Yesterday Charles Pierce at Esquire Politics pointed out that Hurricane Harvey is rapidly becoming an ecological disaster that neither Texas or the federal government is prepared to handle. It is the result of bad decisions made by states that have deregulated industry over the years. To the point that even knowing if there is a …

Tag: deregulation

Feb 16 2011

Timmy “Too Bigs” Geithner: “We’re going, like, existential.”

Geithner (via creditwritedowns):

“I take human life seriously. I’m obsessed with it: death, existence, bankruptcy, God, mark-to-fantasy-values, interpersonal relationships (mostly with bankers and my self-reflective consciousness). Unlike Woody Allen, I can’t play Dixieland, so I feel uniquely isolated in an indifferent, if not hostile universe; I was simply born into this financial chaos of logical, ontological, and moral non-structure; and while my existence is inexplicable, I face up to it; I take full responsibility for bailing out the profanely wealthy at the expense of the vast majority of humanity. Life is hard, and inscrutable to rational or empirical scrutiny, so I create my own reality, in deeds. God and I can’t both be free. That’s my facticity. That’s my authenticity. That’s my freedom. That is my will, bitchez. I have no idea what I’m doing, but I decided. I acted. When I choose, I choose for the whole world. It’s absurd, but I open Pandora’s box, in order to create myself. We’re all terrified about that, but I owe you that much. Every ethical act I perform is the point of no return. If I cut Isaac’s throat on God’s command, that will be my decision. I take human life seriously.”

That possible interpretation of Geithner’s existential epiphany is my roundabout way of asking, “What bong-farts in Hell did Geithner toke from Bernanke’s ass to utter such, “We’re going, like, existential” nonsense?

Actually, I know what he really means:

Nov 12 2010

Wild Wild Left Radio #87 Catfood, Soc. Security & a Devalued Dollar – An Austerity Trifecta !!!

Join Wild Wild Left Radio every Friday at 6pm EST, via BlogtalkRadio, with Host and Producer Diane Gee to guide you through Current Events taken from a Wildly Left Prospective…. her Joplinesque voice speaking straight from the heart about the real-life implications of the Political and the Class War on everyday American Citizens like you.

The “MSM Headline” stories are treated by what they are NOT telling you, as much as by what they are. From Domestic Policy to International Politics, WWL Radio also speaks freely about the un-and-under reported stories, a vigilant watchdog of what you should know.

The True and Radical Left, WWL’s Diane Gee and our Regular Contributors form a coalition of subversion undermining the PTB by speaking Truth to Power!!!!

The call in number is 646-929-1264 to join the conversation!

Listen live here:

The live chat link will go live around 5:30.. found at the bottom of the show page, or by clicking the link below. Be heard via the live chat page too!

CHAT LINK:

http://www.blogtalkradio.com/f…Miss the show? The podcasts are available at the link above, or at Wildwildleft.com.

Our Topics This Week:

Fire up your helicopters, and burn your worthless Benjamin’s to warm your catfood, the perfect trifecta of economic shocks will have austerity measures in your lap before you can say “re-regulate.”

While former Prez’nit Decider re-writes history to give us a warm fuzzy about the anal probe, he extols the virtues of our Current Capitulater for a good reason… he’s about to help jam it in us deeper than the Shrublet’s wildest dreams!

Viewed within the history of deregulation, business personhood and recent overt Elite favoring SCOTUS rulings, let WWL Radio guide you into the latest Shock therapy the US is undergoing. The market has been flooded with a weakened dollar, while Obama tries to market it to the G20. (or 19 he’s screwing) The Catfood Commission has ruled that we need to give the rich more and the people less. Trillionaire businessmen have bought ads to flood Prime Time to convince us that the SOLVENT Social Security must be privatized or you won’t GET yours! (bullshit)

And not ONE of these measures will bring you a JOB or the Country economic relief.

As the Fear and Loathing is ramped up against our own citizens and our Justice system takes a pass on everything from rich hit and run drivers to CIA destruction of Evidence – the rise of a Class War 2 tiered system is evident on every level. Will we wake up before its too late?

In 1975 Secretary of State Henry Kissinger said, ‘The illegal we do immediately; the unconstitutional takes a little longer.’

That time is NOW.

