized the U.S. economy and the economies of many other nations as well.

– Federal Reserve Governor, Ben Bernanke, 2004

Ben Bernanke, Nobel Prize winner Milton Friedman, and most other economists out there agree that the reason the Great Depression was so deep and destructive was that the Federal Reserve failed to keep the money supply from shrinking. I’m a little more skeptical, but I agree that it would be impossible for an economy to grow without a growing supply of money in a debt-based monetary system.

That’s why this news article should be extremely distressing.

The stock of money fell from $14.2 trillion to $13.9 trillion in the three months to April, amounting to an annual rate of contraction of 9.6pc. The assets of insitutional money market funds fell at a 37pc rate, the sharpest drop ever.

“It’s frightening,” said Professor Tim Congdon from International Monetary Research. “The plunge in M3 has no precedent since the Great Depression. The dominant reason for this is that regulators across the world are pressing banks to raise capital asset ratios and to shrink their risk assets. This is why the US is not recovering properly,” he said.

As our political and financial leaders are using every tool at their disposal to jump-start the economy, there are fewer and fewer dollars in circulation. That’s not a prescription for a growing economy. It’s a prescription for economic disaster.

May 28 2010

On Cannon Fodder

Cannon Fodder

Function noun

Date: circa 1891

1 soldiers regarded or treated as expendable in every battle

2 an expendable or exploitable person, group, or thing

So today, late in the work day my boss says ‘Hey Brunemeyer, lets go. We’re off to Monmouth County to push up a 30’. This translated into driving to one of the wealthiest towns in the country to push ups a $2,000 flagpole, on a guys front lawn, in front of his brand new anitque looking 4000 sq ft summer home, a block from the ocean.

On the way back south to our humble base camp we got to discussing the state of affairs we face today. Things like the, largest environmental disaster ever seen, the riots in Greece and Ice Land, Wall St. bailouts and ‘to big to fail’.

I mentioned that I’d been listening to the Lord Ramage novels and the Richard Sharpe series on my blinky book reader and how the idea of Cannon Fodder hadn’t changed since the beginning of time. We, and I’ll be liberal in thinking of anyone not of the ‘mover and shaker’ cast are nothing but cannon fodder. 1% give or take of humanity is and has always controlled the game. The 99% remaining are nothing but Cannon Fodder. We the ‘enlisted, drafted, enslaved, pressed’ are of no concern beyond our use as prostitutes consumers, borrowers, laborers, clarks willing of necessity to sell our minds bodies and souls to survive swindled and defrauded with the scam we call the American Dream. “yep, you too can live the life of luxury and hedonistic over indulgence if ya work hard and do as we say”

Now you may say ‘not me, I have a degree, a good job, great future and who knows what all else but think about it. Loose your job, get sick or have any sort of setback and see how fast all that secure future is real and how much is so much hype.

It’s the same old tune, cyclical and unending, I’d hoped we’d evolved to something better than our brutish past proved. I’d thought maybe just maybe we’d learned at least in some small way that we’re all in it together but no I was delusional, drunk or stoned. We are still a brutish species. The revolutionary war in the U.S., the French Revolution, Russia, India, Iran, Cuba et al are but blips in the great theater of history. The little men behind the curtain still play Svengali and we still march, bayonets at the ready, stocks on, hopes and patriotism swirling in our minds into the breach to die. To play our parts, no more valuable than chits, or playing cards in the great game of life.

Mar 03 2010

Translator is depressed tonight

Feb 18 2010

“Bipartisan” campaign targets US working class

Original article, by Patrick Martin and subtitled Behind Obama’s overtures to Republican right, via World Socialist Web Site:

The Obama administration is announcing Thursday a new initiative for joint action by the Democratic Party and the Republican Party against American working people, when the leaders of a new bipartisan commission to slash the federal deficit are introduced at the White House.

Jan 03 2010

Must See Movie: “The Secret Of Oz”

Perhaps you’ve heard of the movie “The Money Masters” before by Bill Still. But regardless, it is well known that our U.S. Economy is not really getting better — nor will it ever get better.