Please join us for the only “out there where the buses don’t run” LEFT perspective with interviews, op/eds and straight talk without the hand-wringing PC that has crippled our movement!

Controversy? We face it. Cutting Edge? We step over it. Revolutions start with information, and The Wild Wild Left Radio brings you the best in information and op/eds from a position that others on the Left fear to tread…. all with a

grainshaker of irreverent humor.

Oct 02 2010

Citibank fails to prove Mortgage Ownership, in Foreclosure Suit

Thank goodness. It couldn’t have happen a day too soon.

NBC Nightly News (03-09-09) Tent Cities of Homeless Springing Up In Bad Times

http://www.youtube.com/watch?v=_F94f_Ycsjs

Tent City, USA

http://www.youtube.com/watch?v…

Jun 09 2010

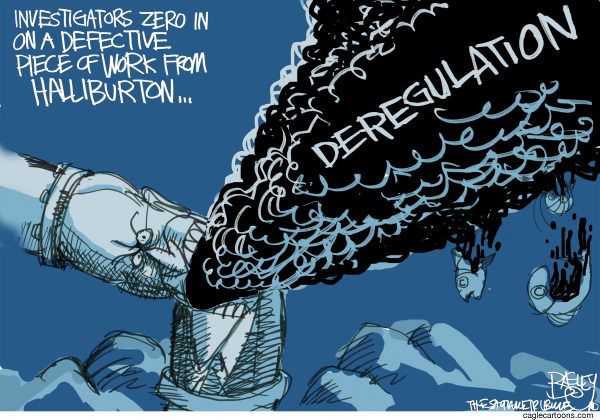

The Week in Editorial Cartoons – The Cheney/Halliburton Connection

Crossposted at Daily Kos

THE WEEK IN EDITORIAL CARTOONS

This weekly diary takes a look at the past week’s important news stories from the perspective of our leading editorial cartoonists (including a few foreign ones) with analysis and commentary added in by me.

When evaluating a cartoon, ask yourself these questions:

1. Does a cartoon add to my existing knowledge base and help crystallize my thinking about the issue depicted?

2. Does the cartoonist have any obvious biases that distort reality?

3. Is the cartoonist reflecting prevailing public opinion or trying to shape it?The answers will help determine the effectiveness of the cartoonist’s message.

:: ::

Cheney Spews by Pat Bagley, Salt Lake Tribune, Buy this cartoon

May 02 2010

D-D-Drill B-B-Baby D-D-Drill: BPs Black Money Tide

From Youtube user golefttv – April 30, 2010:

The Gulf of Mexico oil spill is becoming worse by the day, with over 200,000 gallons of crude a day. Environmental Attorney Mike Papantonio appears on MSNBC’s The Ed Show to discuss the disaster and the legal ramifications of it.

Mike Papantonio is an American attorney and radio talk show host. A prominent trial lawyer, he co-hosts Ring of Fire Radio, a nationally-syndicated weekly radio program, with Robert F. Kennedy, Jr.

Apr 25 2010

Derivatives: An Investment on Nothing!

Warren Buffet gave a prophetic pronouncement back in 2003 about the Derivatives market, seeing the exponential dangers of this “paper-thin” type of investment.

Buffet did not mince words. He called them “financial weapons of mass destruction“:

Buffett warns on investment ‘time bomb’

BBC – 4 March, 2003

The derivatives market has exploded in recent years, with investment banks selling billions of dollars worth of these investments to clients as a way to off-load or manage market risk.

But Mr Buffett argues that such highly complex financial instruments are time bombs and “financial weapons of mass destruction” that could harm not only their buyers and sellers, but the whole economic system.

[…]Some derivatives contracts, Mr Buffett says, appear to have been devised by “madmen”. […]

Dec 13 2009

Should Wall Street Speculators, have to pay their Fair Share? w Poll

H.R. 1068, the Let Wall Street Pay for Wall Street’s Bailout Act.

Wall Street Transaction Tax Proposed by Democrats

Ryan J. Donmoyer

Dec. 3, 2009 (Bloomberg) — A group of congressional Democrats proposed taxing large transactions in stocks and derivatives, an idea that has received a cool reception from the Obama administration. […]

.25 Percent for Stocks

The measure would be based on legislation DeFazio proposed in the House that would apply a tax of 0.25 percent or 25 basis points to stock transactions in excess of $100,000, and a levy of 0.02 percent or 2 basis points on derivatives including futures, options, swaps and credit default swaps.