How could it? That is, until and unless we solve our astronomical debt problem, and stop borrowing money at interest, just to pay off the never ending massive pile of interest from our old debts — all of which can never go away under our existing system because the very creation of money itself is also debt generating ( as the crooked Federal Reserve System was designed [Rothschilds, Rockefellers, Morgans]).

Some people, namely Ron Paul, have talked about a return to a Gold & Silver based monetary system. But this solution, while constructive for discussion, would appear to be incomplete. For we see even today that the price of Gold and Silver are greatly manipulated in a corrupt manner by the various Central Banks, the IMF, and various Governments. Therefore, how could either Gold or Silver possibly offer any stability when it is itself under the domination and control of “The Money Masters“? For example, given that size of the U.S. Money Supply has quadrupled in just the last few years alone, it would then logically follow that the correct price of Gold relative to the watered-down U.S. Dollar should already be in the vicinity of $5000/OZ.

Dec 18 2009

Officials and Experts Warn of Crash-Induced Unrest

Officials and Experts Warn of Crash-Induced Unrest

This is one of those entries where I’m going to basically just send you over to the link so you can check it out for yourself. The site itself has become a daily must-visit for me, and should be for others interested in what’s really going on. I don’t know who this guy is, but he’s really really good.

His entries are so chock-full of links that cutting and pasting what he’s saying is almost pointless, unless you include all the links (and if anyone knows an easy way to do that, I’d love to learn it!).

Anyway for all the Larry Summers MORONS out there who think that sunny days of economic lushness are right around the corner, well, this is something of a buzz-kill. (the same guy has an awesome piece that just DESTROYS Summers).

Anyway, here’s a sample:

Today, Moody’s warned that future tax rises and spending cuts could trigger social unrest in a range of countries from the developing to the developed world, that in the coming years, evidence of social unrest and public tension may become just as important signs of whether a country will be able to adapt as traditional economic metrics, that a fiscal crisis remains a possibility for a leading economy, and that 2010 would be a “tumultuous year for sovereign debt issuers”.

Sep 16 2009

“The Demise of America as we Know it”

Got any gold? It just hit $1016 an ounce. Sure wish I hadn’t sold mine to pay the rent.

James Beeland Rogers, Jr. (born October 19, 1942) is an expatriate American investor and financial commentator based in Singapore. He was a co-founder of the Quantum Fund, and is a college professor, author, economic commentator, and creator of the Rogers International Commodities Index (RICI). He considers himself of the Austrian School of economics.[2]

Funny, the Austrian School is also the world of economics Peter Schiff inhabits. He’s another guy who speaks a lot of common sense.

Ben Bernacke, YOU LIE! I mean, can you freaking believe that Ben Bernacke actually came out and said the recession is over? Man, did he ever go all “Baghdad Bob” on us.

Here’s a popular Youtube video, “Peter Schiff was Right”

And indeed he was. And so is Jim Rogers.

Sep 01 2009

The Unfolding Capitalist Crisis – a nightmare for workers everywhere

The Unfolding Capitalist Crisis – a nightmare for workers everywhere

By Rob Sewell

Shared via AddThis

Aug 24 2009

Army Trains For Battle For Mental Health

Sunday, NPR Morning Edition, 08.23.09 {4min 5sec.}

Daniel Zwerdling, of NPR, continues his outstanding research into and reporting on the Army’s, and the Military’s, care of returning soldiers suffering from PTSD and other possible mental problems developed as to serving in these wars and occupations.

Jul 27 2009

Rachel Maddow breaks down Wall Street Deregulation into these simple Frames …

Way back in March of 2009, Rachel explained the “Highway Robbery” which happened on Wall Street, using a few simple word-pictures. (ie. simple Frames). These perhaps deserve a quick review …

Rachel Maddow – Cops and Robbers

Link to Rachel’s very humorous Clip

Great Framing Rachel! … I love it, when Progressive Talkers, make learning FUN! The simpler the Word-Pictures, the better the Frame!

“Is our childrens learning?” as George W. used to ask.

Could be, … Maybe we just needed to “Turn the Page” …