Harkin and DeFazio said the proposed new levy is backed by more than 200 economists, the AFL-CIO labor union federation and business leaders including Warren Buffett and Vanguard Group Inc. founder John C. Bogle, now president of Bogle Financial Markets Research.

Dec 11 2009

Banksters get Tagged in the UK, Only to Flee to, Guess Where?

Finally a Representative body, that knows WHO they work for …

Class war breaks out in the U.K.

The Labor government announces a tax on exorbitantly-paid bankers. American populists gnash their teeth in envy

By Andrew Leonard, Dec 9, 2009

Unsurprising headline of the year: “U.S. Probably Will Avoid Matching U.K. 50 percent Bonus Tax.”

Alistair Darling, the U.K. Chancellor of the Exchequer, announced the tax — aimed squarely at overpaid bankers

[…]

From Bloomberg:

“There are some banks who still believe their priority is to pay substantial bonuses,” Darling said in Parliament. “I am giving them a choice. They can use their profits to build up their capital base. If they insist on paying substantial rewards, I am determined to claw money back for the taxpayer.”

Paul Krugman says the move is “entirely reasonable.” Justin Fox asks, “why the heck not?” Felix Salmon says “well done.”

But don’t expect a repeat across the pond.

http://www.salon.com/technolog…

Interesting … maybe the People CAN Fight back?

Nov 27 2009

Top Ten Reasons: NOT to Trust Wall Street

Wall Street is sick. And its illness is Unchecked Greed. … The bug is call OPM.

Their fever has risen so dangerously high, that the Wizards of Wall Street, the Captains of Industry, for the most part see your assets as their “playing chips”.

Your Money, is their Bread and Butter.

Exploiting and Levering OPM (Other People’s Money) is the key to their Extreme Wealth.

This contagion on Wall Street has reached such a point, that one of those “Captains of Industry” has been speaking out against it. He has been working to “right the ship” of speculative, reckless investing, using our OPM, as the collateral.

Jack C. Bogle, founder and CEO of the Vanguard Group, is one of those “old school” investors — you know, that we should be “investing in a better future“, NOT just a “better bank account“.

Jack has listed the symptoms of this wide spread illness — NOW if only we could find some “Doctors” wise enough to quarantine the Damage …

The Damage unregulated greed has done … before they try to “go for broke” AGAIN …

Oct 24 2009

Ratigan reviews Frontline’s Warning, labels Wall Street as Legalized Gambling

If you missed Dylan Ratigan’s interview today with Senator Maria Cantwell (D-WA) — well you missed a lot!

They spell out in stark relief the very REAL need for serious Wall Street Regulation — NOW! (and still!)

Or we risk a repeat of the same Bubble-driven collapse of Trillion Dollar Derivative Bets, that occur in the dark, beyond the reach — or even the Watch — of any Govt Regulator, or even the Public scrutinity.

Nothing has changed, they can STILL Gamble Trillions in Derivatives, and let US the Taxpayers pick up the Tab, whenever their Bets GO Bad!

Link to MSNBC Clip to the Ratigan Cantwell Interview

Definitely a “Must See”, in my opinion.

So much so, I transcribed much of it, to help peak your interest …

Oct 20 2009

FRONTLINE Presents: The Warning (on the economic meltdown)

FRONTLINE INVESTIGATES THE ROOTS OF THE FINANCIAL CRISIS

FRONTLINE Presents

The Warning

Tuesday, October 20, 2009, at 9 P.M. ET on PBS

In the devastating aftermath of the economic meltdown, FRONTLINE sifts through the ashes for clues about why it happened and examines critical moments when it might have gone much differently.

In The Warning, airing Tuesday, Oct. 20, 2009, at 9 P.M. ET on PBS (check local listings), veteran FRONTLINE producer Michael Kirk (Inside the Meltdown, Breaking the Bank) unearths the hidden history of the nation’s worst financial crisis since the Great Depression. At the center of it all he finds Brooksley Born, who speaks for the first time on television about her failed campaign to regulate the secretive, multi-trillion-dollar derivatives market whose crash helped trigger the financial collapse in the fall of 2008.